Chaay_Tee

Bargain hunters rejoice: now at year-to-date lows, the stock market is full of cheap stocks for the first time in years, particularly in any name that has a whiff of e-commerce attached to it.

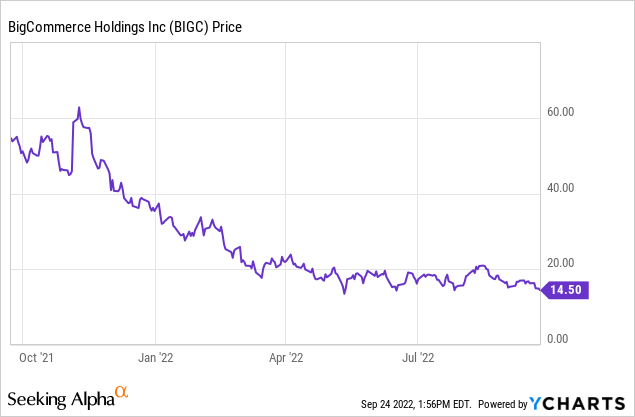

BigCommerce (NASDAQ:BIGC), in particular, has seen a great deal of pain this year as investors adopted a risk-off attitude and lamented the sharp deceleration of e-commerce activity relative to the pandemic era. And while it’s true that there’s some added amount of fundamental risk here, it’s hardly aligned to the 60%+ drop in the company’s stock. It’s a great time, in my view, for investors to re-assess the bull case for BigCommerce.

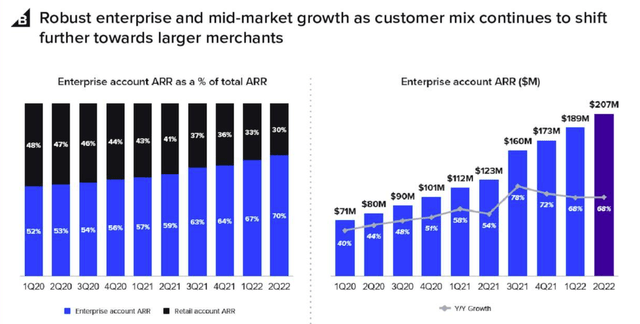

I remain bullish on BigCommerce and believe current fears to be far overblown. There are two reasons why I think BigCommerce is relatively more shielded than other B2C e-commerce companies: first, the company is largely enterprise-driven. The company’s share of ARR accruing to enterprise companies has hit 70%, as shown in the chart below. Note as well that the company’s pace of enterprise ARR growth has continued at a very impressive ~70% clip through Q2:

BigCommerce enterprise ARR (BigCommerce Q2 earnings deck)

The second reason BigCommerce is shielded: right now, many companies are cutting their growth expectations due to FX impacts from the strengthening dollar. BigCommerce, meanwhile, has a largely U.S.-driven revenue base.

Looking to the future, here are all the long-term reasons to be bullish on BigCommerce:

- E-commerce is a massive market opportunity. This hardly needs to be said: BigCommerce expects global e-commerce spend to reach ~$7.4 trillion by 2025, up from $4.9 trillion in the current year. Of that, merchants’ spending on software platforms like BigCommerce is expected to hit $9.9 billion by 2025. In other words, BigCommerce has barely scratched the surface of this opportunity.

- Tilt toward enterprise. More and more of BigCommerce’s business these days is not coming from small individual sellers (though it does help set up storefronts for these retail users as well), but from enterprise goliaths. Enterprise makes up $207 million, or 70%, of BigCommerce’s current ARR. Global enterprise clients and well-known brands in the BigCommerce fold include Vodafone, Mazda, Reebok, Sharp Electronics and Johnnie Walker.

- Multiple routes to monetization. Like Shopify, BigCommerce’s main revenue streams come from sellers’ subscription fees and transaction fees, but the company also stands to gain greater wallet share by doubling down on ad/product placements, shipping services, payment processing, and other seller services.

- Profit potential. 2022 is an investment year for BigCommerce, so we won’t see much margin leverage this year. However, the company’s mid-70s gross margins and its ability to generate single-digit operating loss margins in the past bodes well for BigCommerce’s ability to scale profitably.

The biggest appeal to BigCommerce right now is its bargain-basement valuation. At current share prices near $14, BigCommerce trades at a market cap of $1.06 billion. After we net off the $358.7 million of cash and $336.5 million of debt on BigCommerce’s most recent balance sheet, the company’s resulting enterprise value is $1.04 billion.

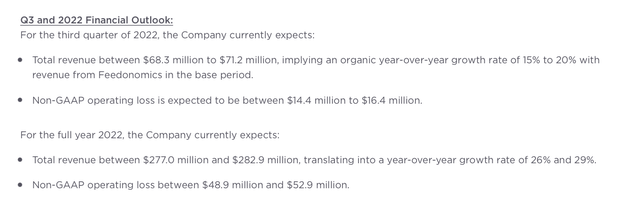

For the current fiscal year, BigCommerce has updated its guidance outlook to $277.0-$282.9 million, representing +26-29% y/y growth (slightly cutting from the high end of the prior outlook of 26-30% y/y growth).

BigCommerce outlook (BigCommerce Q2 earnings release)

Looking ahead to FY23, Wall Street consensus is currently expecting BigCommerce to generate $338.7 million in revenue, representing 21% y/y growth (data from Yahoo Finance).

This puts BigCommerce’s valuation multiples at:

- 3.7x EV/FY22 revenue

- 3.1x EV/FY23 revenue

Needless to say, this is quite a cheap revenue multiple for a stock that is still managing to grow revenue at north of a >30% y/y clip. Utilize the recent dip as a buying opportunity.

