KentWeakley

Most investors think that rental properties are more rewarding investments than real estate investment trusts (“REITs”) (VNQ). They think that this is the case because:

- You can buy rental properties with debt.

- You don’t need to pay managers.

- You may enjoy tax benefits from depreciation.

- The yield is typically higher.

- And after all, you are putting in a lot of work and taking more risks, so naturally, you would expect to earn higher returns.

And yet, the reality is the opposite.

Many studies have been conducted on this topic, and they all say that REITs are more rewarding than rental properties or even private equity real estate funds such as those managed by firms like Brookfield (BAM) and Blackstone (BX).

Here are the results of three of those studies:

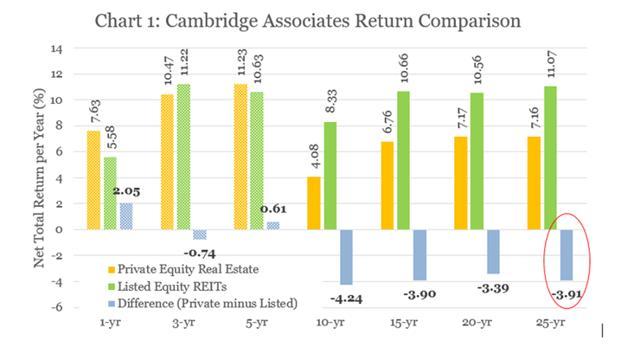

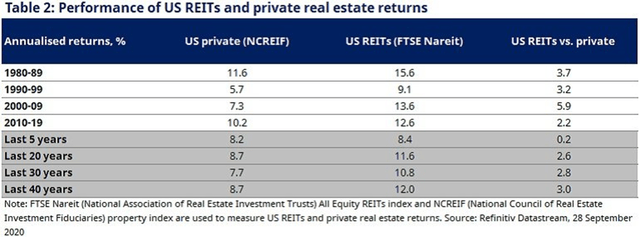

Study 1: REITs outperform by ~4%:

EPRA

Study 2: REITs outperform by ~4%:

Cambridge

Study 3: REITs outperform by ~3%:

How could this be?

The results seem so improbable that most people won’t seek to understand them. Rental investors are especially quick to dismiss the results because they would hate to admit that all their hard work might have gone to waste.

But in today’s article, I will explain to you why these results are actually logical and expected. In fact, I would say that it would illogical if REITs didn’t outperform rental properties.

Here are 10 reasons why:

Reason #1: REITs have better access to capital

Let’s start by correcting a big misconception about REITs, which is that you cannot use leverage when investing in them.

Rental investors think that they can earn higher returns because they can use a mortgage to leverage their equity. But what they ignore is that REITs are doing exactly the same thing and you enjoy the same benefits as shareholders.

What’s traded on the stock market is the “equity value”, not the total asset value. This is why it is volatile. It is leveraged by additional debt that REITs use to make their real estate investments.

As such, you enjoy the same benefits of leverage, but REITs are typically able to get lower interest rates and better terms such as longer interest-only periods. Moreover, REITs can also access many other sources of capital to leverage your capital further in a risk-mitigated way. As an example, they may leverage your common equity with additional preferred equity that has no maturity and does not share the upside. It may also use convertible debt, issue bonds, foreign debt, and many other forms of capital to optimize its cost and mitigate its risks. To give you an example: EPR Properties (EPR) uses debt to boost returns, but it also has some preferred equity on its balance sheet (EPR.PE; EPR.PG) to leverage its equity even further.

As a rental investor, you have much worse access to capital. Your options are more limited and lenders won’t give you the same preferential terms since you are a much riskier borrower to them.

REITs share these benefits with you, resulting in higher returns, and best of all, it also reduces risks since you are not actually signing on any of the loans and aren’t personally liable for them.

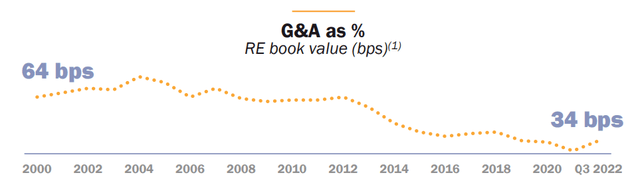

Reason #2: The management of REITs is extremely cost-efficient

Another big misconception is that REITs must generate lower returns because greedy managers take big salaries.

