eyegelb

Earlier this year, I wrote on Galiano Gold (NYSE:GAU), noting that it continued to be a less attractive way to get exposure to the gold price given that it was a high-cost single-asset producer in a Tier-2 jurisdiction. Since then, the stock has underperformed the gold price by nearly 15% and saw a drawdown of more than 45% at its June lows. However, while many laggards have struggled to get up off the mat or remain deeply in negative territory for the year, Galiano Gold has recovered most of its losses and is doing a much better job of managing expectations under its new CEO, Matt Badylak (previous GM Kisladag and Tanjianshan, and MD of Eldorado China).

This has been evidenced by the company raising its guidance for the second time this year after improving its recovery rates (work completed to optimize plant performance) and better cost performance due to workforce rationalization. Additionally, the much-awaited independently verified metallurgical test work on Esaase material came in as expected, allowing the company to release a new Feasibility Study and reinstate reserves. Given the improving operational performance and continued exploration success, I see the stock as a Speculative Buy at US$0.43.

Asanko Gold Mine Operations (Company Website)

Unless otherwise noted, all figures are on a 100% basis for the Asanko Gold Mine JV. The Joint Venture is split 50/50 for the 90% economic interest, with Ghana holding 10%. Therefore, all figures are attributable on a 45% basis to Galiano.

Q3 Production & Sales

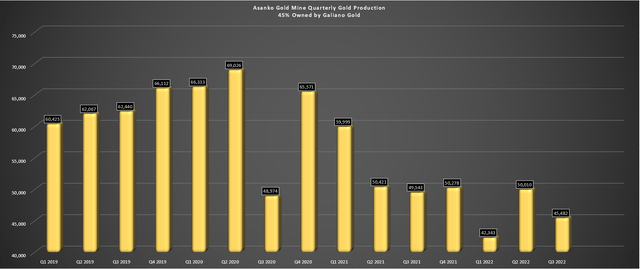

Galiano Gold released its Q3 results last week, reporting quarterly production of ~43,900 ounces, an 11% decline from the year-ago period. The decline in output was related to lower throughput and lower recovery rates, with the Asanko Gold Mine [AGM] lapping production of ~49,500 ounces in Q3 2021 during a strong period for throughput (~1.54 million tonnes processed). However, while production was down year-over-year, it continues to track miles ahead of initial guidance of 100,000 to 120,000 ounces, with ~136,300 ounces produced year-to-date. The outperformance prompted the company to raise production guidance a second time to 160,000 to 170,000 ounces for FY2022.

The decline in 2022 initial guidance vs. 2021 production levels (~210,200 ounces) can be attributed to a plan to process stockpiled material in H2 to preserve higher-grade resources while it figured out the recovery issue that surfaced in Q1.

Asanko Gold Mine Quarterly Gold Production (Company Filings, Author’s Chart)

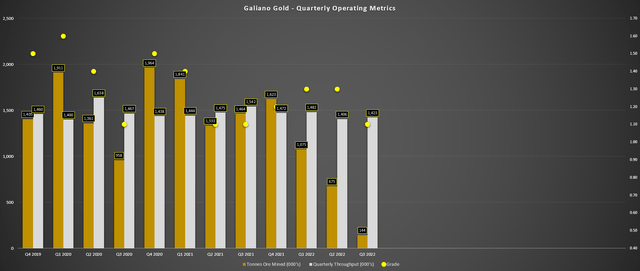

During the quarter, ore tonnes mined dropped materially as mining was completed at the Akwasiso Pit, and the company will continue to feed stockpiles to the mill for the remainder of the year. Meanwhile, throughput was in line with the 3-year average at ~1.42 million tonnes, and grades were down sharply vs. peak levels, but this isn’t surprising given that the combination of Akwasiso ore and stockpiled material came in at significantly lower grades than Nkran, a much higher-grade deposit, where mining from Cut 2 was completed in mid-2020. Based on the mid-point of FY2022 guidance, Galiano will see its weakest quarter of the year in Q4 but will still smash its initial guidance of ~110,000 ounces.

Asanko Gold Mine – Quarterly Operating Metrics (Company Filings, Author’s Chart)

While the quarterly results were better than expected, the major news was the receipt of independent third-party metallurgical test work on the Esaase deposit, which showed overall weighted estimated gold recoveries of 87%. This is a huge relief after much lower-than-expected recovery rates from this deposit earlier this year, with the Esaase deposit making up a significant portion of measured & indicated resources (~33% ex-stockpiles) at the Asanko Gold Mine. The result is that the AGM joint venture can reinstate mineral reserves. It’s also worth noting that recovery rates improved further in Q3 to 88%, helped by work completed in Q2 to optimize plant performance (revising mill feed blend, increasing mass pull in the gravity circuit, and adjusting and reagent additions in the CIL circuit).

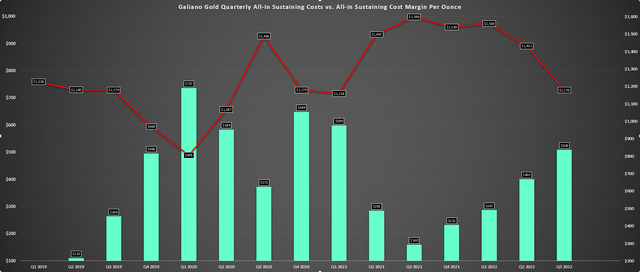

Costs & Margins

Moving over to costs, Galiano reported all-in-sustaining costs of $1,1178/oz in Q3 2022, a significant decline from $1,598/oz in the year-ago period. This was related to the rationalization of the workforce, which led to lower labor costs, lower mining costs due to winding down operations at Akwasiso, and a positive NRV adjustment of $3.2 million. These benefits were partially offset by higher electricity, fuel, and reagent costs, impacting nearly all producers sector-wide. However, it’s also worth noting that sustaining capital is tracking well behind the downward revised guidance of $13 million for FY2022, suggesting it will increase materially in Q4 vs. relatively low levels year-to-date, which helped to lower unit costs in Q3 (Q3 2022 sustaining capital: $2.2 million vs. $6.3 million).

Galiano Gold – AISC & AISC Margins (Company Filings, Author’s Chart)

Given the significant decline in costs, margins improved materially from the year-ago period and more than offset the weaker gold price in the period ($1,687/oz). As shown above, AISC margins improved to $509/oz in Q3, representing the best quarterly performance since Q1 2021. The result was that the Asanko Gold Mine joint-venture reported cash flow from operations of $26.1 million and free cash flow of $16.3 million, a very solid quarter amid gold price weakness. The AGM joint venture expects to report operating cash flow before expiration costs and non-recurring working capital items of $90 million for FY2022, significantly above its previous estimates ($60 million).

Valuation & Technical Picture

Based on ~234 million shares outstanding and a share price of US$0.57, Galiano Gold trades at a market cap of ~$133 million, a very reasonable valuation for a company with approximately 95,000 ounces of attributable gold production (two-year average). After subtracting ~$54 million in cash, Galiano’s enterprise value comes in at closer to $79 million, a valuation typically reserved for an explorer, not a producer. Even based on conservative estimates of attributable operating cash flow of $37.0 million in FY2023, this leaves Galiano trading at one of the lowest cash flow multiples sector-wide.

While this is undoubtedly cheap, it is important to note that there is typically a significant discount in place for single-asset producers, given that risks are magnified when they rely solely on one operation. This is especially true when the mine is located in a Tier-2 or Tier-3 jurisdiction. Fortunately, the AGM is in a much better jurisdiction than South Africa, Nicaragua, or Guatemala, even if it is in Africa, where we can often see lower multiples assigned. Based on what I believe to be a conservative multiple of 3.50x cash flow and FY2023 estimates of $0.16, this points to a fair value of US$0.79 when adding in $0.23 in cash per share. From a current share price of US$0.57, this translates to a 40% upside from current levels.

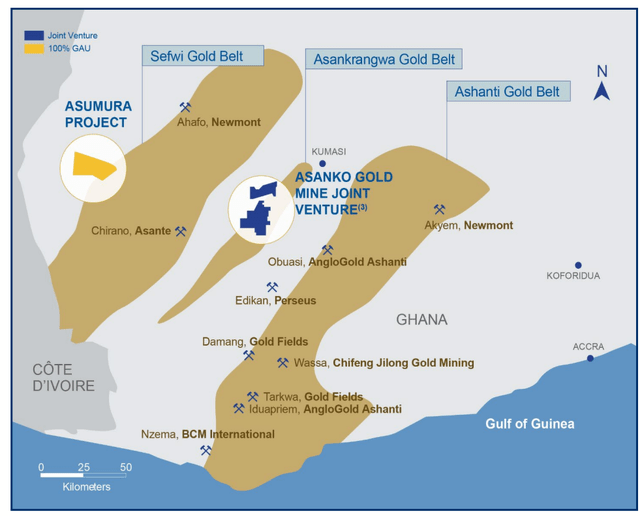

Galiano Gold Assets (Company Presentation)

While the valuation is undoubtedly attractive at less than 2.5x forward cash flow (which assigns zero value to its Asumura Project that lies south of Ahafo), Galiano has now rallied sharply off its lows and is getting closer to the upper portion of its expected trading range. This is based on the next support level coming in at US$0.42 and strong resistance overhead at US$0.63. Measuring from a current share price of US$0.57 translates to $0.06 in potential upside to resistance and $0.15 in potential downside to support or a reward/risk ratio of 0.40 to 1.0. Generally, when buying micro-cap stocks, I prefer a minimum reward/risk ratio of 6.0 to 1.0 or pass entirely, which would require a dip below US$0.44. So, while Galiano is cheap, I don’t see a low-risk buy point with the technicals not lining up for a low-risk trade here.

Summary

Galiano Gold had another solid quarter, and things look to be improving for this turnaround story after a tough year (H1 2021 – H1 2022). That said, Q4 will be the weakest quarter of the year, with fewer ounces sold and lots of catch-up on sustaining capital (only 54% of sustaining capital spent year-to-date), and it’s possible this could lead to some underperformance as other producers set up for very strong finishes to the year. From a bigger-picture standpoint, the updated Feasibility Study will be a major catalyst, and with lots of drilling planned and incredible intercepts continuing to come out of Nkran/Nkran Deeps, there’s lots of news to look forward to next year.

Given this improving setup for Galiano with reserve deletion risk off the table (potential metallurgical issues averted) and better management of investor expectations under its new CEO, I see GAU as a Speculative Buy at US$0.43. When it comes to putting new money to work in small-cap names currently, my favorite idea is i-80 Gold (IAUX) which trades at a massive discount to net asset value with over 200% upside if it executes successfully. Plus, it continues to report some of the best drill results sector-wide from a top-3 mining jurisdiction which doesn’t appear reflected in its current share price.

Be the first to comment