8vFanI

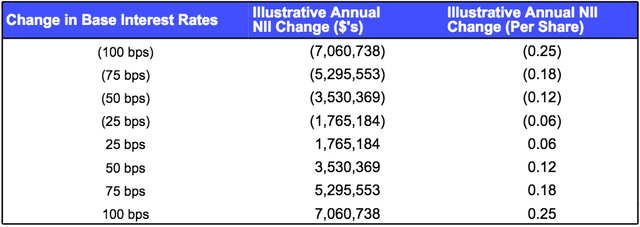

Wouldn’t it be useful to be on the right side of the rising rates equation?

Well, that’s what is happening for certain Business Development Companies, or BDCs. These companies lend money to privately held companies – their loans are often predominantly at floating rates, with interest rate floors, while BDC debt is mainly at fixed rates.

Capital Southwest Corporation (NASDAQ:CSWC) is a prime example of this beneficial situation – 98% of its investments have floating rates. Management estimates that the company will gain $.25/share in NII for a 100 basis point rise in rates:

Another strength for CSWC is that 89% of its investments in companies are co-sponsored by hedge funds and venture funds, which also give support to these companies during tough times, such as during the pandemic lockdowns.

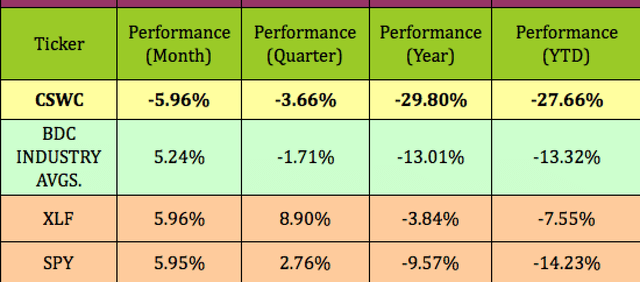

With recession fears looming, the market has been shying away from CSWC in 2022, causing it to lag the BDC industry, the Financial sector, and the S&P 500 (SPY).

Those fears are misplaced. Why?

Because CSWC’s co-sponsors will step in and aid their portfolio companies which need additional support. In fact, they’ve already done so in one non-accrual scenario in this most recent quarter. That stands to reason – these private equity/hedge fund/VC co-sponsors have a lot more $ tied up in these investments than CSWC has.

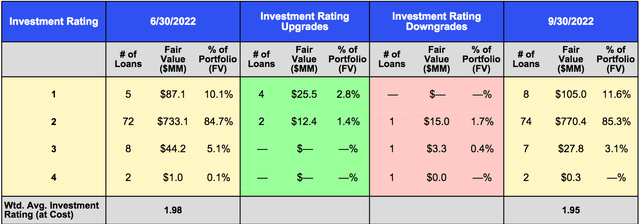

Ratings:

CSWC’s management reviews and rates its holdings quarterly, using a 4-tier system, with 1 being the highest rating, and 4 being the lowest. As of 9/30/22, ~97% of CSWC’s holdings were in the top 2 tiers, a ~200 basis point improvement vs. the quarter ending 6/30/22.

Company Profile:

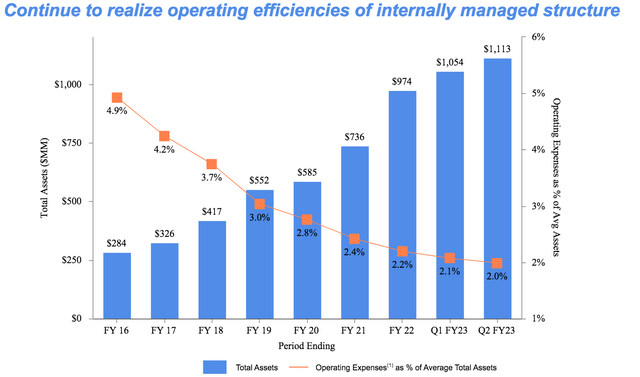

CSWC is an internally managed BDC, specializing in credit and private equity and venture capital investments in lower and middle market companies with EBITDA between $3M and ~$20M; and leverage of 2X to 4X Debt/EBITDA through CSWC’s debt position.

Being internally managed is a plus for CSWC – it avoids those often expensive management and incentive fees that externally managed BDC’s must deal with.

This operating expense chart illustrates how CSWC’s Opex costs/Assets have steadily declined over the years:

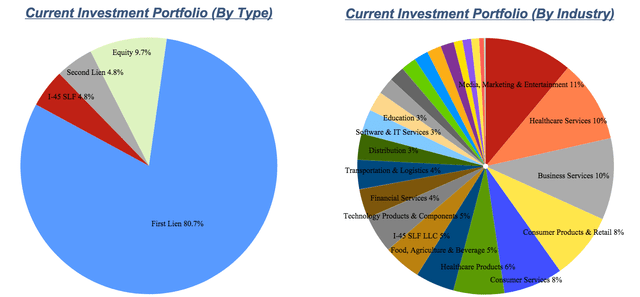

80.7% of CSWC’s investments are 1st Lien, followed by 9.7% in Equity, 4.8% in 2nd Lien, and 4.8% in its I-45 JV. Media & Entertainment remained the largest industry exposure in the quarter ending 9/30/22, at 11%. Healthcare Services rose from 7% to 10%, while Business Services slipped from 11% to 10%. The 2 Consumer categories were exposure totaled 16%, down from 17% in the previous quarter ending 6/30/22.

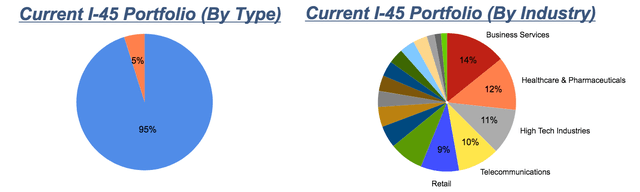

CSWC also manages a JV – its I-45 Senior Loan Fund (“I-45 SLF”), in partnership with Main Street Capital. As of 9/30/22, 95% of that portfolio’s investments were in Senior Loans. There were $168.6M in debt investments in 39 companies, with an average issuer EBITDA of ~$81M, and a 6.3% LIBOR spread.

Earnings:

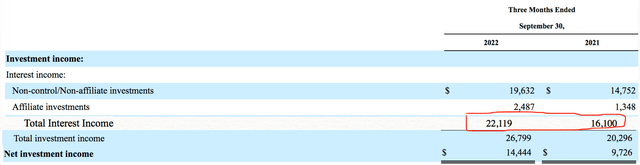

CSWC’s fiscal year ends on March 30th. It had strong earnings growth in its 2nd fiscal quarter, the period ending 9/30/22, with NII up by 48%, and total Investment Income rising by 32% in the quarter.

The key was Interest Income, which rose 31% vs. 1 year earlier, due to higher rates on a larger portfolio:

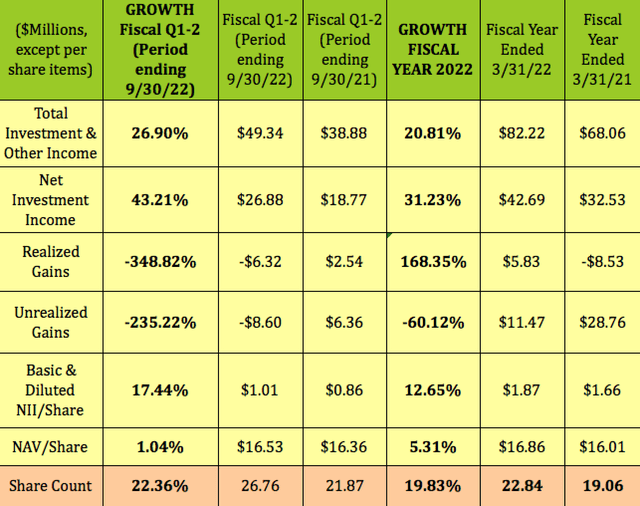

For Fiscal Q1 -2 , (periods ending 9/30/22), total Investment Income rose ~27%and NII rose ~43%, improving upon the growth rates for Fiscal year ending 3/30/22, which saw strong growth rates of ~21% and ~31%, respectively.

Realized Gains, which are often lumpy, due to timing issues, dropped from $2.5M to -$6.3M, while Unrealized Gains reversed from $6.36M to -$8.6M in the latest 2 quarters.

Although NII jumped 43%, NII/Share rose 17.4%, due to a 22.36% jump in the share count vs. last year. The company issued 2.5M shares under its ATM program, raising $30.3M in gross proceeds at 160% of the prevailing NAV/share during the quarter.

NAV/Share was $16.53, up 1%. It also would have risen much more if the share count hadn’t increased as much as it did.

New Business:

Management originated $85.7M in new commitments during the quarter ending 9/30/22, consisting of investments in five new portfolio companies totaling $66.6M, and add-on commitments in five portfolio companies totaling $19.1M.

There were 3 exits during the quarter – CSWC received full prepayments on 2 debt investments totaling $13.9M, and proceeds from the sale of one debt investment totaling $0.7M.

Dividends:

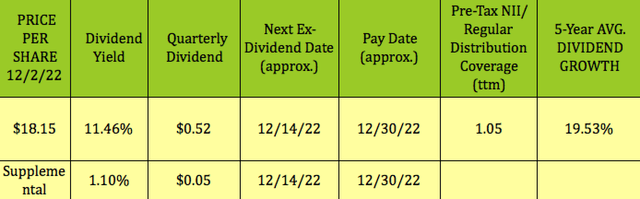

At its 12/2/22 price of $18.15, CSWC’s regular dividend yield is 11.46%. However, management also declared another $.05/share supplemental dividend, which adds an additional 1.10% to the mix, bringing the total yield to 12.56%.

As for those supplemental dividends, management intends to keep them coming, taking advantage of higher interest rates:

“It is our intent to distribute supplemental dividends for the foreseeable future while base rates remain materially above long-term historical averages.” (CSWC site)

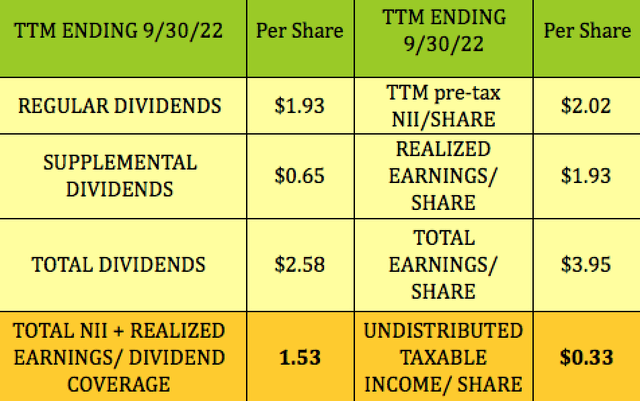

For the 4 trailing quarters ending 9/30/22, CSWC covered its $1.93 in regular dividends via $2.03 in NII/share, a factor of ~1.05X.

Adding in the supplemental Dividends brings the total to $2.58, which was covered by a combo of NII and Realized Earnings/Share of $3.95, for a total coverage factor of 1.53X. Management estimates that CSWC had an Undistributed Income/Share balance of $0.33 as of 9/30/22:

Profitability & Leverage:

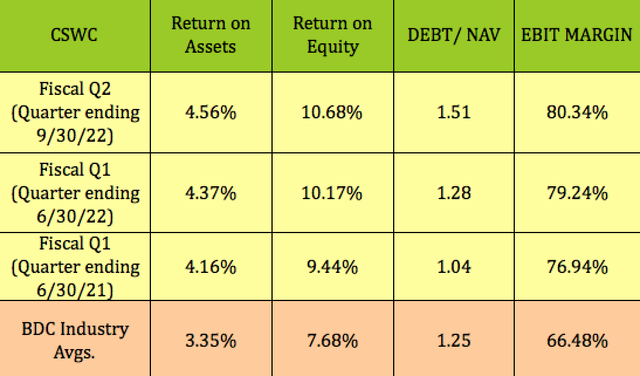

ROA, ROE, and EBIT Margin all improved marginally in the latest quarter, and remained above BDC industry averages. Management increased leverage to 1.51X in order to grow the portfolio, which is a common practice in the BDC industry.

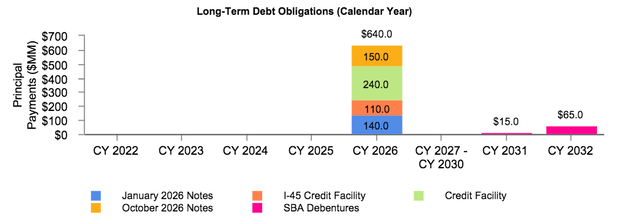

Debt:

CSWC has no debt maturing until calendar year 2026. Hmmm, will rates be lower when they refinance, say in 2024-2025? Could very well be.

Analysts’ Estimates & Targets:

As detailed above, CSWC had a very good quarter ending 9/30/22, but check this out:

We noticed a headline saying “CSWC misses Q2 Earnings Estimates.”

We say balderdash to that headline, and we’ll add an extra harrumph for good measure!

Most of you probably already realize this, but for those who don’t, do take analysts’ earnings estimates with a very large grain of salt. Just look at Apple’s supposed “beats” and “misses” for verification.

Imagine a scenario in which you chat with an outsider about your company’s prospects and financials, and they go away and make a guesstimate of how much you’re going to earn in your upcoming quarter. That’s a lot to ask of someone who’s not privy to all of the inner workings of your company, isn’t it?

So, when the outsider screws up and over-estimates your company’s quarterly earnings, you’d expect him to get canned or face some other suitable punishment, (fill in the blank).

Not on Wall St. – which finds that your company has “missed” earnings estimates, and promptly discounts your price/share.

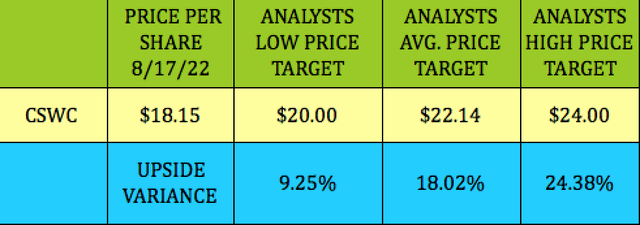

Well, for better or worse, there are also analysts’ price targets, which are used to give some idea of how high or low the street thinks your company’s price/share can go.

At $18.15, CSWC is 9% below the lowest price target of $20.00, and 18% below the $22.14 average price target.

Valuations:

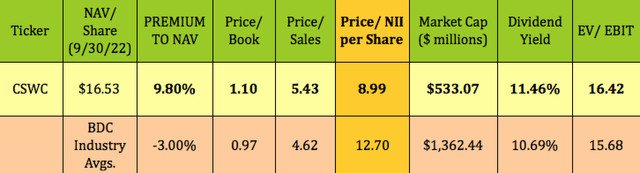

At its 12/2/22 price of $18.15, CSWC is priced at a 9.8% premium to its $16.53 NAV/Share, vs. a 3% BDC industry average discount to NAV.

That may sound like CSWC is overpriced vs. its industry, but, this current pricing is just about the lowest premium to NAV that CSWC has had in 2021-2022, when its P/NAV has been as high as 1.60-plus.

A more appropriate way of valuing it would be to look at its earnings multiple, Price/ Net Investment Income per Share, or P/NII. With a P/NII of 8.99X, CSWC is actually undervalued vs. broad industry averages.

Parting Thoughts:

With an underpriced earnings multiple, one of the highest dividend growth rates in its industry, a well-covered attractive dividend yield, and management’s intent to keep paying supplemental dividends, we rate Capital Southwest a BUY.

If you’re interested in other high yield vehicles, we cover them every weekend in our articles. All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment