Russian Labo/iStock via Getty Images

Nothing that is worth knowing can be taught”― Oscar Wilde

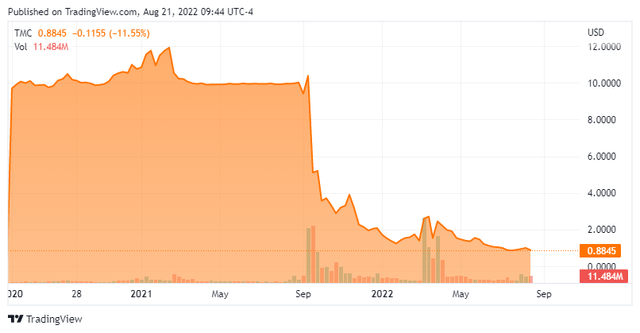

Today, we take our first look at a small and unique mining concern with an unusual name. The company came public via the SPAC craze of 2020 and 2021. Like most of that “vintage,” the stock has done little but destroy shareholder value since debuted on the public markets. However, the shares are seeing insider buying and the company is potentially position to ride the huge growth in the electric vehicle (“EV”) space. An analysis follows below.

Company Overview:

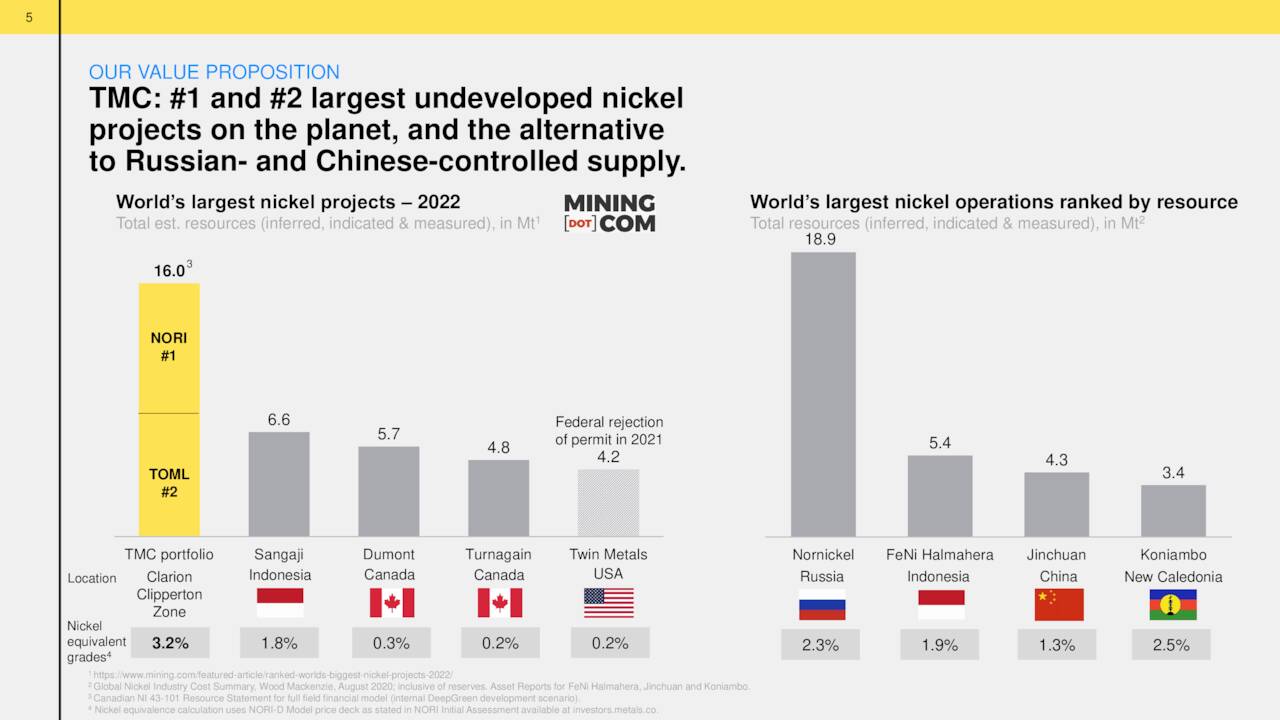

TMC the metals company Inc. (NASDAQ:TMC) is headquartered in Vancouver, Canada. The company plans to primarily explore for nickel, cobalt, copper, and manganese products via the collection, processing, and refining of polymetallic nodules found on the seafloor in the Clarion Clipperton Zone [CCZ] in the southwest of San Diego. The stock sells for just under a buck a share and sports an approximate $200 million market cap.

May Company Presentation

Given the explosion in electric vehicle production, the company has some long term tailwinds given how much of its potential future production such as nickel is used in the electric vehicle manufacturing process.

May Company Presentation

The company was formerly known as Sustainable Opportunities Acquisition Corp. (“SOAC“), which came public last summer via a SPAC merger with DeepGreen Metals Inc. Deep Green Metals was a Canada-based mining group founded in 2011.

It is important to note the company is really more of an advanced concept right now than an operating mining concern. The firm intends to extract materials the deep seabed floor starting in 2024 in the CCZ where it has secured rights. Management believes it has rights to globe’s largest undeveloped Nickel project. It also thinks it can be a low cost producer as plans to harvest these Polymetallic nodules (AKA, manganese nodules) from the sea floor. These nodules hold the four primary battery metals which are cobalt, nickel, copper, and manganese. These are contained within a single ore which doesn’t have heavy metals, easing the process of extraction considerably. Both the equipment and process for this sort of complex extraction is in the testing phases, and the true ecological impact of such deep-sea extractions remains unknown.

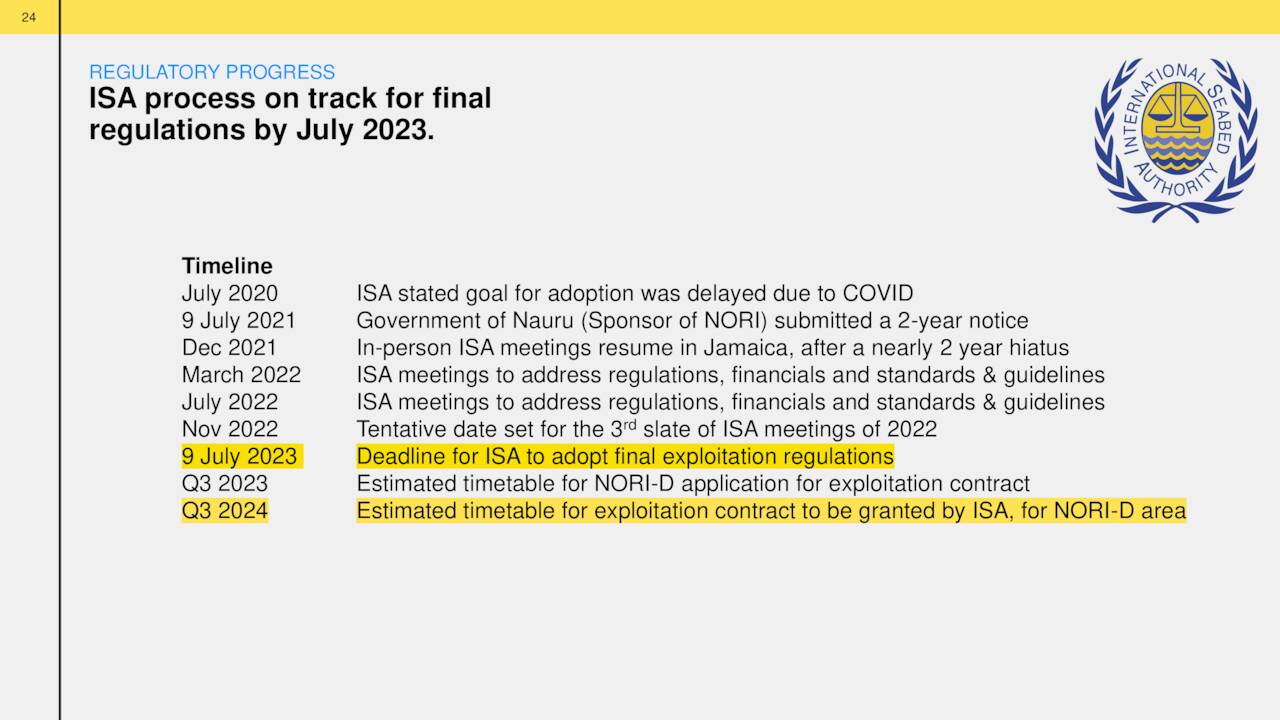

One of the many obstacles the company will have to overcome to start extracting minerals from the sea floor is waiting for final regulations from International Seabed Authority, or ISA. They are due out in 2023. Then there will likely be resistance/potential lawsuits from the usual environmental groups. However, that is likely to balanced by the increasing national security ramifications from Russia’s invasion of Ukraine this year. This resulted in myriad sanctions against Russia, which is the largest producer of nickel and a large producer of many other minerals. A recent article on Seeking Alpha captured nicely these competing influences.

May Company Presentation

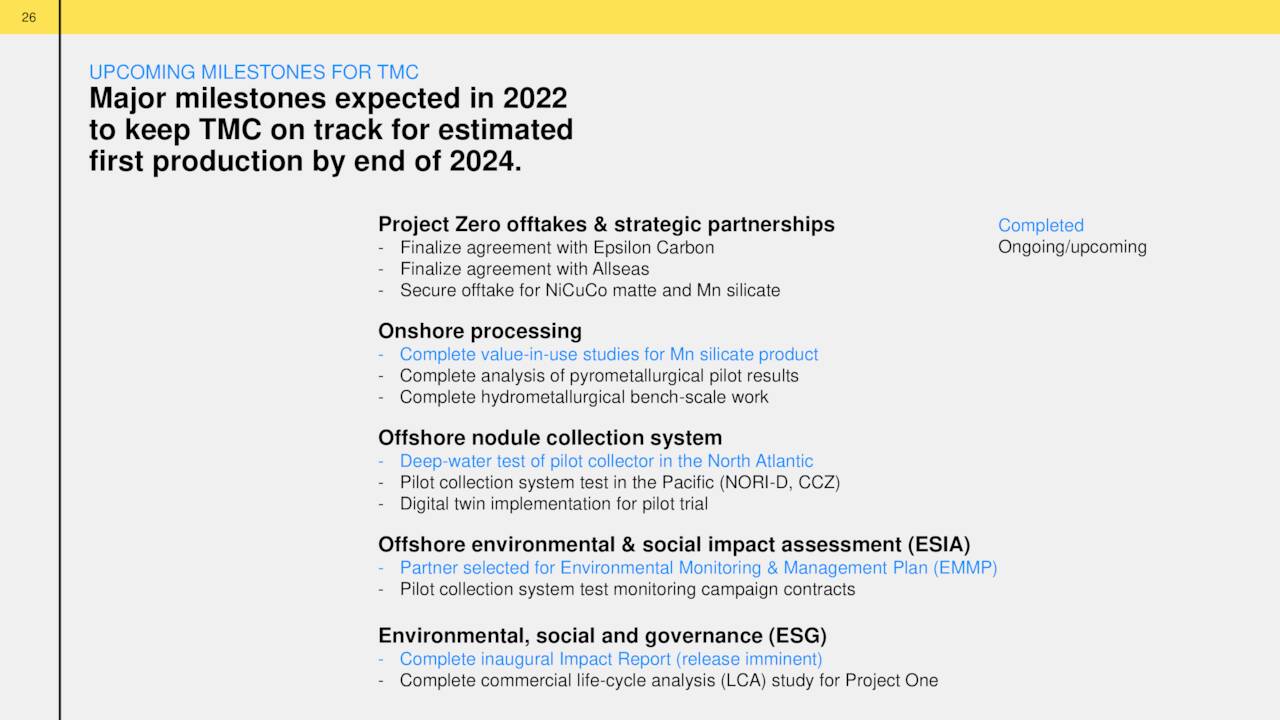

The company has many partners is this huge endeavor including Allseas, Glencore, Epsilon Carbon and Maersk. As can be seen below, there are numerous major tasks to check off before production can begin, hopefully in 2024.

May Company Presentation

Analyst Commentary & Balance Sheet:

Only two analyst firms, Wedbush ($3 price target) and Piper Sandler ($2.50 price target) have offered up ratings on TMC the metals company Inc. so far in 2022. Both have Hold ratings on the stock. Insiders seem more sanguine on the company’s prospects. The CEO purchased some $100,000 of new shares on August 12th. The same day a beneficial owner added $5 million to their holdings in TMC, which was part of PIPE to raise additional capital. This follows similar moves by both entities in March of this year. There has been no insider selling in the shares since the company debuted on the market. Less than three percent of the outstanding shares are currently held short.

The company had just over $45 million of cash and marketable securities at the end of the second quarter after posting a net loss of $12.4 million during the quarter. Management then executed a secondary offering (38 million shares at 80 cents per) to bolster cash reserves. Approximately 70% of that capital raise was bought by existing shareholders.

Verdict:

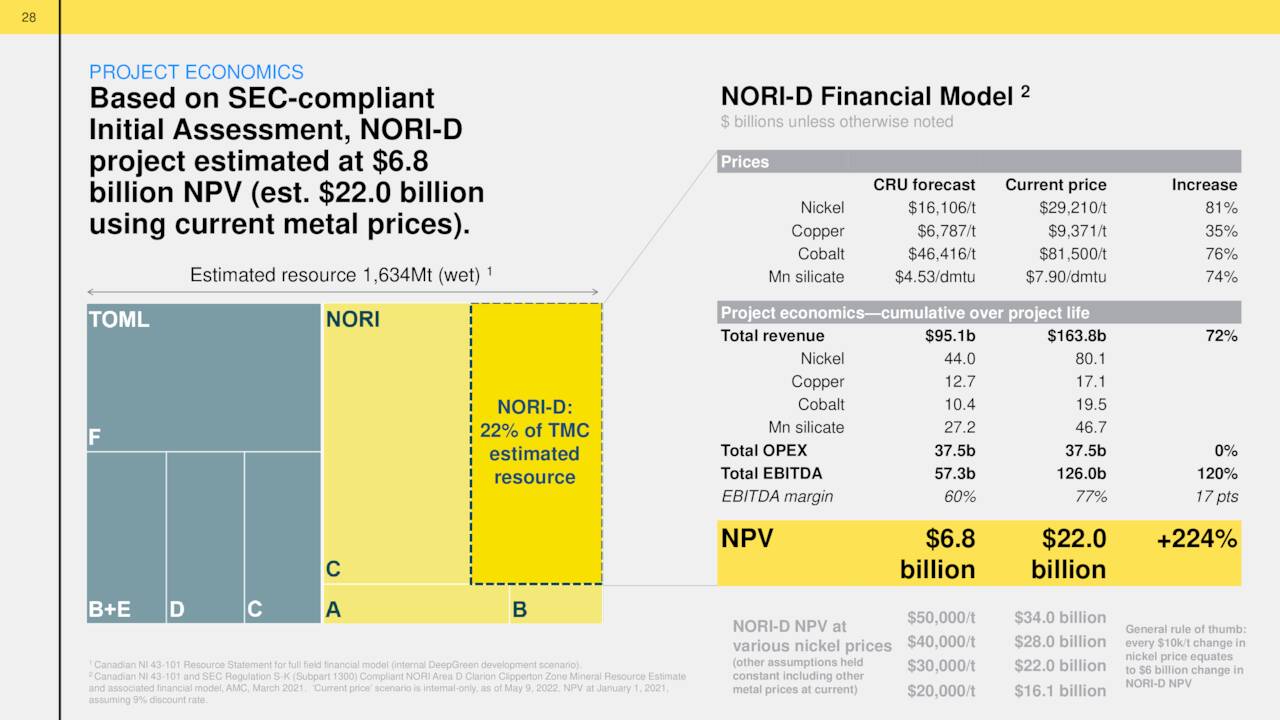

TMC the metals company Inc. is one of the more complex stories I have ever tried to analyze. I literally could spend a day detailing the risks and rewards of this endeavor. The company’s first project could have a NPV north of $20 billion, according to management.

May Company Presentation

Given the company’s small market cap, any kind of potential and economical extraction success is likely going to make TMC a “multi-bagger” for investors. The problem as far as valuation is the myriad unknowns to get to that scenario. Therefore, the stock should be viewed only as a lottery ticket”‘ suitable for only aggressive investors comfortable with this sort of huge risk/reward profile.

The only real mistake is the one from which we learn nothing.”― Henry Ford

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment