alvarez

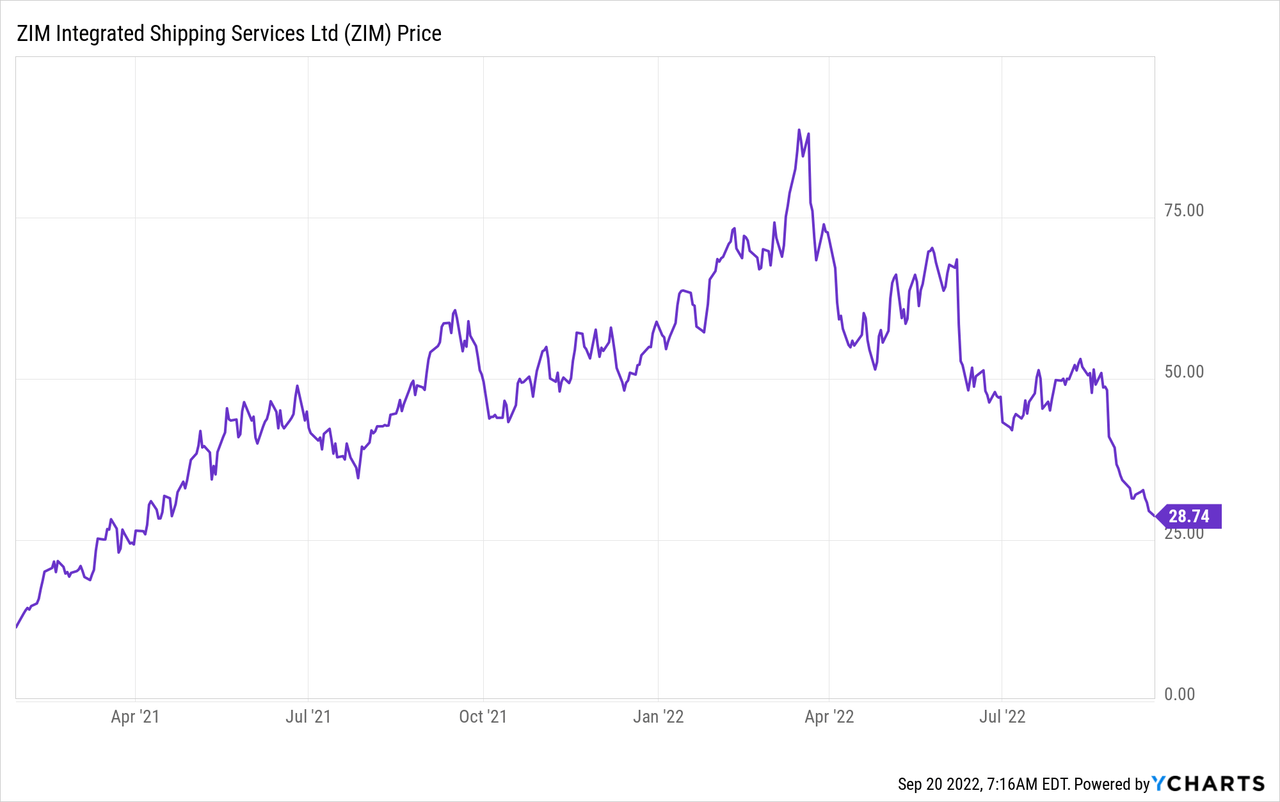

ZIM Integrated Shipping (NYSE:ZIM) is an international shipping company, which was founded in 1945 but didn’t IPO until January 2021. As the old saying goes “a rising tide lifts all boats” and in this case that has been particularly true. The “rising tide”, has been higher freight rates, driven by the unprecedented economic reopening of 2021. ZIM’s stock price popped by a blistering 600% to all-time highs of $84 per share. But since then the share price has corrected down by ~65%, driven by a “normalization” of shipping rates.

