Bruce Bennett/Getty Images News

GameStop Corp. (NYSE:GME), a specialty retailer, provides games and entertainment products through its e-commerce properties and various stores in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, virtual reality products, and memory cards; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads. It also sells collectibles comprising licensed merchandise primarily related to the gaming, television, and movie industries, as well as pop culture themes. – Source: Seeking Alpha

In June 2022, we have published an article on Seeking Alpha, titled: “We Are Not Convinced With GameStop’s Strategy“. In that article, we have rated GME’s stock as “sell”, because of the following reasons:

- Despite the first quarter revenue growth, we were expecting GME’s financial performance to be hurt by the declining consumer confidence.

- Diversification efforts may not be successful due to fierce competition in both physical stores and online.

- The timing of the launch of GME’s Ethereum wallet and its NFT marketplace appears to be unfortunate, due to the current market sentiment in the crypto market.

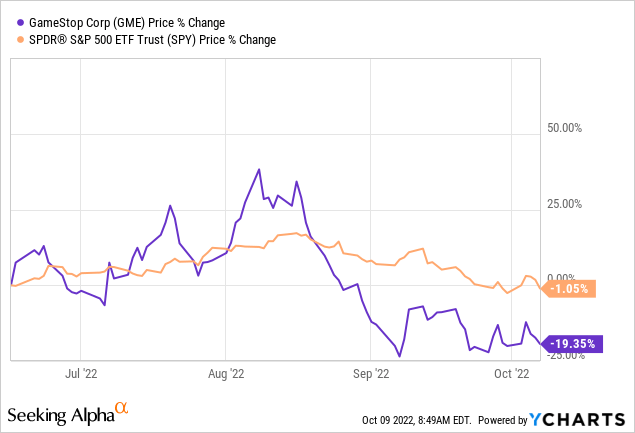

Since our article, GME’s stock price has dropped by as much as 19%, significantly underperforming the broader market, which has only lost 1% in the same time period.

Today, we will revisit our thesis on GME, taking the latest news and quarterly earnings into account.

Quarterly earnings

Net sales

The latest quarterly earnings report of GME was not particularly impressive. Despite beating the earnings estimates of analysts, the firm’s financial performance remains poor.

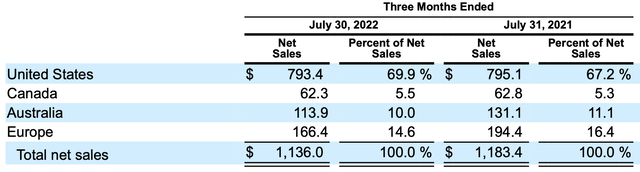

In the second quarter, net sales have decreased by as much as 4%, year-over-year.

Net sales by segment (GameStop)

This decrease was a result of declining sales across all reportable segments. The firm has attributed the poor performance to the following factors:

- decline in new software releases during the second quarter of 2022

- decline in new gaming hardware sales due to slowing demand on certain previous generation hardware

- latest generation hardware remains supply constrained despite strong demand

The negative impacts on the other hand were partially offset by the continued sell through of our pre-owned gaming product lines, and an increase in toys and collectibles sales.

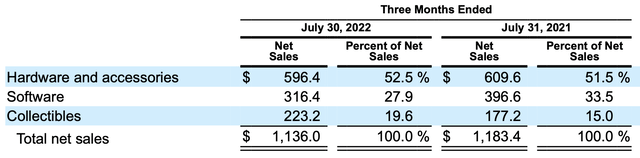

Let us take a brief look at the net sales by significant product category.

Net sales by product category (GameStop)

These figures are important to understand, how the company is executing on its strategic initiatives. The four strategic initiatives as defined by the firm are:

- establish omnichannel retail excellence

- expand our selection to deliver a market-leading offering in gaming & entertainment

- leverage existing strengths and assets

- invest in new growth opportunities

Net sales have declined across both the hardware and software segment, which we believe shows that the demand for GME’s products are weak in the current market environment. We do not see that the firm is able to deliver market-leading offerings or leverage their existing strengths and assets.

On the other hand, net sales in the collectibles segment has increased, indicating that GME’s investment in new growth opportunities may be working. But it still remains the smallest segment of the firm, contributing less than 20% to the total net sales.

On the positive side however, we have to mention the recent partnership deal of GME with FTX. This may help GME boost its net sales, however we would like to see its real impact first, before getting too excited.

Further, the macroeconomic environment has not improved since our last writing. Consumer confidence in the United States remains at extremely low levels. In our opinion, the negative sentiment is likely to keep negatively impacting the demand for GME’s products and services in the upcoming quarters.

Because of these reasons, we believe it is not justified to change our previous “sell” rating on the stock.

Gross profit

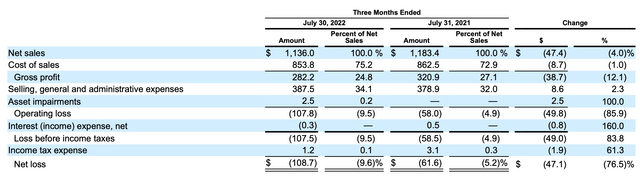

In the second quarter, gross profit has decreased $38.7 million or 12.1%, compared to the same period a year ago. The main drivers of the gross profit decline were:

- incremental inventory reserves driven by slower product sell through rates

- market pressures resulting in higher markdown rates

We believe that both of these factors are strong indications of a declining demand for GME’s products.

Selling, General and Administrative Expenses

SG&A during the second quarter has increased by $8.6 million, or 2.3%, compared to the year ago quarter. The increase can be primarily attributable to:

- transformation initiatives, which include increased labor costs as the Company in-sources talent

- investments in technology to support growth

The increases however were partially offset by the net impact of certain digital asset related activities, lower marketing costs and the continued benefit from lower store occupancy costs as a percent of sales driven by prior year cost reduction initiatives.

To sum up

Declining sales and increasing costs are putting an increasingly negative pressure on the financial performance of GME.

Consolidated results of operations (GameStop)

The net loss of the firm has significantly widened compared to the year ago quarter.

In our opinion, the strategic initiatives of the firm are not yet visible on their financial performance, while the macroeconomic environment remains challenging. Therefore we cannot justify upgrading our rating based on the latest quarterly results.

We maintain our “sell” rating on GME.

Be the first to comment