400tmax/iStock Unreleased via Getty Images

Introduction

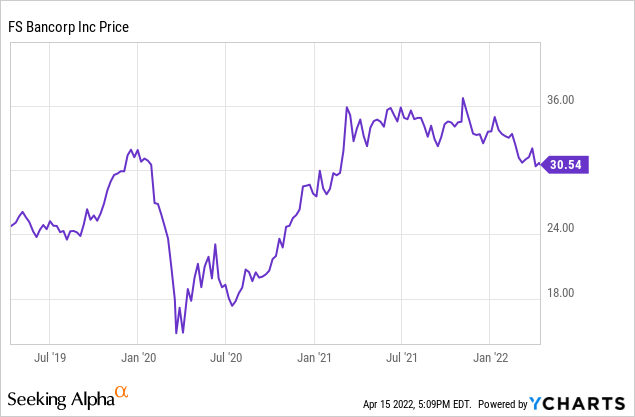

In my quest to find some good regional or local banks to invest in, I came across FS Bancorp (NASDAQ:FSBW), the holding company for the 1st Security Bank of Washington which has been serving the Puget Sound communities for in excess of 100 years. The bank started out as a credit union but “upgraded” itself to a state-chartered mutual savings bank in 2004 and subsequently became a stock savings bank in 2012. The bank is currently operating 21 branches in the area, and with a balance sheet total of in excess of $2.2B, it’s a sizable operator in the region.

An expanding balance sheet results in a stronger financial performance

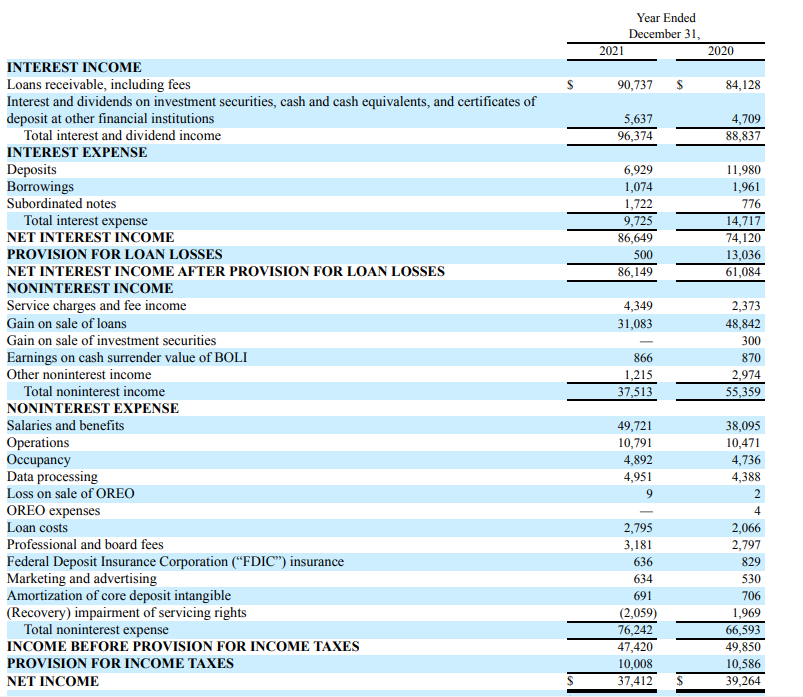

Thanks to the increased size of the balance sheet, FS Bancorp saw its interest and dividend income increase by approximately 10% to $96.4M. And despite accepting more deposits as a source of funding, the total interest expenses actually decreased from $14.7M to $9.7M. And the combination of a lower interest expense while the interest income increased obviously resulted in a very impressive increase of the net interest income which increased from $74.1M to $86.6M.

FSBW Investor Relations

FS Bancorp also is making money on the sale of loans it originates. That helped the bank to get through the pandemic year 2020 as it was able to record almost $50M in gains on the sale of those loans and the only reason why the EPS decreased in 2021 was because the bank recorded a lower income on the sale of those loans.

The pre-tax and pre-loan loss provision income in FY 2021 was approximately $48M (compared to almost $63M in FY 2020), but as you can see on the image above, the difference can entirely be explained by the much higher recorded gains on the sale of loans in 2020.

It’s also interesting to see how the amount of loan loss provisions decreased to just $0.5M in FY 2021 as the provisions recorded in 2020 seems to have been sufficient. The EPS in FY 2021 was approximately $4.42 but that’s based on the average share count of almost 8.5M shares. As the bank ended the year with less than 8.2M shares outstanding, the EPS will likely be boosted in 2022, keeping all other elements unchanged.

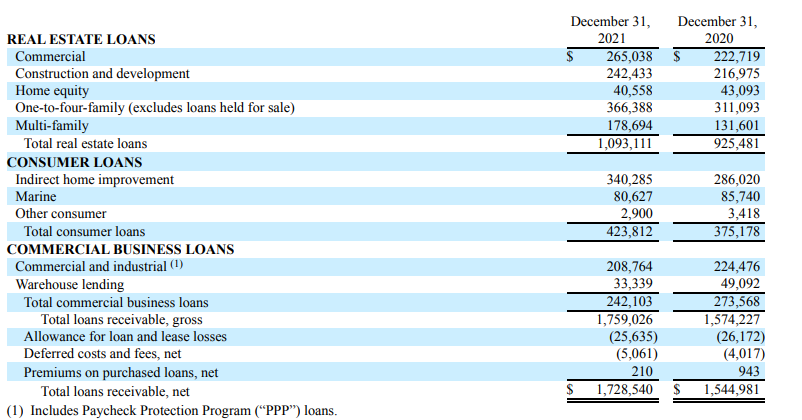

A substantial portion of the loan book consists of ‘home improvement loans

As you notice, a substantial portion of the profit is determined by FS Bancorp’s ability to sell the loans it originates. That makes it more difficult to “guesstimate” the financial performance of the bank as it’s not entirely clear how much money the bank would also be able to save on staff expenses and other overhead expenses if it would forego pursuing the sale of loans it originates. And just to give you an idea, the bank sold about $1.44B of loans in FY 2021 and originated $1.35B in new loans. Meanwhile, in 2020, about $1.67B of loans were sold while the bank originated bout $1.73B in new loans. It’s very difficult to try to calculate the contribution from the sale of loans as there’s no firm timing with regards how long an originate loan remains on the FS Bancorp books.

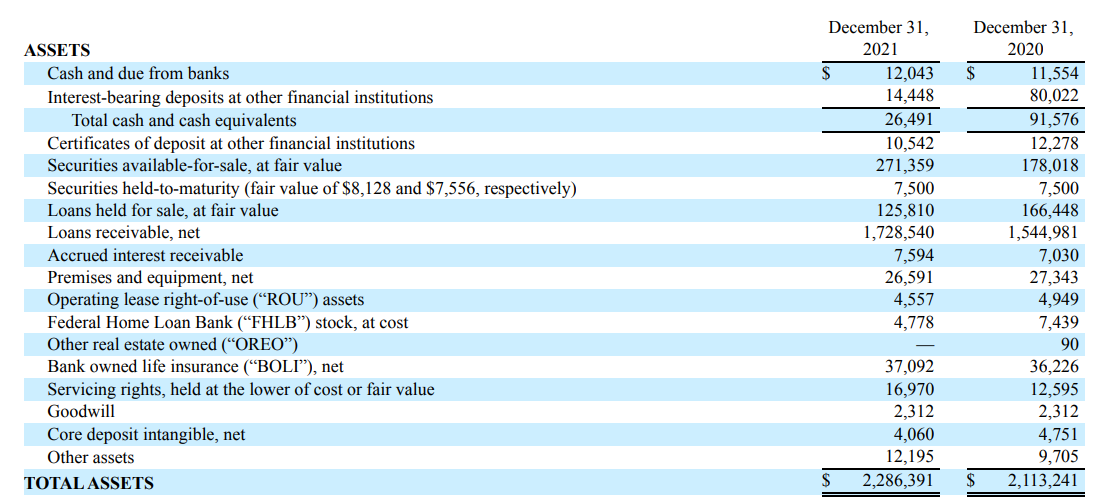

That is the “swing factor” and I prefer to focus on the elements of the balance sheet FS Bancorp does control. And more specifically, I’m interested in the $1.73B loan book.

FSBW Investor Relations

About 60% of those loans are related to real estate with CRE and construction and development loans taking up about half of the real estate loan book. The other half is related to residential real estate.

FSBW Investor Relations

I was very interested in seeing the indirect home improvement loans on the balance sheet as those make up about 20% of the entire loan book. These loans are related to the purchase of for instance new windows or an HVAC system for a home, are offered by the vendors of said items and are underwritten by FS Bancorp. This is a very interesting niche and FS Bancorp is very clearly expanding in this division as the total amount of home improvement loans has increased by almost 20% while the amount of commercial loans has decreased. That being said, the amount of commercial loans excluding the PPP loans has increased from $162M to $184M.

The image above also shows the total allowance for loan losses exceeds $25M and that’s relatively high considering the total amount of loans on a non-accrual status is relatively low at less than $6M as of the end of 20221.

FSBW Investor Relations

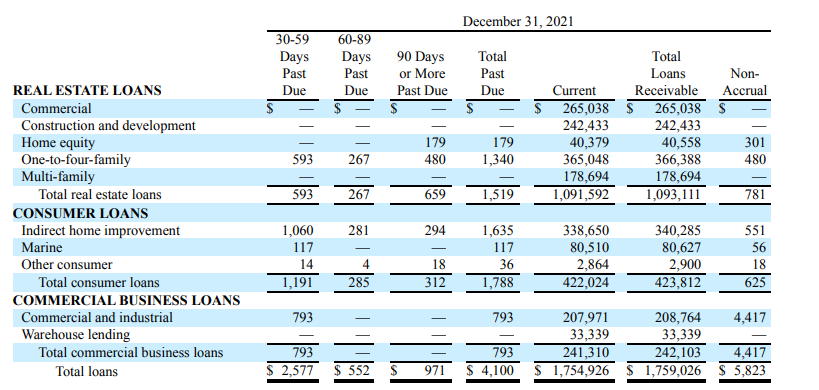

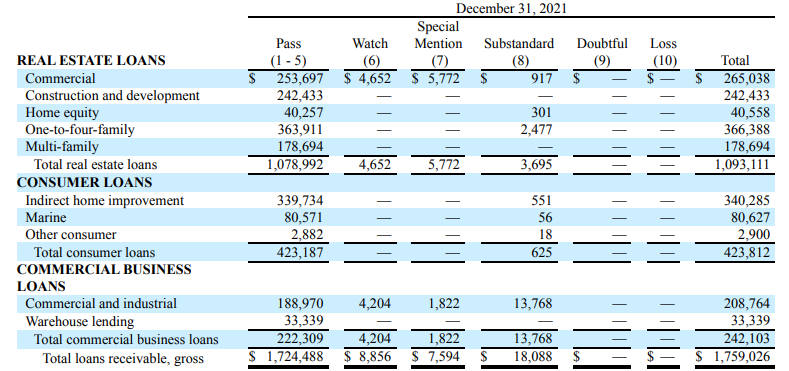

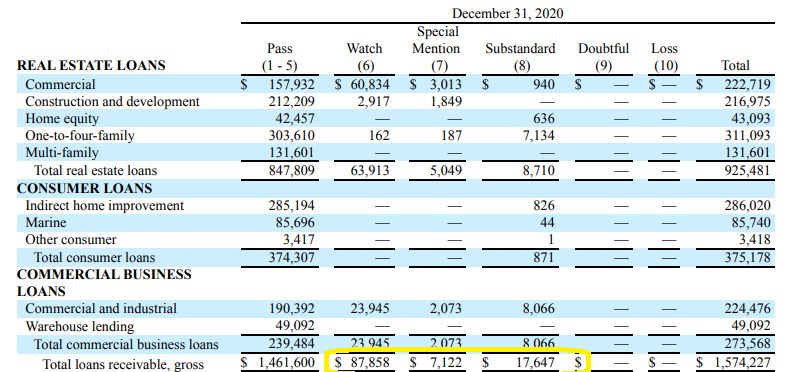

Of course we will have to keep an eye on the total amount of loans past due as well, but it looks like FS Bancorp’s provisions are sufficient. That being said, in excess of $34M of the loans were classified as “watch,” “special mention” and “substandard,” as you can see below. Fortunately a substantial portion of these loans are related to real estate and thanks to the presence of collateral, the actual losses should remain limited. I’m more “worried” about the almost $20M in commercial and industrial loans that did not qualify in the “pass” category.

FSBW Investor Relations

That being said, FS Bancorp has come a long way since the end of 2020 (see below) when the total amount of loans in those three riskier categories totaled in excess of $112M with almost 30% of the commercial real estate loans not making the “pass” category. But throughout 2020 and 2021, pretty much every single home improvement loan was ranked very high when it came to determining the credit quality so I definitely understand why FS Bancorp has been expanding in this niche.

FSBW Investor Relations

Investment thesis

The gains on the sale of loans are both the main driver as well as the main uncertainty when it comes to valuing FS Bancorp. It’s virtually impossible to estimate how much money the bank will make in any given year by selling some of the loans it originates and that explains why the bank is trading at less than 8 times its earnings. And as the dividend yield is relatively low ($0.20 per quarter, for a 2.6% dividend yield), FS Bancorp also doesn’t attract the income-focused investors.

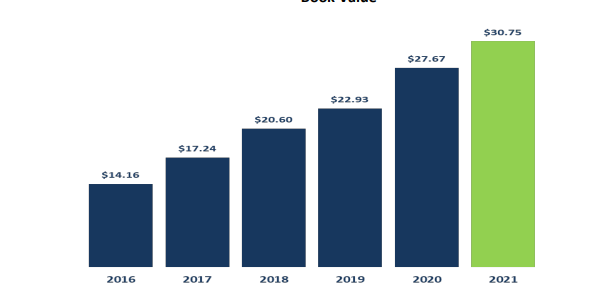

FSBW Investor Relations

There’s value though as the bank ended 2021 with a book value of in excess of $30/share and a tangible book value of $29.50. As FS Bancorp has been aggressively repurchasing its shares and as the majority of its earnings is retained on the balance sheet, I expect the bank’s tangible book value per share to exceed $32/share by the end of this year (subject to no sudden surprises in the loan sale division) which makes the bank rather cheap at the current levels. Perhaps a small position is warranted, but I need to keep in mind originating and selling loans is an important part of the business model here.

Be the first to comment