Diego Thomazini

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on August 14th, 2022.

Western Asset High Yield Defined Opportunity Fund (NYSE:HYI) has several attractive features going for it. This high-yield closed-end fund has been putting up similar returns to its benchmarks. At the same time, they’ve been providing a monthly distribution to shareholders.

Due to the market volatility lately, the lack of leverage that the fund utilizes has been beneficial in limiting the downside. This is also a benefit when interest rates are rising. Most closed-end funds have floating rate borrowings and will be impacted by higher leverage expenses. With HYI, that isn’t a concern.

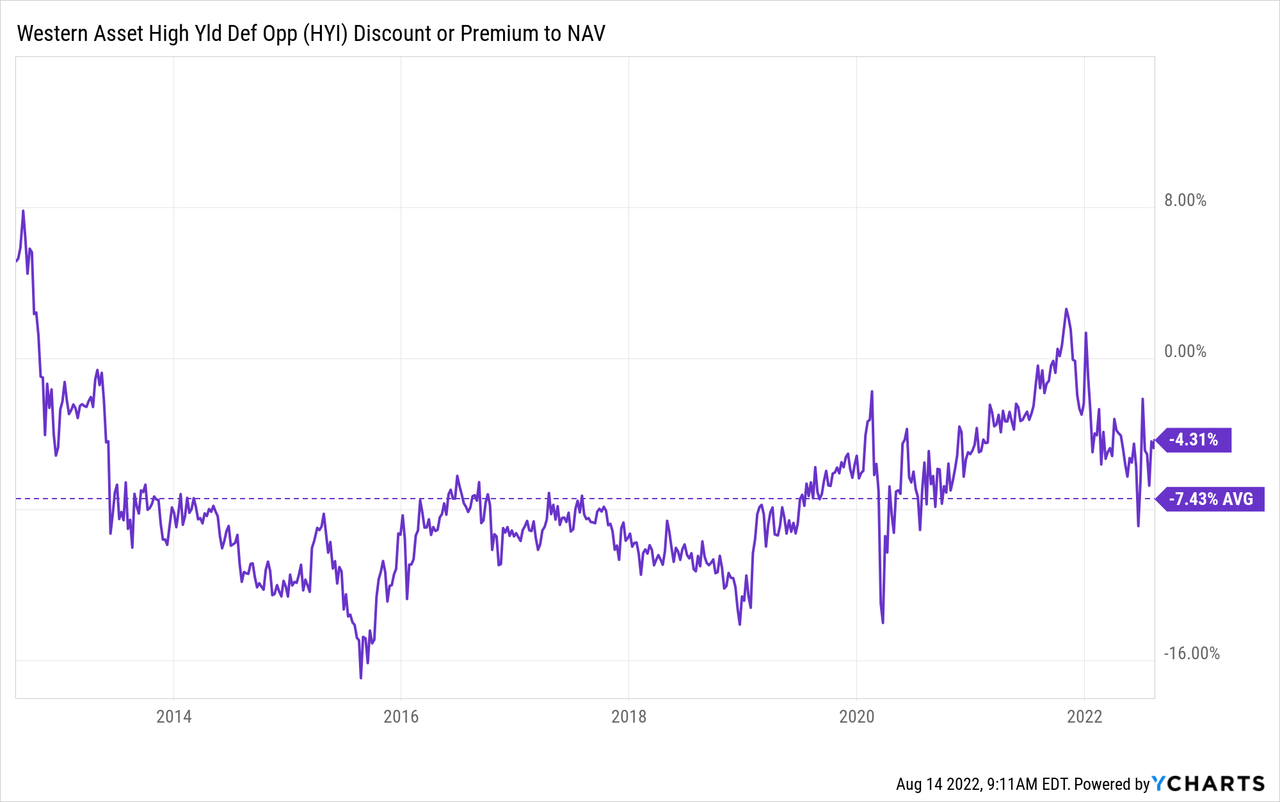

Additionally, the fund has a term structure. That means the fund is anticipated to liquidate around September 30th, 2025. With perpetual CEFs, they can trade at discounts perpetually. A term structure generally allows the chance for being able to cash out at the NAV of the fund. That means the discount can be realized. The discount is quite attractive at this time. That could provide a bit of upside over the next few years before its termination date, all else being equal.

The Basics

- 1-Year Z-score: -0.58

- Discount: -4.31%

- Distribution Yield: 8.85%

- Expense Ratio: 0.92%

- Leverage: N/A

- Managed Assets: $286.09 million

- Structure: Term (anticipated liquidation date of September 30th, 2025)

HYI has an investment objective of “high income, with capital appreciation as a secondary objective.” They “emphasize team management and extensive credit research expertise to identify attractively priced securities.”

They are free to invest across various types of fixed-income securities. However, they primarily focus on high-yield corporate debt, “…under normal market conditions, at least 80% of its net assets in a portfolio of high-yield corporate fixed income securities…”

The fund is rather small, but the expense ratio is still relatively low for a CEF.

Term Structure

This fund is a bit more unusual with its term structure as it launched in 2010. At that time, there really wasn’t a standard wording for the term CEFs as they weren’t very common.

There is no wording for switching to a perpetual fund after a tender offer of 100% of outstanding shares at 100% of NAV. That’s usually standard wording that’s included in today’s CEFs.

Although, they do include that it can be shortened or extended by shareholder approval. Also, note that the fund expects to complete its final liquidation in September, but the liquidation process could extend that.

If the Board of Directors determines that under the circumstances, termination and liquidation of the Fund on or about September 30, 2025 would not be in the best interests of stockholders, the Board of Directors will present an appropriate amendment to the Articles at a regular or special meeting of stockholders. The Articles require either (i) the affirmative vote of at least 75% of the Board of Directors and at least 75% of the votes entitled to be cast by stockholders or (ii) the affirmative vote of 75% of the Continuing Directors (as defined in the Articles) and the approval of the holders of a majority of the votes entitled to be cast thereon by stockholders. Unless the termination date is amended by stockholders in accordance with the Articles, the Fund will be terminated on or about September 30, 2025 (regardless of any change in state law affecting the ability of the Board of Directors to amend the Articles).

An additional way out of the term structure will be if the fund were acquired or if the fund fails financially. A CEF has never “failed,” it would be hard to imagine a non-leveraged one failing. The fund being acquired would also need shareholder approval.

Performance – Attractive Results

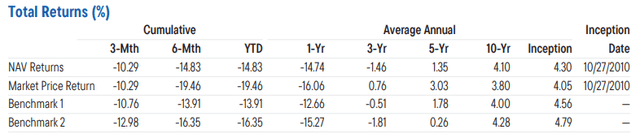

Through the end of June 2022, they’ve provided some competitive returns relative to the two benchmarks they compare themselves against. In this case, they use the Bloomberg U.S. High Yield 2% Issuer Cap B Component and Bloomberg U.S. High Yield 2% Issuer Cap Caa Component.

HYI Annualized Returns (Western Asset)

While even better returns would be more attractive, they are being compared against benchmarks that aren’t directly investable. CEFs are also designed to pay out more regular income in most cases.

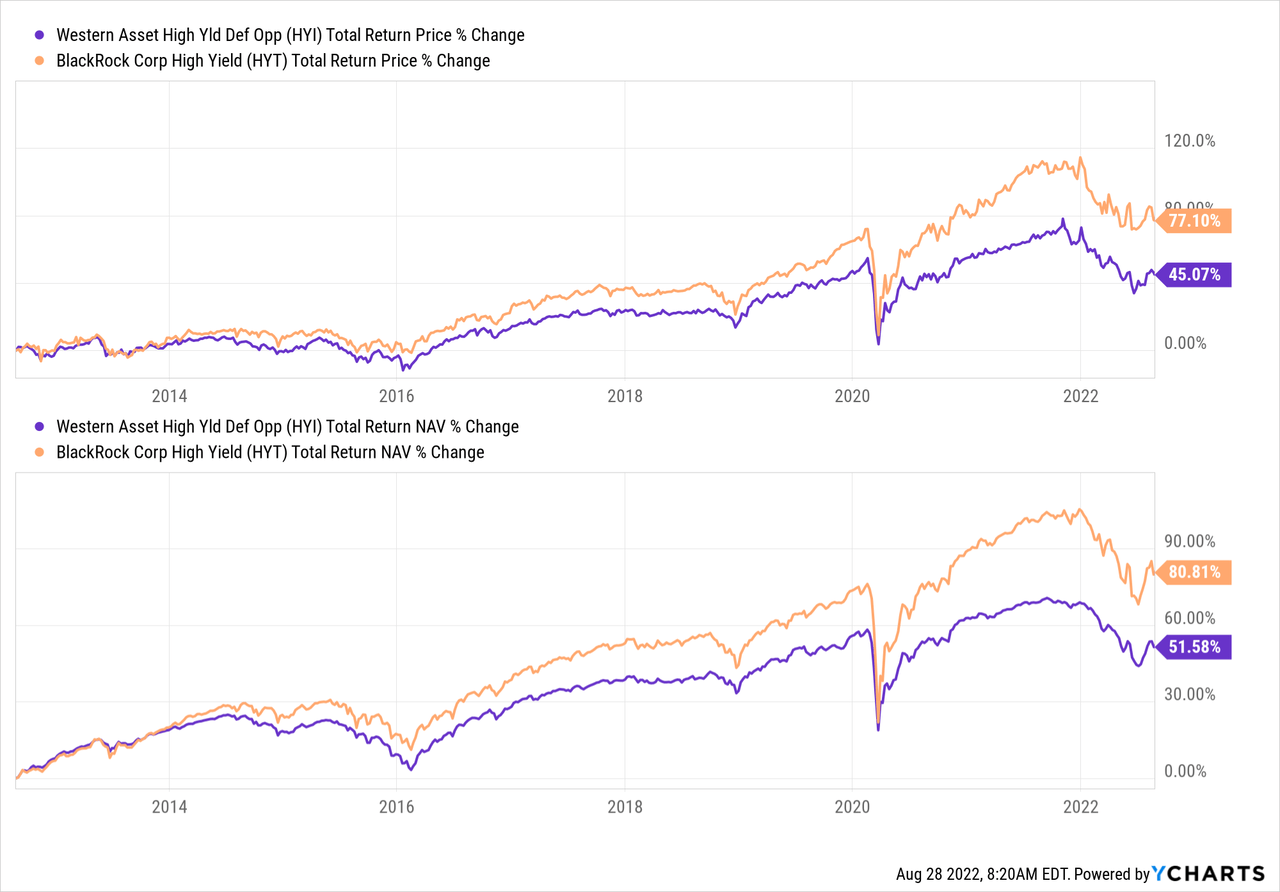

Therefore, I’d prefer to compare it to the BlackRock Corporate High Yield Fund (HYT). This is a high-yield-focused CEF with leverage. That can provide a more direct comparison because HYT also pays out monthly distributions. However, since it is leveraged, we should expect the fund to perform better over the longer term. These have been the results of these funds over the last ten years.

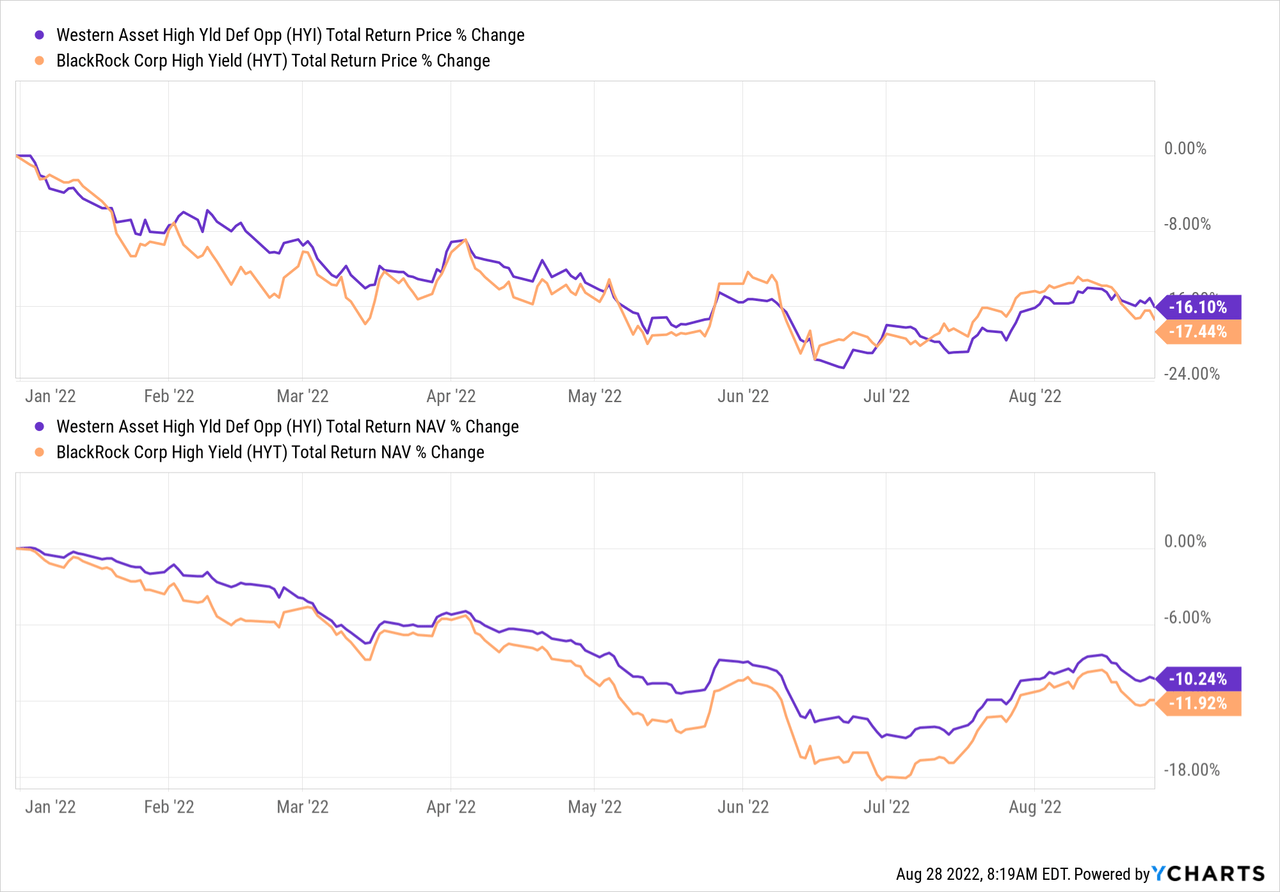

If we look at the YTD results, we can see that on a total NAV return basis that HYI has slightly outperformed. I believe this would be due to the difference between being leveraged and not being leveraged for HYI. Still, HYT has outperformed on a total share price return basis and has really recovered some of the deeper losses it was at previously. Which just highlights why I believe that HYT is the gold standard for high-yield CEFs.

Due to that type of performance from HYT, though, it seems investors have pushed HYT’s discount to very narrow levels. In 2021, it was even trading at a premium for a while. HYI’s term structure and anticipated liquidation date that’s what provide HYI the potential edge over the coming years.

The fund has traded at deeper discounts historically, but even HYI’s discount has become more narrow. It also joined other funds at a premium in 2021, which was very unusual. As we move along the next few years, we should see HYI’s discount gradually shrink naturally into the term date. However, there is still plenty of time for some volatility. That could push HYI’s discount around with it.

Ycharts

Distribution – Attractive Yield, But Coverage Should Be Watched

In a previous update on HYI, I noted that the fund’s distribution coverage came to light. I thought a trim could be in the cards. That hasn’t happened yet as the fund has continued to pump out its $0.0945 monthly.

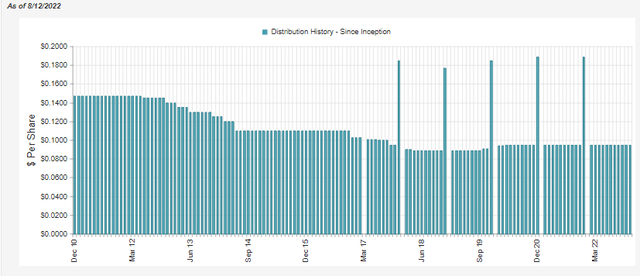

HYI Distribution History (CEFConnect)

One of the reasons for the lack of coverage was a dramatic fall in rates. The distribution trend above mirrors plenty of other fixed-income focused funds. It has become gradually lower and lower over the last decades as 0% rates have put pressure on what funds can pay out. The fund’s NAV distribution yield is also 8.44%, with the average coupon of the fund paying out 6.37%. That doesn’t add up, suggesting a lack of coverage will continue for now.

With rates rising back, the fund should be able to capture higher yields once again. However, net investment income actually declined with the latest report once again. It was a much slower pace than the previous drop and could mean that we see it increase in the next report.

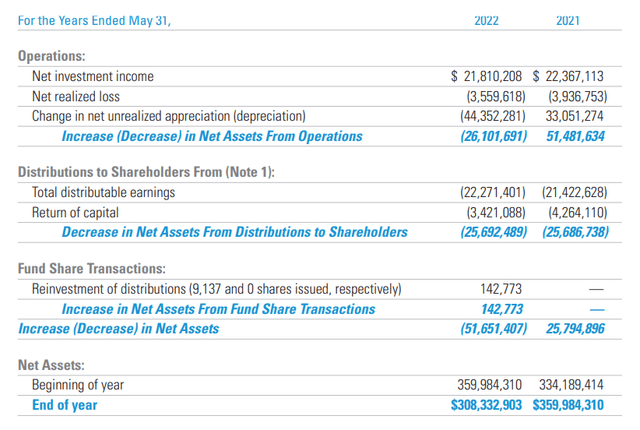

HYI Annual Report (Western Asset)

At NII coverage of 84.9%, I’d certainly like to see that come up before I was confident in the payout being maintained. We can see that they couldn’t produce any realized capital gains to offset the lack in coverage for the prior two fiscal years either.

So, for now, I’ll continue to say that we can expect a trim, but the outlook is a bit better due to higher rates. Remember, with HYI not employing any leverage; their expenses won’t climb. They could be the first to benefit from higher rates than other leveraged high-yield funds.

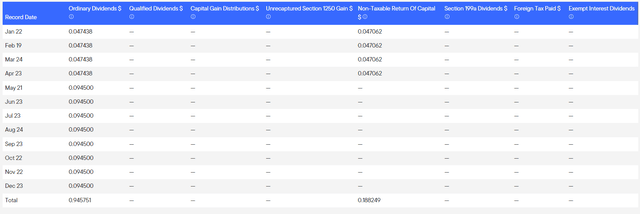

Due to a lack of distribution coverage, it isn’t too surprising that we have seen some return of capital in the fund’s distribution. Here is the breakdown they provided for 2021.

HYI 2021 Tax Character (Western Asset)

HYI’s Portfolio

With a high yield-focused portfolio, the fund’s duration is relatively lower at 4.47 years. This is impacted significantly by the weighted average life of 6.44 years. High-yield debt often has shorter maturities as investors typically want their cash back faster from these types of companies. The longer that debt is outstanding, the greater the chance that a rough economic patch could cause defaults and bankruptcy.

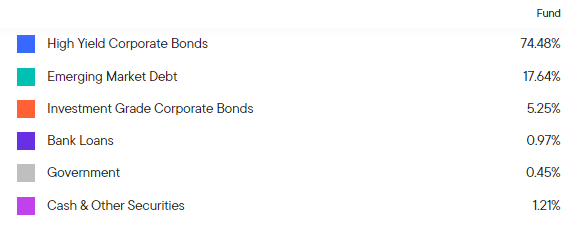

For HYI, what isn’t invested in high-yield corporate bonds goes to mostly emerging market debt. They carry only a small sleeve of investment-grade corporate bonds. Not too much for it to be very meaningful on the end results.

HYI Asset Type Exposure (Western Asset)

Within that sleeve of emerging market debt, there is an ever so slight allocation to Russia. Not enough here to have too much of an impact.

HYI Country Exposure (Western Asset)

One of the things that high-yield funds do to protect themselves is to diversify like mad. In HYI’s case, CEFConnect puts its number of holdings at 264. That’s actually fairly tame for this type of fund. For some context, HYT carries 1511 positions.

Here are the top ten holdings in the fund at the end of July 2022. These top positions are 15.85% of the fund’s assets.

HYI Top Holdings (Western Asset)

I would say that despite holding a relatively smaller number of holdings, they still aren’t weighted too significantly in any one position. However, it should be noted that these are individual positions and not what they have in each company. From the top ten, we can see that DISH represents two positions here. In the last report, they held four different DISH positions. That means that the overall company exposure can be greater than what the holdings list might reflect.

Conclusion

If you are in the market for some high-yield exposure, HYI could present an attractive opportunity. The fund’s discount is fairly attractive at this time. With the expectation of a termination date in the future, this discount could be realized. Additionally, the fund doesn’t utilize any leverage. So if you are feeling a bit risky to invest in high-yield debt but do not want to get overly adventurous with leverage, HYI could be the happy medium.

Be the first to comment