FatCamera

Experts were once amateurs who kept practicing.”― Amit Kalantri

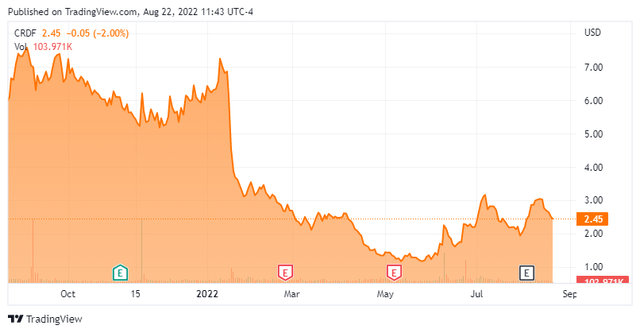

Today, we revisit Cardiff Oncology, Inc. (NASDAQ:CRDF) for the first time since October of last year. The shares have proved to be disappointing since that article hit the wires.

Company Overview:

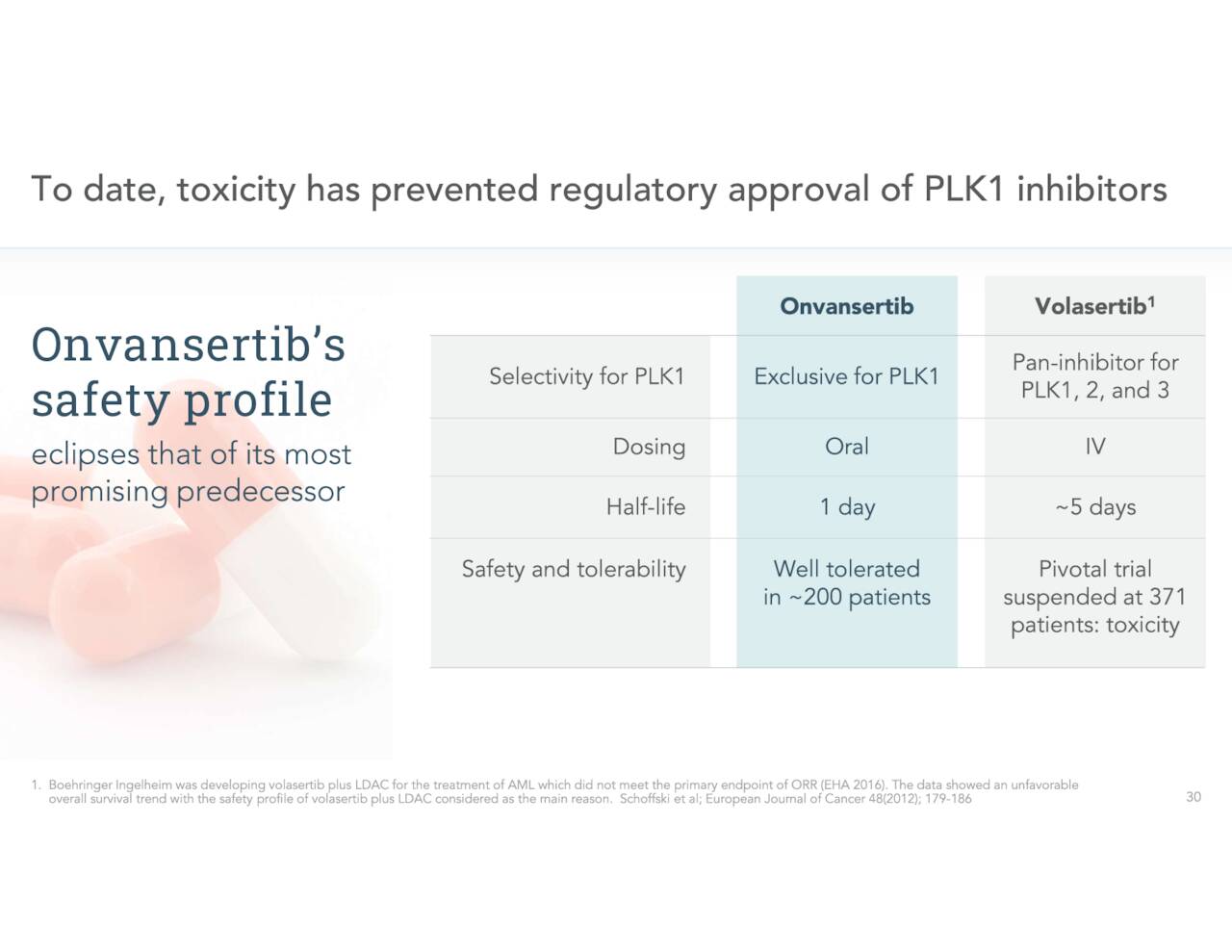

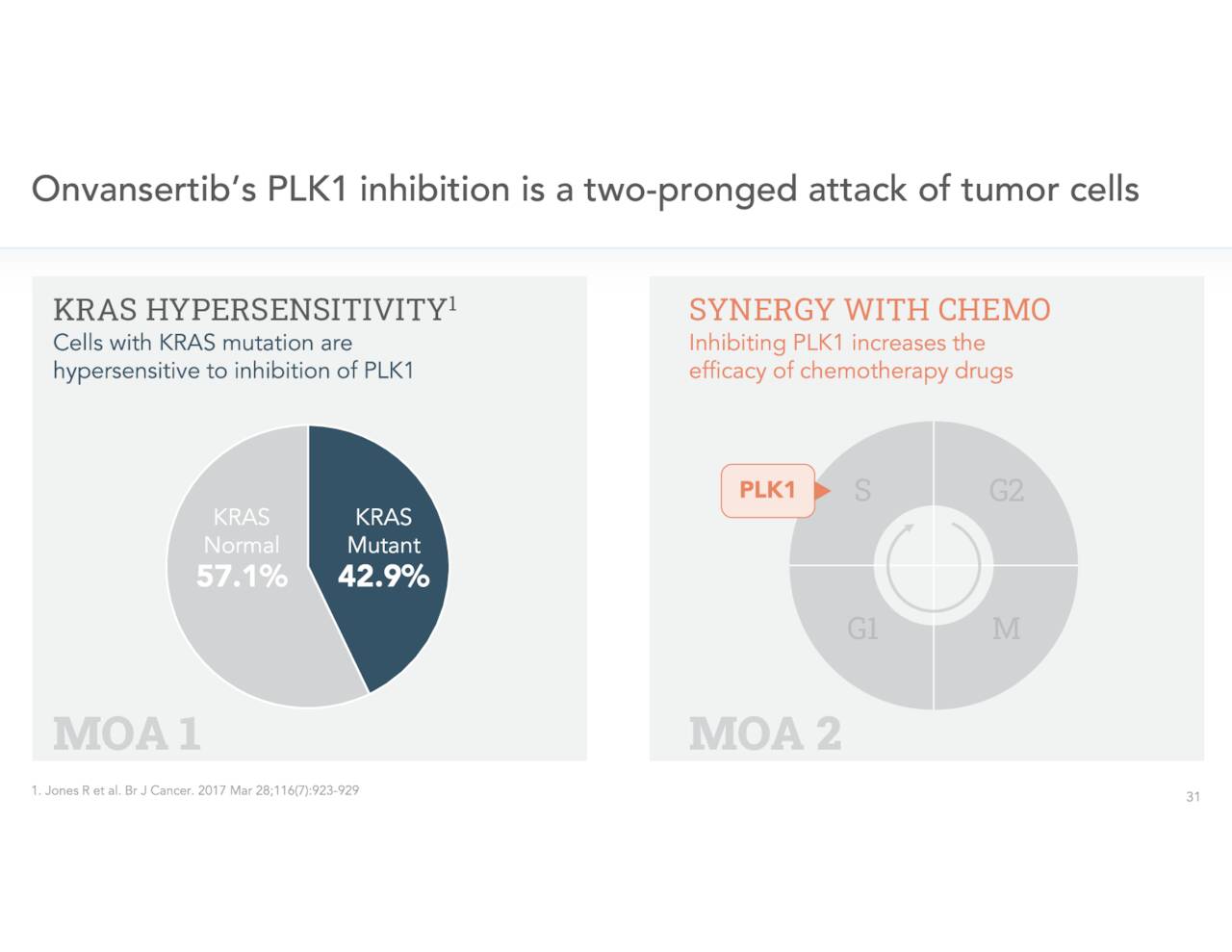

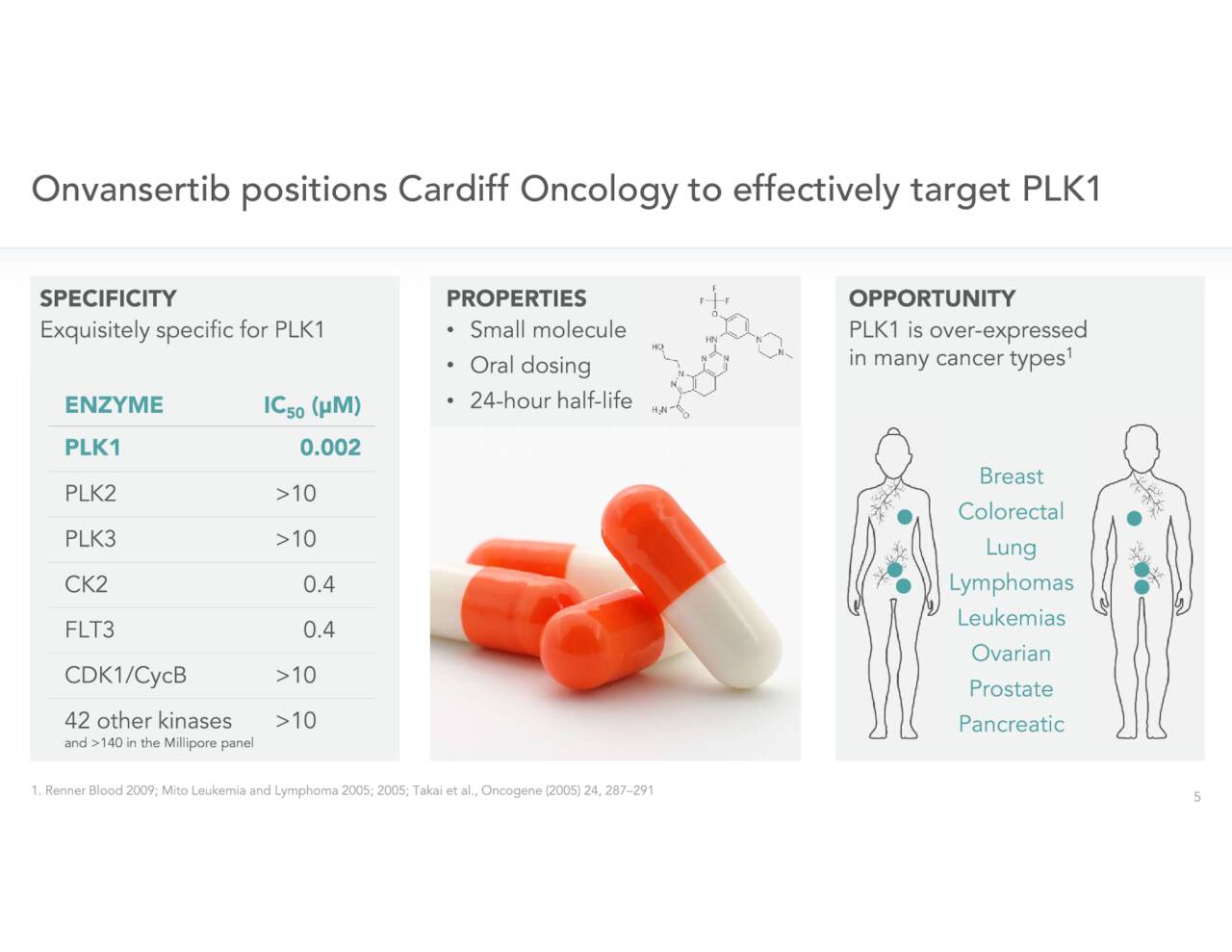

Cardiff Oncology is a small oncology firm based in San Diego. The one key asset in this company’s pipeline is a drug candidate called Onvansertib. This compound is an oral and highly selective inhibitor of Polo-like Kinase 1 or PLK1. This drug candidate was licensed to Cardiff by Nerviano approximately five and half years ago. Cardiff is the first to correctly target PLK1, a target in several solid tumors, in all KRAS-mutated cancers. PLK1 is substantially overexpressed a variety of different cancers including colorectal and breast cancer. Leadership is focused on using Onvansertib in combination with standard of care ((SoC)) therapies targeting cancers with KRAS-mutations, thus improving current treatments.

May Company Presentation

The stock currently trades right around $2.50 a share and sports an approximate market capitalization of $110 million.

May Company Overview

May Company Presentation

Recent Developments:

May Company Presentation

Five weeks after our last piece on Cardiff ran, the company snagged a $15 million equity investment (2.4 million shares at $6.22 per) from drug giant Pfizer Inc. (PFE). This was a part of Pfizer’s Breakthrough Growth Initiative, a program focused on funding innovative science to meet patient needs.

May Company Presentation

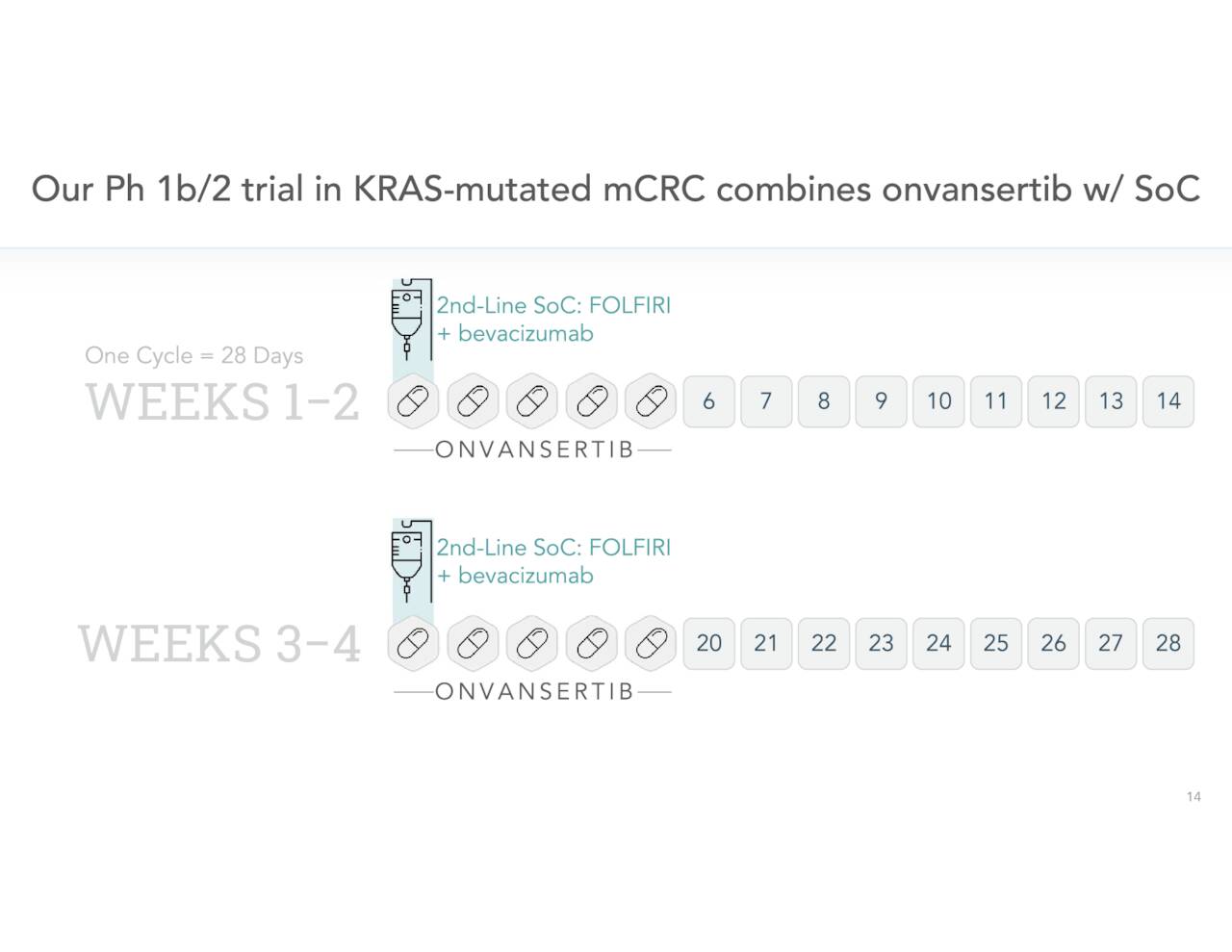

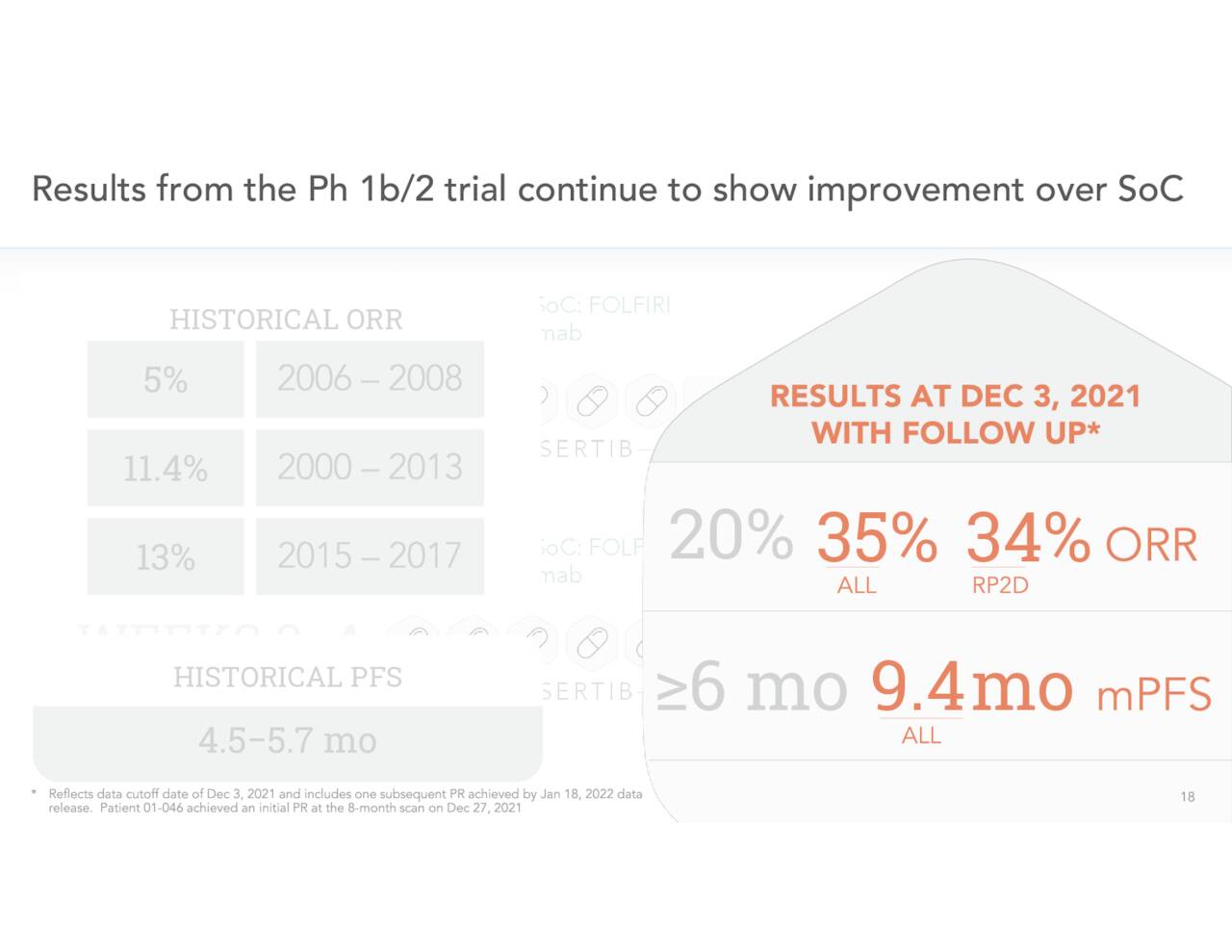

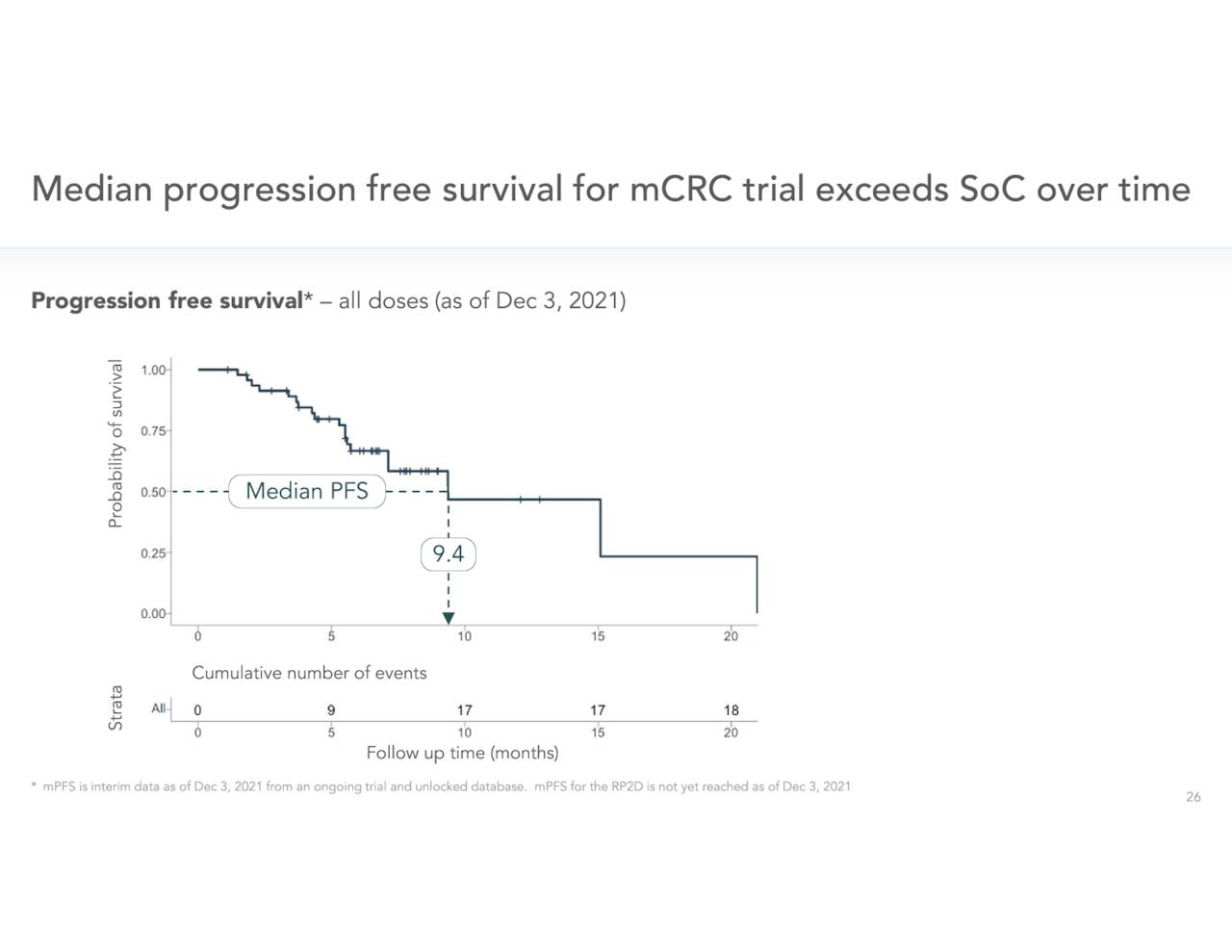

In January of this year, the company provided updated data from a Phase 1b/2 trial evaluating Onvansertib as part of a combination therapy for a second-line option for patients with KRAS-mutated metastatic colorectal cancer ((mCRC)). 17 of the 48 (35%) patients across all dose levels achieved a complete response or CR or partial response (PR). However, 5 of the 48 (10%) patients in the trial had discontinued the trial to seek metastasis-directed treatments such as surgical resection or microwave ablation and Median progression-free survival of mPFS of 9.4 months was less than was hoped for, even if it was above the current standard of care [SoC] which is around five months. This data appears to be the primary trigger for the decline in the stock since we last looked in on Cardiff.

May Company Presentation May Company Presentation

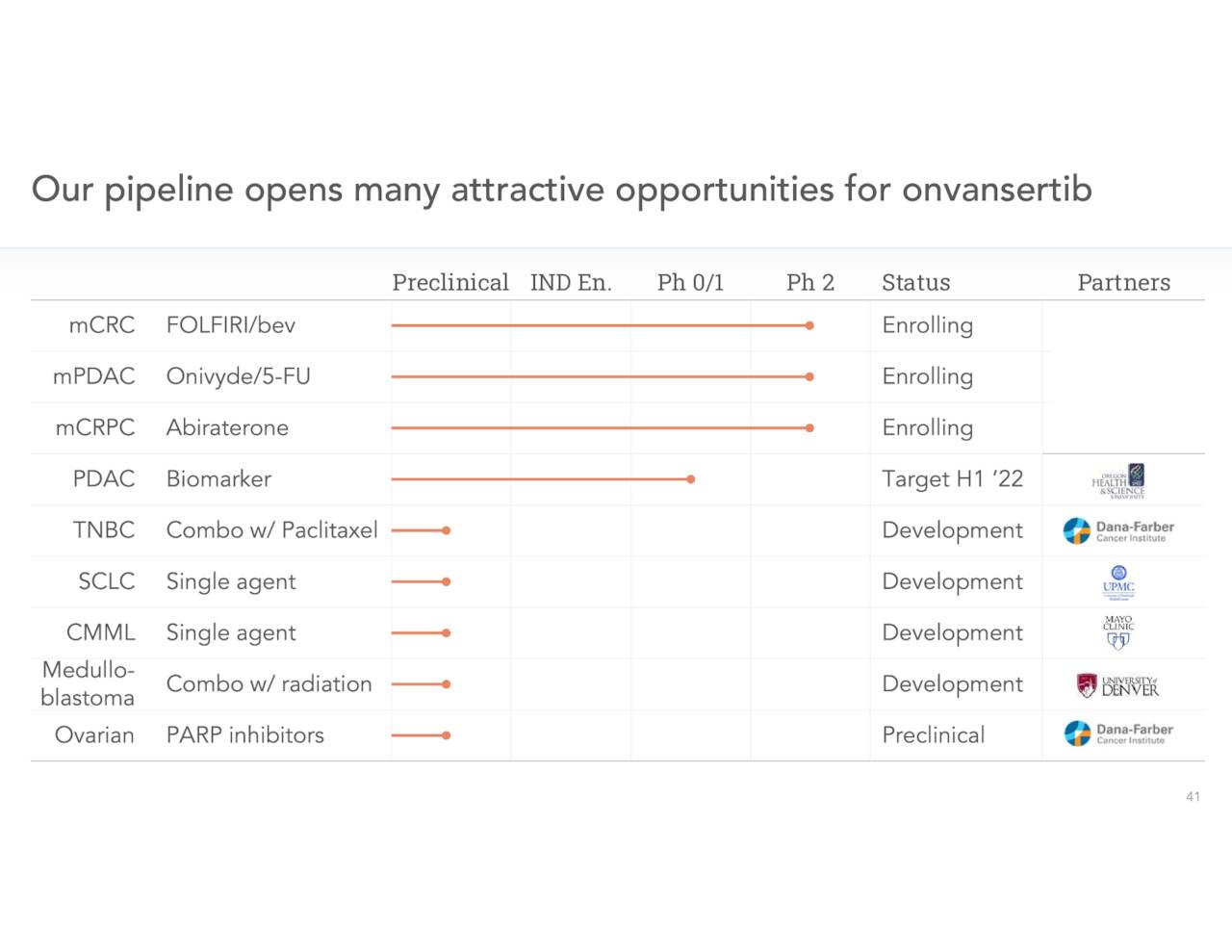

The company has three mid-stage studies currently underway targeting different indications with different combination partners for Onvansertib. A June article on Seeking Alpha stated that there is a “total addressable market of +$11.5 billion just for the three indications in Phase 2 trials only for the US and Europe.”

May Company Presentation

The company has several more potential trial milestones on the near term horizon.

May Company Presentation

Analyst Commentary & Balance Sheet:

There has been no insider activity in this stock since March of 2021. Approximately five percent of the outstanding shares are currently held short. The stock gets somewhat sparse coverage on Wall Street. William Blair initiated the shares as an Outperform in January to start 2022. On May 10th, Robert W. Baird maintained their Buy ratings on the shares but lowered its price target to $9 from $13 previously. Late that month, Piper Sandler slashed its price target to $7 from $22 previously, but maintained its Overweight rating on the stock. Finally, on August 8th, H.C. Wainwright reissued its Buy rating and Street high $22 price target on CRDF, down from $25.

After using $6.7 million worth of cash in the second quarter for operating activities, the company ended the first half of 2022 with just over $120 million in cash and marketable securities on its balance sheet. Cardiff has no long term debt.

Verdict:

Cardiff has a solid balance sheet given its quarterly burn rate and has multiple “shots on goal” at some large addressable markets. The company is years away from potential commercialization, however. The deal with Pfizer should be construed as a positive, and given how acquisitive the drug giant has been over the past 18 months, a strategic “bolt on” purchase of Cardiff at some point can’t be entirely ruled out.

The stock continues to have a favorable risk/reward profile even if it is in a high beta sector of the market. I have averaged down a bit in CRDF this year via covered call orders as shares have fallen sharply over the past few quarters. The equity still merits “watch item” status as the company continues to advance its primary drug candidate.

Some lessons have to be experienced before they can be understood.”― Michael Batnick

Be the first to comment