NGUYENTHANHTUNG/iStock via Getty Images

Background

We believe Profire (NASDAQ:PFIE) is due for a significant upside because of the topline push from diversification efforts and its strong balance sheet as reflected through the recent repurchase program. PFIE manufactures, installs, and services burner management systems (or BMS), a critical technology in upstream, midstream, and downstream oilfield infrastructure. The Profire BMS maintains burner flame, manages fuel flow to the burner to regulate vessel temperature, and safeguards the flaring of volatile hydrocarbons for safety and emissions control. The company dominates the North American small and mid-size oilfield burner management system market with an 80% market share.

A broad analysis of 53 oilfield services equities; was recently completed by my co-author, Thomas Prescott. Profire Energy was the best value the in the group according to a matrix based on valuation, growth, profitability, ownership, and debt. PFIE is a micro-cap with a market capitalization of only 48.44M.

Outlook and Strategy

PFIE has recently expanded its BMS offerings beyond the oil and gas market into renewables, infrastructure, power generation, mining, agriculture, food & beverage, and manufacturing. Among its recent innovations, it has already beta-tested a solution for collecting and reporting real-time carbon emissions data. Further, the company has been active in R&D activities to develop new products and revenue streams. It continued product trials through Q2. During Q2, it saw increased inventory from the strategic orders, allowing it to fulfill the order backlog in 2H 2022.

Although PFIE has recently diversified into new industries, oil and natural gas will remain key markets. North American energy production is likely to ramp up as demand increases. According to the EIA, US crude oil production can grow by 0.6 million barrels per day in 2023 compared to 2022. But because of the supply chain handicap, the global energy supply will remain tight, resulting in upward pressure on the prices. The recent sanctions against Russia and its fallout on European energy supply would keep Russian oil restricted, leaving room for an elevated energy price. Plus, the continued labor shortages and the delays in the supply chain would unsettle any production ramp-up.

Over the past year until Q2, Profire has found a solid footing in the large midstream plants and alternative industries. Backed by the energy drilling and completion activity uptick, it expects to complete more projects in Q3 and Q4 while it adds new customers and receives repeat orders from the existing ones. Management believes that supplying to large midstream plants can achieve revenue growth exceeding 100% in FY2022 compared to FY2021 in the midstream business. Currently, it expects to exceed its previous forecast ($1 million in revenues) from this segment.

Risk Factors

PFIE is a small oil field supplier reliant on revenues from a single product line, burner management systems. PFIE appears to have solid price return potential if it can meet revenue estimates. Forward share price estimates are based on past price/sales ratios. These ratios, although empirical, also reflect market sentiment. The broader energy sector has been exceptionally volatile with high perceived risk. In the short term, price/sales ratios could contract if market sentiment deteriorates further.

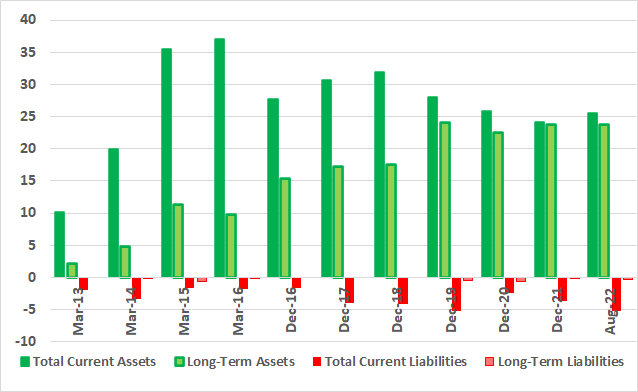

PFIE Balance Sheet: 2013 – Present

Author created and Seeking Alpha data

PFIE’s balance sheet is a fortress with 0.08% long-term debt/equity compared to the industry average of 116.5%. Over the last ten years, total assets have increased almost 300%, from $12.4M to $49.4M. Despite an industry-wide downturn beginning in late 2018, PFIE was able to add to its long-term assets through synergistic acquisitions.

In June 2019, PFIE acquired assets, including an innovative and complementary product line with manufacturing capacity in China, from Midflow Services for $2.5M in cash. In August 2019, it increased exposure to Northeast shale plays by acquiring ownership interests in Millstream for $2.4M Cash and $1M in Stock. These two acquisitions are expected to add $3.5M to $5.5M in annual revenue.

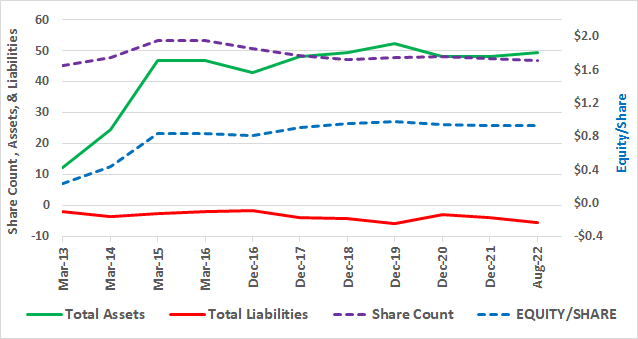

Total Assets & Liabilities, Share Count, and Equity/Share

Author created, Seeking Alpha

Since 2013, PFIE has increased book value per share by over 300% from $0.23 to $0.93/share. Much of this increase occurred as an energy sector upcycle beginning in 2015 matured and reached its final peak in late 2014. Through the pandemic dip, PFIE increased total assets while decreasing share count and total liabilities. The share count was reduced by about 2.4% as 451,000 shares were repurchased at an average price of $1.22.

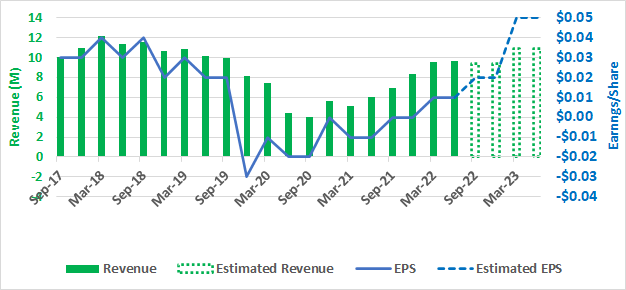

Earnings Per Share and Revenue

Revenue and EPS

According to estimates, revenue and EPS have increased for the last six quarters and are expected to increase further through 2023. On August 4th, PFIE reported Q2 GAAP EPS of $0.01 in-line with estimates and revenue of $9.6M (+59.2% Y/Y), beating estimates by $0.9M. Subsequently, shares rallied to almost $1.30 on August 11th and joined a broad energy sector slide to close at $1.04 on September 20th.

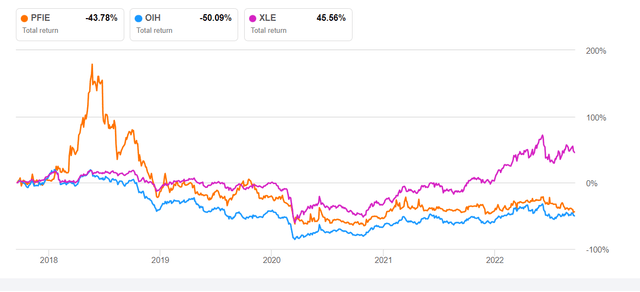

Past Price Return Behavior with Relation to Broader Energy Market

Price Return: 2008 – Present

PFIE is plotted in blue with OIH in green and XLE in purple in the upper pane, while CL1 is plotted in the lower pane. Over the period, PFIE has lagged both XLE and OIH. However, in two periods (mid-2014 and early 2018), PFIE shares spiked on greater than average volume. Both periods coincided with a maturing upcycle in the broader energy market and a sustained period of elevated CL1. If energy markets remain at current levels or above and market sentiment improves, PFIE shares could rally similarly.

Valuation Estimates

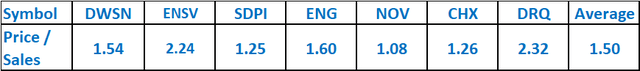

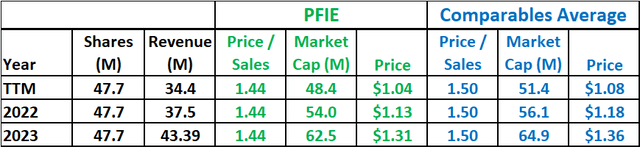

Comparable OFS Equities

Author created and Seeking Alpha

Average price/sales value was calculated based on price/sales values of comparable OFS equities selected by industry and market cap.

PFIE’s price/sales ratio is near its 10-year low. In the short term, based on the current bearish market sentiment, it may contract further. However, over the medium-to-long term, we think the energy sector sentiment will improve, and hence, price/sales could expand towards historic highs.

Market Cap and Share Price Estimates

Market cap and share prices were calculated based on the present and estimated revenues, current PFIE price/sales, and comparables average price/sales. Based on current revenue, PFIE is valued at between $1.04 and $1.08. If PFIE meets forward revenue estimates, we believe the share price could expand towards $1.31 up to $1.36 based on over two years.

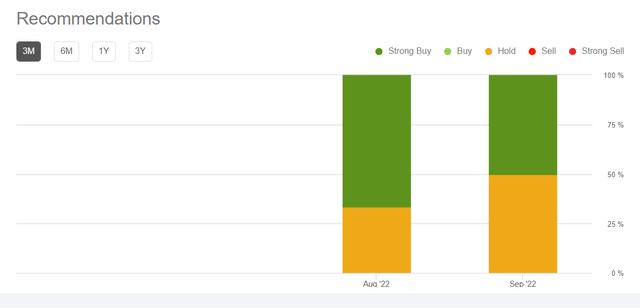

Analyst Recommendations

According to Seeking Alpha, only one sell-side analyst rated PFIE a “buy” in the past 90 days (including “strong buy”), while one recommended a “hold.” None of the analysts rated it a “sell.” The Wall Street analysts’ estimates suggest a 118% upside at the current price.

Why Do We Change The Rating?

I was cautiously bullish and recommended a “hold” for PFIE in my previous article from April. While its objective was already molding into capturing the gains from diversification, it suffered from a slow turnover because the energy demand collapsed, and the refineries and petrochemical plants deferred project plans. I wrote:

While its PF2100 crude oil burner management system saw enhanced adoption in Q4, a more prominent driving force came through due to its diversification in the downstream distribution pipeline, transmission segments, and the renewable energy market.

Management looks bold with its finances after the recent decision to repurchase shares at an average price of $1.22, which is a 17% premium to its current price. In Q2 2022, the company’s revenues and earnings/share have increased, with estimates calling for further growth due to its current focus on large midstream plants and alternative industries. This also indicates the balance sheet strength. So, we are upgrading it to a “buy.”

Conclusions and Recommendations

PFIE has an exceptional balance sheet and has recently reduced share count and long-term debt while increasing capacity and market exposure through acquisitions. It has diversified into renewables, power generation, mining, and food & beverage, among other activities. We expect a significant topline push from the large midstream plants and alternative industries in the coming days. Over the last several quarters, revenue and earnings per share have increased, with estimates calling for further growth. Based on a straightforward analysis of projected revenues and Price/Sales, the share price is forecasted to climb to $1.31 -$1.36 or about 25% over the next two years. I recommend investors buy PFIE at the current market price.

Success is just this – retaining the substance and transmuting the potential into the kinetic. – Jack London

Be the first to comment