Justin Sullivan

After the market closed on September 7th of 2022, the management team at video game retailer GameStop (NYSE:GME) announced financial results covering the second quarter of the company’s 2022 fiscal year. By pretty much every objective measure, the company is doing a fairly awful job from a fundamental perspective. Although the company did beat from an earnings perspective, sales fell far short of expectations and the firm continues to hemorrhage cash. The company does have a significant amount of cash on hand right now, and it bears very little debt. But this situation cannot last forever. One potentially bright spot, at least in the eyes of those who are bullish about the company, involves a partnership the company announced with FTX. But with details there virtually nonexistent and the core operations of the company continuing to suffer, I believe that the realistic outcome for shareholders is incredibly pessimistic.

Some painful numbers

Anybody who’s been following me for any length of time will know that I’m incredibly bearish about GameStop. The company continues to shrink as stores close and as the video game industry posts continued weakness. It doesn’t help that the company is drastically overpriced, as I detailed in a prior article. That article was published on August 29th of this year and, in that short window of time since then, shares have fallen rather mightily, plunging by 23.8% compared to the 1.3% decline experienced by the S&P 500. Even if we count the nice increase in price the company experienced in after-hours trading in response to its second quarter earnings release, shares would still be down 14.9% in just several days. So far, my decision to rate the company a “strong sell” is looking to be a good one.

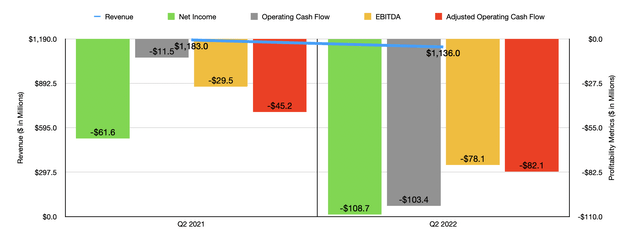

Author – SEC EDGAR Data

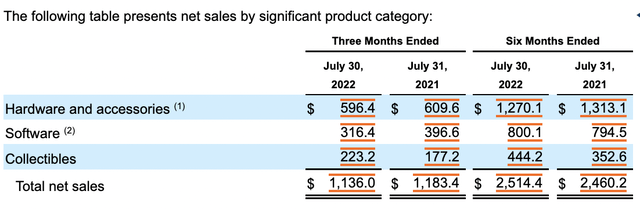

To see why I am bearish about GameStop and its future, the best thing that I can point to as an opening salvo would be its overall fundamental condition. Consider how the business performed during the second quarter of the year. Sales came in at $1.14 billion. Not only is this lower than the $1.18 billion generated the same quarter one year earlier, it’s also $130 million below analysts anticipated. This pain came as a result of weakness across two of the company’s key revenue-generating categories. Hardware and accessories sales for the latest quarter came in at $596.4 million. That represents a modest decrease of 2.2% compared to the $609.6 million generated the same time last year. Management attributed this decline in sales to slowing demand for certain previous-generation hardware. On top of that, the latest generation hardware continues to experience supply constraints even in light of strong demand.

Software sales experienced even greater downside, with revenue plunging by 20.2% from $396.6 million to $316.4 million. Management chalked the decline in software sales up to a decrease and new software releases during the quarter. Both on the hardware and software side of things, none of this should come as much of a surprise. As I pointed out in my prior article, the video game space is experiencing weakness pretty much across the board, so it was highly probable that some decline in one or both of these categories would have been experienced during the quarter. Perhaps the only bright spot for the company, from a revenue perspective, with the performance of its collectibles category. Revenue in the latest quarter came in at $223.2 million. That’s 26% above the $177.2 million generated the same time last year.

Profitability for the company was also negative but mixed relative to expectations. The company generated a net loss of $0.36 per share in the second quarter of this year. That means that it beat analysts’ expectations to the tune of $0.05 per share. Even though it’s nice to see the company outperform in this respect, it did still translate to a net loss for shareholders of $108.7 million. That’s almost double the $61.6 million loss generated the same time last year. Other profitability metrics also worsened, with operating cash flow, for instance, plunging from negative $11.5 million to negative $103.4 million. Even if we adjust for changes in working capital, cash flow would have gone from negative $45.2 million to negative $82.1 million. Meanwhile, EBITDA for the company also fell, dropping from negative $29.5 million to negative $78.1 million.

GameStop

In truth, there’s nothing great in any of these numbers. The fact that the company continues to worsen year over year is concerning. Even the items that management says are positive have a negative side to them. For instance, the company ended the quarter with net cash (cash in excess of debt) of $867.9 million. While this is a significant amount of cash to have access to, it does represent a drop of $173.5 million compared to the cash, in excess of debt, the company had at the end of the first quarter of this year. Another item that management said was positive was the fact that inventory, as at the end of the quarter, came in at $734.8 million. Their claim is that having this excess inventory will help the company to maintain adequate stock in order to meet customer demands and to offset lingering supply chain headwinds. Well, as we demonstrated already, demand is weakening and there is a significant risk, especially in the event of a real economic downturn, of being left with inventory there has to be sold off at a substantial discount. That is what I believe is more probable at this point and management is trying to spin it off into something great.

There are some other interesting items to discuss here. As an example, management announced a partnership with crypto platform FTX. The partnership will involve collaboration with FTX on new e-commerce and online marketing initiatives. The retailer will also begin carrying FTX gift cards in its stores and will be considered FTX’s preferred retail partner in the US. While this may seem good on paper, management did not disclose any financial terms associated with the partnership. We also have no idea how sizable the revenue opportunity on this front will be. So until we see further evidence, anything else that we say is likely speculative. The company also confirmed, again, the launch of its NFT marketplace. But once again, there are no real details for us to rely on. Perhaps the best decision the company made was in revamping its compensation plan for the store leaders in its network. The new arrangement will entitle store leaders $21,000 in time-based equity compensation over a three-year window. Depending on performance, store leaders are also able to get performance-based equity grants over time. Being able to pay your employees using drastically overvalued stock is never a bad financial decision for the company doing it.

Takeaway

Based on all the data provided, I see little in the earnings release that should give investors any real degree of optimism. The company is losing cash and the majority of its fundamental performance figures are a mess. Any sort of investment in the company should be considered highly speculative in nature and largely based on the idea that the company’s foray into NFTs and all other things crypto/blockchain, will end up paying off. But again, there really is no substantive data to suggest that this is even possible, let alone probable. In the absence of anything positive to show from a fundamental perspective, I cannot in good conscience rate the company any better than a “strong sell” at this time.

Be the first to comment