RomoloTavani

Genasys Inc. (NASDAQ:GNSS) offers integrated security systems to international clients in a target market growing at double-digits. In my view, the scalability of the services offered by GNSS and inorganic growth will likely serve as a driver for future free cash flow and revenue generation. I do see certain risks from potential litigation and concentration of clients. With that, my discounted cash flow (“DCF”) model indicates an upside potential in the stock valuation.

Genasys

Genasys is specialized in the development of integrated security systems. Most products try to keep the customer, especially the residents of the affected area, aware of these emergencies by managing multi-channel communication alerting.

Genasys’ services are offered in times of disruption and provide assistance and information in situations where natural calamities occur and other communication systems may be disrupted. The company provides its information and alerts through SMS, CBC channels, and live broadcast.

Genasys advanced speaker systems, which feature satellite connectivity and solar power options, GEM facilitates the dissemination of alerts, warnings, notifications, information and instructions through multiple channels, including location-based Short Message Service, Cell Broadcast Center mobile push, text, email, social media, TV, radio, and digital displays. Source: 10-Q.

Among the different products, I would highlight Genasys Cloud Base. It delivers information and messages through a command console and mobile app. Genasys provides instant alerts to people in case of weather forecasting, earthquakes, floods, fires, and other disasters. Management directs its personnel to provide immediate guidance to people in such situations.

Considering previous emergencies all over the world, I believe that the demand from government administrations could be substantial. The contact center software market is expected to grow at a CAGR of 14.4% during the 2022-2029 period. Hence, Genasys operates in a growing market.

The market is expected to grow from USD 30.74 billion in 2022 to USD 78.75 billion in 2029 at a CAGR of 14.4% during the 2022-2029 period. This information is provided by Fortune Business Insights, in its report, titled, Contact Center Software Market, 2022-2029. Source: Contact Center Software Market.

Beneficial Analysts’ Expectations And A Solid Financial Situation

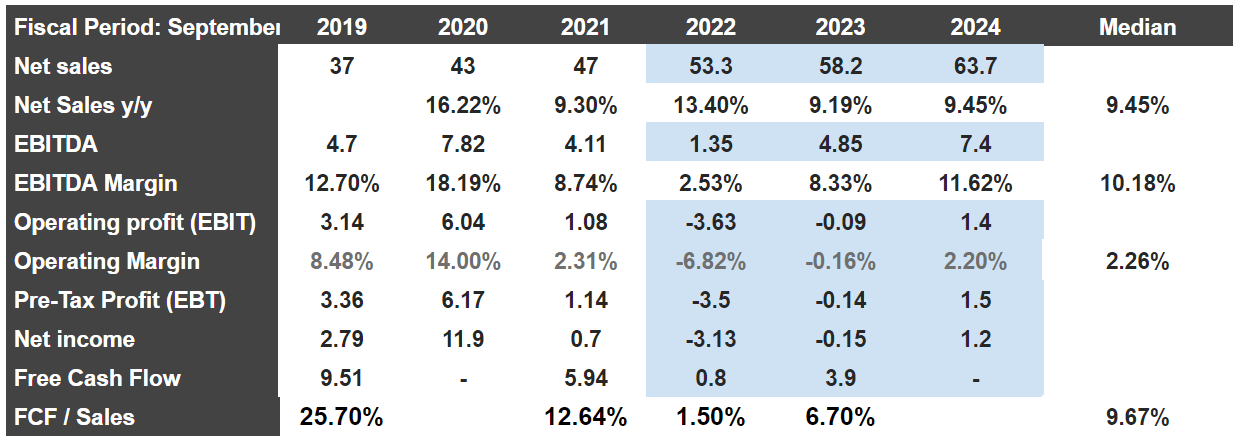

Analysts expect 2024 total sales of $63.7 million with net sales growth of 9.45%, in addition to an EBITDA of $7.4 million along with an EBITDA margin of 11.62%. The operating profit would be $1.4 million with an operating margin of 2.20%. Finally, net income would stand at $1.2 million with a free cash flow margin of 6.70%.

With positive net income and already reporting positive free cash flow (“FCF”), I believe that the figures are quite beneficial. I used some of the median figures obtained from the expectations of analysts.

Source: marketscreener.com

Balance Sheet

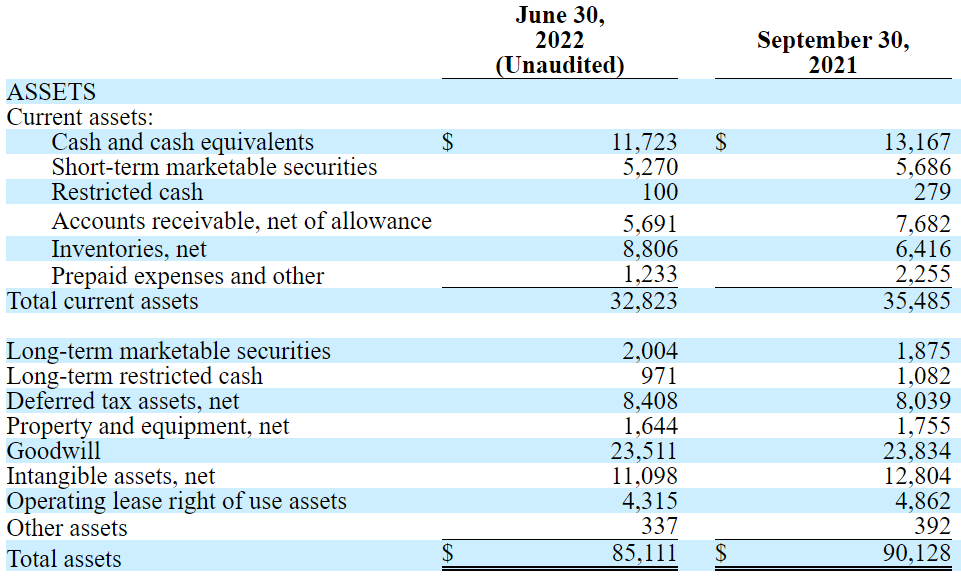

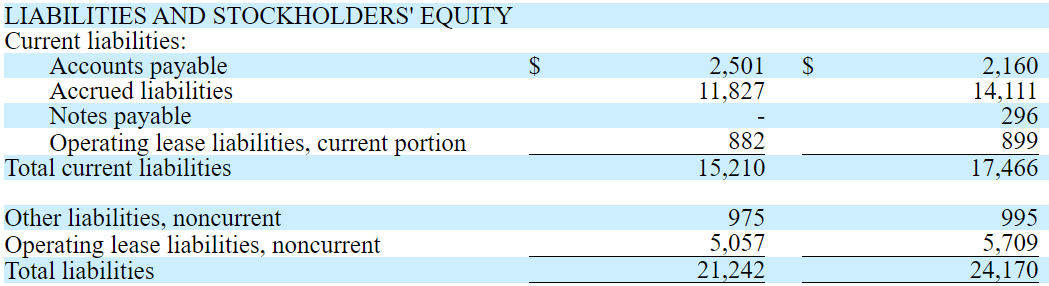

As of June 30, 2022, Genasys Inc. management reported cash of $11.723 million with short term marketable securities of $5.270 million. Also, with accounts receivable worth $5.691 million and inventories of $8.806 million, total current assets stand at $32.823 million. The total amount of current liabilities appears to be close to half the total current assets. I believe that Genasys has a significant amount of liquidity.

Non-current assets include deferred tax assets worth $8.408 million, goodwill worth $23.511 million, and intangible assets worth $11,098 million. Finally, total assets stand at $85.111 million, implying an asset/liability ratio close to 4x. In sum, the balance sheet appears in good shape.

Source: 10-Q

Genasys’ liabilities include accounts payable worth $2.501 million, with accrued liabilities of $11.827 million and total current liabilities of $15.210 million. Operating lease liabilities were $5.057 million, and total liabilities stand at $21.242 million. With no debt, in my view, most shareholders will not be worried about the total amount of liabilities.

Source: 10-Q

Under An Optimistic Case Scenario, I Believe That The Fair Price Could Be Worth $5.3 Per Share

I believe that the internationalization efforts reported in the most recent quarterly report will likely enhance sales growth. The company appears to be present in Spain, Canada, United Arab Emirates, Singapore, and many other jurisdictions.

The Company has eight wholly owned subsidiaries, Genasys II Spain, S.A.U., Genasys Communications Canada ULC (“Genasys Canada”), Genasys Singapore PTE Ltd, Genasys Puerto Rico, LLC, Zonehaven LLC, and Genasys Inc. (branch) in the United Arab Emirates and two currently inactive subsidiaries, Genasys America de CV and LRAD International Corporation. Source: 10-Q

In line with my previous lines, let’s note that Genasys has a salesforce working with many jurisdictions abroad. In my view, international sales will likely grow as more clients learn about the products offered by Genasys.

We market and sell products and services through our salesforce based in California, Florida, Missouri, Pennsylvania, Washington, Wisconsin, Canada, France, Singapore, Spain, Sweden, and the U.A.E., as well as through a full-time business consultant in Germany. Source: 10-k

Besides, I believe that scalability could enhance future free cash flow margin, which will likely benefit the company’s stock valuation. Management was very clear about the fact that their software offers significant scalability.

Genasys products have been deployed across the globe and can be scaled to meet the needs of small towns, multinational corporations, and everything in between. Source: 10-k

Finally, under this case scenario, I also assumed that more acquisitions would take place. Let’s note that Genasys has significant expertise in the M&A markets at an international level. Recent acquisitions took place in Spain, Canada, and the United States.

On January 18, 2018, Genasys acquired all of the issued and outstanding shares of capital stock of Genasys Holding.

On October 2, 2020, Genasys acquired substantially all of the assets and business of Amika Mobile Corporation

On June 7, 2021, Genasys completed the acquisition of Zonehaven Inc. Source: 10-k

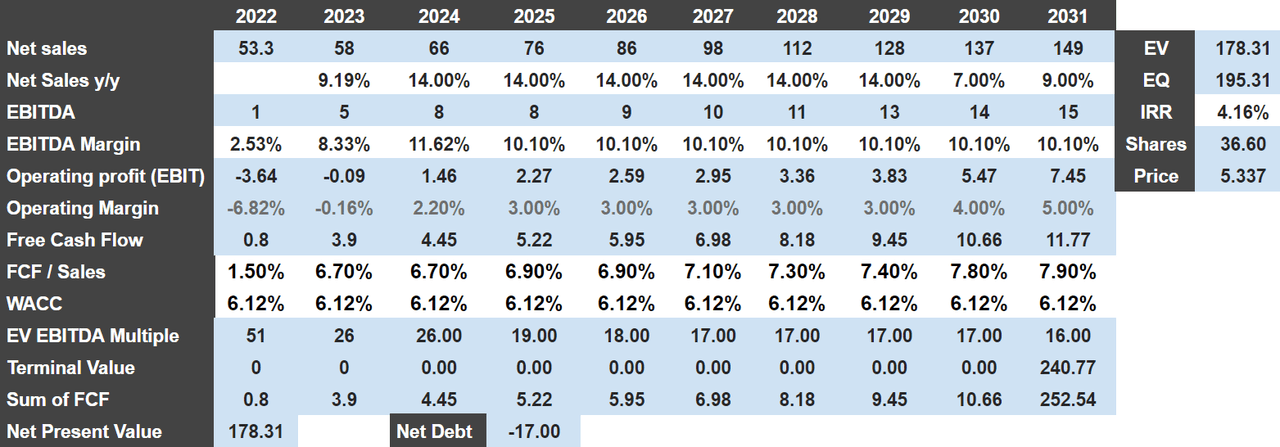

If we use 2031 net sales growth of 9%, an EBITDA margin close to 10.10%, and FCF margin around 7.9%, 2031 FCF would be close to $11 million. Besides, I obtained 2031 EBITDA close to $14.7 million. With an EV/EBITDA multiple close to 15.8x, the enterprise value is equal to $178 million. Finally, I obtained an equity valuation of $195 million, an IRR of 4%, and a fair price of $5.3 per share.

Source: Author’s DCF Model

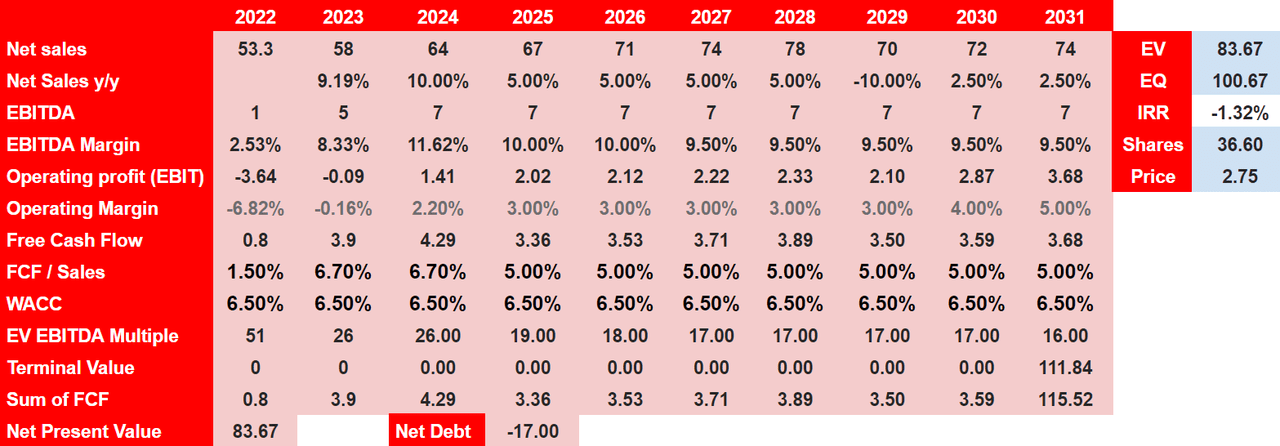

My Bearish Case Scenario Would Imply A Valuation Of $2.75 Per Share

Under this case scenario, I assumed that Genasys may have some trouble due to the fact that management counts with one supplier for compression drivers for its LRAD products. If the supplier decides to negotiate prices or stops production, Genasys’ free cash flow margin would decrease.

The Company relies on one supplier for compression drivers for its LRAD products and is working to obtain alternative suppliers to reduce such reliance. Source: 10-k.

I am also worried about the client’s concentration risk. The company reports one customer that accounts for close to 58% of the total amount of revenue. If the client decides to lower its contribution, the decline in revenue may affect the company’s stock price.

For the fiscal year ended September 30, 2021, one customer accounted for 58% of revenues, with no other single customer accounting for more than 10% of revenues. Source: 10-k

Besides, Genasys appears to be afraid of the fact that most revenue comes from a core directional product category. Lack of diversification may create revenue volatility in the coming years. Management discussed these risks in the annual report.

We are dependent on our core directional product category to generate our revenues. While we have expanded our product offering to include omnidirectional products and Software-as-a-Service systems and solutions, no assurance can be given that our core directional products will continue to have market acceptance or that they will maintain their historical levels of sales. Source: 10-k

Finally, I would be expecting certain disputes from clients and other parties due to errors in the distribution of communications. From here, I cannot really say how expensive litigation could be, but the disclaimer given by management was not small.

We may become a party to litigation, disputes and claims in the normal course of our business. Litigation is by its nature uncertain and unpredictable and there can be no assurance that the ultimate resolution of such claims will not exceed the amounts accrued for such claims, if any. Litigation can be expensive, lengthy, and disruptive to normal business operations. An unfavorable resolution of a legal matter could have a material adverse effect on our business, operating results, or financial condition. Source: 10-k

Under bearish conditions, I included declining sales growth, an EBITDA margin of only 9.5%, and FCF margin of 5%. 2031 FCF would stand at close to $3.65 million, and I assumed an EV/EBITDA multiple close to 15.5x. The results include an enterprise value close to $85 million, an equity valuation around $100 million, and a fair price of $2.75 per share.

Source: Author’s DCF Model

Takeaway

Genasys appears to provide necessary services for governments, universities, large corporations, and other institutions. With international exposure, a growing target market, potential scalability, and inorganic growth, Genasys’ stock price could be worth around $5.3 per share. I do see risks from potential litigation and concentration of clients and suppliers. With that, I wouldn’t be afraid of a decline in the Genasys Inc. stock price because the market price is already quite low.

Be the first to comment