AndreyPopov

A Quick Take On Sterling Check

Sterling Check (NASDAQ:STER) went public in September 2021, raising approximately $377 million in gross proceeds for the company and selling shareholders from an IPO that priced at $23 per share.

The firm provides a range of personnel screening and verification products and services.

Prospective investors with a patient time horizon may wish to begin nibbling at STER at the current level of around $20.00, but for now, I’m on Hold for STER until we see the trajectory of the U.S. labor market from here.

Sterling Check Overview

New York, New York,-based Sterling was founded to develop a full suite of background screening, verifications and ongoing monitoring services for businesses.

Management is headed by Chief Executive Officer Joshua Peirez, who has been with the firm since July 2018 and was previously president and COO of Dun & Bradstreet and held senior roles at MasterCard prior to that.

The company’s primary offering categories include:

-

Identity verification

-

Background screening

-

Credential verifications

-

Onboarding

-

Ongoing monitoring

The firm pursues large clients through a direct sales team approach organized by industry vertical and region.

Sterling Check’s Market and Competition

According to a 2021 market research report by The Insight Partners, the global employment screening market, one of the firm’s focus areas, was an estimated $4.2 billion in 2020 and is forecast to reach $6.4 billion by 2028.

This represents a forecast CAGR of 5.5% from 2021 to 2028.

The main drivers for this expected growth are increased populations in urban areas resulting in greater job opportunities and employee demand and a growing incidence of application fraud or inflation.

Also, the number of applicants for each job opening has increased along with a larger number of contract, temporary and “gig economy” workers.

Major competitive or other industry participants include:

-

First Advantage

-

HireRight

-

Accurate Background

-

ADP

-

Cisive

-

Checkr

-

DISA

-

Triton

-

Other smaller players

Sterling Check’s Recent Financial Performance

-

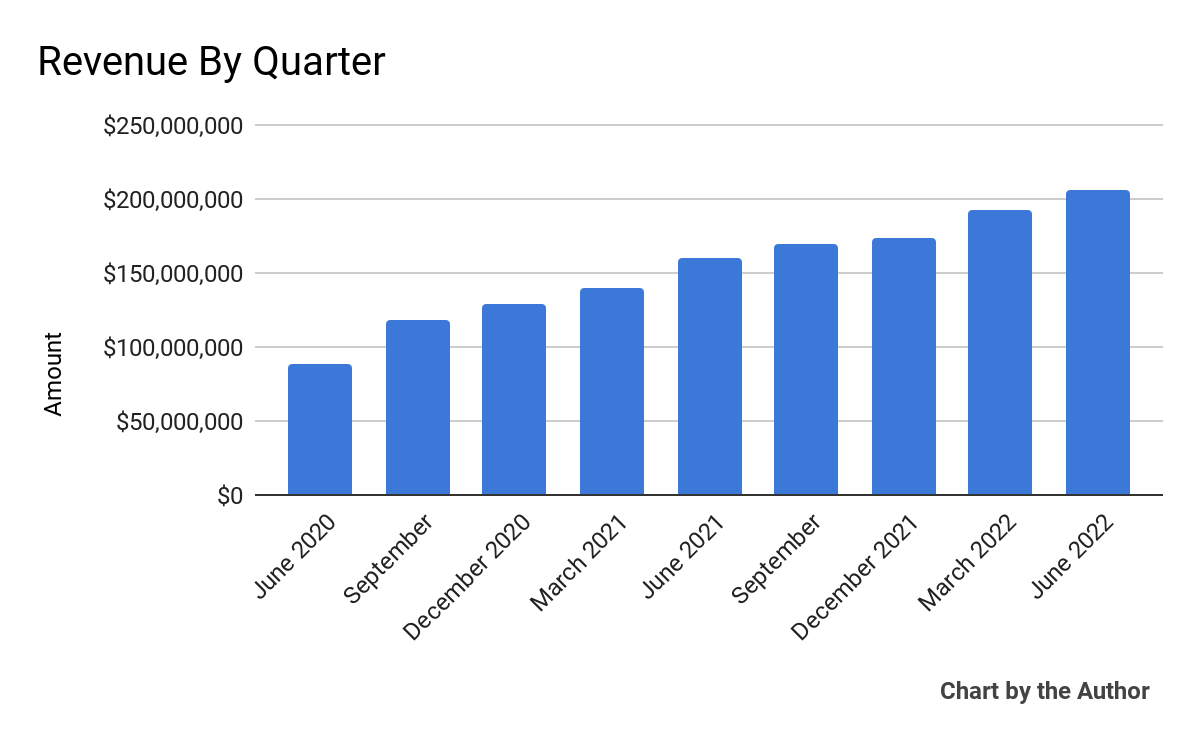

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

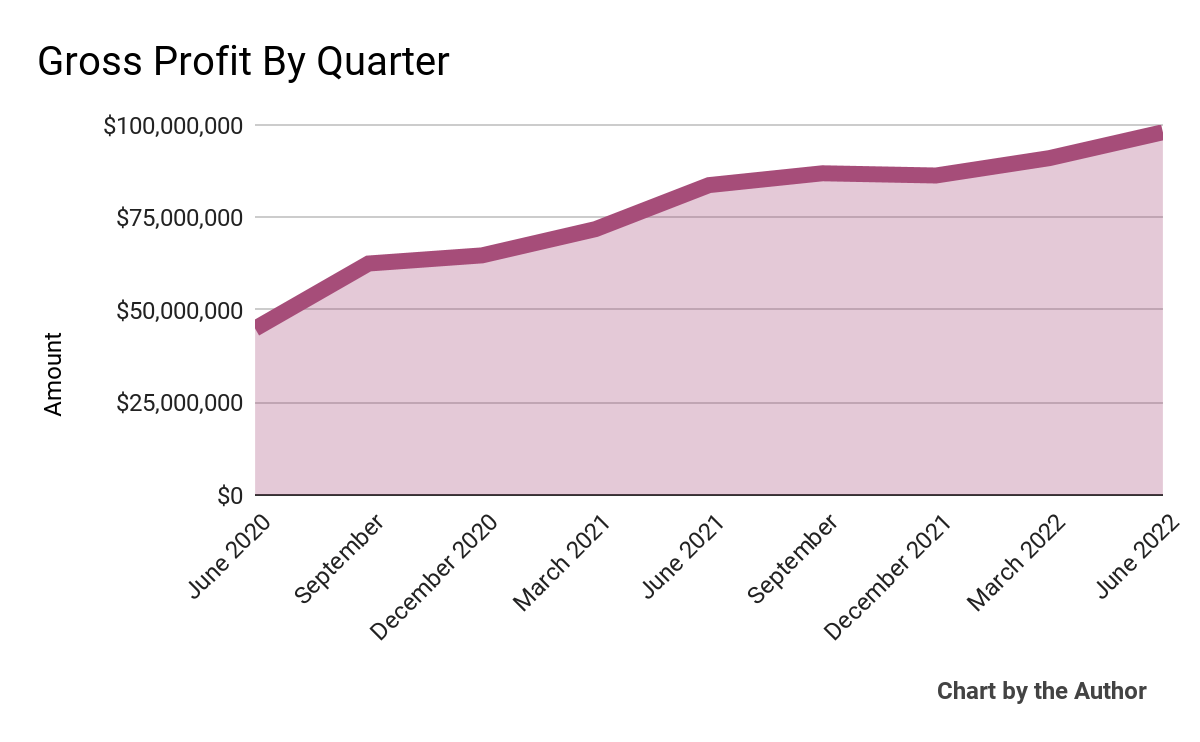

Gross profit by quarter has also grown with a similar trajectory as total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

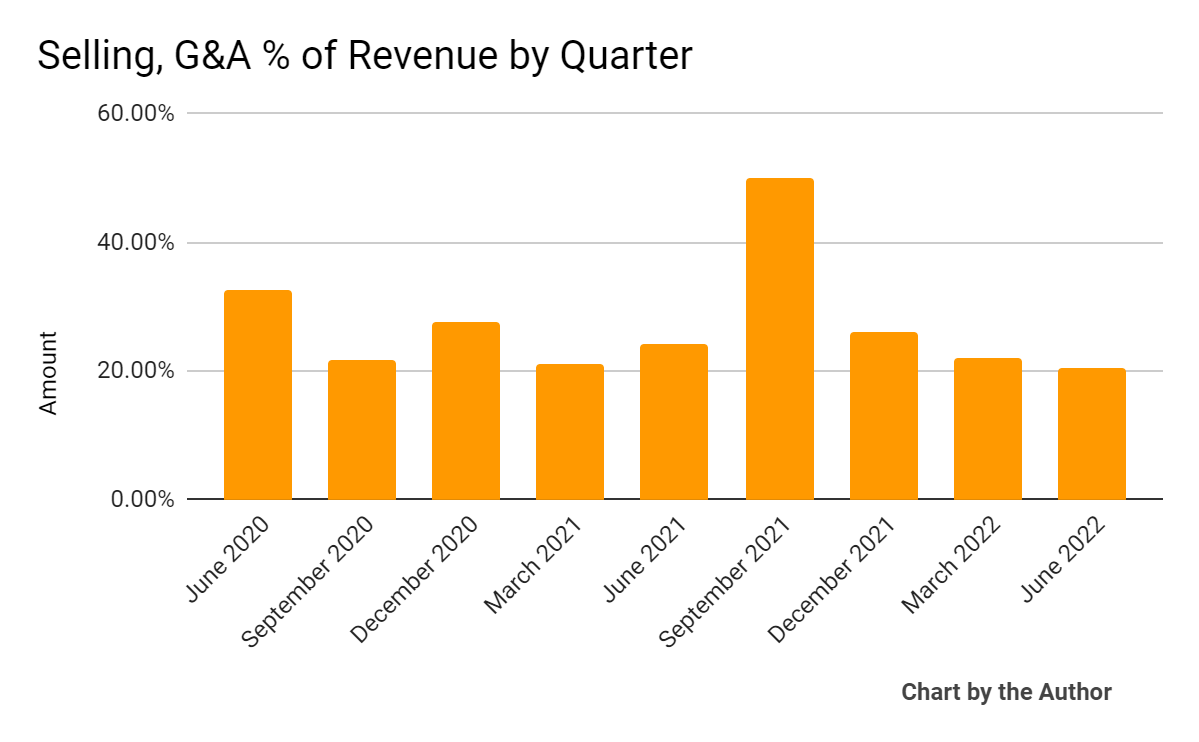

Selling, G&A expenses as a percentage of total revenue by quarter have followed the trajectory shown below:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

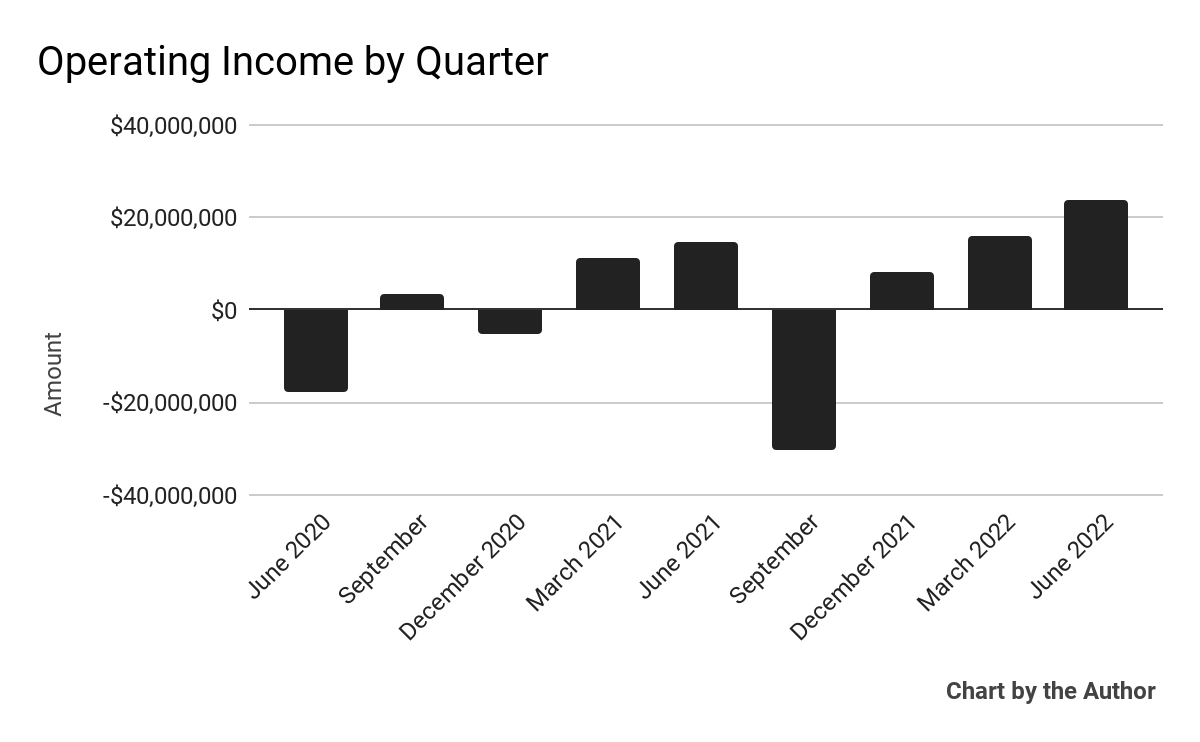

Operating income by quarter has improved in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

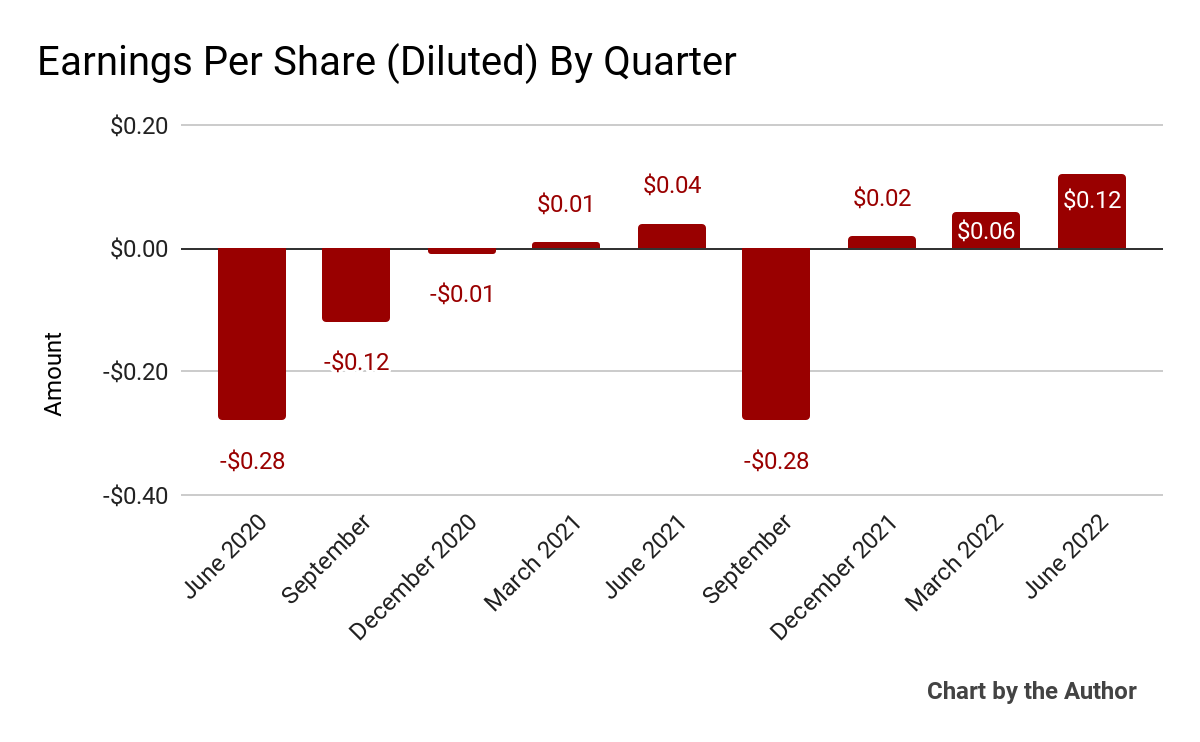

Earnings per share (Diluted) have also shown positive results in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

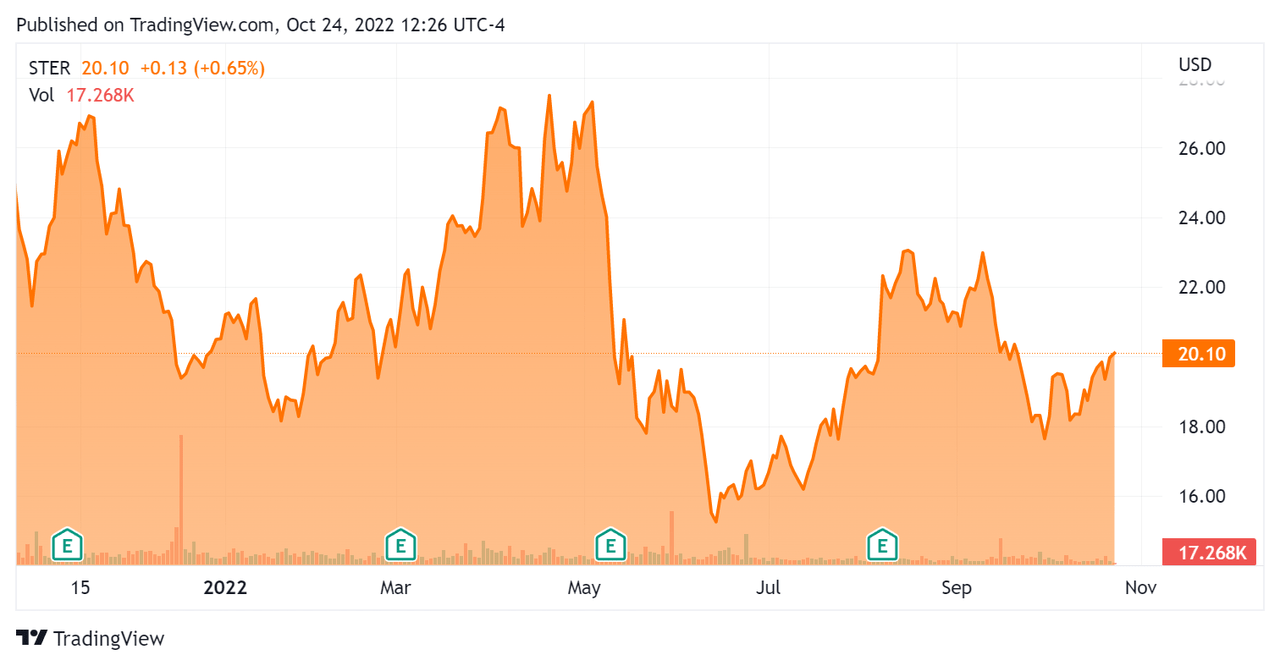

In the past 12 months, STER’s stock price has fallen 19.9% vs. the U.S. S&P 500 index’s drop of around 16.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Sterling Check

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.22 |

|

Revenue Growth Rate |

36.0% |

|

Net Income Margin |

-0.6% |

|

GAAP EBITDA % |

13.3% |

|

Market Capitalization |

$1,920,000,000 |

|

Enterprise Value |

$2,380,000,000 |

|

Operating Cash Flow |

$56,590,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.08 |

(Source – Seeking Alpha)

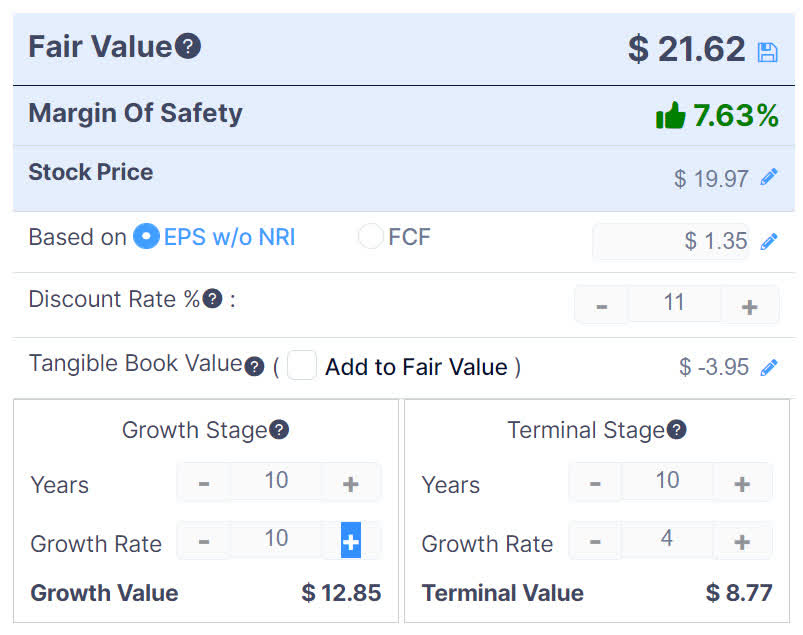

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

STER Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $21.62 vs. the current price of $19.97, indicating they’re potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On Sterling Check

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the “continued momentum” as the firm achieved record revenue, exceeding $200 million in quarterly revenue for the first time.

Leadership noted the potential for ‘changes in the labor market’ as a result of the negative macro environment and said it was “cognizant of the near-term recessionary risks,” although the company hasn’t seen any indication of a “material cyclical slowdown within our business.”

CEO Peirez expects industry growth due to the tailwinds of greater remote work, increasing millennial generation job-hopping and higher utilization of gig economy working arrangements.

As to its financial results, topline revenue rose 29% year-over-year, including an 8% contribution from M&A but 1.5% drop from foreign exchange headwinds due to the strong US dollar.

Management is targeting a gross customer retention rate of around 95%.

GAAP operating income rose to above $20 million, while earnings per share reached $0.12 and management believes margins will improve throughout the remainder of 2022.

For the balance sheet, the firm ended the quarter with cash and equivalents of $66 million and total debt of $507 million.

Over the trailing twelve months, free cash flow was $51.4 million.

Looking ahead, management increased its full-year 2022 guidance, with expected revenue of $790 million at the midpoint of the range and adjusted EBITDA of $217 million at the midpoint.

The firm plans to produce 10% organic revenue growth per year over the next 3 – 5 year period.

Regarding valuation, the market is valuing STER at an EV/revenue multiple of around 3.2x despite significant revenue growth, profitability and free cash generation.

Also, my DCF indicates the stock may be slightly undervalued with conservative assumptions.

The primary risk to the company’s outlook would be a substantial softening of the labor market, reducing demand for its various services and the market is likely focusing on this increasing possibility given the U.S. Federal Reserve’s interest rate hikes which are ostensibly designed to cool off the labor market.

A potential upside catalyst to the stock could include a pause in rate hikes, which would probably increase its valuation multiple while reducing the likelihood of significantly higher unemployment.

I favor STER and the stock appears to be somewhat undervalued, but I’m positive on the U.S. labor market given the Federal Reserve’s menace and apparent intent to continue tightening interest rates.

Prospective investors with a patient time horizon may wish to begin nibbling at STER at the current level of around $20.00, but for now, I’m on Hold for STER until we see the trajectory of the U.S. labor market from here.

Be the first to comment