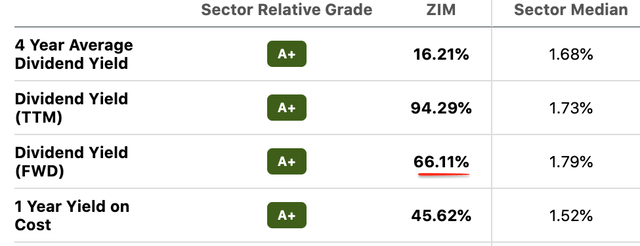

Despite the recent decline in share price, management increased its monster dividend from “just” 20% to over 40% in the second quarter and has up to a 50% yield forecasted. In addition, the Seeking Alpha forward dividend calculator now estimates a yield of over 66%, which would be astonishing. In this extensive report, I’m going to dive into the Bull vs Bear case for ZIM, discuss a few technical patterns I have discovered and even reveal what some legendary investors such as George Soros have been doing with the stock, let’s dive in.

The Divergence Pattern

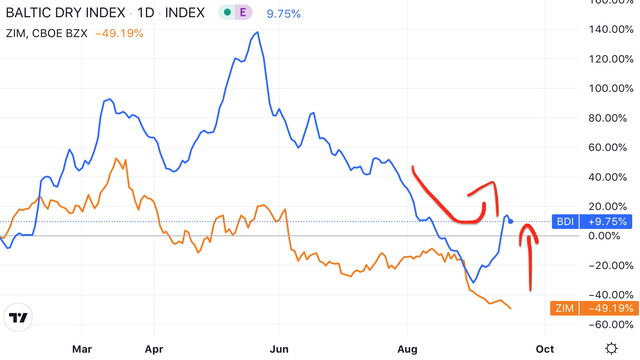

ZIM is a stock that I have covered multiple times and in my last post on the stock, I discovered a correlation between the Baltic Dry Index and ZIM’s share price. The Baltic Dry Index is a weighted average of the cost to move raw materials across the ocean. Thus a link between ZIM’s share price and the Baltic Dry Index makes a lot of sense as if freight rates are higher, ZIM will have greater earnings and thus investor sentiment takes this into account.

As you can see from the chart below, historically the Baltic Dry Index (blue line) has tracked ZIM’s share price (orange line) fairly closely with regards to peaks and troughs. The goal is not to assess magnitude as the charts aren’t on the same scale, but instead the pattern. As the Baltic Dry Index has declined so has ZIM’s share price. But recently I have noticed what I call a “divergence pattern” in September. Basically, this shows, that freight rates reversed temporarily (first red arrow) in September, but ZIM’s stock price is still on a downward trend. This has led me to believe that ZIM’s share price could be due for a reversal soon, at least temporarily anyway. Now, this is not an exact science, but it is a useful data point to watch as a leading indicator before ZIM releases a new earnings report.

ZIM share Price Vs Baltic Dry Index (created by author Ben at Motivation 2 Invest (TradingView chart))

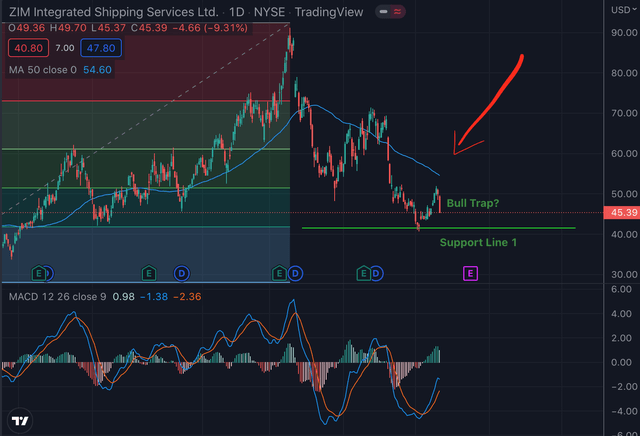

In my previous post, I highlighted a “bull trap”, as the stock price bounced of the $40 per share support before slicing through it and dropping to $28 per share. However, as mentioned prior, a reversal now looks likely due to the divergence from the Baltic Dry Index.

ZIM stock Price (Technical) (Motivation 2 Invest ZIM Post August)

Investors Buying/Selling

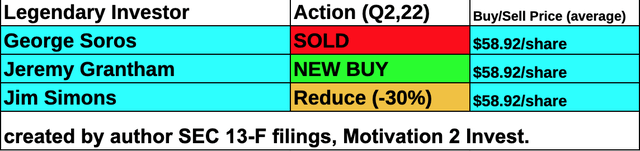

A key component of my investment strategy at Motivation 2 Invest, involves tracking the “smart money” and the greatest investors of all time, in terms of what they are buying and selling. In this case, I see Soros Fund Management, founded by the legendary macroeconomic investor George Soros, sold ZIM in the second quarter of 2022 at an average price of $58.92 per share. This is significantly higher than where the stock trades at the time of writing and thus showed impeccable timing. However, Value investor Jeremy Grantham [GMO capital] who has ~$17 billion in assets and thinks we are in a “super bubble“, bought the stock in the second quarter which is a positive sign.

Legendary Investors (created by author 13-F filing data SEC)

Jim Simons of Renaissance capital, which is the best performing hedge fund in the world, did reduce his position by ~30% in the second quarter. However, it should be noted that Renaissance capital executes algorithmic day trading, and thus his trades are not as timely or relevant. Thus if we look at the George Soros and Jeremy Grantham trades, we have one vote for the bears and one for the bulls. I will check the trades again in the third quarter, so be sure to follow if you want to stay updated on that. For example, if next quarter I see Soros buy back in, that is a powerful data point of bullish strength or vice versa.

Business Strategy

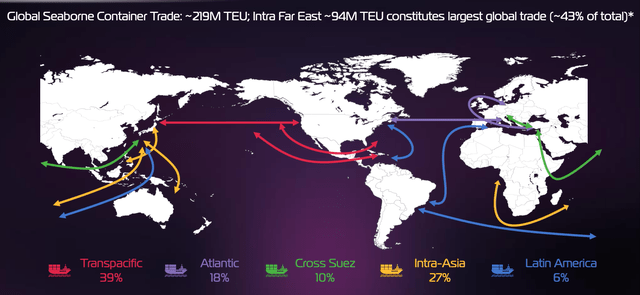

ZIM operates with what they call a “global niche strategy”. The company operates 149 vessels across niche routes where they command a “meaningful market share”. Its most popular route is the transpacific (Asia to the USA) which makes up approximately 39% of trade. The next is Intra-Asia (27% of trade), which covers developing economies in Africa, that provide raw materials to Asia. We also have the Atlantic (Europe to the USA) (18% of trade) and even Latin America (6% of trade) which is an emerging market, and thus has vast growth potential.

ZIM Shipping Rates (Investor Relations)

Cross Suez covers 10% of trade, this is a strategic gateway, which flows through Egypt and saves container ships from having to go around the whole of Africa to get to Europe. My late grandfather who was in the British Army and a Special Branch agent was actually stationed near the Suez Canal during the 1950s, and he informed me it was a prized strategic gateway.

The shipping industry has been historically categorized by a Boom-Bust. This is because when shipping rates are high, more ships come online and this causes an oversupply and we have a bust. ZIM is of course vulnerable to industry economics, but they are more flexible than most companies. For example, the company uses an “asset light” charted capacity model. This basically means the ZIM can lock in contract prices to importers who want lower volatility. Then as demand increases ZIM “opportunistically” sources extra capacity from the second-hand market and takes advantage of high spot rates. The business also has an operational partnership with 2M partners Alliance which consists of Maersk Line and MSC. This effectively puts ZIM in bed with the two largest shipping companies in the world and shows cooperation with competition or “copetition” in the industry.

Ships (ZIM)

ZIM has also expanded its car carrier business to 10 vessels, in order to take advantage of the growth in car cargo exported out of Asia.

In 2023 and 2024, ZIM plans to bring online 46 newbuild vessels, with 28 being Liquified Natural Gas [LNG] powered. This is a genius move as it will improve the cost structure of the business, thanks to more fuel-efficient new builds which could be a key competitive advantage moving forward.

