J. Michael Jones/iStock Editorial via Getty Images

Author’s Note: This article was published on iREIT on Alpha/dividend Kings in November of 2022.

Dear subscribers,

This is far from the first time I’m taking a look at the great company that is Fresenius (OTCPK:FSNUY). At times, it’s very easy to forget that this company, in the very long term, has been an absolutely stellar performer. I’m talking about the fact that investors who bought Fresenius back in the mid-1990s have seen returns of nearly 1,500% in the meantime, and as much as 1,800% if they recognized the overvaluation in 2015-2017 and sold.

My original article is probably one of the worst-RoR pieces I’ve had in around 2 years, seeing the company drop around 45-50% since that time. I’ve been slowly adding during that time, meaning I’m currently deep in the red, but starting to get a very comfortable allocation to the business.

Why am I so convinced about the company?

Here’s why.

Revisiting Fresenius

The company is a large German healthcare company out of Bad Homburg in Hesse. The company was founded in 1912 by Eduard Fresenius. The company’s present focus began back in 1966 when the company began with dialysis. Today, the company’s focus and services are centered around dialysis services for hospitals and inpatient/outpatient medical care.

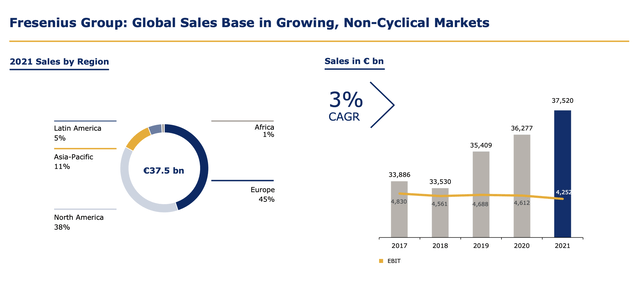

The company is a market leader with a global presence in over 100 countries, €37.5B worth of sales in FY20, and over 300,000 employees across the world. In many of its areas, Fresenius holds a #1 market position, allowing the company a decent moat for its products and services.

Fundamentals remain on par for a positive thesis for Fresenius. A combined increase in overall national income (GDP per capita), together with an aging population, higher amounts of chronic illnesses, a growing healthcare sector, and the increased importance of generic drugs and cost-saving initiatives – all of these trends work in favor of Fresenius being one of the primary winners in the market of the future.

The company, of course, has a whole host of ESG-oriented goals which isn’t something I prioritize all that great, even if the import of such metrics has somewhat increased over the past few years.

Instead, let’s focus on the top and bottom-line trends.

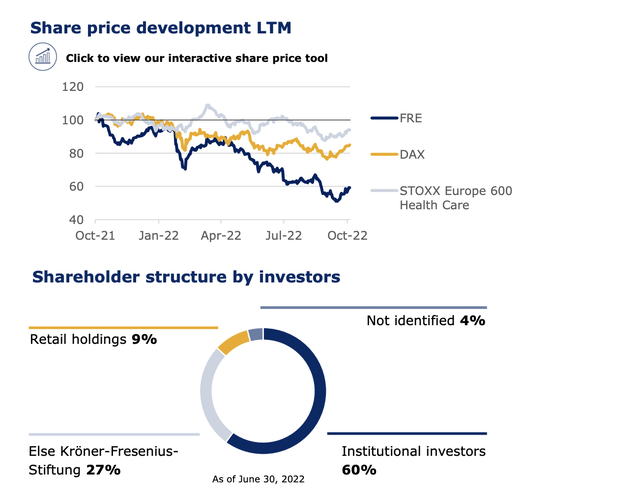

Looking at the share price, you might expect the company to be on a massive decline, with sales and earnings basically going close to negative. How else could we explain this sort of crash?

Well, sales are actually up – and while EBIT is slightly declining, it’s in no way “deteriorating”.

While sales growth trends have taken a bit of a beating – with medical care especially being down to only 1% from 7% in 2017, things like Helios and Vamed as well as Kabi are providing solid numbers.

What are all these things?

By investing in Fresenius instead of Fresenius medical care, you get access to the entirety of a very appealing healthcare portfolio, including supplies, operations and hospital projects.

It would not be wrong to characterize Fresenius as a close to a full-service operator in the healthcare field – and a global market leader in all things dialysis, hospital supplying, and Europe’s largest private hospital operator.

