HJBC

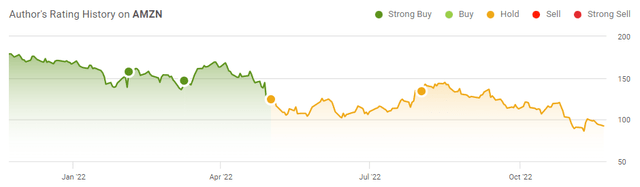

2022 has been a disaster for Amazon.com, Inc. (NASDAQ:AMZN). Share prices have fallen -45.30% YTD as several external factors have impacted its operations. The only bright spot has been AWS, as its North America and International segments have both generated negative operating income since Q4 of 2021.

Rising commodity prices, inflation, and the macro environment have all impacted AMZN’s margins and decimated profitability. Over the past 2 years, AMZN’s cash from operations has declined by -40% on a TTM basis. The combination of declining cash from operations and increased spending in CapEx has caused AMZN to generate negative FCF on a TTM basis since Q4 of 2021. Shares of AMZN are approaching where they traded in the fall of 2019, prior to their expansive growth.

AMZN has had its share of challenges, but if inflation continues declining, some reprieve is felt on commodity prices, and AMZN’s CapEx spending can decline due to the massive investments made over the past 3 years, I believe we will see margins expand, cash from operations increase, and AMZN gets back to being free cash flow (“FCF”) positive. Shares of AMZN could continue to decline, but now is looking like a good point to either start a position or add to an existing one.

Amazon has been saddled with an operating margin problem that needs to be alleviated before shares rebound

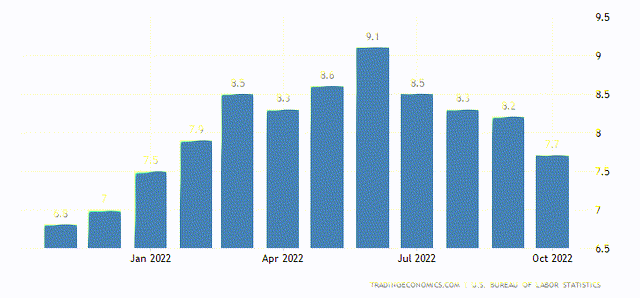

AMZN is a great company, but even great companies face operational challenges. From March to the beginning of May, I changed my stance from being very bullish to neutral, as it was clear inflation wasn’t subsiding and AMZN’s margins would continue to be impacted. By now, the CPI print has been engrained into everyone’s brains, and while we have seen 4 consecutive quarters of inflation declining, it’s still impacting AMZN.

We get caught up on the U.S. numbers, but for multi-national companies such as AMZN, looking abroad is very important. The Eurozone CPI came in at 10.6%, which is the highest on record and well above the European Central Bank’s target of 2.0 percent, amid surging energy prices and euro weakness. The United Kingdom saw its CPI jump to 11.1% in October, which was above forecasts, while Germany is also in the double-digit range with a CPI print of 10.4%.

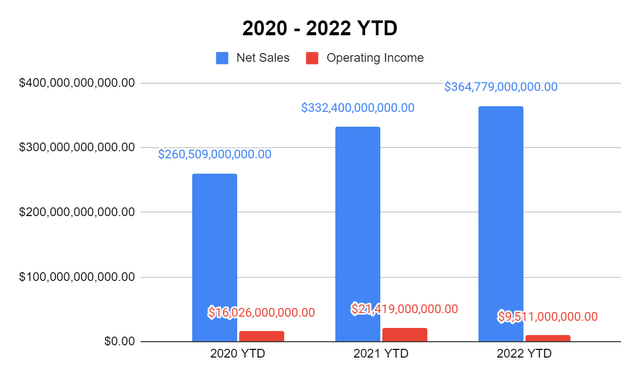

AMZN is a low-margin business, and when its margins are squeezed, there isn’t much room to hide. AMZN’s infrastructure is capital-intensive, and AMZN doesn’t have the luxury of its margins in AWS replicating itself in the North American or International segments. Looking at AMZN from a YTD perspective has seen its margins decimated in 2022, and AWS is the only saving grace. For the first 9 months of 2020, AMZN generated $260.51 billion in net sales and drove $16.03 billion in operating income to the bottom line, which is an operating margin of 6.15%.

2021 was AMZN’s best year in the first 9 months, as they delivered $21.42 billion in operating income from $332.4 billion of revenue, creating an operating margin of 6.44%. As inflation has run rampant, AMZN’s margins have declined significantly. YTD in 2022, AMZN has generated $364.78 billion of revenue and only delivered $9.51 billion of operating income. AMZN has an operating margin in 2022 of 2.61%. For a company that has generated roughly $40.5 billion per month and $1.34 billion per day of revenue in 2022, AMZN is barely profitable.

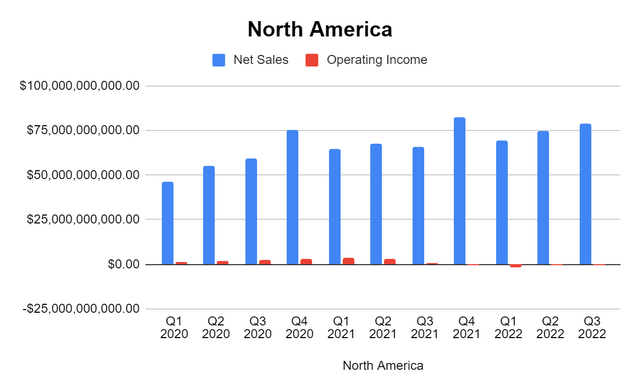

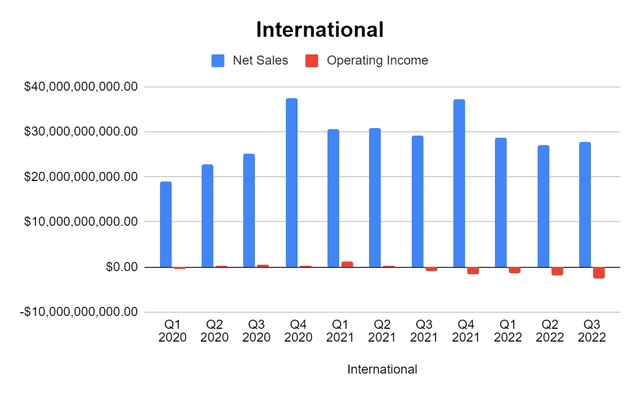

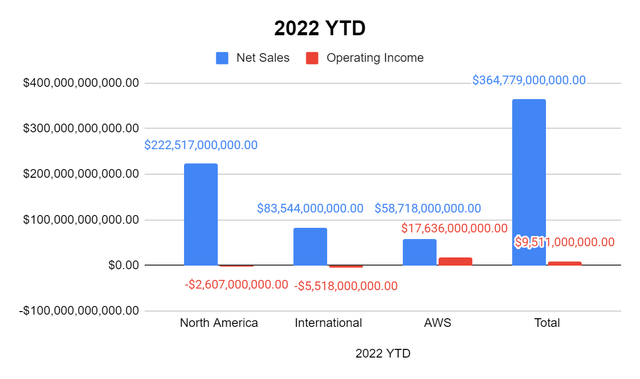

AMZN needs to create efficiencies internally, and for the cost of inputs to decline significantly. The North American segment, which covers all revenue generated from Prime, to e-commerce has not been profitable since Q3 of 2021. YTD in 2022, North American business operations have generated $222.52 billion of revenue, and -$2.61 billion of operating income. Overseas in the International space, things are worse. AMZN hasn’t run a profitable operation overseas since Q2 2021.

AMZN has generated $83.54 billion of revenue YTD from its International business, yet it’s unprofitable as its operating income is -$5.52 billion. This is a problem, and if the company wasn’t AMZN, I believe shares would be down much more. Between North American and International, AMZN has generated $306.06 billion of revenue and delivered -$8.13 billion of operating income. This is the exact opposite of what shareholders want to see. The fact that AMZN can generate over $300 billion of revenue from these 2 segments YTD and lose money is perplexing.

Steven Fiorillo, Amazon Steven Fiorillo, Amazon

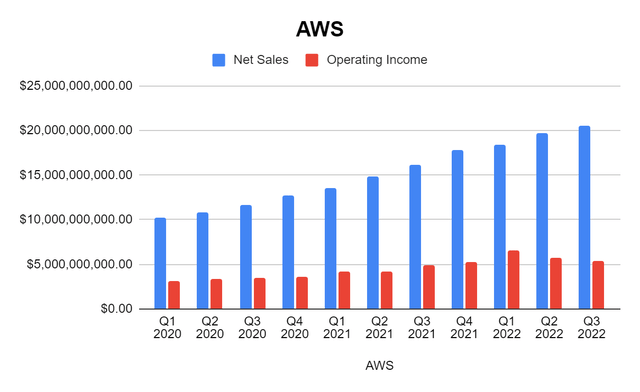

AMZN’s crown jewel is AWS, and they should be thankful it’s been able to fend off other cloud services. YTD AWS has operated at a 30.04% operating margin, as it has produced $17.64 billion in operating income from $58.72 billion of net sales.

AMZN is a low-margin business, and every percentage point they can improve by means billions in operating income. AMZN has an operating margin problem that needs to be fixed. If AMZN didn’t have AWS, it would be an unprofitable business in 2022. AWS has made up 16.1% of AMZN’s 2022 revenue YTD, and it accounts for 100% of its operating income. AWS is carrying the other segments, augmenting their losses while keeping AMZN in the black.

If the North American and International segments were to run at break-even, AMZN would have delivered an additional 85.43% of operating income YTD in the amount of $8.13 billion. Prior to shares rebounding substantially, AMZN needs to improve its margins as it can’t just rely on AWS. AWS may be generating QoQ revenue growth, but its operating margin and operating income are declining QoQ as it’s becoming more expensive to run AWS. Over the previous 2 quarters, AWS has seen its quarterly operating income decline by over $1 billion and its operating margin decline from 35.35% to 26.31%.

Inflation rolling over and the holiday season could put Amazon back in the driver’s seat and provide a spark in the share price

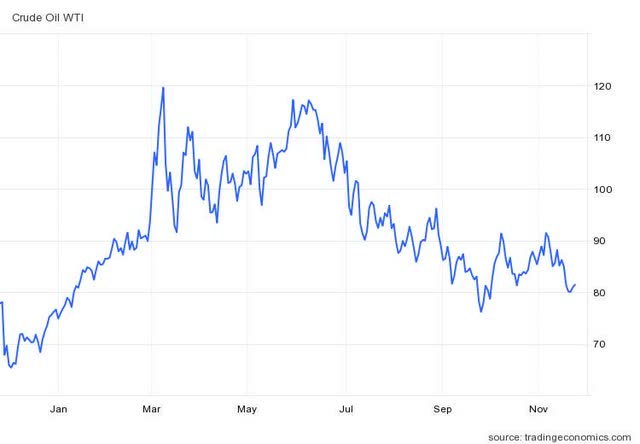

The macro is easing, and AMZN should be a benefactor in the coming months. Crude topped out at $119.65 in March and has declined by -31.97% since then. When inflation topped out at 9.1% in June, Crude reached $117.15 on June 8th. The last CPI report, which is a lagging indicator, came in at 7.7%, and crude is trading at $81.42 per barrel. Gasoline also spiked on June 9th at $4.08 and has declined by -37.5% to $2.55 since then.

As commodity prices and inflation roll over, I am expecting AMZN’s price of goods and total operating expenses to decline. It could take several quarters to work its way through, but I think we could see some costs decline as soon as Q4. If this occurs, and AMZN continues to grow, its top line will increase, and its margins should expand and help get back to a breakeven point on the North American and International segments.

The 2022 holiday season could be stronger than expected. We may be getting a glimpse of what’s to come as several notable retail companies delivered strong Q3 earnings:

- American Eagle Outfitters (AEO)Q3 GAAP EPS of $0.42 beats by $0.21.

- Abercrombie & Fitch (ANF)Q3 Non-GAAP EPS of $0.01 beats by $0.13.

- Best Buy (BBY) Q3 Non-GAAP EPS of $1.38 beats by $0.36.

- Macy’s (M) Q3 Non-GAAP EPS of $0.52 beats by $0.33.

- Walmart (WMT) Q3 Non-GAAP EPS of $1.50 beats by $0.18.

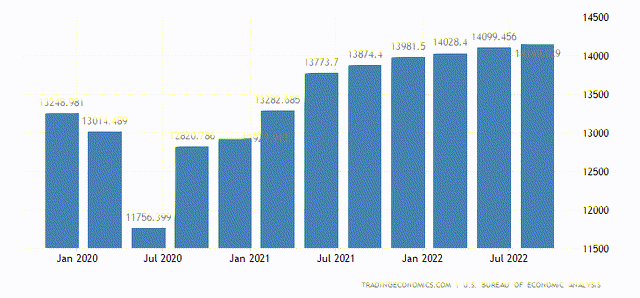

In Q3 2022, consumer spending increased to $14.15 trillion in the U.S. and marked its 9th consecutive QoQ increase. Retail sales increased 1.3% MoM in October to the strongest it’s been in 8 months after a flat report in September. The consumer is spending, we’re seeing this firsthand in the economic data points, and it reflects in Q3 earnings for many companies throughout the retail sector.

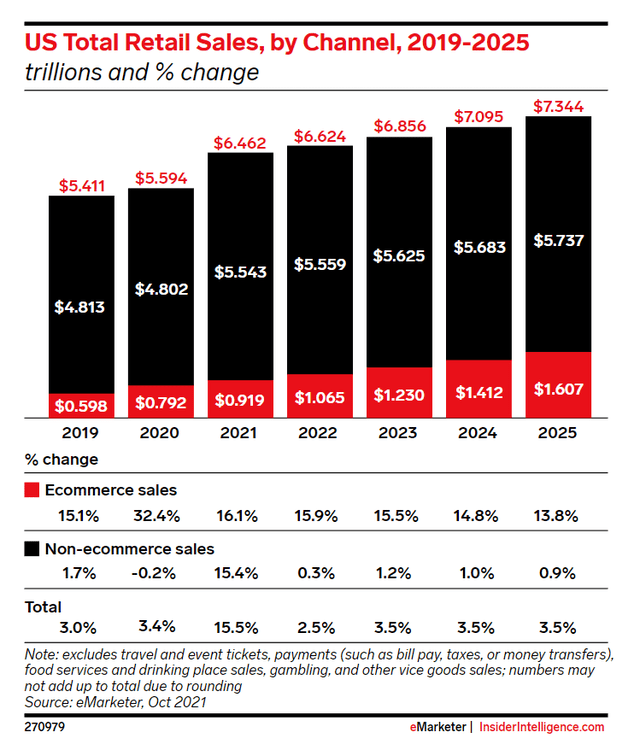

In 2022, the U.S retail sector is projected to generate $6.62 trillion in sales. E-commerce is projected to total $1.07 trillion in sales, which is 16.08% of the retail sector. In 2025, e-commerce sales will grow to $1.61 trillion, and while this is an increase of 50.89%, it is still only projected to be 21.88% of the retail sector. While e-commerce penetrates the retail sector and accounts for more of the sales channel mix, sales in physical brick-and-mortar locations are expected to increase by $178 billion (3.2%) between 2023 – 2025.

Based on the projections from InsiderIntelligence, AMZN should be a major benefactor of e-commerce, increasing its position in the U.S total sales as it chips away at its overall position in the retail sales mix. I am getting bullish again on AMZN at the current valuation. In the TTM, AMZN has spent $286.03 billion on the cost of revenue and another $203.19 billion on its operating expenses. AMZN has also allocated $65.99 billion toward CapEx in the TTM, and since 2020, has allocated $167.18 billion toward CapEx. AMZN continues to outspend its competition across the board, as Microsoft (MSFT), Walmart (WMT), FedEx (FDX), and United Parcel Service (UPS) have spent a total of $51.32 billion in CapEx in the TTM.

I believe there is a good chance that expenses will come down, as we’re seeing favoring numbers from economic indicators and commodity pricing. I would also like to think that AMZN can reduce its CapEx to around $40-45 billion in 2023, which would allow them to spend almost as much as their competitors combined and get them back to FCF positive. If these items fall into place, it is a strong possibility that AMZN will return to profitability in the North American and International segments in 2023, expands their margins, generates top-line growth, and returns to being FCF positive.

Conclusion

Shares of AMZN have declined -45.30% YTD, and a lot of things have gone wrong. I was concerned about a lot of things, especially AMZN not producing as much cash from operations and not being FCF positive. For the first time since March, I see a path for AMZN to expand their margins, get the North American segment back to profitability, and get back to being FCF positive. If AMZN is going to get back to where it was, AWS can’t generate 100% of its operating income.

The economic indicators and commodity prices are showing me that inputs should be on the decline, and AMZN will get some reprieve on their operational expenses. I am back in the bullish camp, as I believe the data shows we will have a strong holiday season, and I think Amazon can post better-than-expected numbers in Q4.

Be the first to comment