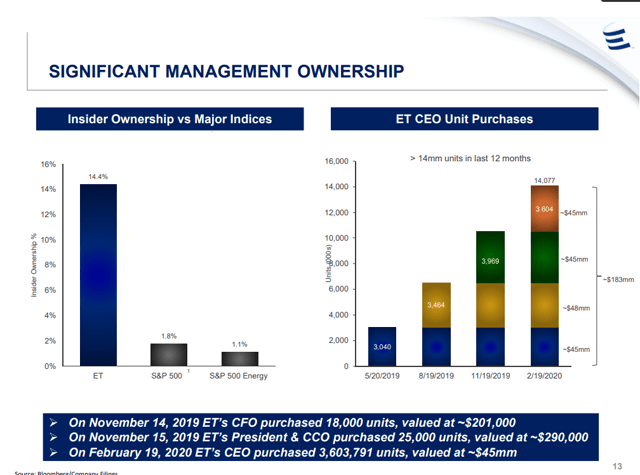

I have been bullish on Energy Transfer (ET) for some time now. I particularly like the midstream space, as ET is basically a toll both collecting fees as natural resources travel from point A to point B. Overall ET’s unit price has been an atrocity, as it has declined 55.58% from $15.87 to a close of $7.05 over the past year. Taking a long-term view, the human population will continue to grow and the global demand for energy will follow keeping the bull case for ET alive. I am looking at ET for the long haul, and I can withstand low prices over the short term while I reinvest the dividends. Over the past month, five insiders, including the CEO, CFO, COO, President/CCO and a Director, have all bought units ranging from $12.53 to $7.40. I am following the senior leadership team of ET and buying more units while others sell. I am bullish on ET, as my long-term outlook on energy hasn’t changed. ET’s forward yield on its distribution now exceeds 17%, and insiders have made nine purchases over the past month indicating they believe units are undervalued. I believe now is the time to purchase ET, as others are fearful.

(Source: ET February 2020 Investor Presentation)

I am following senior management’s bullish mentality on ET and adding to my position

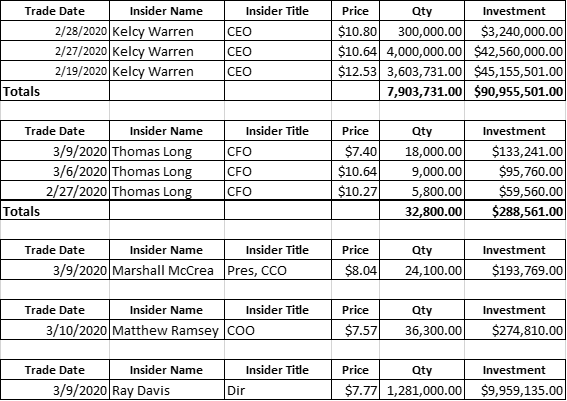

I look favorably on a management team that is willing to put their personal money on the line and bet on themselves. While this doesn’t always work out for the best, I take it as a bullish sign. Kelcy Warren, CEO, has made three purchases over the past month at prices of $12.53, $10.64 and $10.80. Thomas Long also made three purchases at $10.27, $19.64, and $7.40. Marshall McCrea, Matthew Ramsey and Ray Davis all made one purchase each between the prices of $7.57 and $8.04. When you have the C-suite executives and one of the Directors purchasing units, it’s hard not to take this as a bullish sign. These were all coded as P on the trade type, so these were all, in fact, purchases and not grants.

(Source: Steven Fiorillo; Data Source: Open Insider)

Over the last month, these five insiders have purchased 9,277,931 units valued at just over $101 million. I could be wrong as I was with Occidental Petroleum (OXY), but I really don’t see ET slashing its dividend with this type of recent investment from senior leadership, especially with a distribution coverage ratio of 1.96x. To me, this says that senior leadership feels ET is undervalued and the price per unit is too cheap to ignore. Kelcy Warren, Thomas Long and Ray Davis were also buying units in 2018 and 2019 from $15.80 through recent levels. If they were bullish in the $15’s and are still bullish in the $7’s, I am more than happy to take the ride with them. I am planning not to touch this investment for 30 years, so I am expecting peaks and valleys along the way. I will continue to add to my position in ET as long as I see value, and at around $7, I see tremendous long-term value.

(Source: ET February 2020 Investor Presentation)

ET’s distribution yield is now over 17%, and the compounding effect is staggering

In Q4 2019, ET increased its net income attributable to partners by $395 million to $1.01 billion and its distributable cash flow by $30 million to $1.55 billion year over year. For the full fiscal year 2019, the company’s distributable cash flow attributable to the partners of ET was $6.8 billion, which was an increase of 17% year over year. The 2019 distribution coverage ratio was 1.96x, which leaves a lot of room to protect the distribution to unitholders of ET.

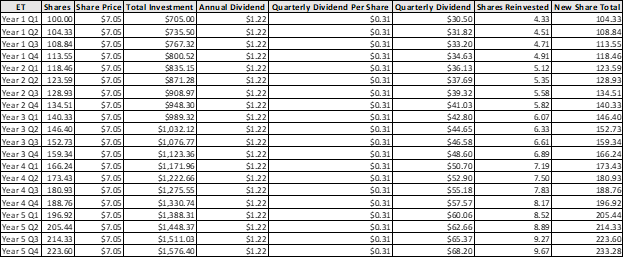

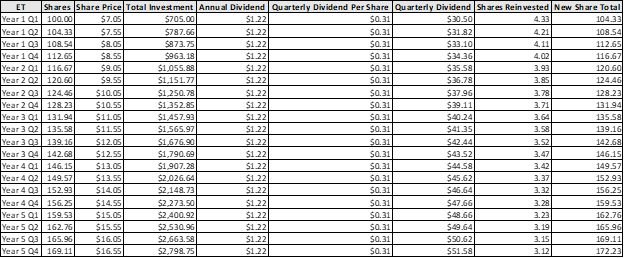

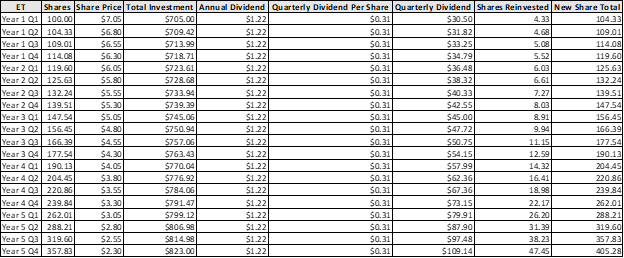

At its current levels, the company is distributing a massive amount of cash for the current unit price of $7.05. I am going to illustrate three scenarios over a five-year period. In all three scenarios, the distribution stays unchanged from today’s current levels, while in scenario A the unit price will remain the same, in scenario B the unit price will increase by $0.50 per quarter and in scenario C the unit price will decrease by $0.25 per quarter. All scenarios will use 100 units as the basis, to keep the numbers simple. All quarterly distributions will be reinvested.

In scenario A, 100 units are purchased at $7.05. The unit price never changes, and all distributions are reinvested. Over the course of five years, your initial 100 units at an investment of $705 would grow to 233.28 units worth $1,576.40. Your units would increase by 133.28%, and your quarterly distribution would increase by 123.60% from $30.50 to $68.20. Your overall investment would increase by 124.49%, as your $705 would generate a profit of $871.40. That’s not bad at all for an investment where the unit price just stays flat. With a 17%+ distribution, your compounding really kicks into high gear quickly as you keep adding more units every quarter.

(Source: Steven Fiorillo; Data Source: Seeking Alpha)

In Scenario B, I have ET’s units increasing by $0.50 per quarter, making the unit price $16.55 at the end of five years. Your initial units would increase by 72.23 to 172.23, or 72.23%, and your quarterly distribution would grow by $21.08, or 69.11%. Over the course of five years your initial investment would be worth $2,798.75 which is a profit of $2,093.75, or 296.70%.

(Source: Steven Fiorillo; Data Source: Seeking Alpha)

In scenario C, I have ET losing $0.25 per quarter and the unit price decreasing by $4.75, or 67.38%, to $2.30. In this scenario, your units increase by 305.28% to 405.28, which throws off an additional quarterly distribution of $78.64 as it increases from $30.50 to $109.14. Your overall investment is worth $823, which is a profit of 16.74%, or $118, over the five years, making it still profitable.

(Source: Steven Fiorillo; Data Source: Seeking Alpha)

These three scenarios are hypothetical and are contingent on the distribution staying at $1.22 per unit over the five-year period. In all three scenarios where units stay the same, increase by 134.75% or decrease by 67.38%, the overall investment is still positive. I am looking at ET for the long haul, and even though in the short term my investment may be in the red, I am confident in the distributions putting me in the green and spitting off more income quarter after quarter.