In addition, a greater number of LNG vessels bolsters the business’s “green credentials” which will help it meet ESG goals and potentially could mean greater inflows from ESG funds in the future.

ZIM has recently entered into a 10-year agreement with Shell to supply its vessels with LNG fuel. LNG is the lowest carbon fuel available at scale currently and offers 20% less GHG emissions when compared to legacy marine fuels.

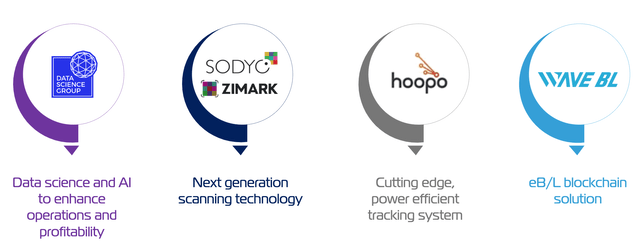

Investing into technology

The shipping industry is one of the oldest in history and is primed for technological improvement and even disruption. ZIM is investing for the future, through its venture capital arm which invests into early-stage tech companies, for the shipping industry. Its investments include Sodyo a scanning technology, hoopo a tracking system, and even a blockchain-powered solution. The beauty of these investments is they don’t just have the potential to improve the company’s business, but also ZIM could then license the technology to other carriers in the future. This effectively adds some “optionality” into ZIM’s stock which you usually don’t see in the shipping industry.

ZIM technology (Investor Presentation)

Growing Financials

ZIM announced its financial report for the second quarter of 2022. Revenues was $3.43 billion, which popped by a rapid 50% year over year, but came in below analyst estimates by $278 million.

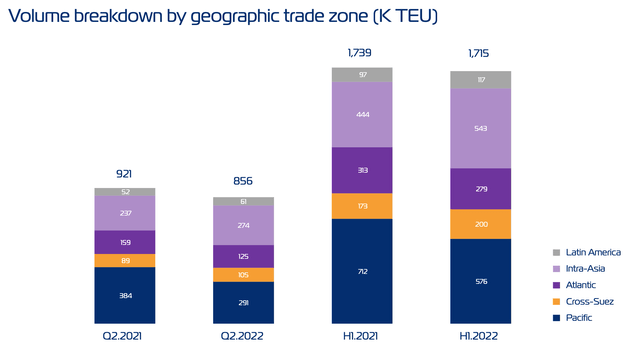

Shipping volume was 1,715 [K TEU] in the first half of 2022, which was down slightly from the 1,739 [K TEU] in the first half of 2021. This makes sense as lower economic demand, combined with a boom in shipping in 2021 caused the surge.

Volume Breakdown (Q2, Presentation)

Increases in freight volume has not been the main driver of ZIM’s revenue since its short time as a public company. The golden metric has been the average freight rate per TEU, which is basically the price ZIM charges per container. In the second quarter, this was $3,596 up a substantial 54% year over year.

