Urupong/iStock via Getty Images

Anwiti Bahuguna, Ph.D., Senior Portfolio Manager, Head of Multi-Asset Strategy

The U.S. economy will continue to grow in 2022, but COVID, inflation, and the labor market may compete for headlines.

The U.S. economy is expected to grow above trend in 2022, but it may not always feel that way. Find out why — and what we think you shouldn’t lose sight of.

We are not recovering from a typical recession.

The intentional shutdown of the economy and the massive, global synchronous fiscal and monetary support have created distortions across the economy — from shifts in consumption patterns to the labor force. This has put policymakers and central bankers in uncharted waters; it’s unusual to have higher-than-expected inflation alongside a labor market that’s still recovering.

Inflation data will get worse before it gets better.

Inflation is proving to be both more persistent and higher than the Fed (and the markets) initially anticipated. Rising costs are impacting a wider set of goods and services, and the supply distortions driving this are not likely to end quickly. While the Fed wants to see some level of inflation, timing the use of its tools to control higher prices requires new surgical precision. If the various forces keeping inflation high ease next year, then the Fed can implement rate hikes in a measured fashion. This is the Goldilocks scenario. The differing expectations on when rate hikes may occur set the stage for higher volatility in the markets — so flexibility in portfolios will be critical. It’s also important to remember that lower inflation (when it happens) will not mean lower prices for many goods (although used car prices may fall). The price gains that we’ve seen for many products will continue to be a reality and may create an even greater need for retirement income.

Pay attention to the labor market if you want to understand the Fed’s plan for interest rates.

The central bank famously has a dual mandate: stable prices and maximum employment. While the Fed’s inflation target for a rate hike has already been met, the usually reliable labor market dynamics are much harder to discern. Sector-specific labor shortages are creating distortions in wage gains. Meanwhile, the Fed’s new maximum employment mandate isn’t well understood. We know that the central bank is looking beyond the headline unemployment rate at measures such as labor force participation, but it’s unclear how maximum employment is measured. Given that the Fed has stated that both its inflation and employment goals must be met for it to hike rates, it will be important to listen to the language on labor (rather than a magic data point);if we see continued inflationary pressure and improvement in the labor market, we may see a much swifter pace of action — even if the central bank expects inflation to eventually moderate.

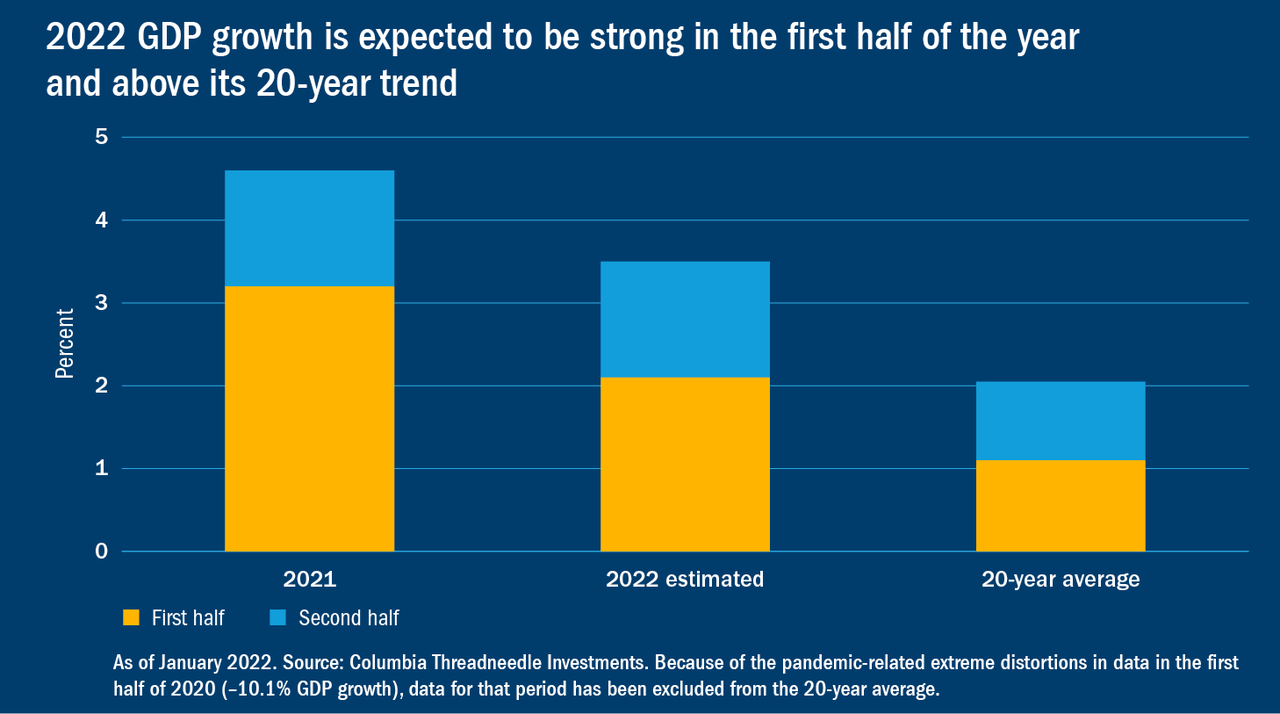

A decelerating growth environment is still a growth environment.

Amid the concern around inflation, lower fiscal spending, the supply chain, and higher energy prices, it can be easy to lose sight of the fact that the U.S. will continue to grow in 2022, and that growth will likely be above the long-term trend. The U.S. is still a consumer-led economy, and we expect consumer demand to stay strong as we enter the new year. The strong labor market and healthy consumer balance sheets will be helpful, so keep an eye on these measures. Historically, above trend growth has been a good environment for risk assets like equities.

In 2021, we knew the Fed would stay accommodative. We don’t have that certainty in 2022.

For the markets, the flood of supportive programs introduced during the pandemic had the beneficial effect of lifting nearly all assets. As that support is withdrawn, there will be clear winners and losers. The shift from risk-on to risk-off can happen dramatically, and investors will need to stay nimble in their portfolios. This makes the case for employing active managers and possibly a model portfolio that can make quick tactical shifts accordingly.

Disclosures

© 2016-2022 Columbia Management Investment Advisers, LLC. All rights reserved.

Use of products, materials and services available through Columbia Threadneedle Investments may be subject to approval by your home office.

With respect to mutual funds, ETFs and Tri-Continental Corporation, investors should consider the investment objectives, risks, charges and expenses of a fund carefully before investing. To learn more about this and other important information about each fund, download a free prospectus. The prospectus should be read carefully before investing. Investors should consider the investment objectives, risks, charges, and expenses of Columbia Seligman Premium Technology Growth Fund carefully before investing. To obtain the Fund’s most recent periodic reports and other regulatory filings, contact your financial advisor or download reports here. These reports and other filings can also be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be appropriate for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate.

Columbia Funds and Columbia Acorn Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA. Columbia Funds are managed by Columbia Management Investment Advisers, LLC and Columbia Acorn Funds are managed by Columbia Wanger Asset Management, LLC, a subsidiary of Columbia Management Investment Advisers, LLC. ETFs are distributed by ALPS Distributors, Inc., member FINRA, an unaffiliated entity.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

NOT FDIC INSURED · No Bank Guarantee · May Lose Value

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment