pixelfit

When we buy stock, we are buying fractional shares in a business. I like to look at the earnings yield of the business, as though I own the whole thing. If I told you, that for just over $8B, you could buy a business that has generated $5.86B of net income over the last 3 years, would you at least be interested in learning more? That is the case with Ally Financial (NYSE:ALLY) and I believe it represents an extraordinary buying opportunity for the long-term investor. Short-term headwinds absolutely will lead to a bit of degradation in net interest margins and earnings, but the company should remain robustly profitable with an excellent opportunity to grow earnings and return capital to shareholders. I see ALLY as a likely double from here and it is an extremely high conviction pick for me.

Ally has likely been over-earning over the last year or so, as a truly exceptional credit environment, combined with expanding net interest margins and high loan demand, created a bonanza of profitability, culminating in $3.06B of net income in 2021. This was obviously a huge step forward from the previous two years, where net income was $1.715B in 2019, and $1.085B in lockdown-riddled 2020. Keep in mind, we are talking about a company with a market capitalization of around $8B. Through the first three quarters of 2022, Ally has already generated $1.603B of core net income, or 19.67% of the market capitalization.

Mr. Market is not happy with stocks currently, and fears of an upcoming recession have him in a majorly pessimistic mood in relation to Ally as well. Not every recession though is a 2008 Global Financial Crisis. The banking system is dramatically stronger, and underwriting has been far more stringent. Higher rates and rampant inflation are certainly pressuring consumers and tightening financial conditions, but there aren’t many signs of any rapid escalation in the unemployment rate, which is the primary driver of credit losses. Consumer spending has been quite buoyant, although there are early signs of that growth moderating from earlier in the year. Savings accounts remain elevated from pre-pandemic amounts, while a low unemployment rate should keep defaults down. CECL accounting frontloads loan losses and most banks, including Ally, are carrying reserves that incorporate recessionary scenarios into them. While used car prices are finally starting to drop from their astonishing rise, Ally has been expecting that to occur and adjusted its underwriting accordingly. The actual financial impact is not nearly as significant as the amount of attention put on used car prices in relation to Ally.

On October 19th, ALLY reported 3rd quarter earnings that were received with disappointment from Wall Street. Ally generated $2.1B of revenues and 3rd quarter adjusted EPS was $1.12. Core net income was $346MM, down from $782MM in Q3 of 2021. This was good for a ROTCE of 17.2%, or 12% excluding the impact of OCI. Core pre-provision revenue was $948MM, down from $1.108B a year ago, providing ample room to deal with any weakening in credit, while maintaining solid profitability.

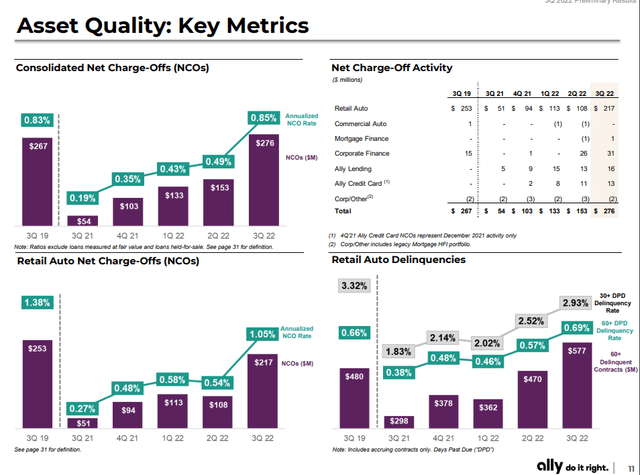

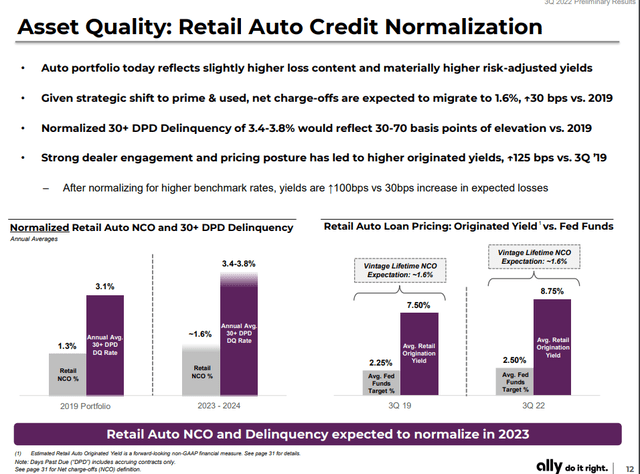

Net financing revenue, excluding OID, of $1.7B was up 8% YoY, due to strong origination volumes and pricing. Adjusted other revenue was $359MM, which was down YoY, but excluding the impact of an impairment, other revenue was in line with the company’s mid-400s expectations. Ally recorded a provision expense of $438MM reflecting origination volume and normalization of credit performance. CECL provisioning guidelines require banks to reserve up front for the expected losses over the life of the loans, which is painful initially, but revenues from growth are earned out in subsequent quarters. Net charge-offs of $276MM were up YoY but remain below pre-pandemic levels and are in line with expectations. Ally has shifted towards higher yields and more used vehicles, which come with higher loss expectations, but better risk-adjusted returns than the Super Prime segment. As pandemic tailwinds normalize, Ally expects delinquencies and net charge offs to migrate above 2019 levels, with normalized delinquencies of 3.4-3.8%, which is 30 basis points higher than 2019. To compensate for that increase, the company has added 125 basis points of price, and adjusting for benchmark rate moves, Ally has added 100 basis points of price to compensate for the 30 basis points of higher expected losses. Non-prime only consists of about 10% of origination volume. Noninterest expense was $1.1B, which was up YoY, mostly due to business investments such as Ally Credit Card.