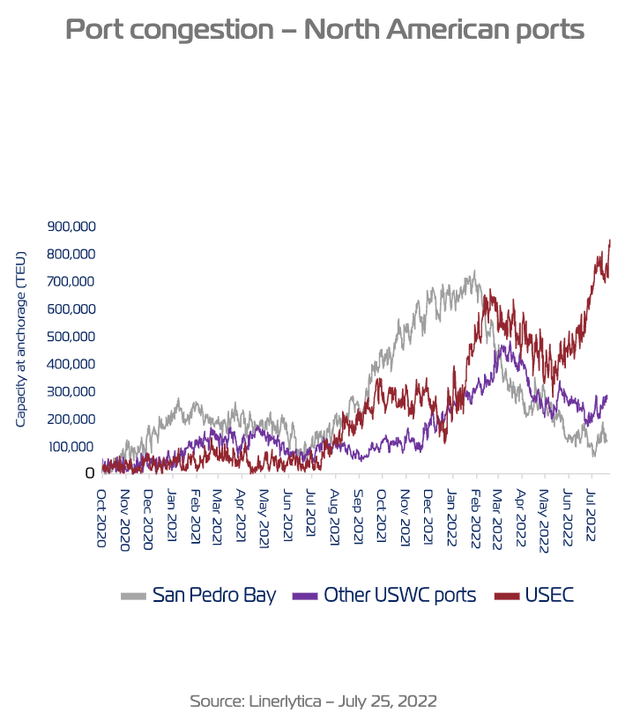

According to an independent study by McKinsey, the rise in shipping rates was not driven by a lack of ships but more by a lack of available capacity due to port congestion. Now although we are seeing shipping rates normalize as economic demand reduces, port congestion is still an issue. For example, the chart below shows a decline in port congestion until June and then a huge spike in July.

Port Congestion (Linerlytica)

US East Coast ports [USEC] have seen the largest boost in congestion, which could explain the spike in the Baltic Dry Index, as mentioned in my introductory section on the “divergent pattern”.

ZIM’s management is forecasting their vessels to continue to have “extremely strong” utilization despite some assumed “easing” of the congestion.

ZIM generated net income of $1.34 billion in the quarter, up a substantial 50% year over year. Earnings Per Share [EPS] was also solid at $11.07 per share, but this did miss analyst expectations by $2.18 per share as freight rates corrected.

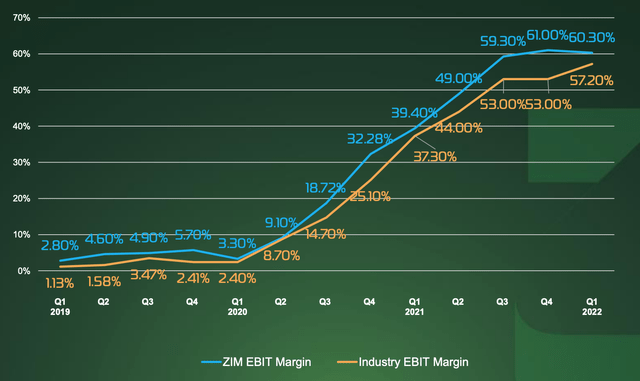

ZIM has historically generated an EBIT margin of ~60.3%, which is greater than the industry average of 57.2%. Now although this data is from the first quarter of 2022, it is clear to see from the chart below ZIM has consistently generated greater margins. In addition, the new LNG vessels should also further widen this gap due to their increased fuel efficiency, as discussed prior.

ZIM vs Industry (Q1 ’22 Earnings Report)

Management elaborated on the expected, improved cost structure over time, in their earnings call.

“As we enter into 2023 and every month when we take delivery of one of this brand-new vessel our cost of operation per TEU our freight cost will go down compared to the current cost of operation of the company.”

Monster Dividend

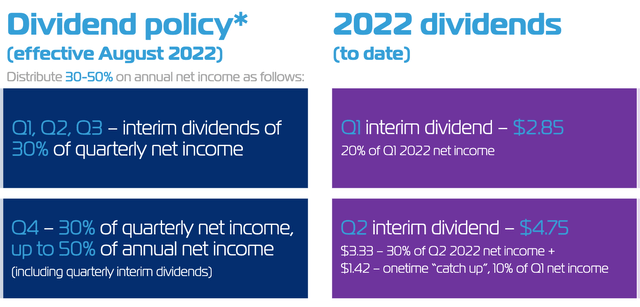

ZIM’s management has increased its dividend repeatedly since going public which has been fantastic for shareholders. In the second quarter, management announced plans to distribute between 30-50% of annual net income. With 30% in Q3, and up to 50% in Q4 which is a strong positive.

Dividend Policy (Investor Presentation Aug 2022)

In addition, the Seeking Alpha dividend calculator forecasts a forward dividend yield of over 66%, which could be a leading indicator of even high payouts.

Dividend Yield (Seeking Alpha)

An even higher dividend wouldn’t surprise me given management doesn’t have many options for its cash. Usually, a business will pay debt, do share buybacks, acquisitions or pay a dividend.

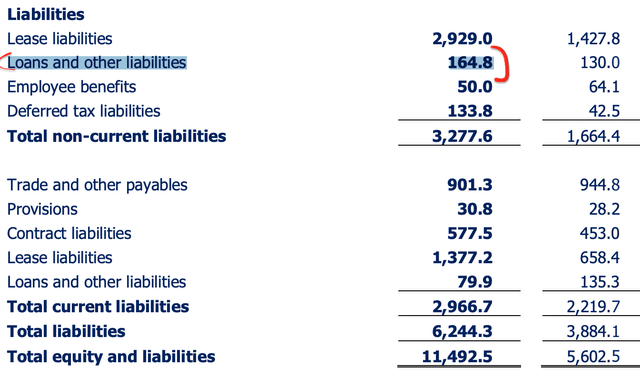

In this case, ZIM has a fortress balance sheet with cash, cash equivalents $3.93 billion, with Net Debt of just $630 million, which gives a net leverage ratio of 0.1x. This may seem great but things could be even better, as when I dive into the details, I see ZIM has many “lease liabilities” for ships. Generally, this is not interest bearing and thus the business’s true debt may be just ~$164 million, as categorized by loans.

Lease liabilities (ZIM Integrated Shipping)

Valuation?

The value of any business is basically derived from the value of future cash flows discounted back to today. Given there is much uncertainty about the future cash flows, as this is heavily dependent upon shipping rates and volume, I will look at a relative valuation using multiples.

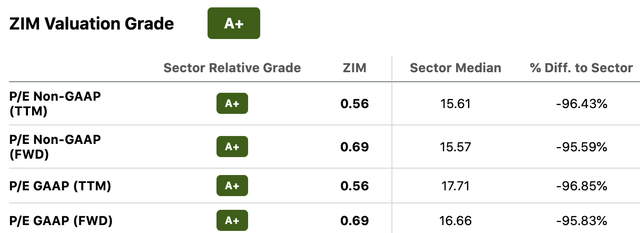

ZIM is trading at a very low forward P/E ratio of just 0.69, which is cheaper than historical levels, which range between a PE = 1.7 and 2.1.

ZIM stock valuation (Seeking Alpha Valuation Calculator)

