A stockphoto

Dear readers/followers

I’ll assume here that you’re somewhat familiar with printing and Xeroxing. In this article, that’s the company we’re looking at. Xerox (NASDAQ:XRX) is a company in legacy hardware, namely printing, and copying. It’s one of those companies that’s gone from a market-dominating position in a necessary segment, to that segment/business not being as necessary in the modern world.

We’ll see if Xerox has anything worth offering modern investors here.

What is Xerox?

The company describes itself as a “workplace technology company”. It works with integrating and building software and hardware for small and large businesses. This is a storied legacy giant with many “firsts” under its belt. Xerox did not only invent the copier, but also the Ethernet, as well as the Laser printer. This is what enabled Xerox to become a storied brand that the world came to rely on.

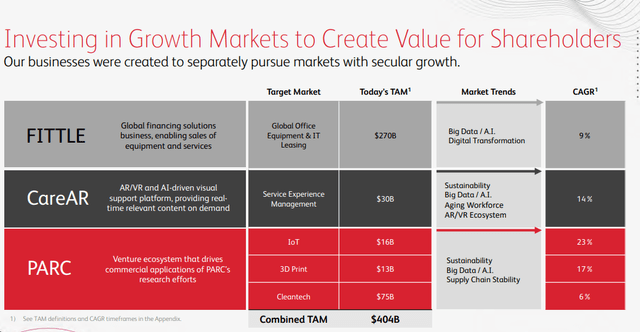

Its current foci include things like investments in AI, AR, robotics, sensors, and IoT technology as well as 3D printing and cleantech. The company’s footprints span over 160 countries.

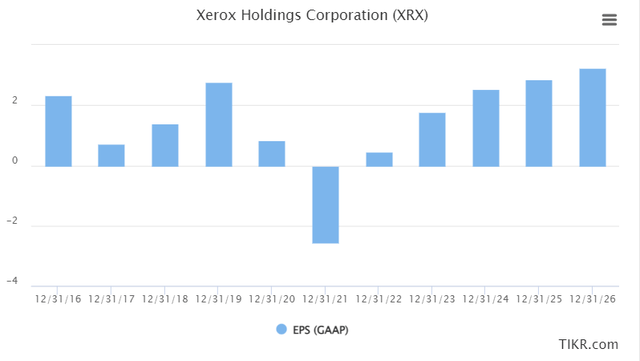

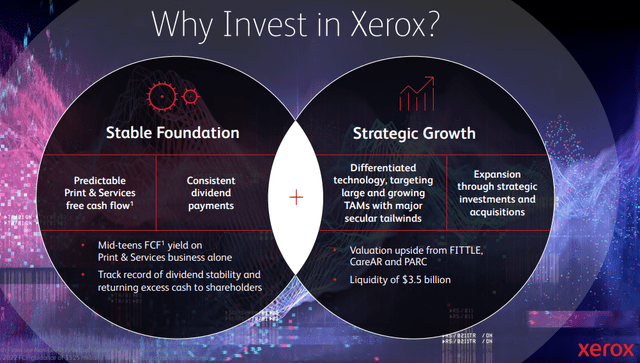

The company, once conservative and safe, has dropped to a BB credit rating and is no longer IG-rated. Despite a crash in EPS back in 2020, seeing a decline of more than 60% on an adjusted basis, the company retain and continues to pay out its $1 dividend, making the company’s current yield a very impressive 7.36%. Despite this however, the company has not delivered good results for the past 5-7 years. $10,000 invested in the company back in early 2016, would have been worth around $7,200 today, and that’s including nearly $2,350 worth of dividends during the time. Not the greatest track record.

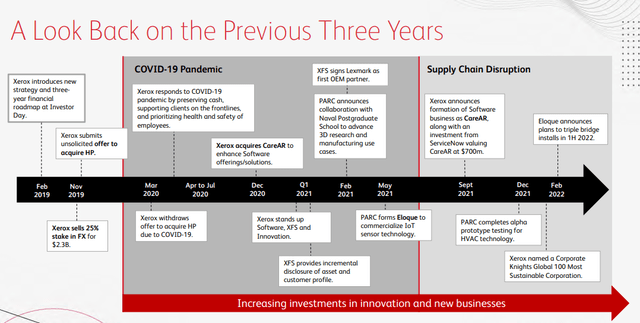

Still, the company believes there is reason for this to turn around. While the three last years have been sub-par, the company prefers you look at them in the following way.

Not just investments, but innovations in new businesses – which are expected to deliver growth going forward. The company was all set to acquire HP, but they canceled this deal. COVID-19 was an absolute horror show for the company, looking at these trends.

XRX argues its focus has been on strategic priorities, ignoring the short-term. This came down to optimization, driving revenues, monetizing innovations, and focusing on FCF. So far, that hasn’t materialized, even if parts can be said to have been materialized. XRX has achieved gross savings of close to $1.8B since 2018 through its program, and synergies and efficiencies are starting to appear. While EPS has gone down, the company has managed to generate almost a billion dollars in positive free cash flow, while returning $1.6B to shareholders – another impressive trend.

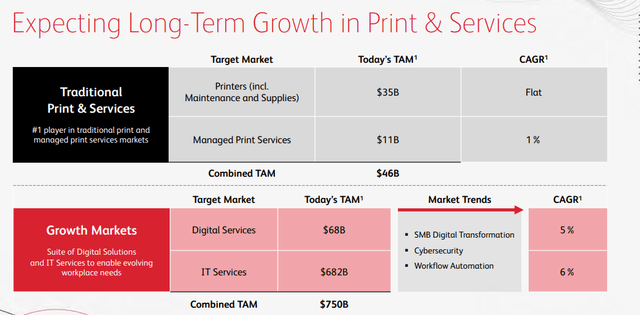

Despite ongoing legacy trends, Xerox continues to expect legacy printing services to generate growth, or at least not go “down” – and Xerox is the market leader in traditional print and managed print.

The company would like to appeal to you, its potential investors, by pointing to the combined trends of growth markets with traditional print and saying that its growth segments including IT and digital, can generate growth while managing to keep the cash flow of legacy. If this is possible, then the company at a cheap price could certainly be worth a second look. The company’s focus on growth markets is centered around three distinct areas with their respective target markets.

The company is expecting FY revenues to come in at over $7B and seeing this growing low/mid-single digit annually until 2024E. The positive thing is that the company expects the respective profit from these revenue dollars is expected to increase over the coming years – by over 200 bps, and FCF is expected to be upwards of $500M per year. This is based on the assumptions of growth in print/service as well as growth markets, and provided that these new areas manage to contribute annually to the company’s foundation.

And this is really what Xerox wants you to focus on.

On the surface, this is not at all an unappealing prospect. But surface evaluations usually tell a simpler story. Even if the company is the market leader and has market-leading print services (and they do, by far), and even if the growth areas are interesting (and they are, quite so), it still comes down to how these things are being received by the market and how this flows to quarterly results.

So many things in the company are based on future assumptions during a time when one of the hardest things to do is forecasting what will happen even in 6 months – let alone 3 years, as the company is basing its positive assumptions upon.

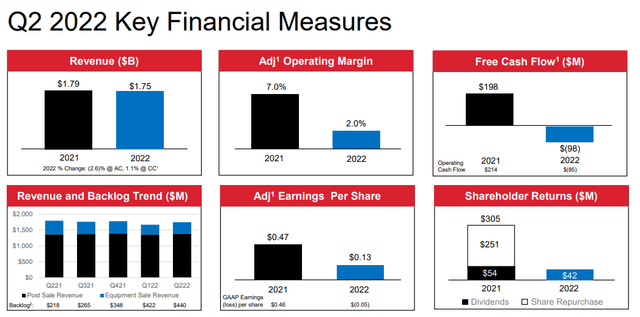

Recent results do not look favorable. In fact, they look very far from favorable as things stand.

Demand is strong, the backlog is up, and revenue in most core segments. SCM outlooks are up, and the company is adding customers. However, everything else is against the company. Gross margins are down, margins are down 500 bps, and EPS dropped 72% YoY. In short, the company, unlike others, are failing to pass no costs to its consumers and customers. Profit margins are down. The company’s capital structure remains decent, and its maturities are well-laddered here.

The company’s 2021 strategy with its three new businesses – CareAR, FITTLE, and PARC will be the growth drivers for this company. These have not yet materialized any of the growth expected. If they do, and if the company delivers the growth that’s expected, then the appeal here could be convincing enough.

The expectations of improving supply chains and improved pricing are opposed to the current market trends we’re seeing. And if a company is unable to pass on the costs we’re currently seeing, it can be argued that it might be even more difficult going forward. While normalization of SCM might occur, inflation certainly won’t come down as far, and it’s hard to speculate just where the stock “might go” from here.

Still, that is what we almost “have” to do when looking at the company valuation here.

Xerox Valuation

The valuation for Xerox is not really bad at all. On a 10-year average, the typical multiple you’d have to pay for the company’s cash flows in terms of P/E would be around 10-11x. The company currently trades at around 10.9x, meaning the upper range of that, having declined from a slight premium in 2020-2021.

2022E is expected to be another downer year. The company is expected by FactSet to average no better than -24% adjusted EPS YoY. S&P Global believes that on a GAAP basis, the company’s results will be significantly better than in 2021, but still very low and not covering the current dividend.

However, where both analyst averages agree, is the relative development from here on out. S&P Global believes that the company can more than quadruple its GAAP EPS in around 3-4 years on the basis of these aforementioned growth pushes, as well as strong legacy trends.

Take a look at these estimates.

XRX EPS development (TIKR/S&P Global)

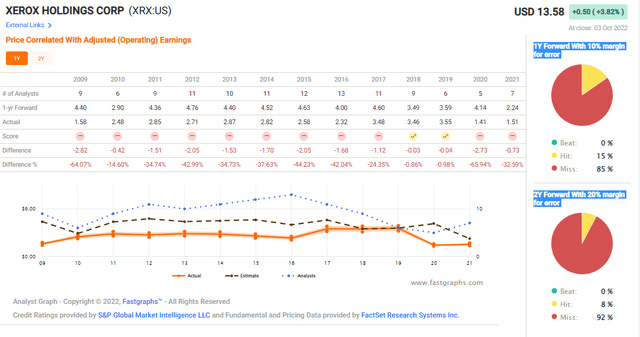

The same development is being forecasted by FactSet. Current normalized forecasts for XRX based on an 11x forward P/E for 2024E, has you generating nearly 92% RoR in less than 3 years by investing in XRX. IF these EPS numbers materialize, it might be a thesis that we could follow. However, I believe these numbers to be far too optimistic, for a few reasons.

Firstly, I think not enough discounting/impairment is being made for the impacts of inflation. Second, I think the company’s growth ambitions are being overestimated – there is nowhere near to where they could, as I see it, generate the sort of earnings we would need here.

Thirdly, and more importantly, XLX is notoriously difficult to forecast. By “notoriously difficult”, what I mean is that you might have more luck going to the casino. Some games offer you a better shot at winning than an 8-15% hit rate, which is what analysts have been able to offer here on XLX.

XLX Analyst accuracy (FactSet/FAST Graphs)

There has not been a single year, and I repeat a single year, when the company has been correctly forecasted, or performed better than forecast, except maybe 2018 and 2019 when these forecasts were within acceptable limits.

This is a very bad track record – and it does not give me high hopes for the future when it comes to that 90%+ RoR until 2024E. Current valuation targets are flying higher than the share price, but not at all close to what you might expect. 7 analysts average a $14-$18 share price with a $14.87, but none of these analysts are currently at a “BUY” for Xerox. The risks seem too high. Instead, we have 3 holds, 3 “underperform” and a “SELL”, despite again those price targets.

I knew going into Xerox that I was going into a volatile business. Legacy businesses that try to up-shift their model always have difficulties, and Xerox is perhaps one of the better examples of this.

Is there substance here that I like?

Of course, there is. You can’t look at the biggest printing business in the world and say that you “don’t” like it. It’s a potential cash cow. But it comes with plenty of risks, and until the company gets its growth pushes on track, there’s little that appeals to me comparatively to the rest of the market.

I can get a top-grade insurer trading at less than 8x P/E with a 4%+ yield, and an upside of just as much as this and more, while investing instead in an A-rated company. Why, when I can do that, would I want BB-rated volatility with this sort of SCM and inflation risk?

That is a question you need to ask yourself prior to investing in Xerox.

For now, I’m at a HOLD” here. The risks are too many for me, even for the upside.

Thesis

My thesis for Xerox is fairly simple.

- While foundationally appealing and with a decent set of prospects, Xerox nonetheless comes with upside and forecast risks that are not for the faint-hearted. This company is a BB-rated IT/legacy printing business. While it could be interesting as a more risky play, there are much safer investments yielding good returns and dividends while at substantially better overall safeties. It’s my view that these should be preferred.

- Xerox nonetheless warrants a price target and a rating. I will rate it at the low point of my forecasts, coming at around $12/share. At $12/share, I could be convinced to give this company a go.

- This makes it a “HOLD” here.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment