AsiaVision

A Quick Take On POSaBIT Systems

POSaBIT Systems (OTCQX:POSAF) reported its Q3 2022 financial results on November 29, 2022, producing the company’s first quarterly revenue in excess of $10 million.

The company provides point-of-sale payment processing systems and services to cash-centric businesses in the U.S.

My current outlook on POSAF is on Hold, but the stock is definitely worth watch-listing for future consideration.

Overview

Kirkland, Washington-based POSaBIT was founded to provide point-of-sale [POS] systems and payment processing services for cash-only businesses such as cannabis sellers.

The firm is headed by co-founder and Chief Executive Officer Ryan Hamlin, who was previously the founder and CEO of PlaceFull and a General Manager at Microsoft (MSFT).

The company’s primary offerings include:

-

Point-of-Sale

-

Payments processing

POSAF acquires customers via its direct sales, marketing and business development efforts, as well as through partner and existing customer referrals.

Market & Competition

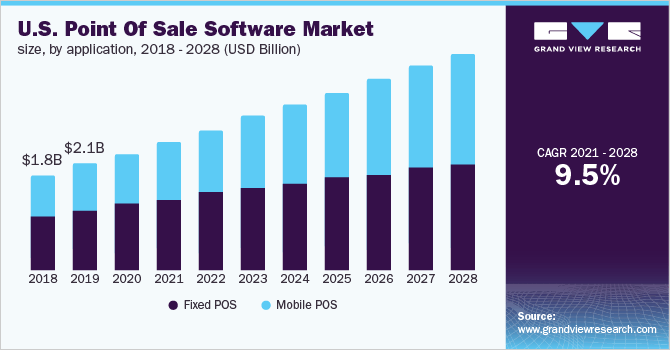

According to a 2021 market research report by Grand View Research, the market for point-of-sale software was an estimated $9.26 billion in 2020 and is forecast to reach $19.1 billion by 2028.

This represents a forecast CAGR of 9.5% from 2021 to 2028.

The main driver for this expected growth is an increased demand for contactless point-of-sale options in the wake of the COVID-19 pandemic.

Also, the chart below shows the historical and projected future growth trajectory of the point of sale market in the United States, divided between Fixed and Mobile POS systems:

U.S. Point Of Sale Software Market (Grand View Research)

Major competitive or other industry participants include:

-

Clover Network

-

H&L POS

-

IdealPOS

-

Lightspeed

-

NCR Corporation

-

Oracle Micros

-

Revel Systems

-

SwiftPOS

-

Square

-

TouchBistro

-

Toast

Recent Financial Performance

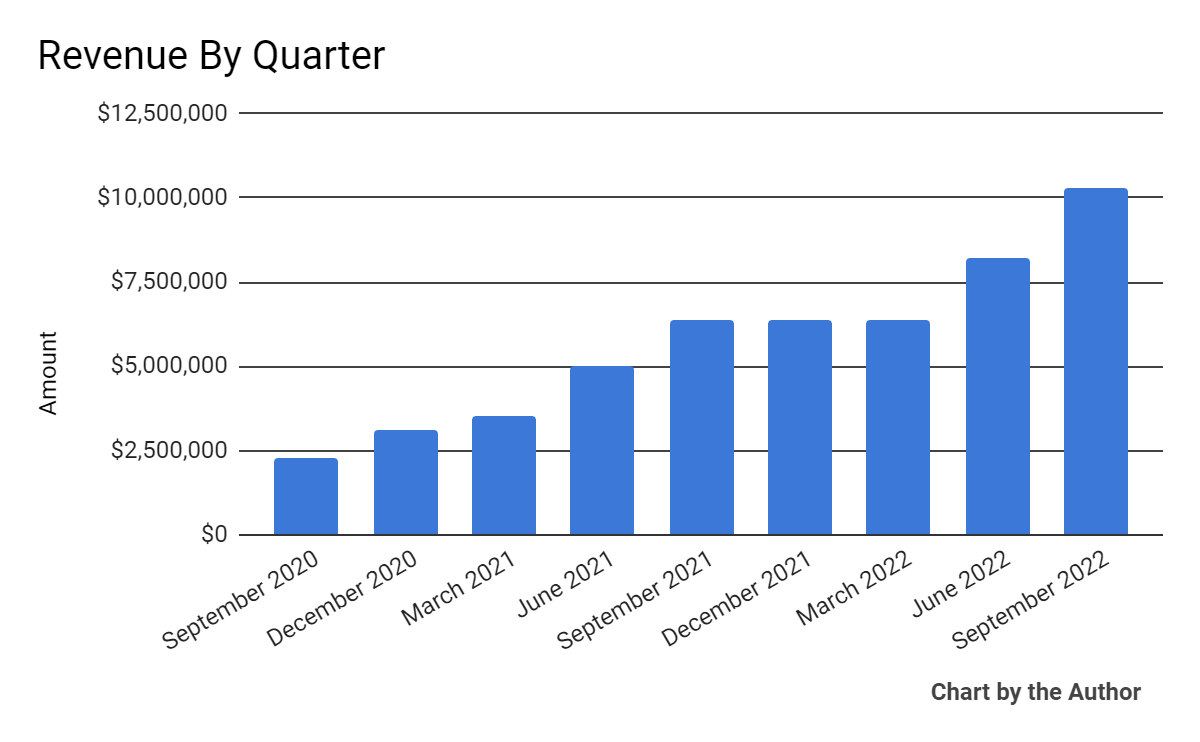

-

Total revenue by quarter has grown according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

