imaginima

Suffering is one of life’s great teachers. ― Bryant McGill

Today, we go to the energy sector and profiled a midcap energy producer whose stocks have had a roller coaster right of late. The shares have seen some broad insider activity of late and shares now have a five percent dividend yield. A full analysis follows below.

Company Overview

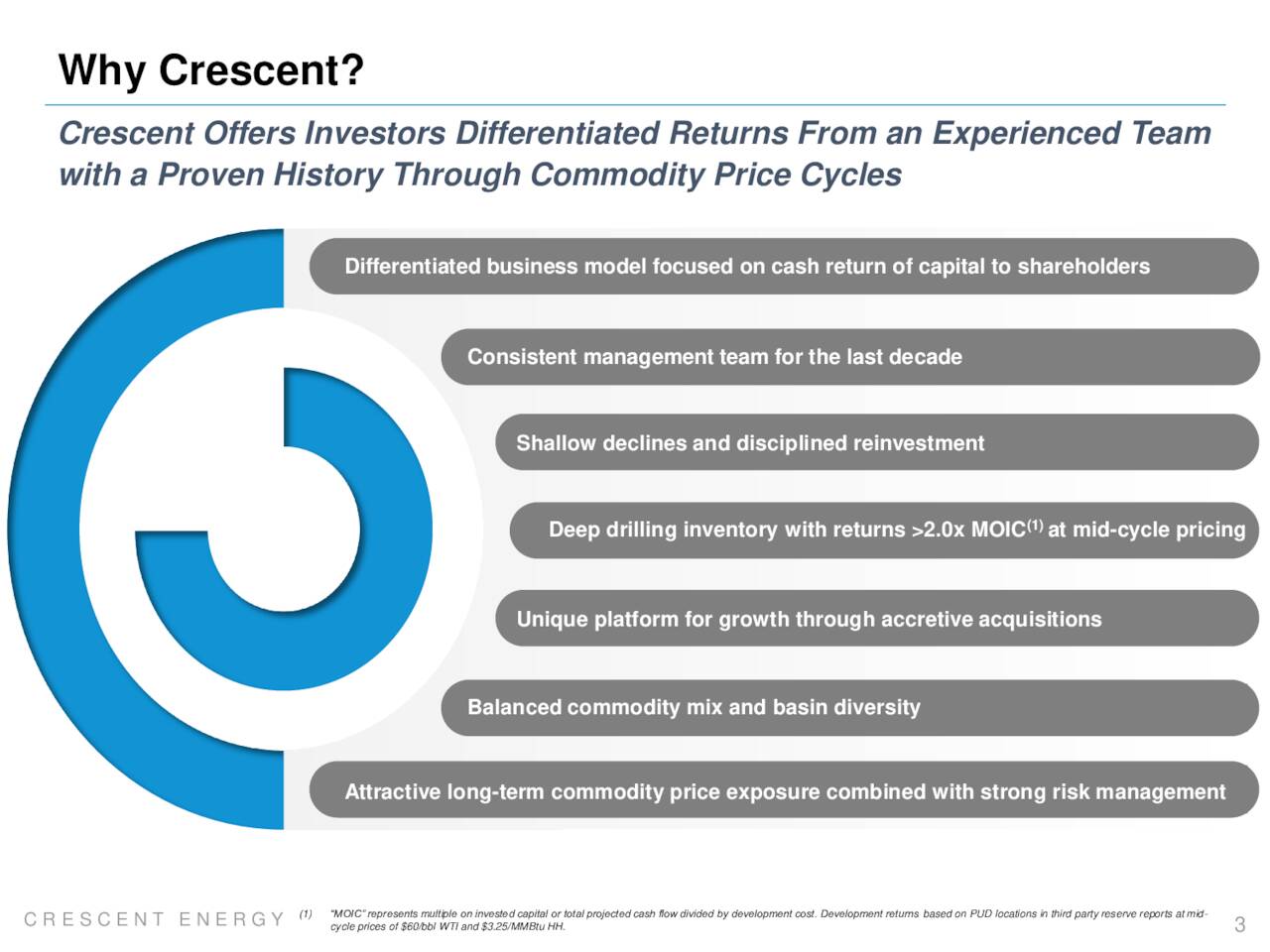

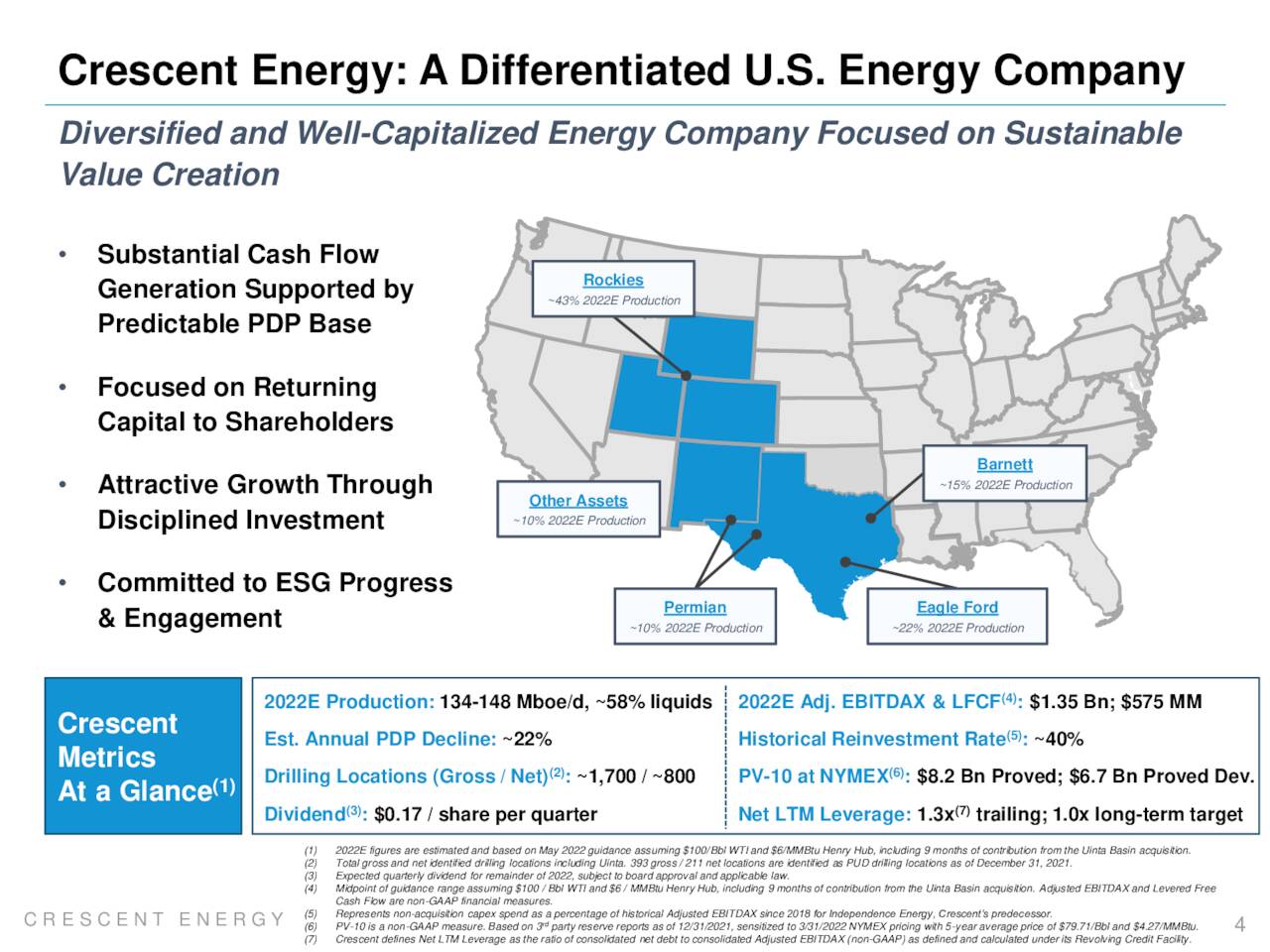

Crescent Energy Company (NYSE:CRGY) is a Houston based independent energy concern with a focus on the production, development, and acquisition of oil, natural gas, and NGL reserves across onshore basins in five states, including the Eagle Ford, Rockies, Barnett, and Permian. The company held pro forma YE21 proved reserves of 598 million barrels of oil equivalents (MMBoe) valued at ~$8.6 billion (PV-10), comprised of 55% liquids and 83% proved developed reserves with ~65% of its revenue derived from oil. Crescent was formed from the merger of publicly traded Contango Oil & Gas Company and Kohlberg Kravis & Roberts’ (KKR’s) Independence Energy in December 2021 with its first trade executed at $15.10 a share. Its stock trades around $13.50 a share, translating to a market cap of $2.55 billion.

May Company Presentation

The company is capitalized by two classes of stock. The 42.0 million shares of publicly traded Class A stock confer economic benefit and one vote per share. The 127.5 million shares of privately held (by KKR) Class B stock bestow no economic interest, one vote per share, and transferability into Class A stock on a one-for-one basis.

May Company Presentation

Approach

Since Contango and Independence both employed growth-through-acquisition strategies pre-merger, their combination permitted Crescent to pursue larger assets in an environment where there is plenty of properties on the market and not many interested buyers, owing to the current geopolitical milieu and longer-term secular trends. As proof, management offers the 150 to 200 assets for sale it will evaluate during 2022.

May Company Presentation

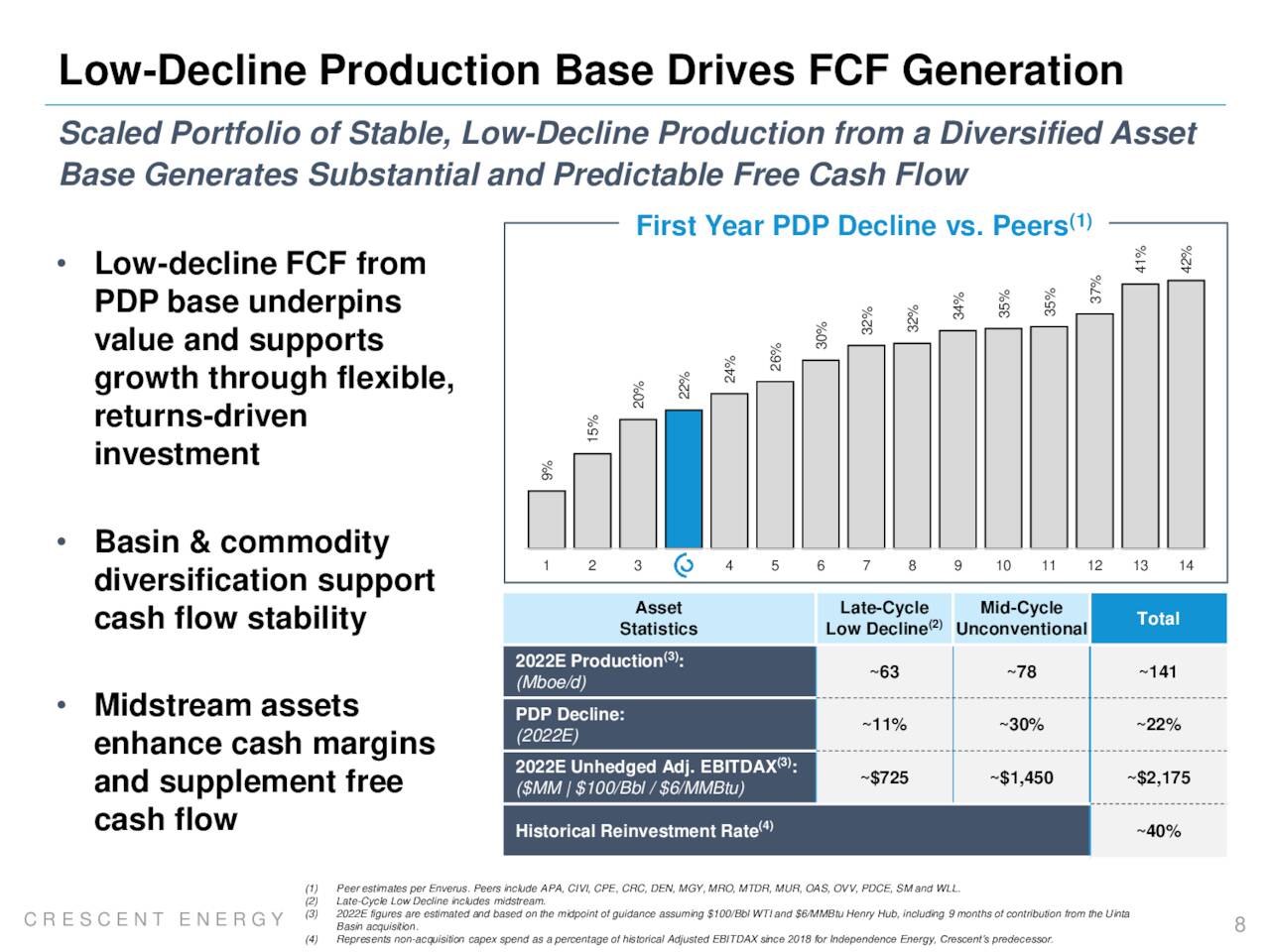

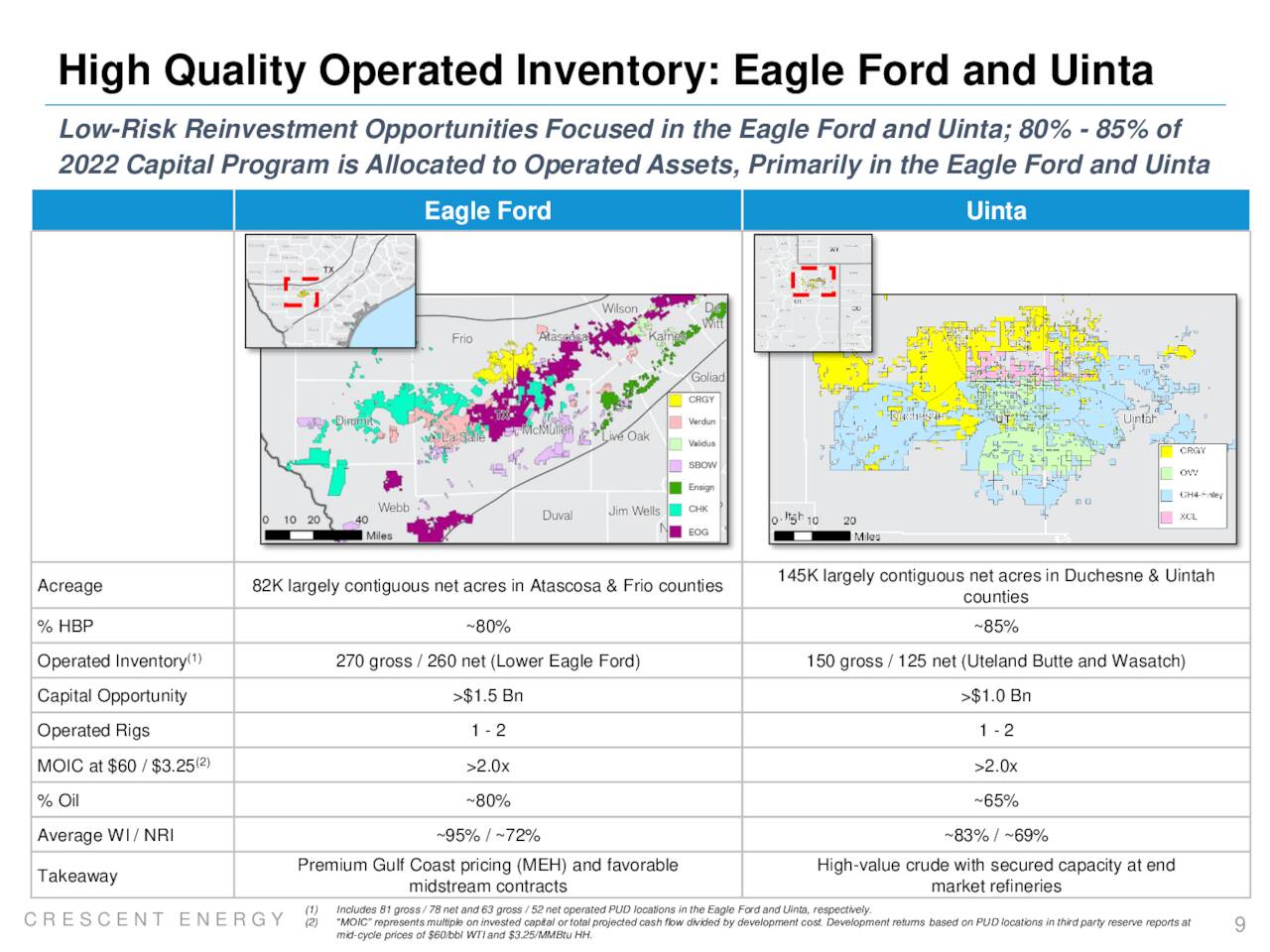

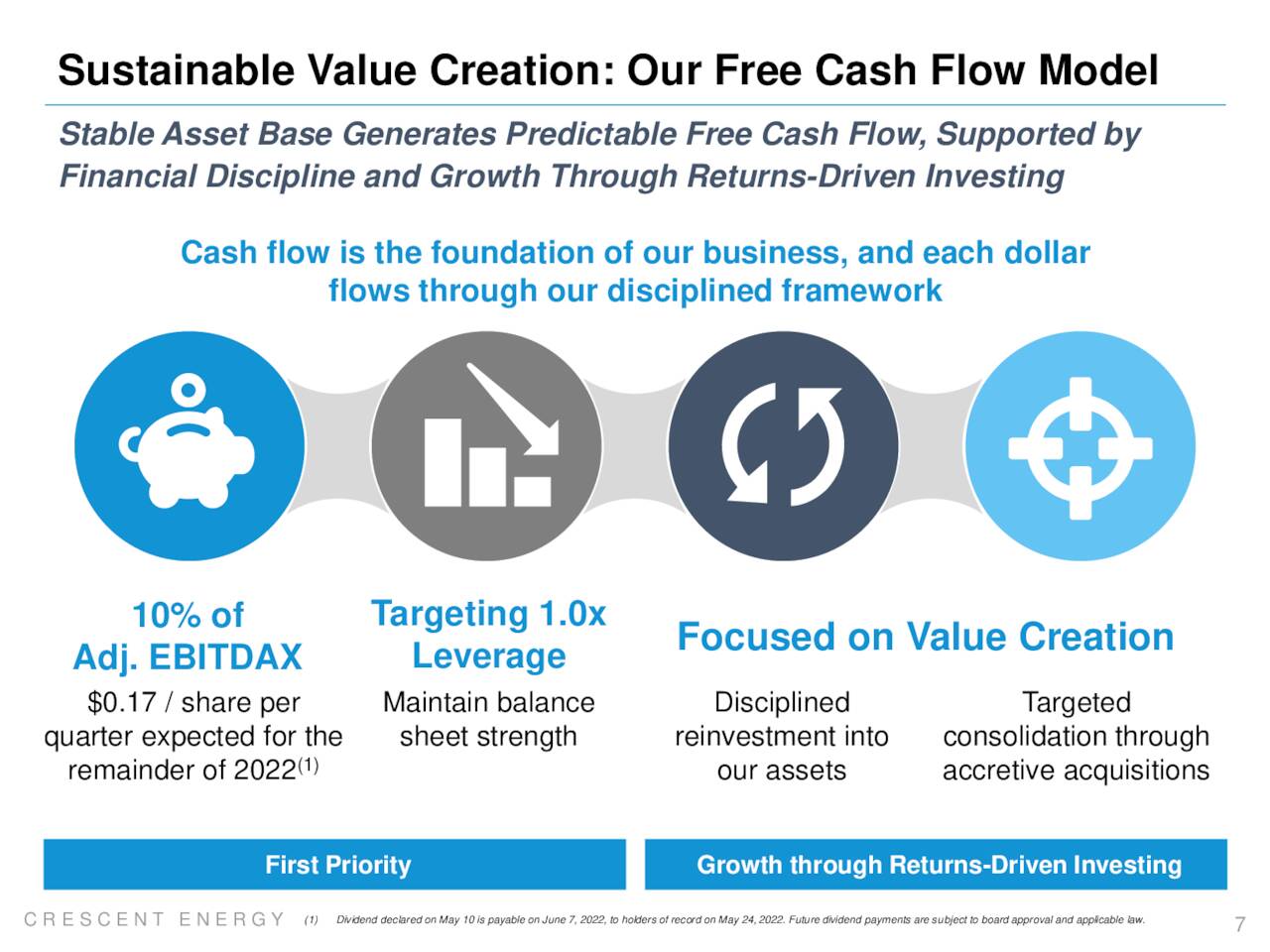

Unlike many of its competitors, the company is well-capitalized and targets a net leverage ratio of 1.0 (versus an industry average of 3.1 since 2014) with acquisitions aimed at generating strong, predictable free cash flow in a highly volatile and low-visibility industry. Specifically, M&A activity is designed to generate returns in excess of two times its invested capital with payback periods of less than five years. Management concentrates on mature assets with low decline rates in low-risk areas with robust midstream support, generally where it has an existing position so it can realize administrative and operating synergies. Capital is then returned to shareholders in the form of dividends that generally equate to 10% of Adj. EBITDAX (i.e., EBITDA before exploration expenses). Employing this approach, Crescent and its predecessor companies have executed 25 acquisitions since the beginning of 2017.

May Company Presentation

Its most recent (March 2022) acquisition is an extension of that philosophy. The company purchased reserves of ~$1.1 billion (PV-10 sensitized to NYMEX pricing on June 30, 2022) and production of 30,000 Boe/d (~65% oil) across 145,000 contiguous acres in the Uinta Basin (of the Rockies) for a cash consideration of $690 million. According to management, the acquisition is accretive, increasing the scale of its production base in the region while reducing its per unit cost structure. The Uinta Basin assets did not alter the company’s net leverage, which remained at 1.3, with expectations for it to return to its 1.0 target by YE22. Crescent has three rigs in total dedicated to its Uinta and Eagle Ford properties, which are responsible for ~85% of its oil production.

To support stability of its near-term cash flows, the company engages in an active rolling hedge strategy, although it does have long-term exposure to oil and gas prices.

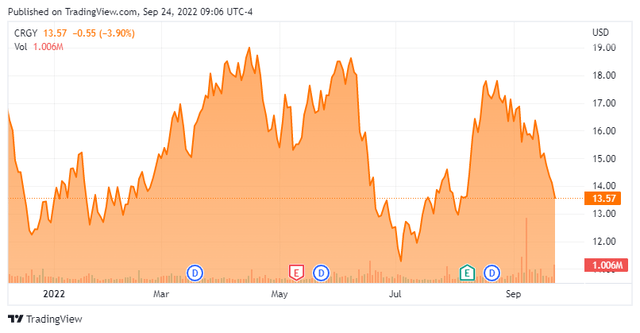

Stock Price Activity

Admittedly, these growth by acquisition and hedging strategies are easier to execute in a period of lower oil prices and no backwardation versus higher oil prices with significant backwardation as sellers are going to want to be paid on current market pricing (or at least somewhere close) while significant sums of money are left on the table hedging in soaring markets. Crescent brief history is case in point. West Texas Intermediate [WTI] closed at $72.36 a barrel the day the new company was birthed via merger at $15.10 per share on December 8, 2021. But within a week, shares of CRGY were began trading below $15 and did not close above $15.10 until the Ukrainian oil rally was in full force on March 4. 2022 with WTI closing at $115.68 a barrel, or $43.32 higher than December 8th. This significant ‘underperformance‘ could be blamed somewhat on its derivative strategy that had 70% of its oil production and 71% of its natural gas output subject to hedging; but it was also a function of the investment community not knowing or caring about Crescent, attributable to its low float and lack of Street coverage until early April 2022.

With oil steadfastly in the triple digits beginning in mid-March until recent recently, Crescent caught a bid and traded predominantly between $16 and $19 a share through June 10, 2022, when it closed at $18.01. On that same date, the company filed an amended S-1 to sell five million shares of stock. The market took notice and revalued shares of CRGY 11% lower in the subsequent trading session to $15.96, triggering a three-plus-week decline to an all-time closing low of $11.28 on July 6, 2022, despite the fact the secondary offering just recently took place. Not helping matters for owners of CRGY at the time was the concurrent retreat in crude prices below $100 a barrel for the first time in three months. Oil just went under $80.00 a barrel late this week.

2Q22 Earnings & Outlook

Although Crescent’s stock did rebound slightly, it remained mostly in the $13 area until the company posted financial results on August 9, 2022, reporting net income of $225.6 million (non-GAAP), Adj. EBITDAX of $373.3 million ($640.2 million unhedged), and levered free cash flow of $137.2 million on revenue of $908.4 million as compared to a loss of $9.3 million (non-GAAP), Adj. EBITDAX of $194.9 million ($370.7 million unhedged) and levered free cash flow of $89.5 million on revenue of $598.9 million in the prior quarter (1Q22). The Adj. EBITDAX and levered free cash flow results represented 92% and 53% sequential improvements as the quarter reflected the addition of the Uinta property – raising output sequentially from 94,000 Boe/d to 142,000 Boe/d – and higher commodity prices. [Levered free cash flow is EBITDAX minus cash components (interest, taxes, and development costs).]

It goes without saying that hedging was exceptionally costly with Crescent losing $177.2 million in 2Q22 ($850.7 million in 1H22) as it realized a price of $78.84/bbl of crude versus $104.23/bbl unhedged and $3.51/MMcf of natural gas versus $6.40/MMcf unhedged.

Management maintained its FY22 outlook – which it had bumped higher concurrent to its 1Q22 report to reflect Uinta – expecting Adj. EBITDAX of $1.35 billion and levered free cash flow of $575 million with production of 141,000 Boe/d, all based on range midpoints.

Balance Sheet & Analyst Commentary

Some of the free cash will be earmarked for Crescent’s quarterly dividend of $0.17 (5% yield), with the balance for debt reduction (assuming no additional acquisitions). The company’s net leverage ratio stood at 1.2 on June 30, 2022 with access to $508 million of liquidity. Its debt of $1.5 billion will not start maturing until 2025. Proved developed reserves (PV-10) covered net debt by a factor of 4.8. In an attempt to improve (or at least maintain) its market visibility, the CFO and board have wisely elected not to pursue a share buyback program due to its already small float. The company priced five million shares at $15.00 apiece via a secondary offering earlier this month.

May Company Presentation

The lone Street analyst covering Crescent’s equity is Neal Dingmann at Truist. He initiated coverage in April 2022 with a buy rating and a price target of $24.

After the 2Q22 earnings report, shares of CRGY rallied to close above $14 which they currently still trade around. And then, in what appeared to be a coordinated effort, seven different insiders, led by CEO David Rockecharlie, acquired 85,666 shares of CRGY between $15.25 and $16.25 a share on August 12th – 16th. Last week, two beneficial owner entities reduced their holdings of CRGY by 5.75 million shares each.

Verdict

While its industry contends with broad inflationary pressures and supply chain constraints against the current backdrop of declining oil prices, Crescent is vexed by anonymity. As a result, its stock can rise and fall substantially on little to no news – and sometimes without any correlation to energy prices – adding complexity to timing an investment. Furthermore, it is difficult to bestow credit on the company’s cash flow stability approach when its hedging strategy cost it $1.82 billion on a pro forma basis over the past 18 months, which includes $970.7 million in the year preceding the Ukrainian conflict. Similarly, it is challenging for a concern with the word ‘energy’ as part of its moniker to receive credit in a declining oil price environment, especially when it wallows in relative obscurity.

That said, its approach is sound – non-optimal timing notwithstanding – and it trades at reasonable valuations: EV/FY22E Adj. EBITDAX of 2.8 and EV/FY22E levered cash flow of 6.5. And owing to its volatility, it enjoys significant option premiums – which, when paired with its 5% yield, would make Crescent more appealing as a covered call play. Unfortunately, while there are options available against the equity, they are not liquid enough to deploy this strategy. Therefore, with commodity prices continuing to fall and global growth noticeably slowing, we are passing on any investment recommendation around Crescent at this time despite its healthy yield.

Some people would rather die in their pride, than live in their humility. ― Anthony Liccione

Be the first to comment