metamorworks/iStock via Getty Images

Investment Thesis

DigitalOcean (NYSE:DOCN) is a cloud computing platform that offers IaaS (infrastructure-as-a-service) and PaaS (platform-as-a-service) tools for developers, start-ups, and SMBs. Today, nearly 610K customers (individuals and businesses) use DigitalOcean’s platform to build, deploy, and scale software apps (mobile and desktop) across the globe. DigitalOcean’s platform services are used by software developers, data scientists, researchers, students, system administrators, and hobbyists across numerous industry verticals and for a broad range of use cases, such as web and mobile applications, e-commerce, website hosting, media, and gaming, managed services, and personal web projects, among many others.

Here’s my investment thesis for DigitalOcean:

- DigitalOcean is a rapidly-growing cloud computing platform company that serves SMBs and start-ups with IaaS and PaaS tools. In a way, DigitalOcean is the AWS for small businesses.

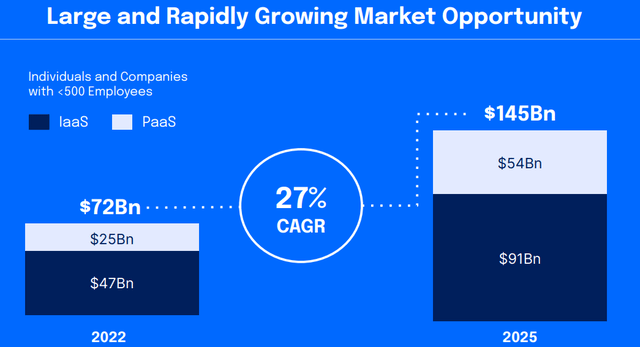

- The cloud IaaS and PaaS market size is estimated to be worth more than $500B by 2024. Although the large enterprise market is dominated by the tech titans (i.e., Amazon’s (AMZN) AWS, Microsoft’s (MSFT) Azure, and Google Cloud Platform (GOOG)), DigitalOcean has carved out a niche for itself by focusing on cloud needs of SMBs. According to DigitalOcean’s filings, its TAM stood at ~$44B in 2020, with the expectation of growth to ~$145B by 2025.

- DigitalOcean’s platform simplicity, developer-friendliness, dedicated customer service, and predictable pricing have enabled the company to differentiate itself from the competitors and build a spectacular business.

- In recent quarters, DigitalOcean has been registering acceleration in revenue growth, and it is on track to do ~$565M+ in revenues this year. The company’s management has guided for 30%+ growth in the medium term. Furthermore, DigitalOcean’s business is already free cash flow generative, with robust gross margins of ~60% (adj. gross margin of ~80%) continuing to trend higher.

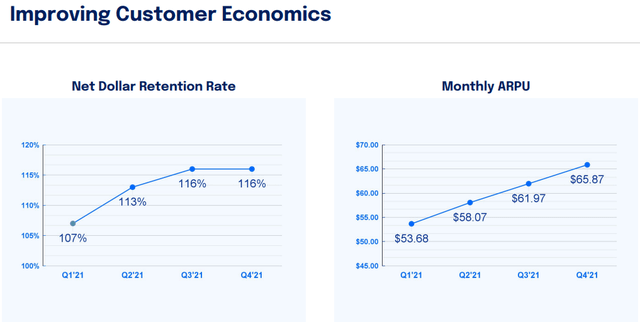

- Although Q4 user growth of just ~6% y/y is not ideal, the weakness could be temporary, and a strong NRR of 116% shows robust customer satisfaction for DigitalOcean’s offerings.

- After a heavy sell-off in its stock, DigitalOcean is trading ~46% below its fair value and offers ~23% CAGR returns from these depressed levels.

In this note, we will analyze DigitalOcean’s business and examine its financial statements and KPIs. Let’s get started.

What Is DigitalOcean?

DigitalOcean provides a highly-differentiated cloud services platform that is purpose-built for developers, entrepreneurs, and small-medium-sized businesses. DigitalOcean’s platform simplifies cloud computing, enabling its customers to rapidly accelerate innovation and enhance their productivity and agility.

Source: Digital Ocean – Brand film

Today, DigitalOcean is making the transformative benefits of the cloud – easy to leverage, reliable, broadly accessible, and affordable – for nearly 610K customers (individuals, start-ups, and SMBs) across 185 countries. DigitalOcean’s comprehensive portfolio of compute, database, storage, and networking products is leveraged by its customers to build and deploy robust applications in the cloud.

Before we dive further into DigitalOcean’s business, let us first understand what’s at stake here.

The Cloud Is A Massive Opportunity

As you may already know, cloud computing has been revolutionizing application development and deployment across the globe. By using cloud services, businesses can lower upfront infrastructure costs while getting superior flexibility, scalability, and extensibility as compared to on-premise software development environments. According to IDC, the global cloud infrastructure services market is estimated to be worth ~$500B. We know that tech titans like Amazon, Microsoft, and Google dominate the enterprise cloud market; however, there’s a growing opportunity in the underserved SMB space.

The benefits of cloud computing are especially valuable for start-ups and SMBs, as they are typically constrained by limited financial resources, operational expertise, and IT personnel. According to IDC, the cloud IaaS and PaaS market (for individuals and companies with <500 employees (SMBs)) are projected to be worth $72B in 2022, and this opportunity is expected to grow at ~27% CAGR to $145B by 2025. Hence, DigitalOcean has a massive TAM.

Digital Ocean Q4 2021 Earnings Presentation

Digital Ocean Q4 2021 Earnings Presentation

DigitalOcean’s TAM is humongous, and naturally, there’s competition. While direct competitors in the SMB market include companies like Vultr, Linode, UpCloud, Amazon Lightsail, among many others, DigitalOcean also competes with AWS, Azure, and GCP as its customers might move over to these cloud platforms once their business or applications scale up. As of now, moving upstream to serve large enterprises doesn’t seem plausible for DigitalOcean due to a lack of resources and formidable competition. Also, DigitalOcean’s management has given no indication of such ambitions; hence, I expect DigitalOcean to remain an SMB-focused cloud platform.

DigitalOcean’s Differentiation

Although DigitalOcean’s product offerings might be less extensive compared to its rivals, they do cover the essential needs of small and medium-sized businesses. Here are some of DigitalOcean’s biggest products:

- Droplets: fast and flexible cloud compute capacity

- DigitalOcean Kubernetes: service offering simple, user friendly, managed Kubernetes

- Managed Databases: managed MySQL, PostgreSQL, and Redis, with setups, backups, and updating done for you by DigitalOcean

- Spaces Block Storage: S3-compatible block storage with a CDN for speed

- Volumes Block Storage: SSD block storage for Droplets

- Networking: Load Balancers, Floating IPs, Cloud Firewalls, and DNS

Everything that DigitalOcean offers can be found on AWS or any other large cloud provider for that matter. As we know, DigitalOcean has amassed 609K+ customers, which means they must be doing something right. So, how does DigitalOcean differentiate itself in a crowded marketplace?

Digital Ocean Q4 2021 Earnings Presentation

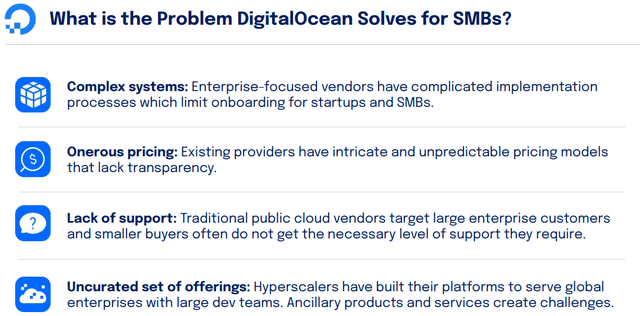

Well, DigitalOcean (in their own words) is built on four key principles that lead to a highly-differentiated experience for its customers:

- Simplicity – We take infrastructure technology and make it simple across all aspects of the product experience.

- Customer Support – We provide live support to all customers, regardless of price point, and we provide free access on our site to tens of thousands of helpful documents.

- Community – We invest heavily in the community of developers and entrepreneurs by helping them in the early stages of idea generation, and by providing various resources to guide them in successfully pursuing their ventures.

- Open Source Software – Through open source software we enable faster, lower-cost innovation without locking customers into a proprietary software technology stack.

Source: DigitalOcean’s IPO filing

The developer community is at the heart of DigitalOcean’s success. Through its simplicity-focused developer cloud platform, DigitalOcean is improving developer experiences and increasing developer productivity. By using DigitalOcean, software developers can spend less time managing their infrastructure and more time on solving business problems or turning their ideas into innovative software applications to grow their businesses. DigitalOcean offers mission-critical infrastructure solutions across compute, storage and networking while also enabling developers to extend the native capabilities of its cloud with fully-managed application, container, and database offerings. Developers can access and interact with this infrastructure through an easy-to-use interface.

In just minutes, developers can set up thousands of virtual machines, secure their projects, enable performance monitoring and scale up and down as needed.

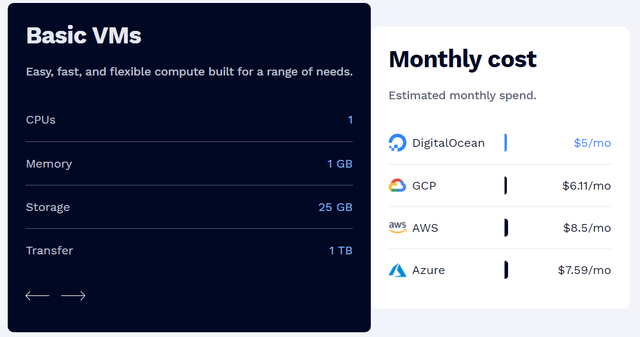

The second selling point for DigitalOcean is its approach to predictable and transparent pricing for its solutions. DigitalOcean’s pricing is consumption-based and billed monthly in arrears, making it easy for its customers to track usage on an ongoing basis and optimize their deployments. Furthermore, DigitalOcean’s pricing is roughly 20-25% cheaper than comparable services on AWS, GCP, and Azure.

DigitalOcean – The developer cloud

The global developer and open source communities are fundamental to DigitalOcean’s business and a key source of ideas and innovations that support our sustained growth (“The Twilio Model”). DigitalOcean’s developer-centric approach has helped foster a large and loyal community of developers. Today, DigitalOcean attracts ~5M unique visitors to its websites every month, hosts one of the largest hackathon events in the world, and offers a comprehensive library of high-quality technical tutorials and community-generated Q&A. The DigitalOcean platform is designed to take advantage of open source technology, which is valued highly by developers and SMBs due to greater choice, affordability, and flexibility.

Lastly, DigitalOcean differentiates itself from competitors on the basis of dedicated customer support. DigitalOcean prides itself on providing 24×7 customer support to all customers, regardless of size. Through dedicated customer support, easy-to-use self-help resources, and an active developer community, DigitalOcean is building tremendous brand loyalty amongst its growing customer base. DigitalOcean’s customers tend to be great advocates for the company and have been a common source of new customer referrals.

DigitalOcean’s NPS score of 65 is comparable to some of the world’s most beloved brands. The efficiency of DigitalOcean’s go-to-market model and its focus on the needs of the individual and SMB market has resulted in a global customer base that continues to grow. As of Q4 2021, DigitalOcean had ~$609K customers across 185+ countries. DigitalOcean has built a highly efficient self-service customer acquisition model, which happens to be complemented by a targeted inside sales force. Today, DigitalOcean has a growing number of customers with higher spending levels, and existing customers are continuing to expand their business with the company. This success is a direct result of the four key differentiators we discussed in this section. Next, we shall focus on DigitalOcean’s leadership.

Founders No Longer At The Helm, But Yancey Spruill Is Doing A Great Job

Soon after its IPO [in March 2021], DigitalOcean’s co-founders left the company. Now, this may seem like a red flag, but none of them held any executive leadership roles in recent years. Hence, I am not concerned about this exodus.

Today, DigitalOcean is led by Yancey Spruill [CEO] – a veteran technology executive who held the roles of COO and CFO at SendGrid (acquired by Twilio) in 2015-2019. Earlier in his career, Yancey worked as an engineer and an investment banker. As DigitalOcean executes on its growth roadmap, Yancey’s leadership will be key, as it has been over the last two and a half years. During his reign as CEO, Yancey has successfully taken DigitalOcean imperiously close to profitability (operating at breakeven net income) while also re-accelerating sales growth, as will see in the next section. Although we generally want to own founder-led, single source-code platform companies, Yancey has proven his mettle as an astute business leader, and I am happy to partner with him on DigitalOcean.