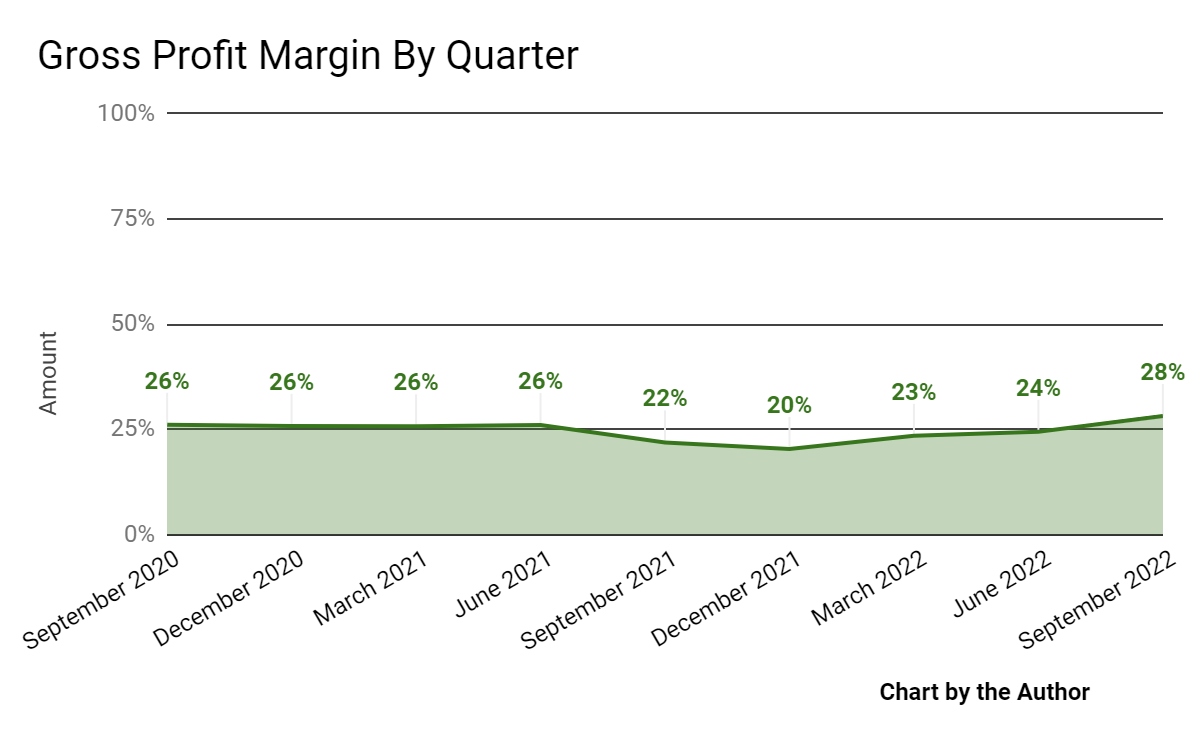

Gross profit margin by quarter has risen in the most recent quarter:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

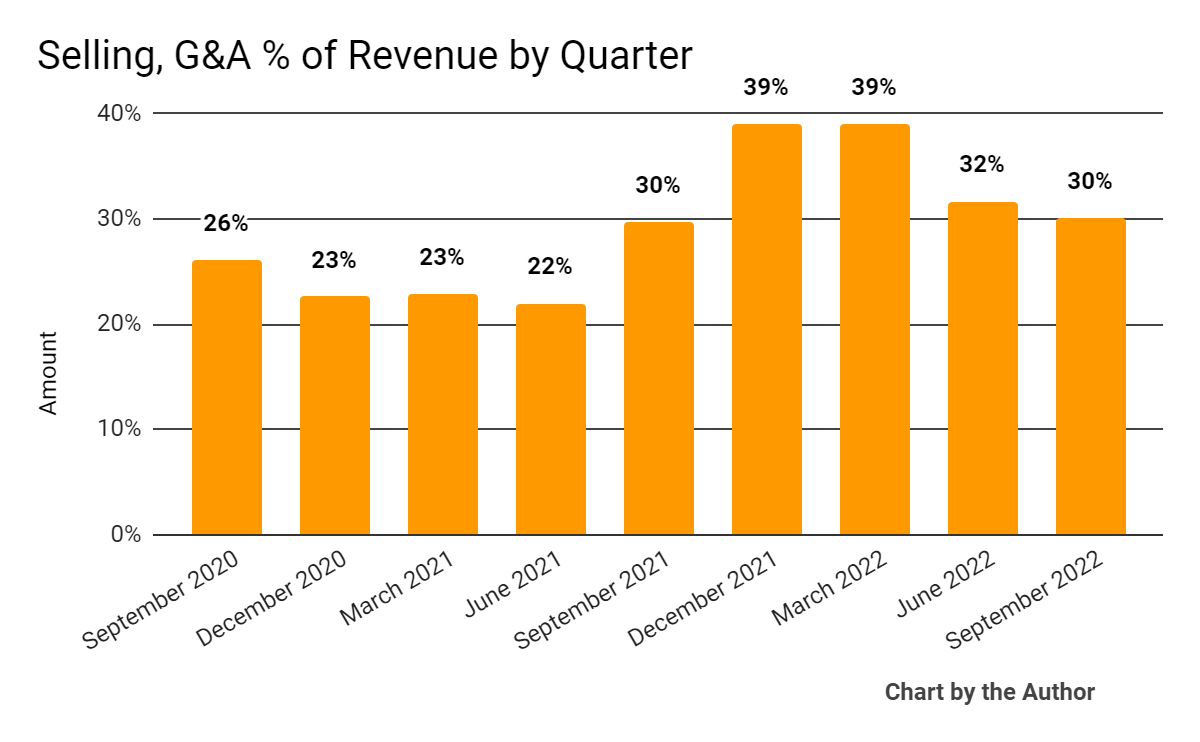

Selling, G&A expenses as a percentage of total revenue by quarter have grown in recent quarters, indicating lower SG&A efficiency:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

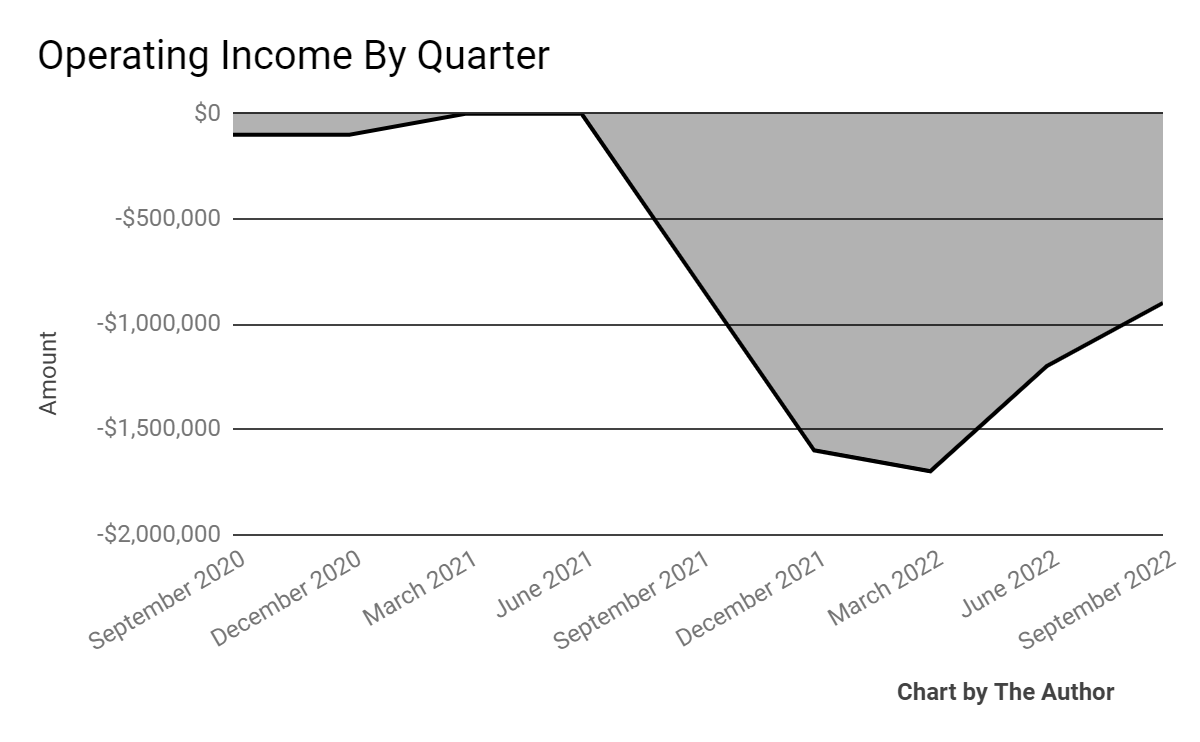

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

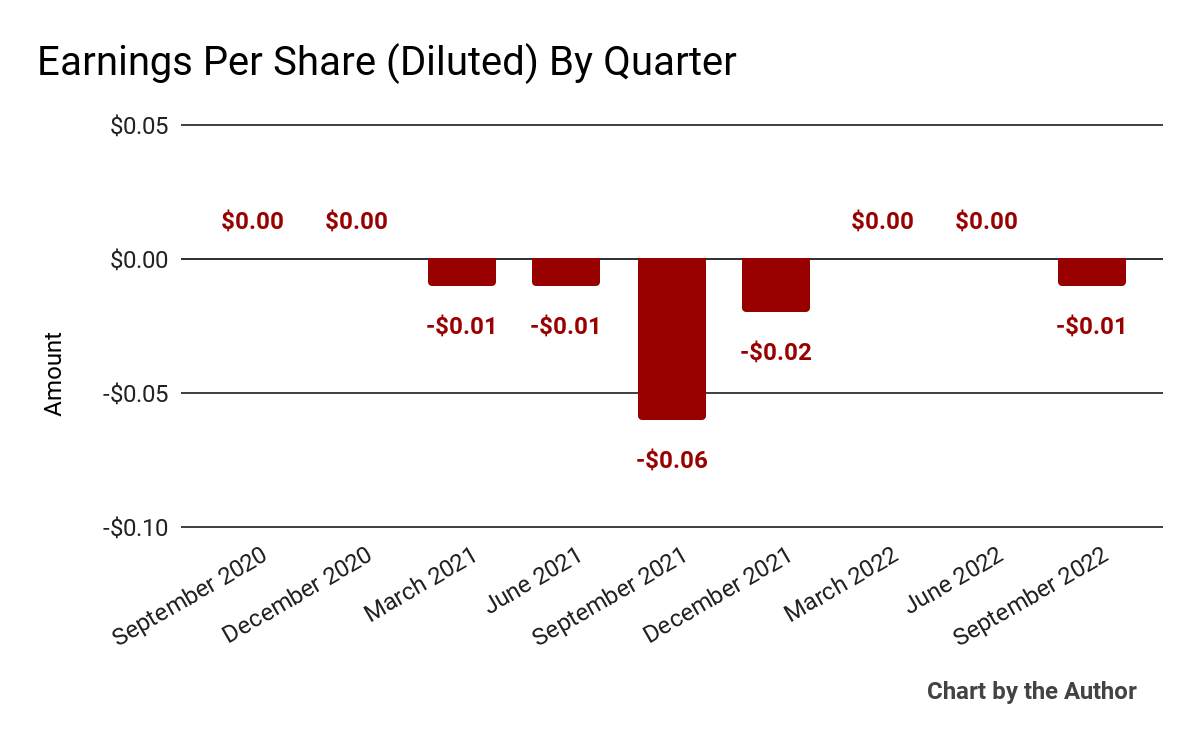

Earnings per share (Diluted) returned to negative territory in Q3 2022:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

