Daria Nipot/iStock Editorial via Getty Images

Article Thesis

Amazon (AMZN) has announced that it will split its shares 20:1. The market has reacted very positively to that announcement. In this report, we’ll show why stock splits should theoretically not matter for the underlying value of the company. We’ll also highlight why they do still matter for investors to some degree – options, liquidity, index inclusion are noteworthy.

What Amazon Announced

On Wednesday evening, Amazon announced that it would split its stock at a 20 to 1 ratio. The stock split will, according to Amazon’s 8-K filing, occur in late May, following approval by shareholders at the company’s annual meeting, which will take place on May 25.

A 20-1 stock split means that each share of Amazon today will turn into 20 shares, 1 existing one and 19 additional ones, following the stock split. Someone holding 10 shares today would own 200 shares in Amazon following the stock split.

Amazon also announced a $10 billion share repurchase program during the same news announcement, more on that later.

Why Stock Splits Shouldn’t Matter – In Theory

The underlying value of a company is determined by factors such as the earnings and cash flow the company generates, the assets it owns, while debt levels, growth, patents, branding strength, etc. also play a role. Neither of these is affected by a stock split.

A stock split doesn’t change what percentage of a company one owns. Suppose someone holds 10 shares of Amazon today, that’s ~0.000002% of the company’s share count of 510 million. The investor in this scenario thus has a claim on 0.000002% of the cash flows and profits that Amazon generates. Should AMZN ever start to make dividend payments, 0.000002% of the company’s total dividends would flow to the investor from our example.

Following the stock split, the same investor will own 200 shares of Amazon. But since the share count has risen 20-fold as well, from 510 million to 10.2 billion, the percentage is the same, at 0.000002%. The stock split does neither result in a larger claim when it comes to the company’s cash flows or earnings, nor does it have an impact on any future dividends, all else equal.

It also seems reasonable to assume that the change in the company’s share count, all else equal, does not translate into higher profits or cash flows for Amazon. It also does not allow for faster business growth, a stronger brand, and so on. From a fundamental basis, stock splits (and reverse stock splits) should thus not have a material impact on a company’s share price. And yet, AMZN is up 10% at the time of writing, following the announcement of its stock split.

This is likely due to speculation, to some degree, but there are also some other factors at play that we should consider.

Why Stock Splits Still Matter – To Some Degree

The underlying value of a company is not dependent on its share count. But share count changes, or stock splits, can nevertheless have an impact on the perceived value in the eyes of investors.

Fractional shares

First, if a company has a high share price, which holds true for Amazon, buying whole shares is not possible for everyone. Someone starting out and investing a couple of hundred dollars at a time can’t buy a complete share of Amazon at $2,800. With fractional share buying being available through many brokers, including Robinhood (HOOD), this has become less of an issue in recent years.

Still, some investors can’t buy fractional shares through their brokers. And even among those that could do so, some tend to avoid this feature, instead deciding to buy round lots only. With AMZN splitting its shares at a 20-1 rate, which will bring down the share price to around $140, buying round lots or whole shares will be way easier for many investors.

Option strategies

A lower share price also is important when it comes to utilizing options. Amazon does, like many other tech stocks, not make any dividend payments. For someone seeking exposure to Amazon’s strong business growth, writing covered calls could be a way to generate some income from their investment through the options that are created by this strategy. But selling covered calls requires owning at least 100 individual shares in a company.

With AMZN at $2800 per share, that means that there is a minimum position size of $280,000 — which likely translates into a 7-figure portfolio (assuming at least some diversification). Selling covered calls on Amazon is thus not possible for many investors. But following the announced stock split, selling covered calls on AMZN will only require a minimum investment of around $15,000, which makes this strategy a lot more accessible to many investors.

In general, the same principle also holds true when it comes to selling cash-secured puts in order to enter a position at a discounted price — that will also be a lot easier for most investors following the stock split. Last but not least, buying calls for leveraged upside potential, and buying puts to hedge positions will also be easier following the stock split.

Index inclusion

Most indices are market-cap weighted, which is, I believe, the most reasonable way to construct an index. That does not hold true for all indices, however. The Dow Jones Industrial Average (DIA) is a price-weighted index, which means that the share price, and not the company’s market capitalization decides about a company’s weight in the index. Naturally, companies with very high share prices can’t be included in the index, as this would distort weightings to a large degree.

This is why Amazon is, so far, not a member of the Dow Jones Industrial Average, despite being one of the largest and most dominant companies in the US. We have seen, following the 7-1 stock split of Apple (AAPL) in 2014, that index inclusion in the Dow Jones Industrial Average can happen very quickly once a large company has brought its share price to a suitable level. This will most likely be the case with Amazon as well, which is why investors can expect index inclusion in 2022, I believe.

Due to the fact that some ETFs replicate the Dow Jones index, index inclusion will lead to forced buying, which could alter the supply-demand picture for shares of Amazon — at least for a while.

We can thus summarize that even though Amazon is not becoming a better company by splitting its shares, there is some impact for shareholders. Liquidity will be higher, using options will be way easier, and index inclusion could lead to some forced buying. That being said, investors shouldn’t buy based on a stock split alone. Instead, I believe that decisions to buy or sell should be primarily based on fundamentals and considering a stock’s valuation.

AMZN: Strong Company, But Not Cheap

Amazon is a dominant company in its industry, and thanks to the rise of AWS, it has become quite profitable in recent years. Compared to the other FAANG+M stocks, Amazon is still rather pricy, however.

Shares are currently trading for around 55x forward net profits, which represents a huge premium relative to how Meta (FB), Alphabet (GOOG), (NASDAQ:GOOGL) and co. are valued. A 50+ earnings multiple also seems quite high relative to how the broad market is valued today (19x 2022’s expected net profit).

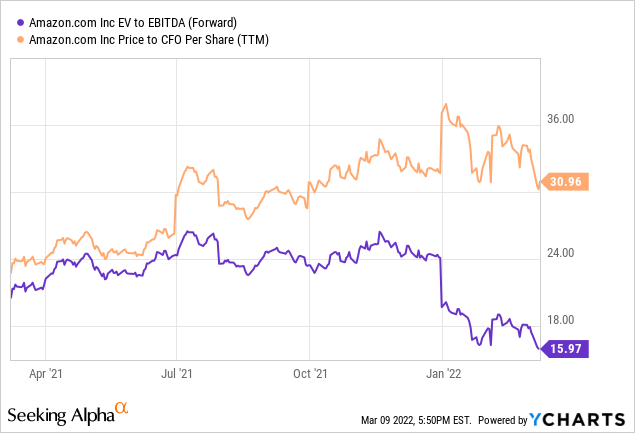

That being said, Amazon looks more reasonably valued based on its enterprise value to EBITDA multiple of 16. This isn’t especially low but does not represent a high valuation, either. Note that enterprise value accounts for debt usage and cash being held on the balance sheet, making it a more telling metric compared to market capitalization. Amazon’s cash flow multiple is 31, which translates into a cash flow yield of slightly above 3%. That’s not low, but does not seem outrageous, either, when we assume that Amazon continues to grow its business at a strong pace for the next couple of years.

Takeaway

Amazon is a strong company at a valuation that could be reasonable, but that surely isn’t low. The company’s $10 billion buybacks program is a positive, but versus a market capitalization of $1.4 trillion, it won’t really move the needle – that’s just a 0.7% buyback. Still, if AMZN were to do buybacks more regularly going forward, there ultimately could be a more meaningful impact for someone holding shares for many years.

The stock split is a good decision, I believe. It will make AMZN more accessible and allow more shareholders to use options easily. At the same time, buying solely due to a stock split is not a good idea, I believe. Overall, I rate Amazon a hold today, as the valuation is not low enough to make it an outright great deal at today’s prices.

Be the first to comment