Alexandre Schneider/Getty Images News

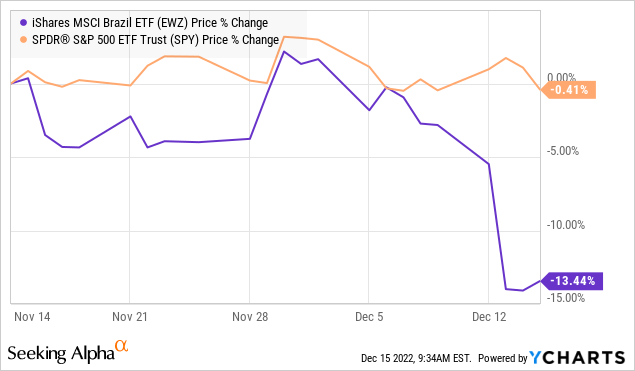

Brazil’s early exit from the 2022 FIFA World Cup isn’t the only loss for the country and iShares MSCI Brazil ETF (NYSEARCA:EWZ) investors. The fund which tracks the largest and most important Brazilian stocks is down more than 15% this month, underperforming global benchmarks, and reversing what had been a positive gain for the year.

The setup is a string of disappointing economic and political headlines, which is in contrast to some of the early exuberance from the Presidential election victory of “Lula”. The appointment of a seemingly political loyalist to the high-profile role of Finance Minister has raised concerns over fiscal responsibility and monetary policy independence.

The backdrop of risk aversion is reflected in a depreciation of the Brazilian Real currency, which has diverged from the trend of a weaker U.S. Dollar against most other foreign currencies. In this regard, market sentiment towards Brazil has soured and the stocks in EWZ are repricing lower also getting hit by the FX impact. Our call is that the risks are tilted to the downside, with high uncertainties regarding the broader outlook.

Brazil Macro Update

We last covered EWZ with a bullish note back in September, citing more positive economic trends through Q3. At the time, we commented on the pending Presidential election with an otherwise neutral tone, suggesting a victory by either party would not necessarily undermine the upside potential. From that article:

Even with an opinion that a Bolsonaro victory should be better for Brazilian stocks, we also believe the risks of a Lula win may be benign. It’s simply too close of a race to call at this point.

The update today is a recognition that we may have underestimated the consequences of the left-wing government regarding the shift in high-level policy direction. The sense now is that while Lula may have portrayed a pragmatic or centralist tilt during the campaign, the actions ahead of the official inauguration on January 1st suggest more of a textbook big-spending government philosophy.

One proposal being pushed by Lula and his team is a workaround to the constitutional spending cap. The latest report is that the government is seeking at least BRL 150 billion, or approximately $29 billion, as an exemption for welfare programs, highlighting the shift from what was an austerity effort by outgoing president Jair Bolsonaro.

The issue here comes down to the impact of often mundane indicators like the budget balance, public debt, and trends in the external account that would move in the wrong direction. For an emerging market like Brazil, these details have an added importance, which is translated into added volatility.

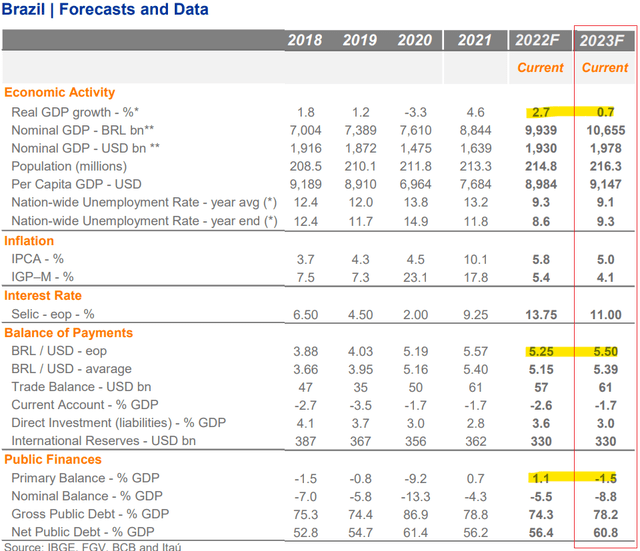

According to Itau Economics Research, a group within Itau Unibanco Holding S.A. (ITUB), the expectation is for the primary budget to flip from a surplus estimated at 1.1% of GDP this year, to a deficit of -1.5% in 2023. This metric, which excludes interest payments, means the government outlays will exceed receipts.

The result is that the gross debt to GDP level climbs from 74.3% this year to 78.2% over the period. These dynamics are recognized as key foreign exchange fundamentals and one reason the group sees a further depreciation in the Brazilian Real towards BRL 5.50 per Dollar from the current level quoted at 5.30.

Furthermore, other indicators are expected to weaken in 2023 with forecasted GDP growth of just 0.7% compared to 2.7% in 2022. Separately, while labor market trends and job growth have been positive this year, the view is that the gains slow with the year-end unemployment rate in 2023 forecasted to reach 9.3% from the current decade low of 8.6%.

To be clear, some of these trends are based on global factors and follow themes seen in both developed countries and other emerging economies. Nevertheless, the policy stance of the incoming government is seen as negatively affecting financial market conditions. The ideological question of whether increasing social spending is the correct policy is worthy of a separate discussion, but generally bearish for near-term economic indicators.

Going back to the fiscal outlook, one concern is that the spending may fuel further inflation. Domestic consumer price indexes have favorably trended lower in recent months, to 5.9% in the latest November print. Depending on the expansionary impulse, and also potentially imported inflation from a weaker currency, the risk is that inflation can remain stubborn. In turn, higher local interest rates would be a further headwind for both the economy and investing environment.

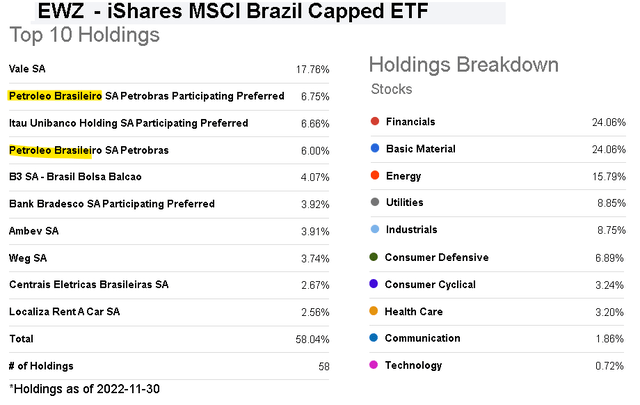

EWZ Holdings

Taking a look at the current EWZ portfolio composition, Vale S.A. (VALE) is the largest holding, representing 18% of the fund. The company as a major iron ore exporter is largely dependent on global market commodity pricing, including demand trends from China. This is a high-quality materials name but faces a more challenging outlook going forward based on international conditions.

Down the list, the fund has overall good diversification, including several banks that better capture local economic conditions from consumer spending to domestic industrial activity. By this measure, EWZ works as intended for targeted exposure to the Brazilian economy.

For us, the stock that stands out is the state-controlled oil company Petroleo Brasileiro S.A. (PBR) (PBR.A), as the second-largest holding, representing 13% of the fund between the two share classes. PBR often gets caught in the middle of any discussion related to political risk, given its oil and gas pricing policies have a sensitive impact on social conditions and inflationary trends.

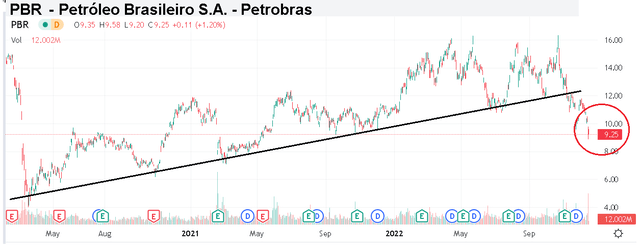

The concern is that an interventionist type of overreach through measures like price caps or influence over investing plans will make the company less efficient and force a discount on its valuation. While the recent messaging from the Lula team is that the administration will take a hands-off approach, the anticipation now is to see who will be named the next CEO, which could be another political ally rather than an experienced industry executive.

The market has taken a more decisively skeptical approach considering the sharp selloff of PBR since the election, down more than 40% from its high of the year. While some measures indicate PBR may be undervalued given its underperformance to global majors recently, it’s evident that the political backdrop outweighs the fundamentals, which we believe will be a recurring theme going forward.

EWZ ETF Price Forecast

There is a case to be made that many of the negatives we’ve covered have already been priced in, and there could be some truth to the fact that extreme pessimism has taken over. The more pressing issue for EWZ traders and investors is what happens next.

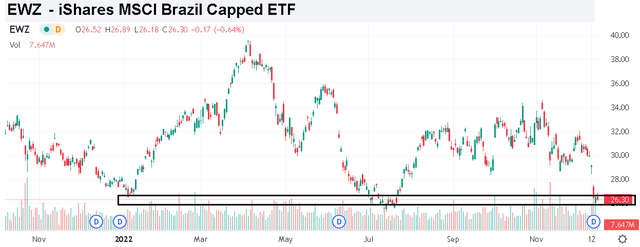

The call we have is to rate EWZ as a hold with a base case to expect a continuation of volatility and consolidation around the current levels. From the chart, the current share price of around $26.00 represents an area of support that goes back to the start of 2022 that could hold over the next few months.

A decisively bearish rating on EWZ would have been the right call in early November, when shares traded nearly 30% higher from the current level. As ugly as the trading action has been, we believe it will likely need another proverbial shoe to drop for Brazil stocks to take another big leg lower.

On this point, global conditions aren’t helping, considering the latest headlines of a gloomier economic outlook with an ongoing hawkish stance by the Fed and European Central Banks. Brazil as an emerging market gets dragged lower with the added weight of its own domestic issues.

To the upside, there is always the potential that economic data outperform going forward, carried by inflation surprising to the downside and stronger than expected activity levels. The Lula government could also end up rolling back its spending push, which would be a head-scratcher, but still possible as part of the bullish case. Policy updates including the monthly economic indicators will be the key monitoring points.

Be the first to comment