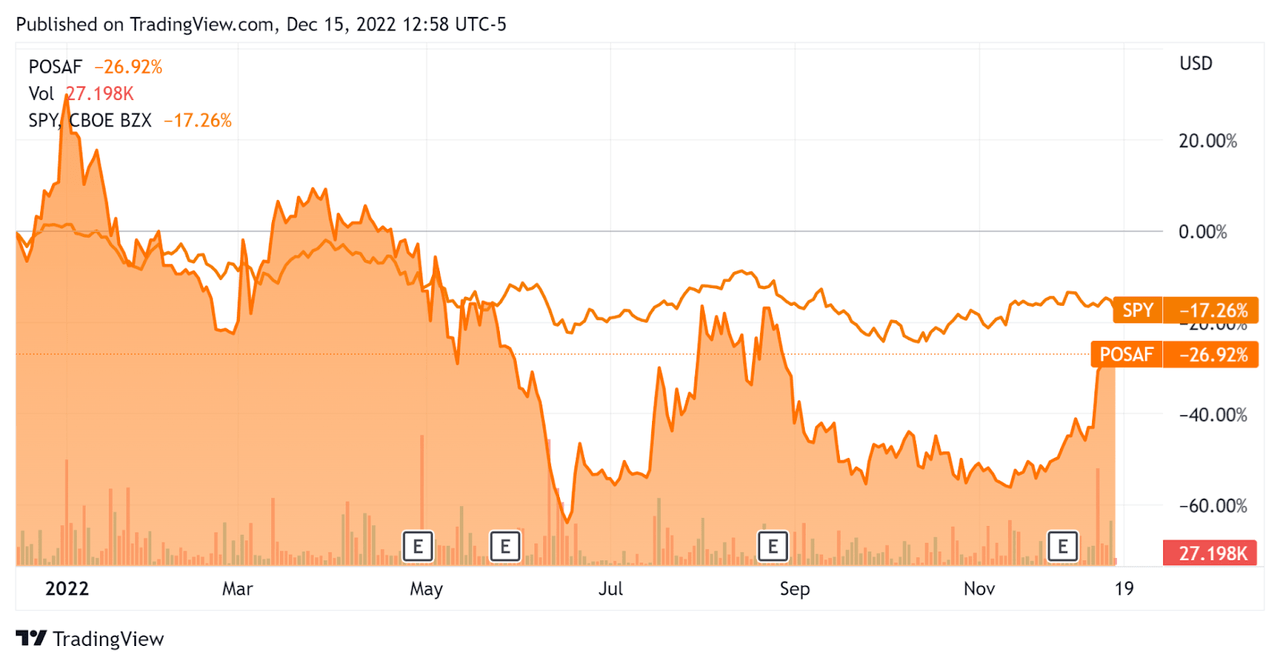

In the past 12 months, POSAF’s stock price has fallen 27% vs. the U.S. S&P 500 index’s (SPY) drop of around 17.3%, as the comparison chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.2 |

|

Revenue Growth Rate |

74.9% |

|

Net Income Margin |

-11.4% |

|

GAAP EBITDA % |

-16.7% |

|

Market Capitalization |

$108,138,416 |

|

Enterprise Value |

$100,127,152 |

|

Operating Cash Flow |

-$1,346,703 |

|

Earnings Per Share (Fully Diluted) |

-$0.03 |

(Source – Seeking Alpha)

Commentary

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the company’s first quarter generating greater than $10 million in revenue.

The company continues its efforts to expand its partnerships but faces a market where customers in key markets see difficult operating conditions as average ticket sales continue to decline amid increasing retailer competition.

However, the states of Maryland and Missouri approved cannabis legalization measures, so the market opportunity is certainly broadening in the U.S. and the company is increasing its presence from its current 21 states.

As to its financial results, revenue rose 62% year-over-year and 26% sequentially.

Management did not disclose any company retention rate metrics.

Gross profit margin recently bumped up but it is too early to tell if this is a durable trend.

Operating losses remain but have reduced in recent quarters.

For the balance sheet, the firm finished the quarter with $8.2 million in cash and equivalents and $200,000 in long-term debt.

Over the trailing twelve months, free cash used was $1.6 million, of which capital expenditures accounted for $300,000 of cash used.

Looking ahead, management reaffirmed previous guidance on full-year 2022 revenue to $38.5 million at the midpoint of the range but increased gross profit to $10.25 million at the midpoint.

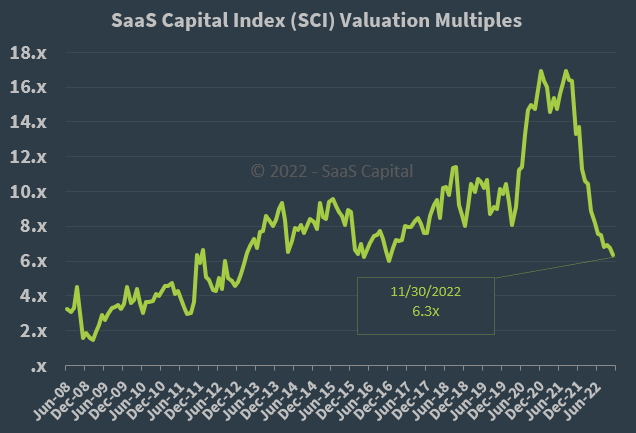

Regarding valuation, the market is valuing POSAF at an EV/Sales multiple of around 3.2x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on November 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, although POSAF is not strictly a SaaS company, it is currently valued by the market at a discount to the broader SaaS Capital Index, at least as of November 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown, which may produce slower sales cycles and reduce its revenue growth trajectory.

A potential upside catalyst would be a ‘short and shallow’ economic downturn in 2023 and continued expansion by the company into additional states.

While I’m cautious on the company’s near-term outlook given deteriorating macroeconomic conditions, optimistic investors may have a bullish case for POSAF.

My current outlook on POSAF is Hold, but the stock is definitely worth watch-listing for future consideration.

Be the first to comment