Analyzing Financial Metrics

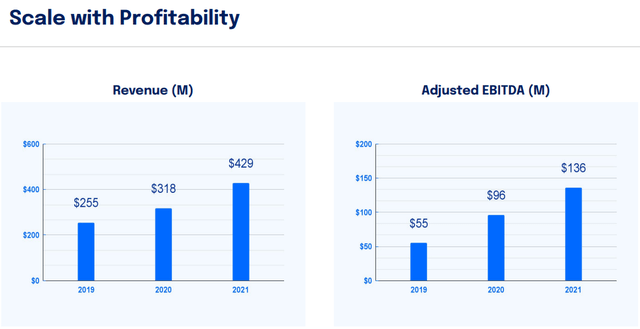

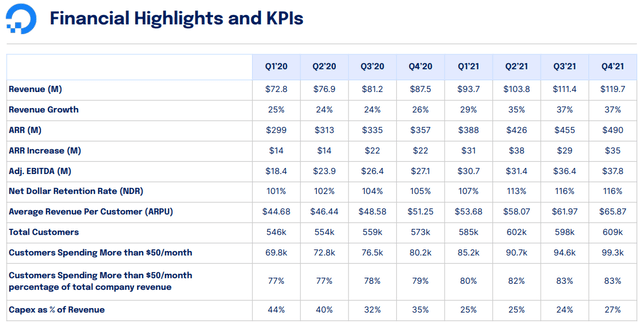

In 2021, DigitalOcean raked in revenues of ~$429M, which implied a y/y growth rate of ~35% (re-acceleration from previous years). As the numbers show, DigitalOcean is growing rapidly at scale with profitability. Considering the growth rates seen across AWS (~37%+ y/y), Azure (~45%+ y/y), and GCP (~50%+ y/y) in 2021, DigitalOcean’s growth appears to be somewhat tepid. In upcoming quarters, I will be closely monitoring customer count growth and NRR metrics to see if DigitalOcean’s business momentum is real or not.

Digital Ocean Q4 2021 Earnings Presentation

Digital Ocean Q4 2021 Earnings Presentation

After going public in March-2021, DigitalOcean has recorded accelerating growth every quarter. The strong growth numbers are being driven primarily by higher ARPU (a result of greater product adoption by existing customers) and somewhat by customer count growth. Although customer growth of ~6% y/y is pretty lukewarm, cloud adoption among SMBs is a powerful secular trend that is set to run for years to come. With the likes of AWS, Azure, and GCP growing faster than DigitalOcean in 2021 from much higher bases, I am not entirely sold on management’s aggressiveness. However, DigitalOcean is highly-profitable (on an adjusted EBITDA basis), and a balanced growth strategy makes sense for a CAPEX-intensive cloud provider.

Digital Ocean Q4 2021 Earnings Presentation

Digital Ocean Q4 2021 Earnings Presentation

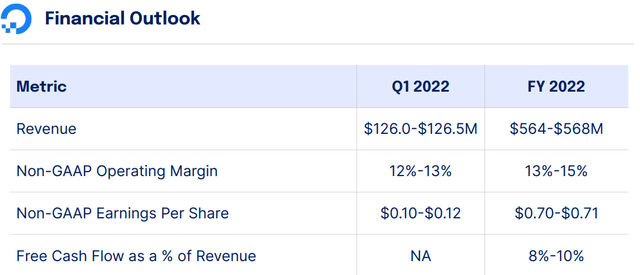

In Q1 2022, DigitalOcean is projecting revenue of ~$126.25M at the midpoint of management’s guidance (implied growth of ~35% y/y), which might be somewhat sandbagged considering past quarterly outperformance. Moreover, DigitalOcean’s margin profile is set to improve further in 2022.

Digital Ocean Q4 2021 Earnings Presentation

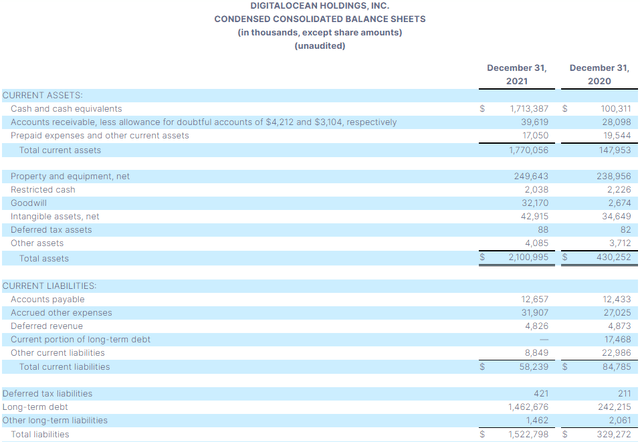

After raising ~$775M at its IPO in March 2021 and an additional $1.3B in debt in November 2021, DigitalOcean’s balance sheet is flush with cash. Since the company is already free cash flow generative, DigitalOcean has ample capital to boost its growth trajectory with no liquidity issues in sight.

Digital Ocean Q4 2021 Earnings Release

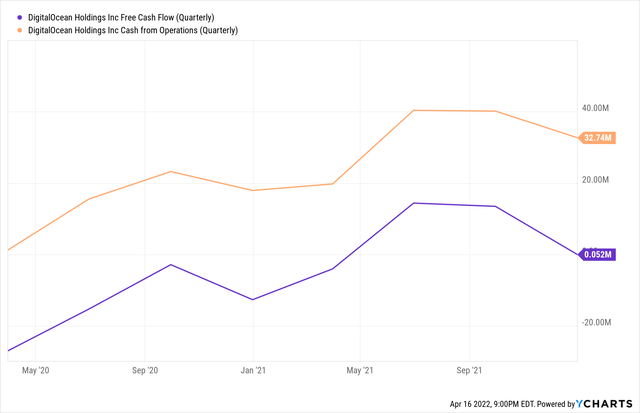

YCharts

In summary, DigitalOcean is a well-run business with its management taking a balanced approach to sales growth and profitability. With cloud adoption still only in its second innings, DigitalOcean has a long runway for growth. In addition to having a robust balance sheet, being free cash flow positive offers DigitalOcean tons of M&A optionality. Hence, despite holding some reservations about current growth rates, I would be willing to allocate capital to this company.

But before we do that, let’s determine the fair value and expected returns.

Fair Value And Expected Returns

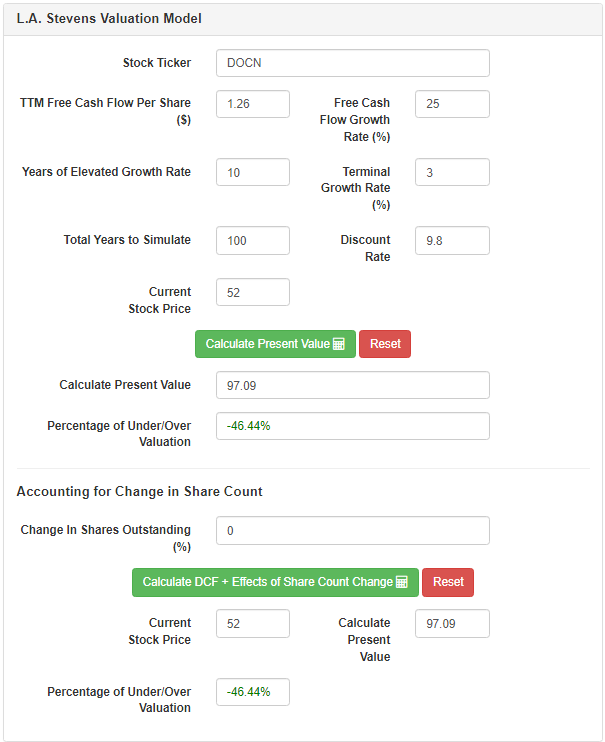

To determine DigitalOcean’s fair value, we will employ our proprietary valuation model. Here’s what it entails:

-

In step 1, we use a traditional DCF model with free cash flow discounted by our (shareholders) cost of capital.

-

In step 2, the model accounts for the effects of the change in shares outstanding (buybacks/dilutions).

-

In step 3, we normalize valuation for future growth prospects at the end of the ten years. Then, using today’s share price and the projected share price at the end of ten years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

Assumptions:

|

Forward 12-month revenue [A] |

$575 million |

|

Potential Free Cash Flow Margin [B] |

35% |

|

Average diluted shares outstanding [C] |

~160 million |

|

Free cash flow per share [ D = (A * B) / C ] |

$1.26 |

|

Free cash flow per share growth rate |

25% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

Results:

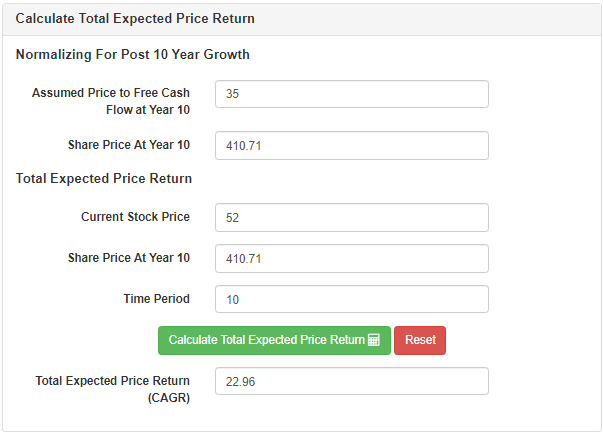

L.A. Stevens Valuation Model

L.A. Stevens Valuation Model

According to my projections, DigitalOcean’s stock could grow from $52 to ~$411 by 2031. Since the implied ten-year expected CAGR return of ~23% is greater than my investment hurdle rate of 15%, I rate DOCN a buy at $52.

Source: L.A. Stevens Valuation Model

Concluding Thoughts

Let’s conclude our discussion on DigitalOcean with our crucial characteristic check:

BTM Crucial Characteristics Check

|

Crucial Characteristic |

Notes |

|

Zero to One Strategy |

DigitalOcean’s cloud platform combines the power of simplicity, community, open-source, and customer support to enable its customers to spend less time managing their infrastructure and more time building innovative applications that drive business growth. By focusing on delivering the benefits of the cloud to underserved individuals, start-ups, and SMBs, DigitalOcean has carved out a niche for itself in a fiercely competitive industry. |

|

The Time Is Now |

With cloud adoption still in the early stages (especially for SMBs) [~85% of enterprise workloads are still run on-premise], the time for a developer-friendly cloud computing platform like DigitalOcean is now. |

|

Long Term Vision |

DigitalOcean has taken a developer-centric, community-based, open-source approach for building out its cloud platform. In my view, DigitalOcean is replicating Twilio’s strategy, albeit as a cloud provider. With simplicity at its core, DigitalOcean’s vision is to deliver the benefits of the cloud to millions of developers globally. |

|

Visionary Founder/CEO |

DigitalOcean is led by Yancey Spruill [CEO], who is a seasoned tech executive with experience in investment banking. Before joining DigitalOcean as its CEO in July 2019 (along with Bill Sorenson as CFO), Yancey was working as COO & CFO at SendGrid, a marketing email platform that was acquired by Twilio in early 2019. DigitalOcean’s co-founders no longer have any involvement in the day-to-day operations at the company; however, Yancey and Co seem to be doing a good job – growth acceleration, higher profitability, and higher net retention rates. |

|

Quality Board of Directors |

DigitalOcean’s BOD constitutes experts from technology and venture capital. To learn more about them: click here. |

|

Proprietary Tech |

DigitalOcean’s cloud services run on hardware built by vendors such as Intel and AMD, and the software used in DigitalOcean’s services is open-source; hence, the proprietary technology owned and created by DigitalOcean is somewhat limited. The company does have multiple trademarks, copyrights, and licensing agreements protecting its business secrets. |

|

Product Roadmap And Evolution |

In a similar vein to Twilio, DigitalOcean is a developer-first company with a community that includes ~5M developers. DigitalOcean’s product roadmap is driven by what its customers need. After starting out as VPS, DigitalOcean now provides many additional products and services. The company is working on filling out the gaps in its platform, and its acquisition of serverless computing company Nimbella shows a flexible approach in build vs. buy. |

| Network Effects | Combined with an affinity for open-source development, DigitalOcean has built a 4.5-5M+ developer-strong community forum, which creates powerful network effects. |

|

Branding |

With NPS scores of 65, DigitalOcean seems to have a positive rating among its customers (primarily developers). DigitalOcean has a strong brand presence among the developer community. |

|

Scale |

Compared to rivals, DigitalOcean is a pretty small player with a limited scale, which happens to be dictated by a lack of resources (capital-intensive infrastructure). However, as DigitalOcean expands over the coming years, it will likely benefit from scale. |

|

Embedding |

Since DigitalOcean doesn’t lock up its customers into a proprietary software technology stack like some of the larger players, it fails to truly embed itself within the customer’s business. As such, I think migrating away from DigitalOcean is relatively simple. |

|

Net Promoter Score / Customer Satisfaction |

DigitalOcean’s NRR has been trending in an upward direction, coming in at ~116% last quarter. This data point indicates the growing usage of DigitalOcean’s services among its existing customers, which is a solid sign of high customer satisfaction. NPS score: 65 |

|

Powerful Secular Growth Trend |

The four key secular tailwinds for DigitalOcean are – 1) Technological innovation driving cloud adoption, 2) Proliferation of cloud-native SMBs, 3) Growing influence of software engineers, and 4) Open source software is accelerating innovation. |

|

Total Addressable Market |

DigitalOcean’s TAM stood at $44B (IaaS + PaaS) in 2020, and the company expects this figure to grow to ~$145B by 2025. The growth in the cloud market for SMBs is expected to remain brisk even beyond 2025. |

|

Market Share |

With an ARR of ~$490M, DigitalOcean has a market share of ~0.01% in the SMB cloud space, which is next to nothing. As more SMBs move to the cloud, DigitalOcean has a massive opportunity to increase its market share. |

|

Competitive Differentiation |

DigitalOcean’s platform simplicity, developer-friendliness, dedicated customer service, and predictable pricing serve as key competitive differentiators in a fiercely competitive market. |

|

Mergers & Acquisition Strategy |

Before switching to technology leadership, Yancey served as an investment banker for several years. With him at the helm, we can expect DigitalOcean to make more strategic acquisitions like Nimbella to fill gaps in the market and make its platform more robust (especially with high levels of FCF generation and a well-capitalized balance sheet). |

|

International Expansion |

DigitalOcean already boasts a presence in 185+ countries, and its revenue mix is well-diversified among geographies; the company has massive room for penetrating deeper into each of its markets. |

|

Sounds Financials |

DigitalOcean is growing rapidly at scale with profitability (positive operational cash flow, breakeven net income). The business is adding cash to its balance sheet every quarter despite being in a CAPEX-intensive industry. With adj. gross margins of ~75-80%, DigitalOcean boasts a SaaS-like margin profile. |

|

Liquidity or Bankruptcy Risk |

DigitalOcean is nearly profitable, and its balance sheet is flush with cash. Hence, I do not foresee any liquidity or bankruptcy risk for now. |

|

Shareholder Dilution Risk |

After accounting for all RSUs and ESOPs, DigitalOcean’s fully-diluted share count is ~160M shares. Since the company is already profitable, the risk of further shareholder dilution is minimal (unless the company performs M&A activity). |

DigitalOcean’s simplicity-focused, developer-centric cloud platform is gaining traction among start-ups and SMBs. Although new customer growth is sluggish (tough comps due to pandemic boost in 2020), existing customers are rapidly increasing their spending on DigitalOcean’s platform. As more and more cloud-native SMBs pop up in the coming years, DigitalOcean has a tremendous opportunity to re-accelerate its new customer acquisition rate. The business enjoys SaaS-like margins, and it is already free cash flow generative. With secular tailwinds supporting a long runway for sales growth, I expect DigitalOcean to sustain high levels of growth (25-35% CAGR) for years to come. After a brutal sell-off in the last couple of months, DigitalOcean’s stock is trading below its fair value and offers an excellent risk/reward tradeoff for long-term investors.

Key Takeaway: I rate DigitalOcean a buy at $52

Thanks for reading. Please share your thoughts, questions, and/or concerns in the comments section.

Be the first to comment