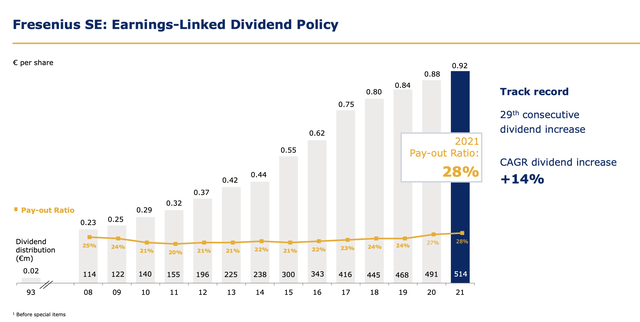

The company has a class-leading dividend policy, with a very conservative sub-30% payout ratio. It also did not cut the dividend at any point in the last 14 years.

One of the more common questions I get is if there is more to Fresenius’s recent crash than might be reported. It’s hard to comprehend why such a company which seems so excellent on the surface is being so insistently punished again and again.

My answer to this is that there are issues in the C-suite and the way the company, overall, is managed, tied to its German roots. While not majority shareholders, the Else Kröner-Fresenius foundation owns 27% of the company. Valuation, shareholding, and recent performance have been almost ridiculously bad compared to what the company actually offers, with most of the issues (most of them temporary) taken away.

It’s not a strange thing that the company is under some pressure. The company’s top line is very much intact, but the company’s bottom line is not. Net income declined 8% Q3 YTD, and the company expects this to worsen to a net income decline of 10% YoY for the full year.

Bottom-line numbers are contracting despite sales growth. The company’s answer to this is simple – cost savings. This is to be achieved through procurement changes, go-to-market model changes, networking, and similar things. The fact is, that the company has already over-delivered its savings targets by 50%.

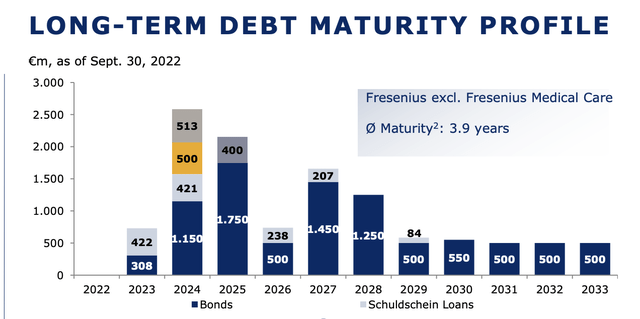

Still, macro impacts continue to hound the company. Vamed’s margins dove to 1.7%, corresponding to a -61% EBIT growth for the latest quarter. The company is still selling product but barely making any money. The company is also re-evaluating contractual assets and it has some project businesses weighing on EBIT. Furthermore, debt is actually up from 3.4x to 3.7x, starting to inch close to 4x. Furthermore, the company has a number of maturities incoming in the next few years, which can really only be described as “unfavorable” in today’s environment.

What the company needs to do to regain some market favor is show improvements in its bottom line, preferably before the maturities in 2024-2027 start to come home to roost.

The company’s medical care arm alone has almost as much sales revenue as the other 3 segments put together. The Helios operation is second-largest at around €10B in annual sales revenues to the Medical care business €18B. Vamed is still very small at barely €2B but is growing.

On a segment-by-segment basis, the company’s Medical Care wing is probably the most appealing and wide-moat of the operations. The company provides world-leading dialysis services and provides services to ~350,000 patients every year at around 4,000 clinics. The company saw 3% patient growth in 2020, and 37% growth in home treatment in the US.

That’s also why this segment’s issues are of such importance to how the company’s share price develops.

Again, there’s no argument to be made against the allegation that the company’s current trends are bad. They are – and the company expects the full-year results to be pretty bad as well, with declines of double digits in net income.

The market has severely punished the business for this for over a year now, and the question that we should ask ourselves is, when is that punishment over?

Valuation for Fresenius

Because let’s make one thing perfectly clear. The valuation for Fresenius has fallen beyond what would consider “reasonable”, even given the headwinds faced by this company from both management and from macro.

When looking at valuations here, we’re looking at Fresenius, not Fresenius Medical Care (FMS).

The relevant ADRs here, therefore, are FSNUY and FSNUF.

To my mind, it’s inarguable that Fresenius does not deserve a high premium – or indeed any premium. But it hasn’t traded at any premium for several years at this point.