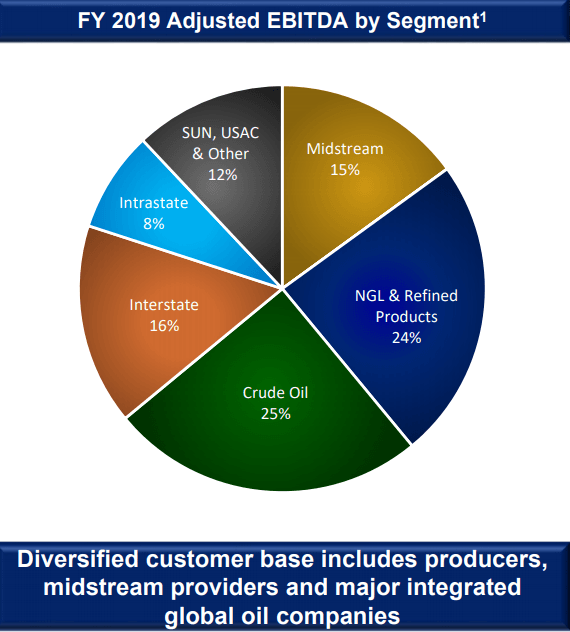

ET’s metrics are still intriguing, and its business is very impressive

The fiscal year of 2019 was very strong for ET, as its adjusted EBITDA increased by 18% to $11.2 billion year over year. To me, the metric that stands out is that revenue was basically flat, as it grew by less than 1%, or $126 million. This is important because it shows how much more efficient the company became. With only an additional $126 million in revenue, ET was able to generate 18% additional EBITDA, grow its net income to almost $5 billion, increase distributable cash flow to the partners of ET by 17% and increase total equity in the company by 9.71%. ET simply became much more efficient and captured significant synergies across its business operations, as its total operating costs decreased by $1.8 billion, or 3.7%.

I believe ET has been building an integrated system which, in my opinion, is the most promising of all the midstream operators. The company has more than 63,700 miles of pipeline for natural gas, with 150 Bcf of working storage and more than 60 natural gas processing and treating facilities. ET has over 9,500 miles of crude pipelines, with roughly 35 million barrels of storage capacity within its terminals. It also provides transportation and storage for refined products by way of 2,200 miles of refined products pipelines and 35 active refined products marketing terminals, with 8 million barrels of storage capacity. With the acquisition of SemGroup, ET now has four major export facilities situated on the east and Gulf Coast of the US, which provides logistical advantages to its end destinations.

ET has its hands in every aspect of transporting fuels and is a tollbooth for the fuels passing through its system, as most of its business is fee-based. With crude, the company makes money from the fees from transporting and terminalling. With NGL and refined products, fees are generated through dedicated capacity, take or pay contracts, storage fees, throughput fees and fractionation fees. On the Interstate transport and storage, fees are generated on reserved capacity regardless of whether the capacity is used, which offers ET a guarantee. In the midstream segment, the company has a minimum volume commitment, utilization-based fees and gets a percentage of the proceeds. ET has built its system where it now has the largest intrastate pipeline system within the U.S. with interconnects through Texas. Its system of pipelines is connected to all major U.S supply basins and demand markets, which includes export terminals.

(Source: ET February 2020 Investor Presentation)

Conclusion

I have been wrong and I have been correct in my stock picks. I believe in the research I have conducted and my thesis on the long-term energy picture. The facts are that by 2057 there will be over 10 billion people on this planet, which is an increase of roughly 29%. There are three things we will need which can’t be refuted, and those are food, water and energy. I believe that the global energy mix will see a reduction in coal, with renewables and natural gas filling the void. I believe fossil fuels will be here for decades to come. If this premise is true, companies such as ET will be critical to making sure fossil fuels are transported to their destination. The barriers of entry for this industry are so vast, from the cost of infrastructure to the permitting and approval process, that I don’t see new competition being a treat to ET. I believe that COVID-19 has provided an opportunity for the long term in the energy sector, even though the short term is quite painful. This is a headwind that will pass eventually, and I plan on continuing to add to my position when I see value and reinvesting the distributions each and every quarter. I am long ET and see tremendous upside from this correction. We may go down further in the days and weeks to come, but I wouldn’t be surprised if shares are trading between $15 and $20 sometime in 2021.

Disclosure: I am/we are long ET. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fits into their portfolio parameters.

Be the first to comment