Justin Sullivan/Getty Images News

Salesforce (NYSE:CRM) may not be the first name you’d think of buying amidst the volatility in tech stocks. Even after the recent selloff, the stock is not obviously cheap relative to other stocks of a similar growth cohort. The company has a long history of M&A in the tech sector with a successful track record of realizing operating synergies. The stock might not be the fastest growing name in tech, but it offers a solid combination of growth and profitability which, alongside mature capital allocation policies, can enable the stock to deliver robust returns for long term investors.

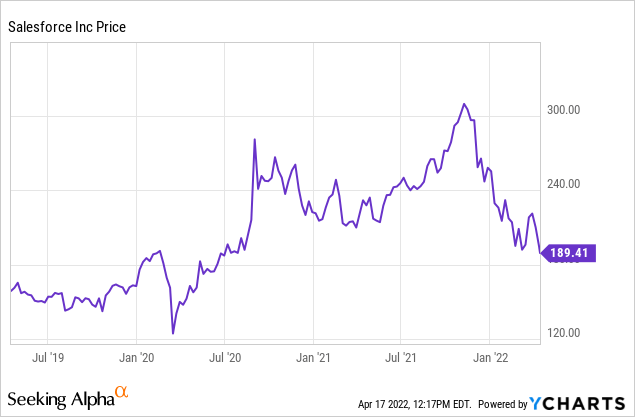

CRM Stock Price

CRM peaked above $311 per share but has since fallen down to around $189 per share. The stock now trades with minimal returns over the past 3 years.

I last covered the name in January when I named the stock a buy in spite of the premium multiple (though noted better opportunities elsewhere in the sector). Since then, tech has continued to crash and CRM has held up better than high-growth peers. That observation may play an important role in how CRM allocates capital moving forward.

The Salesforce Investment Thesis

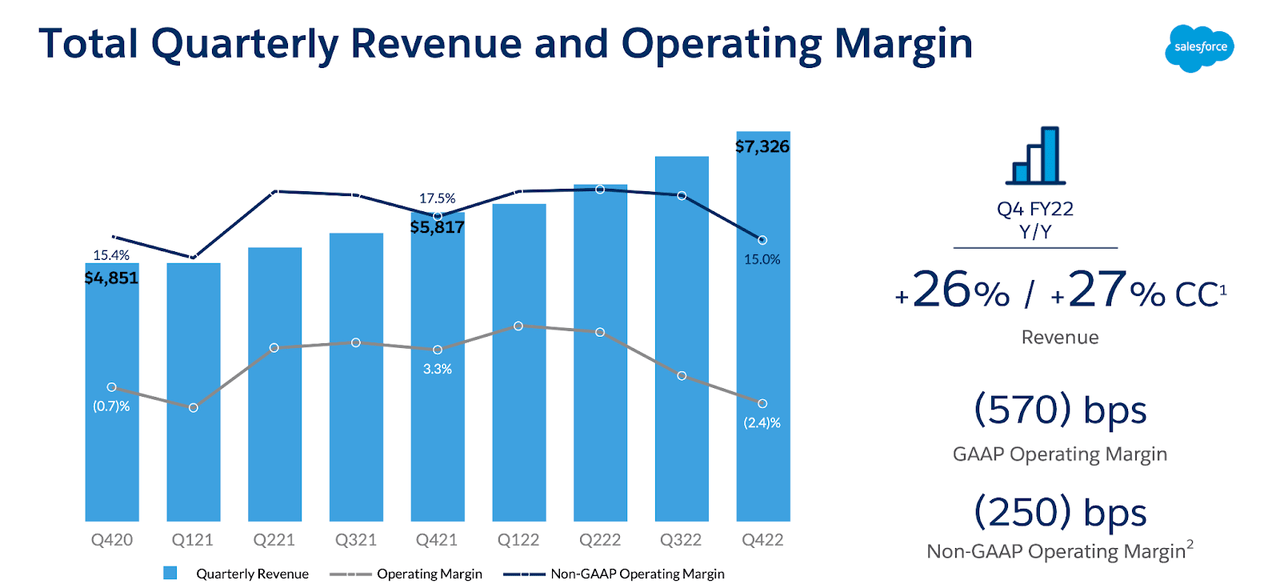

CRM closed out last year with 26% revenue growth in the fourth quarter while maintaining solid 15% non-GAAP operating margins.

Salesforce FY22 Q4 Presentation

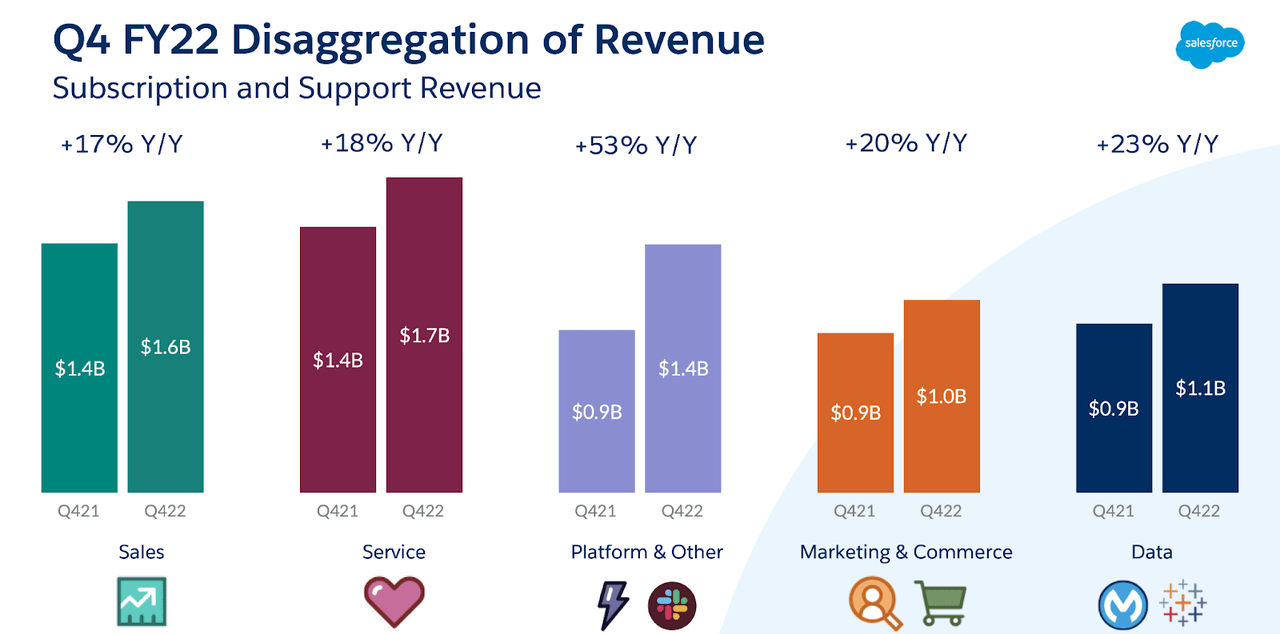

That growth rate is impressive considering that the company generated 24% revenue growth in 2020. In my view, the company has been able to sustain above-market top line growth largely due to its aggressive external acquisition streak. We can see below that departments like by acquisitions like Slack and MuleSoft generated much of the growth, helping to offset the slowing growth in the core CRM business.

Salesforce FY22 Q4 Presentation

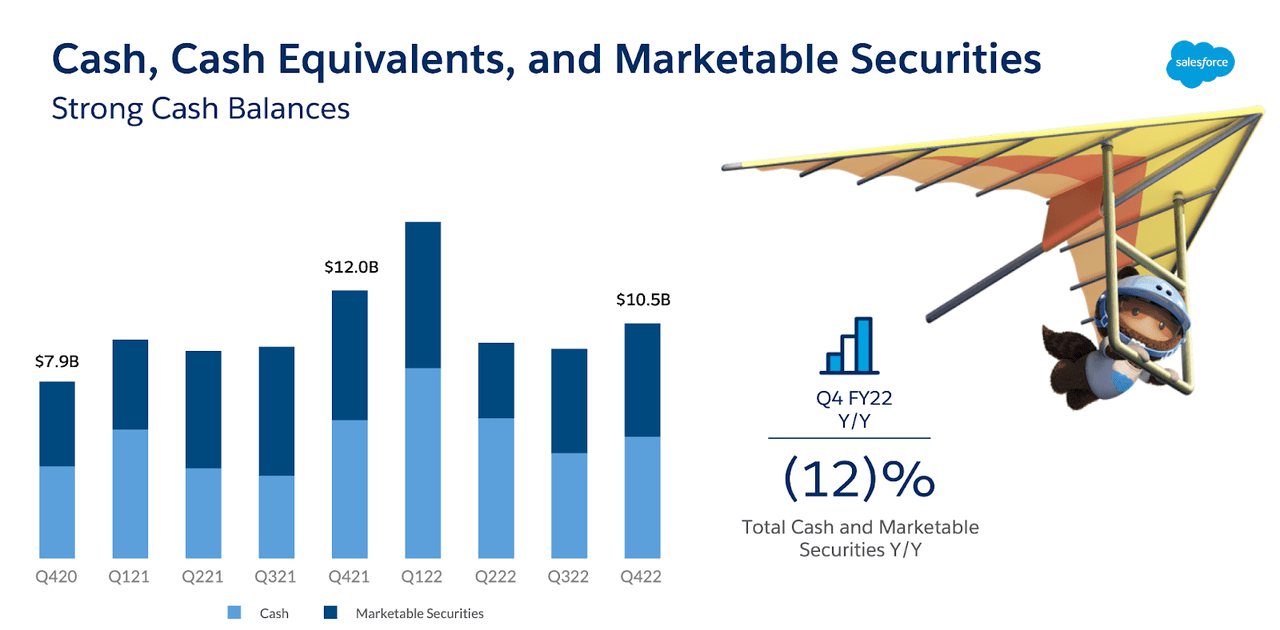

Prior to this tech crash, that kind of observation could make a worthy argument against buying the stock, especially considering that the stock has long traded at curious valuations relative to its organic growth rate. Yet with the tech sector crashing, this may be CRM’s opportunity. CRM ended the year with $10.5 billion of cash & marketable securities, which does not include another $4.8 billion of strategic investments. As disclosed in the annual filing, the strategic investment portfolio is made up of 400 companies, mostly privately held.

Salesforce FY22 Q4 Presentation

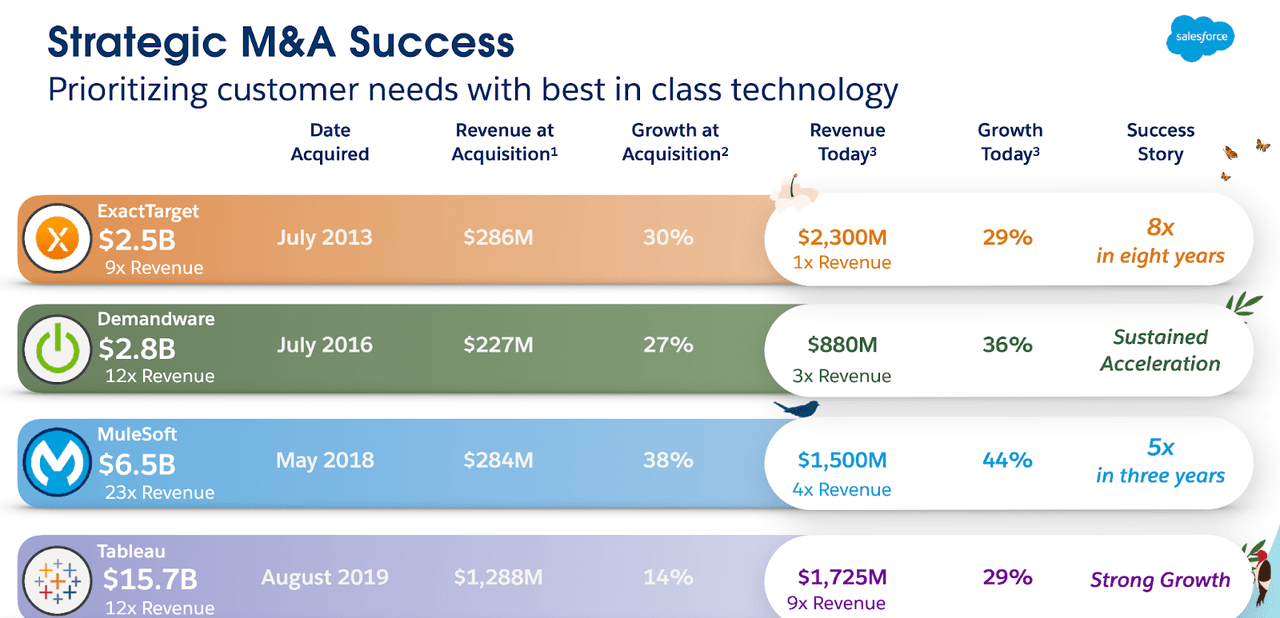

CRM does have $10.6 billion of long term debt, meaning that it does not have a material net cash balance sheet. Yet this may actually be a positive sign as it shows management’s willingness to utilize leverage – that is something that many younger tech companies seem to have not yet embraced. We could see below that CRM has an impressive track record of identifying M&A targets and sustaining high growth rates even many years after acquisition.

Salesforce FY22 Q4 Presentation

In the current environment, CRM may be able to take advantage of low tech valuations by making yet another large acquisition.

Is CRM Stock A Buy, Sell, or Hold?

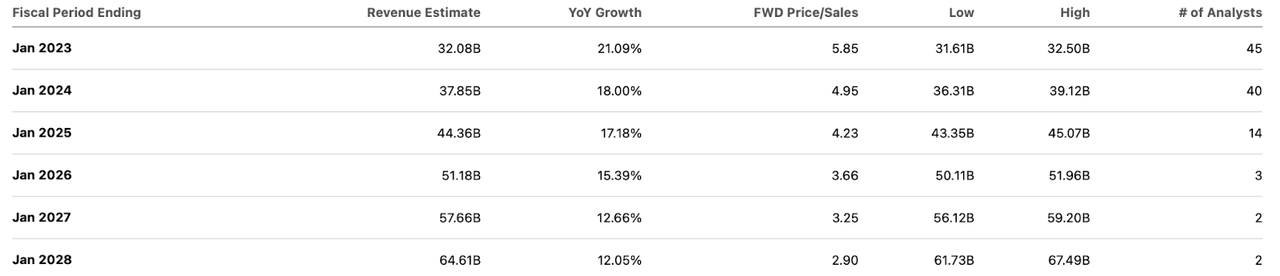

Company management tried to dispel any notion that they have M&A plans on the conference call, but I am skeptical that they are not actively considering such plans due to their track record. Even without the effect of M&A, the stock trades reasonably at 8x sales (I am using 1 billion shares outstanding).

Seeking Alpha

The company generates a meager 5% net margin, but my view regarding these tech stocks is that margins are often understated due to heavy investment in growth. I could see CRM eventually reaching 30% net margins over the long term once the company starts prioritizing profits over high growth. The stock is currently trading at 27x earnings power based on that assumption. The company has guided for 21% growth this coming year. Applying a 2x price to earnings growth ratio (‘PEG ratio’), I could see CRM trading at 12x sales, representing a stock price of $284 or 50% upside. That said, a 2x PEG ratio might not be appropriate in the current environment based on depressed tech valuations and the fact that CRM is not growing as rapidly as before. If we instead assume a 1.5x PEG ratio, then CRM might trade at 9.5x sales, representing a stock price of $225 per share or 19% upside. The main risk here is if I am proven wrong about the understated profit margins especially if this coincides with rapidly decelerating growth rates. CRM is already profitable and thus does not have financial solvency risk, but the premium PEG ratio assigned to the stock may evaporate quickly if Wall Street loses confidence in either the revenue growth rate or ability to drive operating leverage. CRM is not as cheap as many other tech names of a similar growth cohort but the stock’s solid profitability and potentially to capitalize on M&A make the stock a buy today.

Be the first to comment