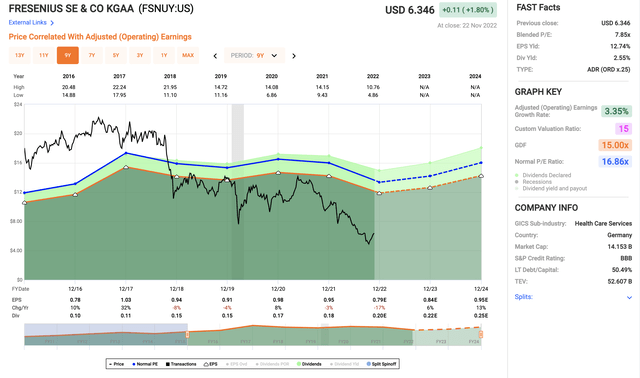

Fresenius Valuation (F.A.S.T Graphs)

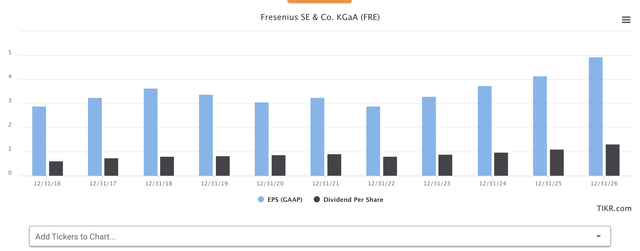

The company now trades at just below 8x P/E, which is interesting given that there hasn’t been any indication of a dividend cut or material and/or long-term drop in earnings. Quite the opposite, expectations are for the 2022E pressures to be temporary and for earnings to slowly turn around following this fiscal.

Fresenius EPS forecasts (S&P Global/TIKR.com)

The dividend is expected to take a hit next year, but I view this as unlikely given the company’s solid dividend tradition. For the past 20 years, FMS has delivered average dividend growth rates of 10.1% and has delivered returns nearly on par with the S&P 500 despite the poor performance for the past 3-4 years.

Successful investing for me is based on buying cheap and, if necessary, selling at expensive levels to maximize returns and to rotate the proceeds into undervalued companies. This company could have enabled such a strategy in the past, and will likely enable it in the future.

The undervaluation seems clear to me not only from historicals but from current trends. The question becomes of how “low” it can go – and current market trends seem to suggest that we’ve found a bottom at around €20/share. I bought some shares at this price – more as it started rising again, and my position in the company is really starting to be solid here.

Am I worried about further declines? No, I’m not. Again, while we’ve seen a continuing decline in EBIT for the past few years, the company will (as I see it) pick this up again starting 2023-2024, at which point it’s also likely that the share price will turn around as well. Of course, when it does, it’ll be somewhat “too late” to buy the business at attractive/bottom-level prices.

Even if we only assume a forward fair-value multiple of 10x P/E, the upside to such a valuation here is almost 26% annually, or 62% until 2024. Analyst valuation estimates call for the company to trade at a range of €18 to €92 – which is downright insane – but comes to a more logical average of around €36, which is down around €7 from my last article. At the current price of €24.6, the company is considered a “BUY” or similar rating by 10 out of 15 analysts, with an average upside of ~44%.

I believe that any long-term investor who has the ability to do so should seriously look at the German-based FRE ticker. Even considering the dividend tax, the potential return from investing in the company at this valuation for the next 4 years could be 100% of invested capital.

However, I realize that for some of you, investing in a German ticker may not be possible. You then have the ADRs as a possibility. This may be a go for some, but others may say that they don’t want to invest in ADRs as a rule, which I respect.

I’m unsure whether I would do it if left in a US investor position – but I would likely go the broker route – allowing myself to invest in the German native share, such as IBKR.

Headwinds for Fresenius are likely to persist for several more quarters. However, the combination of overdelivering on savings, of working to improve margins, of improving productivity and costs tells me that the end result will eventually be a return to growth, and to attractive overall trends for the business.

Investors shouldn’t expect an immediate, or even a quick turnaround as far as things go here.

However, as a long-term 3.5%-yielding healthcare play, this is one of the most attractive potentials in the sector to me, with many potential plays in pharma/healthcare now trading at far higher valuations than they were a year back.

My forecast is for Fresenius to achieve a flat or slight growth EBIT/bottom line for 2023, and for this to be the beginning catalyst of a turnaround in the share price – though it may, as has happened before with companies like Munich Re (OTCPK:MURGY), begin far sooner and more sudden than expected.

Questions?

Let me know!

Be the first to comment