ADragan

Thesis

Arbor Realty Trust, Inc.’s (NYSE:ABR) Q3 earnings release demonstrated the robustness of its ability to drive earnings growth amid a highly challenging macro environment.

As a result, the company posted a double beat on its net interest income and distributable EPS, benefiting from the Fed’s aggressive rate hikes. Furthermore, we urged investors in our pre-earnings article not to join the panic sellers. Accordingly, ABR has outperformed the broad market significantly since our previous article, posting a total return of more than 18%.

As such, ABR’s valuation seems more well-balanced now and also in line with its mREIT peers. Moreover, we don’t expect ABR to be re-rated much higher in the near term, given the headwinds on the real estate market. Also, the Fed could be closer to the end of its unprecedented hiking cycle, as it could potentially move into “data dependency” mode in early 2023.

Coupled with a sharp momentum surge from its early October lows, we deduce that the entry levels no longer look as attractive as in our previous article.

Hence, we move to the sidelines at the current levels, as we anticipate a pullback could follow subsequently.

Revise rating from Buy to Hold.

Easy Double Beat On Lowered Analysts’ Estimates

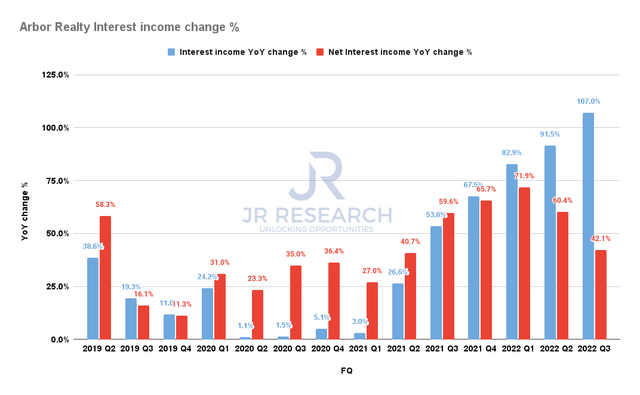

Arbor Realty Interest income change % (Company filings)

Arbor Realty posted an increase in interest income of 107% from FQ3’21 as it continued to leverage the benefits of the surge in interest rates. However, with a higher cost base, its net interest income increased by 42.1% YoY, down from FQ2’s 60.4% uptick. It also followed a trend from Q1 as its growth decelerated.

Management highlighted that its average cost of funds surged to 4.49% in Q3, up markedly from Q2’s 3.1%. Consequently, its overall net interest spreads in its core assets fell to 2.08% from Q2’s 2.16%. Hence, it’s critical for investors to understand that higher interest rates impact its operating performance both ways for Arbor Realty.

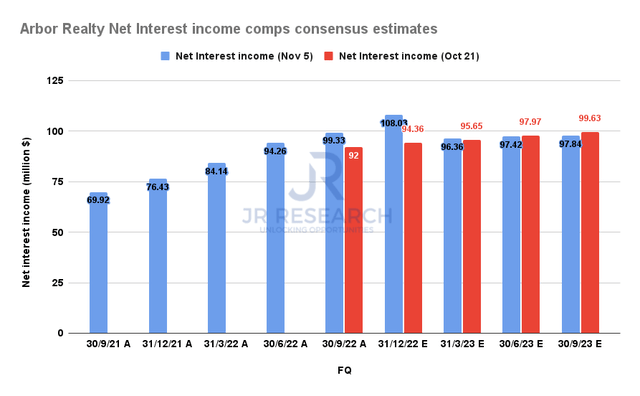

Arbor Realty Net interest income comps consensus estimates (S&P Cap IQ)

However, analysts also lowered the bar for ABR to cross for its Q3 report card, which helped the mREIT achieve an easy beat on its net interest income for the quarter.

As a result, analysts raised their estimates for Q4 by nearly 15%, expecting Arbor Realty to deliver another robust quarter from the current elevated rates environment.

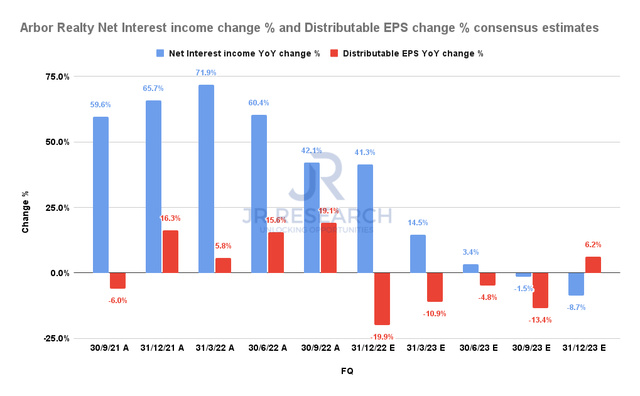

Arbor Realty Net interest income change % and Distributable EPS change % consensus estimates (S&P Cap IQ)

Notwithstanding, investors shouldn’t expect the rate hikes liftoff to continue indefinitely into FY23.

Fed Chair Powell highlighted in the recent November FOMC press conference that we could potentially see two additional hikes before a pause is appropriate to parse the effect, given policy lags.

Hence, analysts have not markedly increased their estimates for ABR’s distributable EPS through FY23. As such, the normalization in Arbor Realty’s interest rate tailwinds could impinge on its EPS growth moving forward.

Is ABR Stock A Buy, Sell, Or Hold?

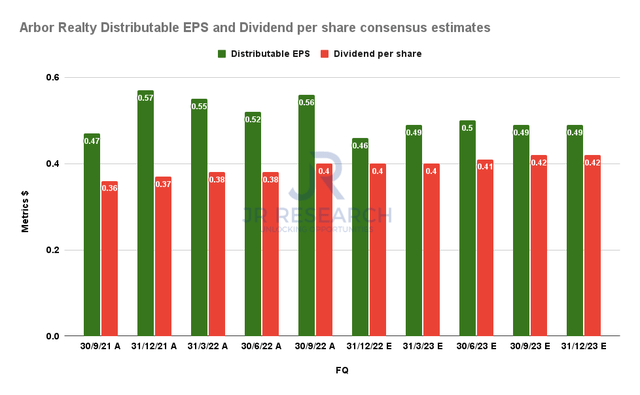

Arbor Realty Distributable EPS and Dividend per share consensus estimates (S&P Cap IQ)

Management raised its dividend to $0.4, given ABR’s robust performance. Moreover, given its relatively low payout ratio, we don’t expect the slowdown in its EPS growth to affect its distribution policy.

Hence, its NTM dividend yield of 11.2% still looks attractive at the current levels (Vs. 10Y mean of 9%).

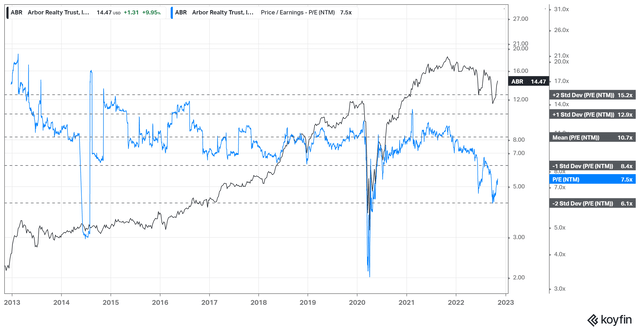

ABR NTM Distributable EPS multiples valuation trend (Koyfin)

The recovery from its October lows has lifted ABR’s earnings multiples but remains well below its 10Y mean, as seen above.

However, we believe the market has de-rated ABR, reflecting increased macro risks, with a recession over the horizon. Therefore, we don’t expect ABR to be re-rated toward its mean in the near term.

It’s also in line with its peers’ median of 7.55x (according to S&P Cap IQ data), with no apparent relative dislocation gleaned.

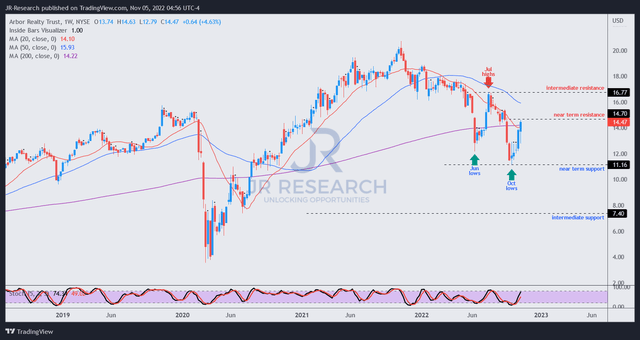

ABR price chart (weekly) (TradingView)

As seen above, ABR continued its recovery from its October lows, as the post-earnings spike helped lift its buying momentum toward its near-term resistance.

However, given the sharp surge, we believe the reward/risk profile is more well-balanced at the current levels.

Also, a series of dynamic resistance zones could continue to impede ABR’s buying upside from the current levels. Accordingly, we expect July highs to continue holding robustly in the near term attracting sellers to curtail incremental buying momentum.

Therefore, we deduce a pullback looks overdue to digest its recent spike.

Revising our rating from Buy to Hold for now.

Be the first to comment