André Muller/iStock Editorial via Getty Images

Published on the Value Lab 17/4/22 for early access

Rubis (OTCPK:RBSFY) dropped 10% for no apparent reason on Friday despite market performing well that day. Turns out there was a specific reason that we believe has been exacerbated by bad holiday timing and an overreaction to the Kenyan exposure. Overall, Rubis continues to trade way below our estimates of fair value, even in the worst case scenario of losing the Kenyan concessions, and the drop represents yet another opportune entry point for investors.

Recent Developments

What are the recent developments and what does it mean for Rubis? In the fewest words possible, Rubis operates fuel distribution infrastructure in Kenya, and has been accused of prioritising other markets through exports for profit reasons, hurting motorists in Kenya with intermittent shortages. Kenya has deported the head of Rubis’ Kenya division in response, with Rubis protesting the accusations on the basis that there have been meaningful increases in demand for fuel (13% for petrol YoY in April) and that shortages in the market, and not by their hand, are the reasons for motorist woes.

Ultimately this boils down to a political situation that could indeed hurt Rubis’ fundamentals in a variety of ways, but only in the Kenyan market in our opinion. The issue should not leak into other East African markets, especially when the accusations imply that other East African nations and benefiting at the expense of Kenya in terms of securing commodities. The risk here is some proportion of the 7% EBIT exposure that Rubis has in East Africa, probably less than 5%. We do not know exactly how likely appropriation of assets are, or how large fines or taxes could be going forward, but even in the worst case scenario where 7% of EBIT disappears, Rubis still remains attractive.

Most importantly, assuming that the figures given by Rubis are not lies, which they wouldn’t be as they can still be verified, we have also been informed in this expected turn of events that petrol markets are doing well in the regions, and are likely doing well in the rest of the African regions too which account for more than 30% of the company’s EBIT. Since margins are fixed markups, higher volumes simply means higher profits, so we can expect that markets that have taken a rest during the pandemic are reviving, and will more than compensate for the lessened demand for bitumen as supply shortages harangue construction (although not by that much, probably 7%), perhaps even writing off the Kenyan market altogether.

Conclusions and Valuation

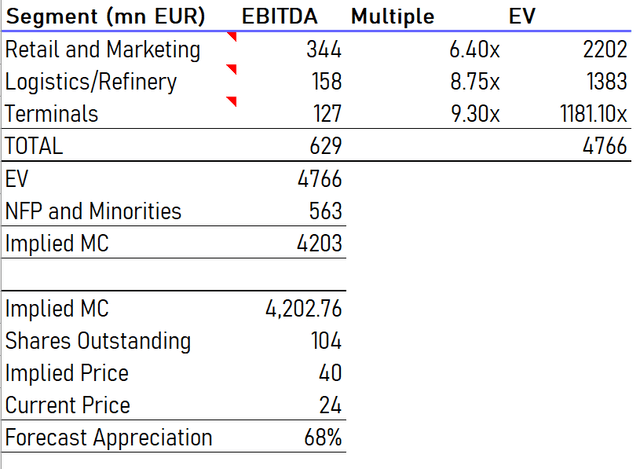

The Rubis valuation continues to appear very pessimistic. Supposing that 7% of EBIT for Rubis disappears out of the retail segment assuming a total loss of Kenyan and East African business, the valuation appears to offer a major margin of safety.

Rubis Valuation (The Value Lab)

Remember, that the multiples being used are also for precedent transactions that happened in western markets. Africa is a region that might never see electrification in my lifetime, as even basic power needs are not properly met, hence the importance of gas as a commodity which Rubis actually provides to the region as well. Therefore, these obviously low multiples for oil assets due to pessimism in western markets should probably not be applied to assets located in these geographies where they serve markets that should last a lot longer for oil.

We think that the reason Rubis traded down so badly was because of Easter Holidays, and that investors couldn’t get in touch with the IR department of the company. We think that this overreaction has created a buying opportunity on Monday if prices remain discounted over the next couple of days from Thursday levels.

While we are not too concerned about these events, we aren’t too concerned about macroeconomic events either as far as Rubis is concerned. Demand destruction due to high prices should be pretty limited, in fact evidenced by the recent Rubis press release on Kenya. Rubis isn’t commodity exposed, but as the reopening progresses, they should continue to recover. With their markets robust to electrification supporting long-term volumes for Rubis, we absolutely remain buyers despite poor investment performance so far.

Be the first to comment