mikkelwilliam/E+ via Getty Images

Investment Thesis

The video gaming industry is a large and fast-growing sector with great potential in the long run. The video game industry is enjoyed by over 1 billion loyal users and influences many other tech industries such as virtual reality software and cloud-based services. According to BusinessWire, the gaming market is predicted to expand at a compound annual growth rate of 14.5% from 2020 and to reach a value of $314B by 2026. The main growth drivers are cloud gaming and the rise in e-sports. Cloud gaming particularly presents an interesting segment since there is no need to download and install games on a PC or console. The increasing trend to move away from physical games to online games has led the industry participants to focus on hardware compatibility and efficiency. Industry leaders have benefited from the surge in demand during the COVID-19 pandemic, which has accelerated many of the industry’s trends. In this article, I will be reviewing the Wedbush ETFMG Video Game Tech ETF (NYSEARCA:GAMR) which provides pure-play and diversified exposure to the gaming industry.

Strategy Details

The Wedbush ETFMG Video Game Tech ETF seeks to track the performance of the EEFund Video Game Tech Index. The Index is composed of a basket of companies involved in the video game technology industry, including game developers, console and chip manufacturers, and game retailers.

If you want to learn more about the strategy, please click here.

Portfolio Composition

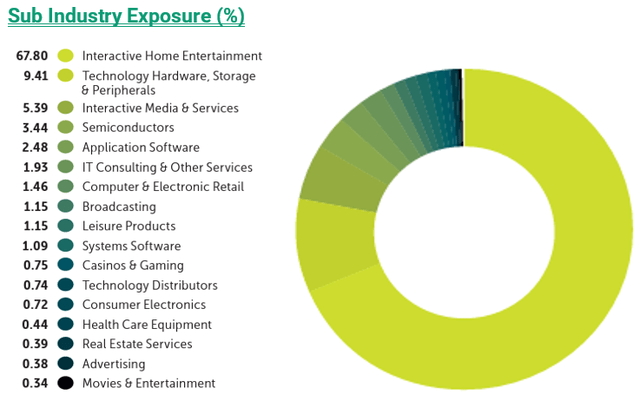

From the industry allocation chart below, we can see the index places a high weight on the interactive home entertainment sub-industry (representing around 68% of the index), followed by technology hardware (accounting for 9% of the index), and interactive media & services (representing around 5% of the fund). The largest three industries have a combined allocation of approximately 82%. Unsurprisingly, the strategy is tilted towards interactive home entertainment stocks. These stocks generally have high betas, thus I think it is important to see if you are comfortable with a higher level of volatility before purchasing GAMR.

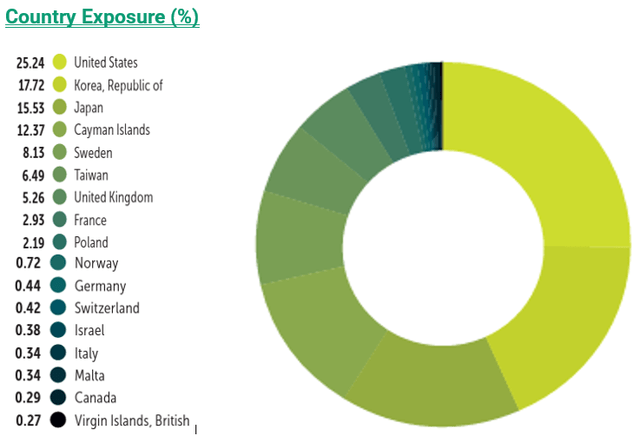

In terms of geographical allocation, the top ten countries represent approximately 97% of the portfolio. The United States accounts for 25%, whereas other countries such as France or Norway seem to be underrepresented given the low weight (3% weight for France and only a 0.7% allocation to Norway).

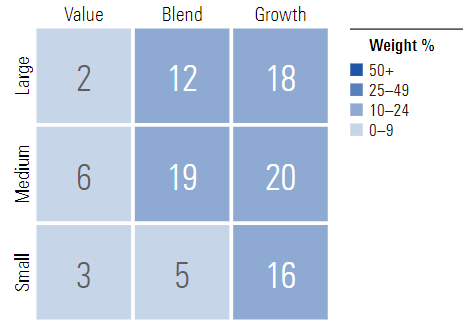

GAMR invests over 20% of the funds into mid-cap growth issuers, characterized as mid-sized companies where growth characteristics predominate. Mid-cap issuers are generally defined as companies with a market capitalization between $2 billion and $8 billion. The second-largest allocation is in mid-cap blend equities. It is interesting to see that this ETF allocates approximately 68% of the funds to small and mid-cap issuers, which generally have a larger runway to grow than large-cap issuers and can therefore compound at a higher rate.

Morningstar

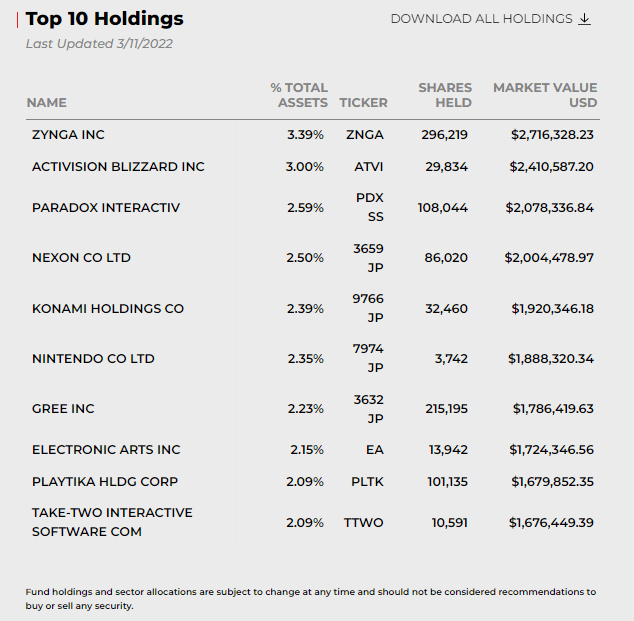

The fund is currently invested in 111 different stocks. The top ten holdings account for 25% of the portfolio, with no single stock weighting more than 4%. All in all, I would say that GAMR is very well-diversified across issuers.

ETFMG

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to Morningstar, the index currently trades at an average price-to-book ratio of 7 and at an average price-to-earnings ratio of 25. The strategy clearly benefited from the COVID-19 pandemic and the lockdowns that followed. Many constituents did very well over the past two years. However, I don’t believe that past performance is a good indicator for future performance in this case. GAMR is trading at a relatively high valuation as we are entering a tightening cycle which makes the bullish thesis less compelling.

Is This ETF Right for Me?

I have compared below the price performance of GAMR against the performance of the Invesco QQQ ETF (NYSEARCA:QQQ) over the last 6 years to assess which one was a better investment. Over that period, QQQ outperformed GAMR by a ~29 percentage points margin. To put GAMR’s performance into perspective, a $100 investment in this ETF at its inception would now be worth ~$285. This represents a compound annual growth rate of ~19% which is a very good absolute return.

As GAMR is heavily tilted towards tech stocks, the correlation between the two strategies is very high. Even if GAMR has strong growth prospects in the long term, I expect a lot of volatility in the short term as central banks around the world are starting to withdraw liquidity from the system. As a result, the pullback that started in Q4 2021 is likely to continue over the next months, which should provide an opportunity to buy this ETF at a lower valuation.

Key Takeaways

The gaming sector has appealing prospects and it is likely to grow at a double-digit rate going forward on the back of strong demand. GAMR provides exposure to a well-diversified basket of gaming stocks and can be used as part of a broader portfolio strategy to get some exposure to this sector. Unsurprisingly, GAMR is concentrated in tech stocks, and its returns are therefore strongly correlated to tech indices such as QQQ. Given the fact that many constituents trade at a high multiple and that central banks around the world are starting to withdraw liquidity from the system, I don’t see any reason why the recent level of volatility will go away over the next few months. As a result, the pullback that started in Q4 2021 is likely to continue in my opinion, which should provide a buying opportunity at a lower valuation.

Be the first to comment