Justin Sullivan

A growing theme developed in 2022 is the downfall of many consumer discretionary retail giants. Some, such as Bed Bath & Beyond (BBBY), are facing potentially imminent bankruptcy, while others, like Target (TGT), are experiencing significant declines in growth. However, virtually all retailers face negative headwinds today as a slew of troubling shorter-term economic trends exacerbates their long-term competitive disadvantages.

Assuming strain will last, at-risk companies may face severe losses that may never be recouped. In my view, the in-store consumer retail sector is at exceptionally high risk due to its inflation and economic demand exposures and its long-term weakness. Almost all retailers have higher overhead costs than e-commerce giants like Amazon (AMZN) and have struggled to compete with Amazon for lower prices. Rising retail wages, electricity, and similar expenses can accentuate retail’s competitive disadvantage. In my opinion, Best Buy (NYSE:BBY) is yet another potential near-term causality of these growing trends.

Why Economic Woes Are Likely To Last

Best Buy, and all retailers, are highly subject to economic winds and can do little to avoid cyclical risks. As such, I believe today’s economic trends are paramount for investors interested in Best Buy (or peers) to understand. Many investors assume retailers will eventually recover as their declines this year stem from acute economic shifts. These temporary factors include the impact of rising interest rates on interest expenses and valuations, reductions in consumer spending power, and increases in variable and non-variable costs.

The inflationary trend is atypical since it is not triggered by aggregate economic demand rising above aggregate economic supply, but by aggregate economic supply falling below demand. These trends are fundamentally tied to rampant supply-side inflation – stemming from domestic and global production declines. Considering there are no signs indicating a return in worldwide commodity and manufacturing production and the labor shortage remains (in the US and abroad), the only way for inflation to slow is for the global economy to decline sufficiently for economic demand to fall to the lower supply level.

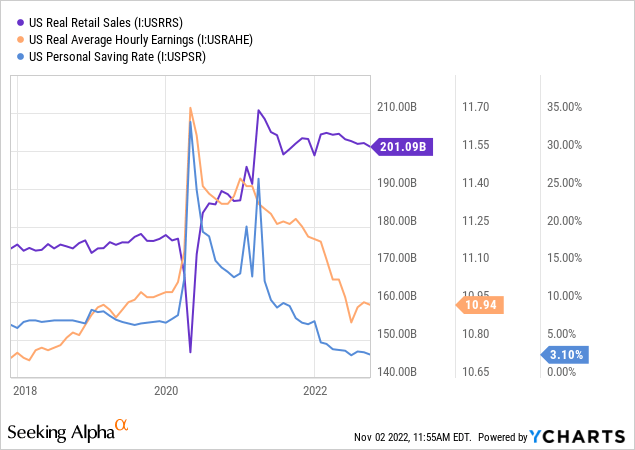

Economic data today indicates that low personal savings and falling real wages are causing real retail sales to stagnate. As these trends grow, I expect real retail sales to decrease as more people reduce spending on discretionary items. See below:

In my view, these trends are not ultimately caused by 2020’s changes, but are due to the fifteen-year stagnation in US industrial production. Since 2007, consumer spending has risen, but industrial production (total production of goods) has gone nowhere. Put simply, an economy cannot continue to grow its consumption without also increasing its production. Inevitably, such a scenario would result in rampant inflation or a significant consumption decline. Undoubtedly, 2020’s lockdown catalyzed the situation by rapidly decreasing US production while artificially stimulating demand (via QE and fiscal stimulus). Still, I believe that the situation merely triggered an inevitable result of the huge pre-existing supply-demand mismatch.

I emphasize this point in many articles as I believe investors must understand the market’s unique situation that is fundamentally unlike anything since the 1970s (triggered by the Iranian oil crisis). Indeed, today’s weak production situation may be more severe than that of the late 70s because it is a global phenomenon that includes, but is not isolated to, the Middle Eastern oil supply. With this in mind, it is unlikely we will see a “typical” quick economic cycle and may face years of stagflationary dynamics until the global goods market returns to a state of balance (either through increased production or lower consumption).

In my view, it is doubtful real retail spending growth will rebound soon and far more likely that it will decline at an accelerating pace. Real wages, productivity, personal savings, and many other demand drivers have been falling for quite a while. Real retail spending has only remained high, likely due to the rapid rise in consumer credit levels. In other words, many people have increased borrowing to offset declines in spending power to maintain spending levels. As this source of household liquidity dries up, it is seemingly inevitable that real retail sales experience a continuing decline.

Best Buy’s Profits May Turn Negative By 2023

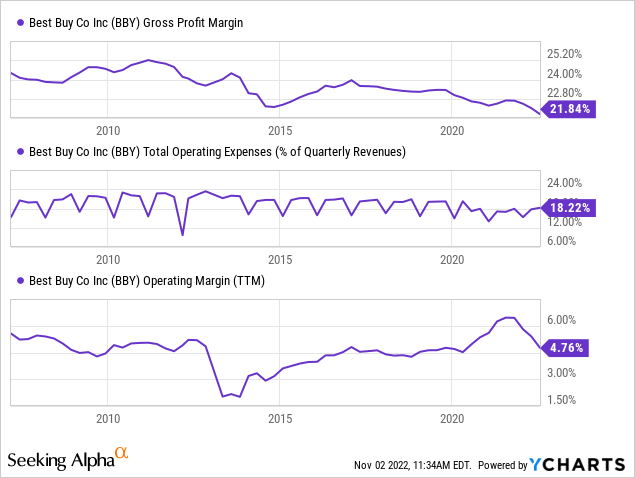

Best Buy has struggled with Amazon and other competitors over the past decade. Fundamentally, the company must charge higher prices than Amazon due to its higher overhead costs. The only area where Best Buy may have a competitive advantage is on large items such as televisions which carry higher shipping costs (limiting Amazon’s edge). On balance, the rise of e-commerce has caused Best Buy’s gross profit margins to decline pretty consistently over the past fifteen years.

Since around 2015, the firm has tried to offset this trend by improving efficiency and lowering operating expense-to-sales, keeping operating margins nearly flat. Like most companies, Best Buy indirectly benefited in 2020 from aspects of the lockdown, which decreased operating costs further (salaried employee layoffs or cuts, declines in business travel costs, etc.). Thus, despite headwinds, Best Buy’s operating profit margin rose dramatically in 2020. However, this benefit appears to end as operating expenses return to normal, while gross margins accelerate lower as economic demand wanes.

Looking forward, I expect Best Buy to see substantial declines in operating profit margins as “Opex-to-sales” return to a steady state of ~19-20% and gross margins slip to ~19-21%, along the current pace, as economic pressures cause price competition to grow. The net result of these two potential factors may push Best Buy’s operating margins from -1% to -2% by next year, potentially causing Best Buy’s EPS to turn negative.

Like almost all retailers, Best Buy has fragile margins, so a slight decline in its gross margins, or a small rise in its operating costs, could easily cause its profits to turn negative. Most analysts expect the company to earn an EPS of $6 to $7 over the next year, indicating a ~3% expected net margin (down from its TTM 3.6%). Based on my profit margin outlook, an EPS ranging from -$2 to $4 is more likely over the next year. Much of this depends on whether or not the firm can avoid price cuts amid waning economic demand.

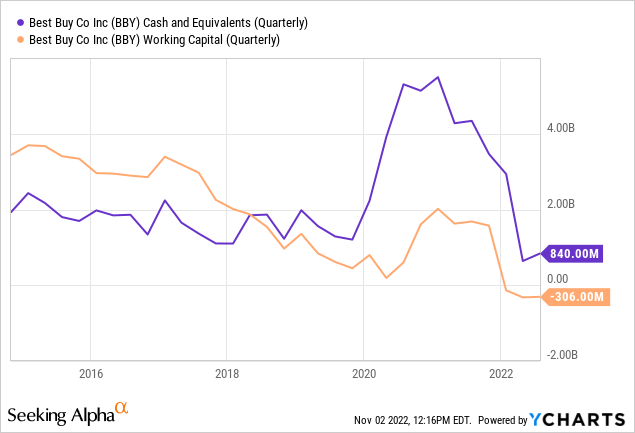

Unlike many retailers, Best Buy did not have excessively high inventory levels at the end of Q2. Still, its cash position was far weaker than it’s been, and its working capital had turned negative in Q1, indicating potential liquidity strain if holiday sales are below expected levels. See below:

Best Buy’s balance sheet is certainly not as weak as that of other retailers like Bed Bath & Beyond and Kohl’s (KSS). That said, it is seemingly more vulnerable than it has been in many years, potentially exacerbating its difficulties amid the economic headwinds.

The “Last Man Standing” May Not Stand Long

Many opinions on retail consumer discretionary stocks suffer some degree of “survivorship bias.” Looking at the stock charts of all retail stocks, it would seem many go through periods of significant declines followed by recoveries. This fact may make it seem as though headwinds are always temporary and that recoveries are inevitable. Of course, that view would exclude the fact that many consumer discretionary retail companies have gone bankrupt over the past two decades, so their stock price charts are not considered.

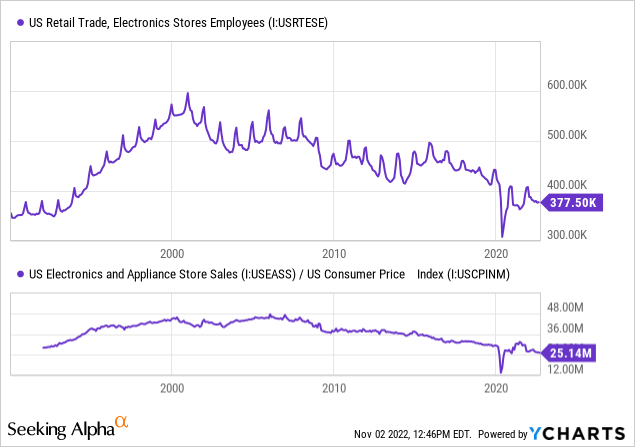

A related bias that is particularly notable for Best Buy is what I call the “Last Man Standing” bias. This bias is the failure to account for sales growth stemming from a competition decline. Best Buy has maintained its sales and profits over the past decade, but how much of this is attributable to the liquidation of Fry’s Electronics, Circuit City, Radio Shack, CompUSA, and likely others? From a long-term standpoint, it is clear that electronics stores are in a state of chronic decline. This trend is illustrated both in the total employee count and inflation-adjusted sales:

The fact is that Best Buy has become the “Last Man Standing” in a dying industry. Its achievement is appreciable, but it does not change the fact that the long-term trend remains against electronics stores due to their fundamental competitive disadvantages in terms of pricing power. Amazon’s key advantage is that it need not earn a profit on item sales, instead earning from its prime subscription and AWS services – allowing it to relatively consistently undercut Best Buy. As such, even Best Buy’s e-commerce segment may not remain competitive against Amazon.

Over the coming years, I doubt Best Buy will remain a profitable enterprise as it cannot grow market share from the demise of its direct competitors. Unless Amazon’s business model breaks, I believe Best Buy will inevitably see its business go the same route as its many defunct competitors. Of course, this potential may still be years away as Best Buy’s balance sheet is not terribly risky. I believe the growing economic storm could rapidly accelerate the timeline.

Personally, I would not buy Best Buy unless the company was to change its business model fundamentally. Still, over the next year, I believe its EPS will decline at least to around $3 to $4, giving it a price target of $30 to $40 using a “10X” fair-value forward “P/E” valuation. Truthfully, I expect the stock will eventually decline below that range as more investors and analysts understand the company’s existential business risks and the seemingly long-lasting nature of the current stagflationary economic dynamic. With this in mind, I am very bearish on BBY and believe the stock may be a good short opportunity.

BBY has a relatively low short interest of 3.7% and virtually no borrowing costs, giving it generally low short-squeeze risk. Potential immediate downside catalysts include weak Q3 earnings amid the general Q3 slowdown in retail sales, a weak holiday shopping season (based on my economic outlook), and dividend cuts stemming from depressed sales. Of course, the stock could rebound as investors buy the stock as a perceived discount opportunity if these bearish potentials are due to occur, so stop-losses may be wise. Such risks could be mitigated through options, though they are not cheap as BBY’s implied volatility level is elevated today. Risks aside, I believe BBY is among the better short opportunities on the market today as it seems that the market is drastically underestimating both short-term and long-term risks facing the firm.

Be the first to comment