Ally Q3 Investor Presentation

Ally Q3 Investor Presentation

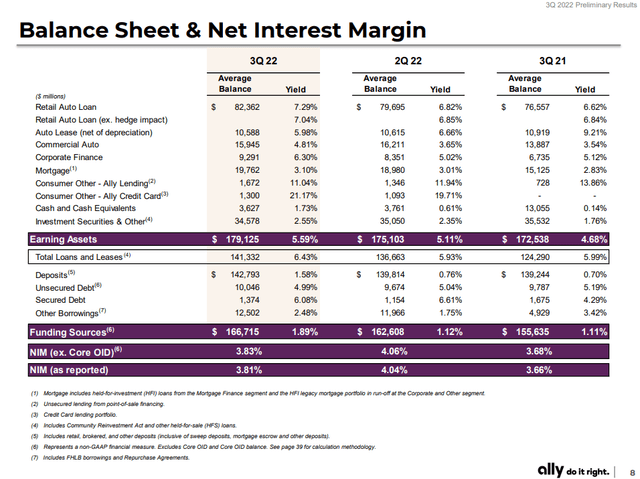

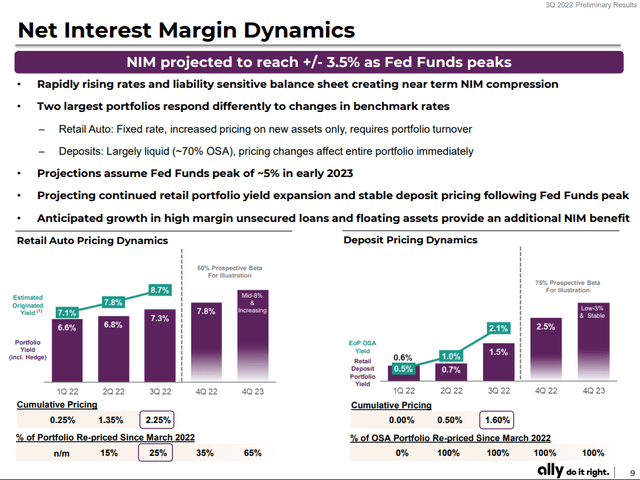

Net interest margin, excluding OID, was 3.83%, up 15 basis points YoY, but down 23 basis points sequentially. Management forecasted that higher deposit costs will continue to pressure NIM, but that they expect to keep it in the upper 3% range but could bottom at 3.5%. Total loans and leases are up $18B YoY, while a reduction of excess liquidity results in total operating earning asset growth of $7B. Earning asset yield was up 48 basis points sequentially and 91 basis points YoY, to 5.59%, as a result of higher origination yields and more than $40B of floating rate exposure across the loan and hedging portfolios. Retail auto portfolio yield expanded 19 basis points sequentially to surpass 7%, which provides ample room to deal with charge offs. Management expects continued earning asset yield expansion moving forward. Cost of funds increased by 77 basis points sequentially and 78 basis points YoY, reflecting higher deposit costs. These costs should continue to increase as the Fed continues its tightening program, but so will the retail auto yield, as the portfolio migrates towards the 9% level that the company is originating at currently.

Ally Q3 Investor Presentation

Total loans grew $4B in the period, which drove a $133MM of provision build. The company also recorded a $136MM impairment in its investment in Better Mortgage Company, due to a substantial weakening in the mortgage industry conditions. The remaining carrying value is now only $19MM, so there isn’t a lot of risk there. Within operating expenses, Ally recorded a $20MM charge associated with the termination of a legacy pension plan, and an additional impact of over $55MM including tax expenses, is expected in the 4th quarter. Moving forward, Ally has no remaining exposure to qualified pension plans.

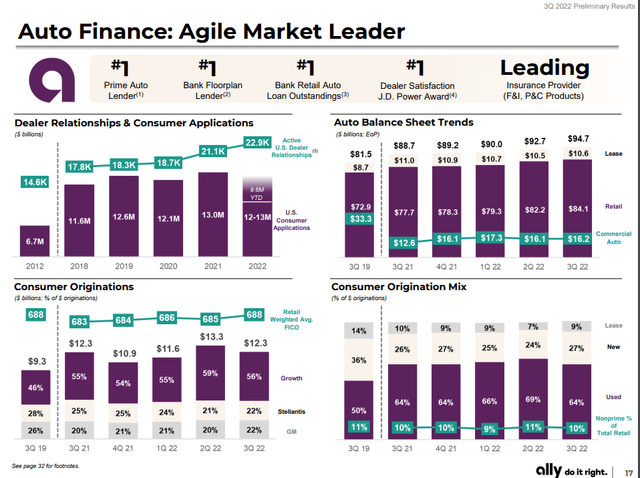

In Auto, consumer originations of $12.3B were flat YoY and $1B lower than in Q2. Originated yields expanded by 93 basis points sequentially to 8.7%. Industry vehicle sales remained slow due to continued supply chain issues and increasing unaffordability with high prices and higher interest rates. Commercial inventory auto loans crept up a little bit, but balances have been very low and will take some time to normalize. These loans are very low risk for ALLY and benefit from higher rates, so that will be a welcome reprieve as things continue to improve there. Insurance written premiums of $291MM were negatively impacted as well by lower inventory levels and industry sales.

At Ally Bank, retail deposit customers exceed 2.6MM, expanding 6% YoY and representing 54 consecutive quarters of customer growth. Balances increased by $2.7B and deposits now account for 86% of funding. The shift towards lower cost deposits funding radically changed Ally’s profitability and while increasing rates will certainly pressure net interest margins over the short-term, the reality is that Ally’s NIM is still a lot higher than many of its competitors and it operates its deposits franchise with less than 30 basis points of non-interest expense, due to its lower cost footprint without all the bank locations that its peers have. Over time, pricing on originations and repricing on its adjustable-rate loans will significantly help mitigate the higher deposit liability costs, which are still far lower than if the company was more reliant on secured and unsecured debt markets, or warehouse lines.

Ally Home originations were $521MM, as the mortgage industry slowed materially, especially refinancings. Ally Invest assets declined with the market, but accounts increased by 4% YoY. Ally Lending, the point-of-sale business, generated origination volume of nearly $600MM, with expansion in healthcare and home improvement verticals. Ally Credit Card reached $1.4B of loan balances and surpassed 1MM active cardholders. Corporate Finance saw strong loan growth and has a held-for-investment portfolio of $9.4B.

Ally’s CET1 ratio ended the quarter at 9.3%, despite $3 billion in RWA growth and $415MM in share repurchases. The company has repurchased $1.6B of stock year-to-date and pays a quarterly dividend of $.30 per share. I was disappointed to see that management intends on lightening up on the stock buybacks given the cloudy macroeconomic outlook, despite having $3.6B above its FRB required capital levels of 7%. This is a big mistake in my opinion, as obviously the stock is dramatically cheaper, and the impact of buybacks is far greater at this valuation. I truly hope that management reconsiders this questionable decision.

Consolidated loan loss coverage increased by 3 basis points to 2.71%, reflecting growth in retail auto, unsecured lending, and the corporate finance portfolio. The total reserve increased to $3.6B, which is still $1B higher than CECL day-1 levels, and three times the levels of 2019 prior to CECL. Retail auto coverage increased by 5 basis points to 3.56% and is 22 basis points higher than CECL day-1 levels. Under Ally’s CECL methodology, the 12-month reasonable and supportable period assumes unemployment increasing slightly above 4% over the next 12 months, before it gradually reverts to a historical mean of about 6.5%. This seems reasonably conservative based on recent employment data, and I think there is a good chance that Ally will outperform its estimates on credit. Importantly, declining used car prices are embedded in management’s loss assumptions of 1.4-1.6%.

Management had a very interesting comment on the Q&A session of its conference call. They said, “if we shocked funding costs to somewhere in the neighborhood of 4%, put lifetime losses on the auto book in excess of 2%, you’re still getting an ROE of around 21, and an ROA just shy of 2%.” This is a phenomenal business in pristine financial condition, trading at a price that reflects considerable distress. While guidance is only for a 10% ROE ex-AOCI in Q4, management expects that largely being the low point, and should increase from there towards the 16-18% through-the-cycle goal. The main issue as we discussed, is that Ally is liability sensitive and there is a lag before assets can adjust to the liability cost growth.

At a recent price of $26.07, ALLY trades at 92% of adjusted tangible book value per share. TBVPS has been declining due to losses in AOCI resulting from higher interest rates but should start to grow again over the next year. Ally trades at only 6 times normalized earnings and a little over 3 times trailing earnings. This is ridiculously cheap for a company that has posted high-teens ROTCEs, has over $3B of excess capital, and is conservatively reserved based on a projected unemployment rate materially higher than what we are seeing currently. Ally offers a dividend yield of 4.6% so you are getting paid to wait. It’s been a tough month or so for Ally and the overall stock market, but the reality is that the business is operating well. Interest rates aren’t going to keep increasing at this same velocity, which will normalize net interest margins at a still elevated rate. ALLY has the funding and underwriting acumen to continue lending at high margins, given many of its competitors are pulling away a bit. The company is constantly adjusting and pulling back from segments that don’t offer high enough risk-adjusted returns. ALLY hasn’t been this cheap since 2020, and as the economy recovered after the lockdown peak, ALLY soared like a rocket and I think there is an excellent chance that will happen again.

Ally Q3 Investor Presentation

Ally Q3 Investor Presentation

Be the first to comment