Alex Wong/Getty Images News

Intro

Six months ago, we covered Amazon (NASDAQ:AMZN) in the article ‘Amazon: Dark Clouds On The Horizon’. In the article, we argued inflation was squeezing the e-commerce business and that Amazon’s capital allocation was deteriorating. In the face of a decade’s long bull market, we assigned a “sell” rating and recommended getting back in at $85 per share. The stock briefly touched down there earlier this month.

So what’s next? Much of our insight six months ago was derived from watching what happened to China’s e-commerce behemoth, Alibaba (BABA). There are still important insights here, especially when it comes to cloud. With no cash returns to speak of, we think it’s finally time for investors to say, “show me the money.” In the decade ahead, we project returns of 7% per annum.

Show Me The Money

Over the past 20 years, Amazon’s e-commerce business grew rapidly using a strategy known in marketing as the “loss leader.” A loss leader is a company that sells goods at a loss in order to grow sales rapidly. This certainly describes Amazon. Amazon’s e-commerce business has had extremely thin operating margins for many years now. After interest, tax, and CapEx, the earnings were next to nil. At the same time, this made Amazon very difficult to compete with.

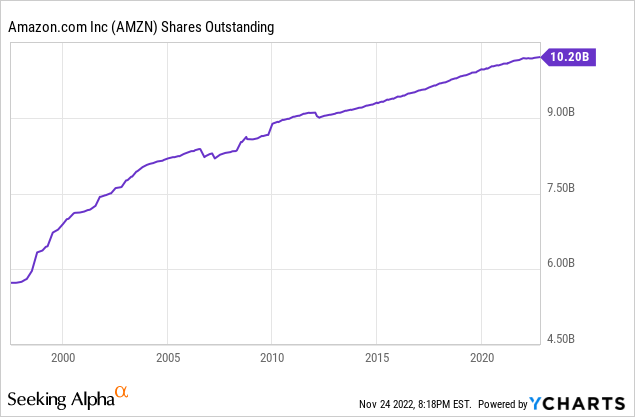

To fund this strategy, Amazon leaned on the enthusiasm of shareholders who didn’t mind a dividend yield of zero and a little share dilution:

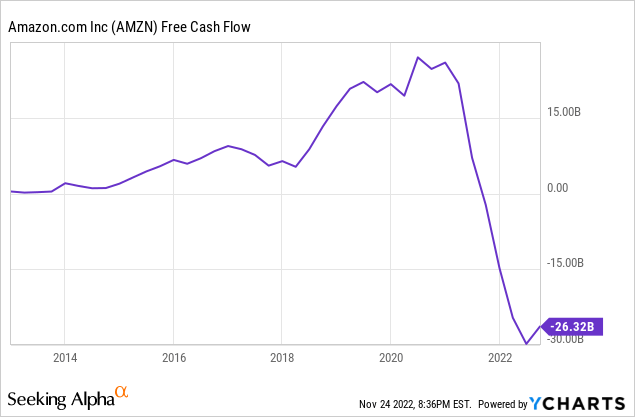

It also helped that Amazon enjoyed a first-mover advantage in cloud. AWS obtained an economies of scale position quickly. The cloud arm is magnificently profitable. All of this funded Amazon’s terrific growth, as well as its capital allocation blunders such as the Fire Phone and recently, Amazon Alexa:

Now with the company’s stock and free cash flow in steep decline, it’s finally time for investors to say “show me the money.”

Does Amazon really have a deep economic moat? It certainly has the scale, now let’s see the profits.

Why E-Commerce Has Bottomed

Global e-commerce businesses could now be at a cyclical trough. The cost of delivery has rarely been this high. As the price of oil normalizes and wage growth slows, margins should improve. The world’s largest e-commerce players have been investing heavily over the past 12 months. As these investments slow, earnings and cash flows should improve.

Normalized Earnings

Looking at adjusted free cash flow, as well as Amazon’s average ROA and profit margins in the past five years, we believe Amazon’s normalized net income is around $23.5 billion. This gives Amazon a normalized PE just North of 40x earnings.

You may ask, “Why use normalized net income or free cash flow instead of EBITDA or operating cash flow?” The answer: we value businesses based on real after-tax earnings. As Warren Buffett and Charlie Munger have often emphasized, interest, tax, depreciation, and amortization are all very real expenses. Sure, they didn’t matter at the peak of the 2021 bubble, but they matter now.

Insights Into AWS

Chinese tech business offer great insight into what’s coming for AWS. China’s been experiencing a spending recession over the past nine months or so. Should the United States enter a recession in 2023, Chinese tech serves as an excellent guide for the future.

One of the most notable trends during this slowdown in China is the slowing growth of cloud. While China’s still in the early stages of cloud adoption, tech giants like Alibaba and Tencent have seen their cloud revenue growth go from 30% annualized to 0%. Technology businesses worldwide are beginning to cut costs. This could flow through to AWS.

Prospective Returns

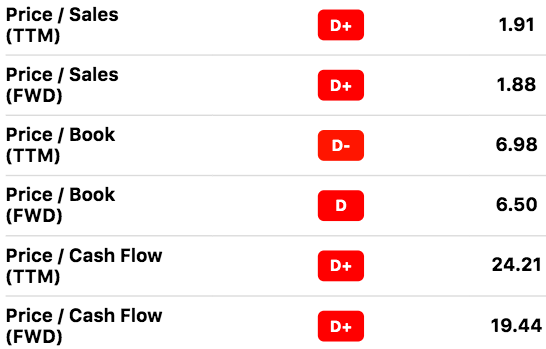

In the short-term, it’s very difficult to predict what will happen with AMZN stock. If the valuation and China serve as any guide, Amazon could fall much further. The stock is by no means cheap:

Amazon Valuation Scores (Seeking Alpha)

That said, Amazon becomes a better investment as the price falls. Let’s take a look at our base-case scenario for long-term returns:

| Normalized EPS | Annual Growth | Terminal Multiple | 2032 Price Target | Annualized Returns |

| $2.30 |

15% |

20 | $186 | 7% |

Amazon has a lot of tailwinds. Its core industries are set to expand significantly in the decade ahead. Amazon’s expanding globally into fast growing markets like India. The delivery of its e-commerce products should only become more efficient over time as autonomous, electric vehicles take to the roads. Along with this, providing more and more ads through Amazon.com and the Amazon app should improve margins.

In Conclusion

We’d like to see Amazon sell off its unprofitable businesses and focus on its key long-term drivers, AWS and Amazon.com. This would improve profitability and allow Amazon to finally return cash to shareholders. AWS’s growth could slow significantly in the next recession, but as cost pressures ease, we think Amazon.com will make a huge comeback. That said, Amazon is by no means cheap at a normalized PE of 40x, and it can always fall further. With prospective returns of 7% per annum, we have a “hold” rating on the shares.

Be the first to comment