Q2 download

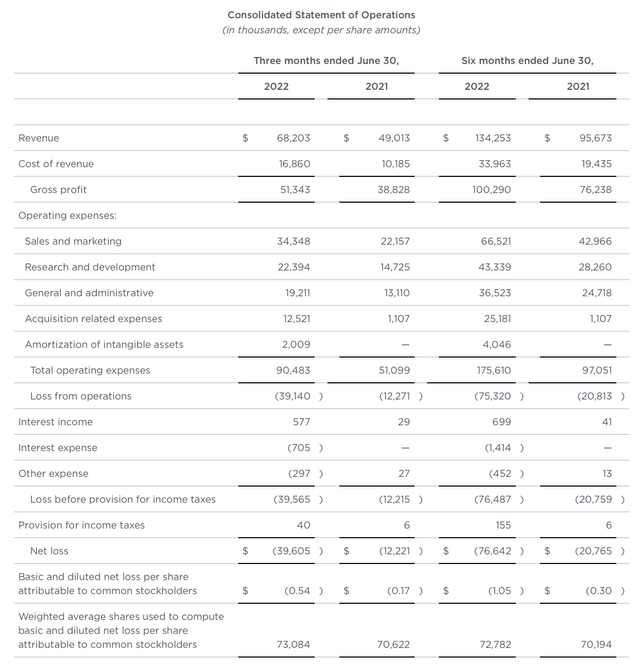

Let’s now go through BigCommerce’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

BigCommerce Q2 results (BigCommerce Q2 earnings deck)

BigCommerce’s revenue grew 39% y/y to $68.2 million in the quarter, beating Wall Street’s expectations of $66.0 million (+35% y/y) by a four-point margin. Revenue growth did decelerate, however, relative to 42% y/y growth in Q1.

The company did add $16 million of net-new ARR in the quarter to end at $296 million in total ARR (of which $207 million, or 70%, is enterprise-based). Outside of the company’s acquisition of Feedonomics in the third quarter of FY21, this was the largest sequential increase in ARR in BigCommerce’s history.

Here’s some commentary from CEO Brent Bellm’s prepared remarks on the Q2 earnings call, detailing why he thinks BigCommerce is well-positioned to muscle through the current macro crunch:

We understand that the market is focused on potential risk areas created by current economic headwinds. Nearly all e-commerce companies have been talking about these risks to their businesses. We too face these risks, but on balance, I believe the strengths of our business model are demonstrated well in this market. And I’d like to dive deeper into why that is.

First 70% of our revenue mix comes from enterprise merchants, which are predominantly established successful businesses from a wide range of categories, geographies, and B2C and B2B use cases. Similarly, but separately, 70% of our revenue comes from recurring subscription revenue, which provides a stable, predictable top line.

The combination of durability from enterprise customers and predictability from subscriptions makes us less vulnerable to short term economic swings then would be a consumption or GMV-based revenue model. Second, the components of our subscription plans that do adjust with GMV tiers or order counts are calculated using a trailing 12 month look back. This has a moderating effect against short term and seasonal fluctuations in consumer spending. Sharp movements upward take time to be fully realized in our pricing and revenue, which we saw during the pandemic, noting that a revenue did not increase as fast as total e-commerce GV did […]

Third, nearly all of our direct sales occur in US dollars today. Foreign exchange risk is limited to partner share like in payments that are earned in non-US GMV, essentials plan subscription upgrades prompted by GMV earned in foreign currencies and are non-US operating expenses. These FX sensitivities impact a small percentage of our total revenue and expense base today. We do not believe a strong US dollar is a material risk to us at this time.”

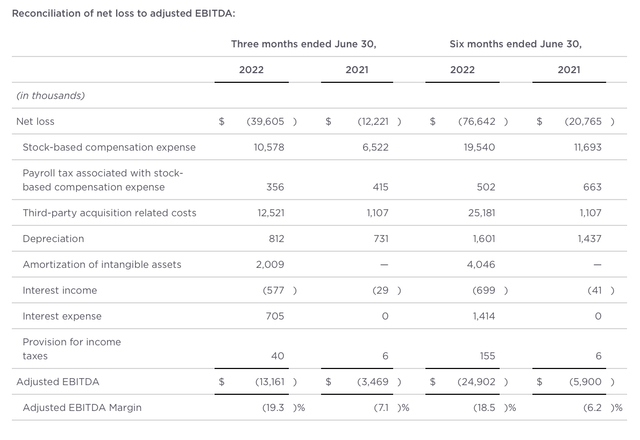

The big black eye for BigCommerce during this risk-off market, however, is the company’s declining margin profile. Adjusted EBITDA losses widened to -$13.2 million in the quarter, representing a -19% adjusted EBITDA margin: twelve points worse than -7% in the year-ago Q2.

BigCommerce adjusted EBITDA (BigCommerce Q2 earnings deck)

In spite of a one-point boost in gross margins, the company’s overall margin profile sunk under the weight of heavier sales and marketing expenses, primarily to drive the company’s international expansion efforts. R&D and general corporate overhead expenses also saw slight increases as a percentage of revenue, driven by post-COVID hiring activity; but BigCommerce does expect to moderate its pace of hiring moving forward.

Key takeaways

Don’t give up on BigCommerce just yet. With its still-strong revenue growth rates built on top of a sturdy enterprise base, BigCommerce is well-positioned to weather through the current macroeconomic cycle and continue benefiting from secular growth in e-commerce. Use the dip as a buying opportunity.

Be the first to comment