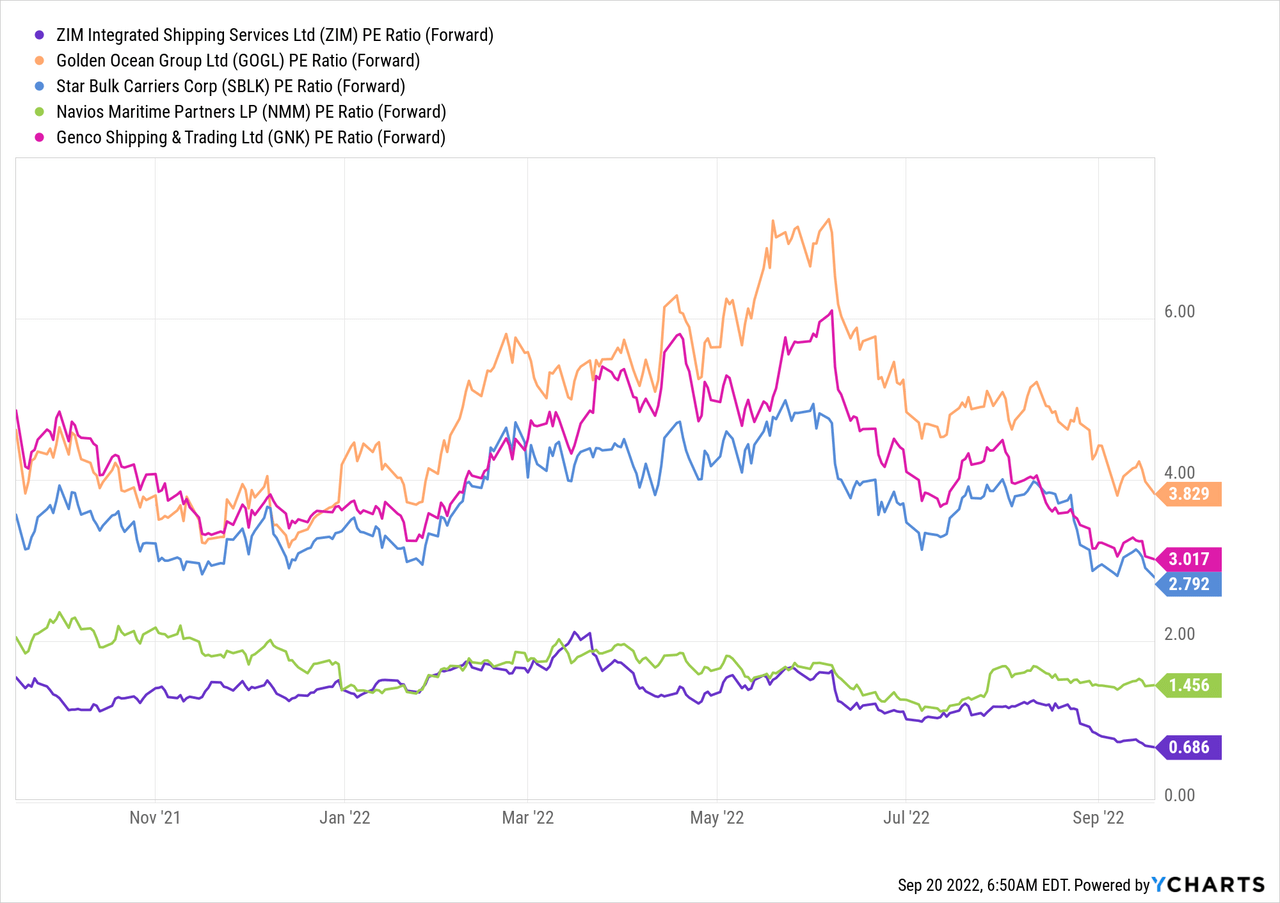

ZIM stock also trades at a cheaper P/E ratio than industry peers such as Navios Maritime Partners L.P. (NMM) which trades at a P/E (forward) Ratio = 1.45 and Golden Ocean Group (GOGL) which trades at a P/E (forward) Ratio = 3.8, at the time of writing.

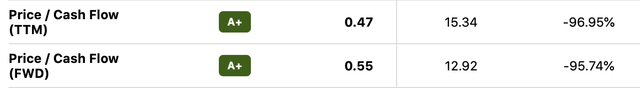

The stock also trades at a forward Price to Cash Flow ratio = 0.55, which is also cheaper than historical levels.

Price to Cash Flow (ZIM)

Risks

Citigroup Downgrade/Recession

Citigroup has recently downgraded ZIM stock to a neutral/high-risk investment as it forecasts slowing economic demand. The high inflation and rising interest rate environment are squeezing both the consumer and businesses alike. Thus with less consumer demand, shipping volume is expected to slow and thus shipping rates are expected to correct.

The good news is that despite this downgrade the Citigroup analyst still has a price target of $51.50 per share, which is vastly above the ~$28 per share at the time of writing.

Dividend Withholding Tax

As ZIM is an Israel-based company it has a “withholding tax” on dividends paid to shareholders. The current rate is between 25% and 30%, which is not great for investors. However, investors may be eligible for a “reduced Israeli withholding tax rate” subject to a variety of conditions based on tax treaties etc. You can read more about this in the company’s press release and I suggest seeking independent tax advice for details.

Final Thoughts

ZIM Integrated Shipping has rewarded investors handsomely over the past couple of years and taken shareholders on a tremendous voyage. Management is smart, fast acting, and seems to have an answer for pretty much every question analysts throw at them. ZIM’s new LNG fleet should improve margins over time, while the company’s technology investments add optionality to the stock. The future of ZIM and its spectacular dividend rests upon the future of shipping rates moving forward. Given the business’s cheap valuation, I will still label the business as a “Buy” but caution should be taken as generally, I find great investments come from the contrarian approach.

Be the first to comment