Clemens Bilan/Getty Images Entertainment

Investment Thesis

PVH Corp. (NYSE:PVH) will see higher stock prices due to increased digital sales and marketing, debt reduction, and share buybacks. PVH can provide an excellent return from covered call premiums and dividends even if the stock does not move much.

PVH Corporation

PVH designs and markets branded apparel in more than 40 countries. Its key fashion categories include men’s dress shirts, ties, sportswear, underwear, and jeans. PVH’s leading designer brands, Calvin Klein and Tommy Hilfiger, generated nearly all its revenue after it disposed of most of its smaller brands in 2021. PVH distributes its clothing wholesale to retailers and through company-owned stores and e-commerce.

PVH’s five largest customers accounted for 15% of FY 22 revenues. Macy’s (M) and J.C. Penney are two of PVH’s ten largest customers and have closed over 300 stores since 2016. However, the company has seen strong growth in Calvin Klein, up 39% in FY 22 compared to FY 21, followed by Tommy Hilfiger, up 29%.

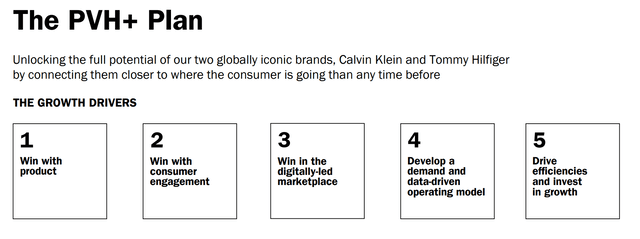

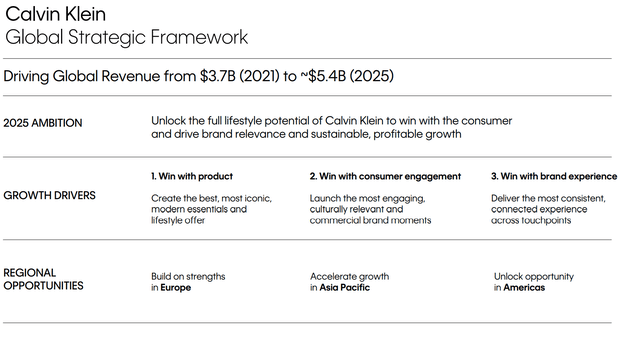

Below are slides I selected from their April 22, 2022; Investor Day Presentation found on the corporate website. They plan to increase their efforts in the area of digital sales and marketing to achieve corporate goals.

PVH Investor Day 2022 Presentation

Direct-to-consumer now accounts for over 40% of sales.

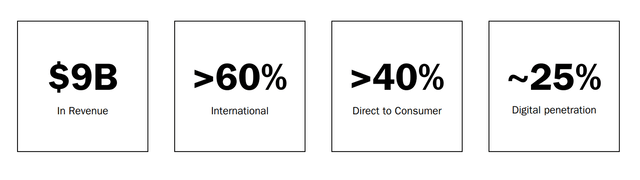

PVH Investor Day 2022 Presentation

The Tommy Hilfiger brand has shown consistent growth for the past decade with a temporary pandemic dip.

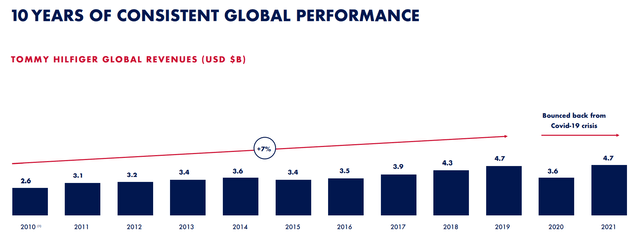

PVH Investor Day 2022 Presentation

There is a high degree of brand awareness.

PVH Investor Day 2022 Presentation

The Calvin Klein brand is projected to show strong growth.

PVH Investor Day 2022 Presentation

PVH has annual sales above $9B with 31K employees. They are 101.5% owned by institutions with 5.7% short interest. Their return on equity is 17.7%, and they have an 11.4% return on invested capital. The free cash flow yield per share is 8.7%. The price-to-book ratio is 0.6. Their Piotroski F-score is seven, indicating strength.

Balance Sheet Improvement and Aggressive Share Buybacks

PVH’s balance sheet is in better shape, with a net debt-to-EBITDA ratio of 2.3. PVH took on new debt when the pandemic hit, but it paid down more than $1 billion in debt in 2021. Consequently, the firm had $2.2 billion in debt at the end of July 2022, down from $3.6 billion at the end of 2020. PVH sold most of its heritage brands for $223 million in mid-2021. They had $699 million in cash at the end of July. The company is expected to generate free cash flow and further reduce its debt in the next few years.

PVH has also been actively returning cash to shareholders through stock buybacks. This policy makes sense as the stock trades at such low levels. The company repurchased $302 million and $325 million worth of shares in 2018 and 2019, respectively, and an additional $111 million in early 2020. PVH suspended its buyback program when the COVID-19 crisis hit but resumed it in the second half of 2021, with combined repurchases of about $700 million in 2021 and 2022. Their buyback yield per share is 17.7%. They currently have 70M shares outstanding.

Insiders are Buying Shares

Corporate insiders bought shares at prices near $53.90, all on September 6th. Coughlin Zachary, the EVP and CEO bought 1,856 shares at $53.85 totaling $100K. Stefan Larsson, the CEO and Director bought 18,540 shares at $53.93, counting $999K. Hagman Martijn, the CEO of Europe, bought 1,856 shares at $53.93 totaling $100K. I call this cluster buying and find it an important indicator of good things to come.

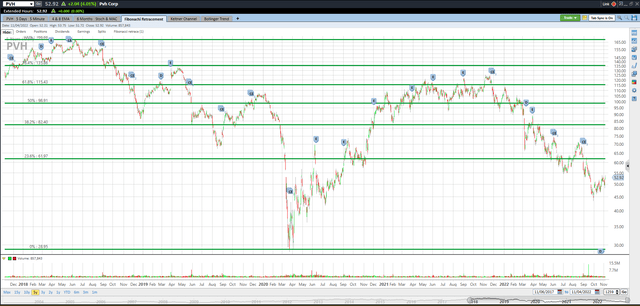

Good Technical Entry Point

The share price of PVH dropped sharply from $119.56 one year ago to a $52.92 closing price on November 4th. The firm has been dealing with the pandemic, war in Ukraine, shipping delays, inflation, depreciation of the euro versus the dollar, and higher taxes. Many of these problems are beginning to dissipate and will show improvement in 2023. Its key brands are healthy, and efforts to elevate products, achieve cost efficiencies, and build e-commerce will result in consistent earnings growth. PVH is reducing its dependence on department stores by increasing sales through mono-branded stores and e-commerce.

I’ve added the green Fibonacci lines, using the high and low of the past five years for PVH. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. PVH is below the 23.6% Fibonacci retracement level but could go lower. However, I believe that PVH will trade near the 23.6% Fibonacci level of $61.97 by June for the reasons in this article.

The three most accurate analysts have an average one-year price target of $89.67, indicating a 69% potential upside from the November 4th closing price of $52.92 if they are correct. Their ratings are mixed with two buys and one hold. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

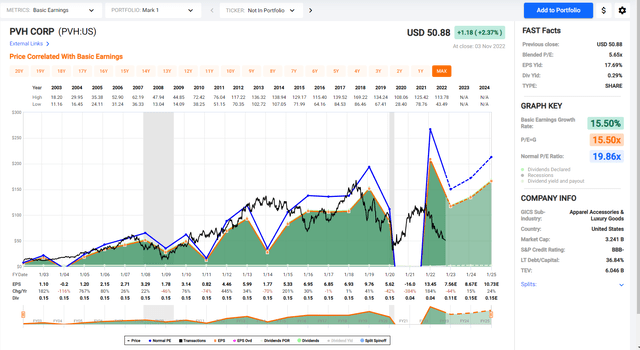

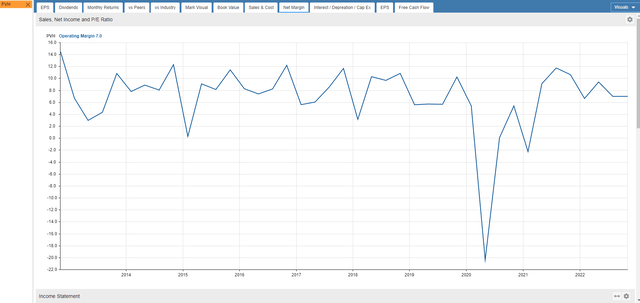

Trend in Earnings Per Share, P/E Ratio, and Operating Margin

The black line shows PVH’s stock price for the past twenty years. Look at the chart of numbers below the graph to see that PVH earnings were $9.76 in 2019, $5.62 in 2020, and -$16.00 in 2021, and they are projected to earn $13.45 in 2022 and $7.56 in 2023.

The P/E ratio for PVH is currently at 5.6, but the average ratio over the past ten years is 14. I don’t think the P/E will rally back to 14 anytime soon. If PVH earns $7.56 in 2023, the stock could trade at $55.18 if the market assigns only a 7.3 P/E ratio.

PVH saw an operating margin between 8.2% to 9.5% before the pandemic began, and the company is projected to be around 9.5% over the long term.

Sell Covered Calls

My answer to uncertainty is to sell covered calls on PVH six months out. PVH closed at $52.92 on November 4th, and June’s $55.00 covered calls are at or near $8.40. One covered call requires 100 shares of stock to be purchased. Selling a June covered call will allow the investor to collect dividends in December, March, and June at $0.0375 each. The stock will be called away if it trades above $55.00 on June 16th. It may even be called away sooner if the price exceeds $55.00, but that’s fine since capital is returned sooner.

The investor can earn $840 from call premium, $3.75 from dividends, and $208 from stock price appreciation. This totals $1,052 in estimated profit on a $5,292 investment, which is a 32.3% annualized return since the period is 224 days.

If the stock is below $52.92 on May 19th, investors will still make a profit on this trade down to the net stock price of $43.86. Selling covered calls and collecting dividends reduces your risk.

Takeaway

PVH will see higher stock prices due to increased digital sales and marketing, debt reduction, and share buybacks. Even if PVH’s stock price only moves from $52.92 to $55.00 by June 16th, a 32.3% potential annualized return is possible, including covered call premiums and dividends.

Be the first to comment