But the reality is the opposite.

Yes, good REIT managers get paid handsomely, but this is well-deserved given that REITs hire the best talent in the real estate world, and the management cost remains a lot lower than that of rental properties because REITs enjoy significant economies of scale.

To give you an example, the management cost of Realty Income (O) is just 0.3% of total assets each year. It is so low because they own thousands of properties:

Compare that to a rental property:

Managing it yourself would be very expensive because you are not a professional and your time is valuable. This is real work and you could use your time to work another job so you cannot ignore the opportunity cost. Assuming your time is worth $30 per hour and you end up spending 3 hours per week on average each year on your rental, then that’s $90 per week and $360 per month. (Some weeks you will work more than 3 hours, and some weeks you will spend no time at all. This is an average that includes also the time spent to find the property, negotiate it, finance it, remodel it, etc.)

If your property’s net operating is $1,000 per month, it means that 36% of it wasted in management cost. Most rental investors won’t even consider this cost, assuming that their time has no value, but that’s just lying to yourself.

The other option is to hire a property manager, who will typically cost you 8-12% of the gross revenue – or 15-20% of the NOI. That’s more cost-efficient and will save you many headaches but the issue with property managers is that their interests are completely different from yours since their business makes money by getting as many properties under management as possible and spending as little time as possible on each of them.

This means that the tenants will likely be poorly screened. Maintenance costs will go up. And your overall returns will suffer from poorer management in many cases.

Reason #3: REITs enjoy huge economies of scale also on other levels

And importantly, REITs are not just cost-efficient on the management level.

They also make significant savings on all other levels thanks to their scale.

This includes brokerage, maintenance, insurance, property taxes, etc.

To give you an example: if Mid-America Apartment (MAA) has a deal with a contractor to change 500 carpets in a specific region each year, it will get a far better deal than you for a single carpet.

Similarly, a REIT like Invitation Homes (INVH) will have its own legal team in-house, allowing it to battle increases in property taxes to lower its overall cost.

The same applies to all other costs. Real estate is a low-margin business and scale matters to improve returns.

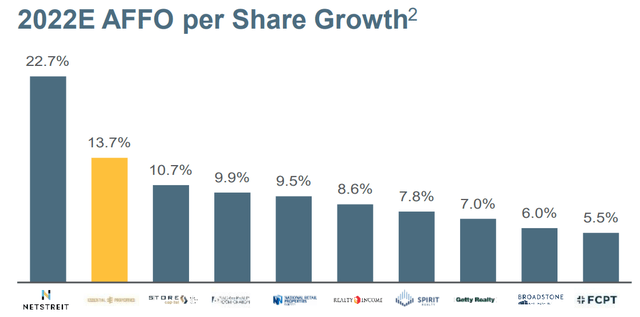

Reason #4: REITs can do spread investing to supplement their organic growth

Rental property investors are limited to rent increases to grow their cash flow.

REITs aren’t.

Because they are publicly traded, they can always raise more equity to buy additional properties.

Investors will often falsely think that this is dilutive, but that’s not the case. In most cases, capital raises are accretive, which is the opposite of dilutive. It means that it grows the cash flow “on a per share” basis.

That’s because REITs will typically raise equity if their average cost of capital is inferior to the expected return of their targeted investment.

To give you an example: Essential Properties Realty Trust (EPRT) might have an average cost of capital of 5% (equity + debt), but it is buying properties at a 7% cap rate and the rents of these properties are growing. As such, there is a 200 basis point spread to be earned as it raises capital to buy more properties. This is how it is able to grow its FFO per share by 12%, despite only having 1.5% rent increases in its leases:

This is the main reason why REITs like EPRT are so rewarding when compared to what most private investors are earning when buying the same properties.

To give you another example: Realty Income has historically earned 15% average annual returns by buying Class A net lease properties and using little debt. Typically, private investors would be happy to earn half of that. Realty Income has been so much more rewarding thanks to spread investing.

Reason #5: REITs are able to develop their own properties

REITs are active real estate investment firms, not just passive landlords.

This means that they will seek to earn higher returns by doing things like redeveloping existing properties or even building new ones from the ground up.

AvalonBay (AVB) is developing new apartment communities at a 6-7% yield, but these properties are worth a ~4% cap rate when stabilized. This means that it earns a >50% higher yields by building its own communities. It also creates a lot of value and then owns new communities with limited capex as well.

Most rental investors are buying old properties with more capex and aren’t able to add as much value.

Reason #6: REITs can skip brokers and do sale-and-leaseback transactions

The transaction cost of buying and selling a property can be very significant and it eats into your returns. The brokerage fee alone can be around 5% when buying or selling a rental property.

REITs will often bypass these expenses by buying properties directly from their owners. REITs have their own teams of brokers and business development partners that will directly approach owners and offer sale-and-leaseback transactions.

It allows them to skip brokerage fees, and also allows them to structure their own leases to improve their risk-to-reward with longer lease terms, steady rent hikes, greater capex burden on the tenant, etc.

Reason #7: REITs can enter additional real estate-related business

In addition to all of that, REITs may also offer additional services to other investors to earn extra fees, which then ultimately result in higher returns for the shareholders of the REIT.

To give you a few examples:

Armada Hoffler (AHH) develops a lot of properties for itself and it also provides construction services to other investors in exchange for fees.

SL Green (SLG) structures JVs and sells equity interest to other investors and then earns fees for managing those investments.

Farmland Partners (FPI) has a farmland brokerage and auctioning business, earning it fees as well.

Rental investors miss out on these additional profits.

Reason #8: REITs have access to the best talent and do a better job of aligning interests

REITs have the scale and resources to hire the best talent and pay them handsomely.

They are also very good at aligning interests by forcing executives to invest in their stock and tying up their pay to performance metrics such as the growth of FFO per share and total returns.

Not surprisingly, having the best talent working for you and being motivated to drive performance will result in higher returns over time.

Reason #9: REITs are highly taxed efficient

Investors commonly think that rental properties are more tax efficient than REITs, but that is not necessarily the case.

In my case, I actually pay less taxes investing in REITs.

The tax efficiency of rental properties is commonly overstated because investors forget that depreciation isn’t a gift. It is just a tax deferment tool. You may not pay taxes today, but it lowers the cost basis of your property, which will hurt you later when you sell the property, or if you refuse to sell, then it will hurt you by forcing you to remain invested in real estate, whether it is a good investment or not.

On the other hand, the tax efficiency of REITs is commonly underappreciated. Here’s why REITs are very tax efficient:

- They don’t pay any corporate taxes.

- They retain 30-50% of their cash flow to reinvest in growth, and that part of the cash flow is not taxed.

- A portion of the dividend is typically classified as return of capital, which is taxed deferred. BSR REIT (OTCPK:BSRTF) only makes such payments as an example.

- The portion that’s taxed enjoys an additional 20% deduction.

- Most of the returns from REITs come from appreciation, not income, and the appreciation is tax deferred. REITs generate more returns from growth because they retain cash flow (explains the lower yield) and they invest in higher growth assets, development projects, and other real estate-related businesses.

- Finally, you can also put your REITs in a tax-deferred account.

Ultimately, REITs are often more tax efficient, resulting in more compounding over time.

Reason #10: REITs are able to invest in more rewarding specialty property sectors

REITs aren’t just investing in single-family homes like most rental property investors. There are times when single-family homes become pricey and aren’t worth buying. This is the case today in my opinion.

But only a few out of 200+ REITs actually invest in single-family homes.

Most of them invest in higher-growth property sectors like apartment communities, e-commerce warehouses, farmland, data centers, or even cell towers. That’s how REITs like Public Storage (PSA) and American Tower (AMT) have managed to generate 15%+ annual total returns.

Bonus Reason: REITs are today discounted relative to their net asset value

Especially today, REITs are much better investments and should generate far higher returns going forward because they are historically undervalued relative to private properties.

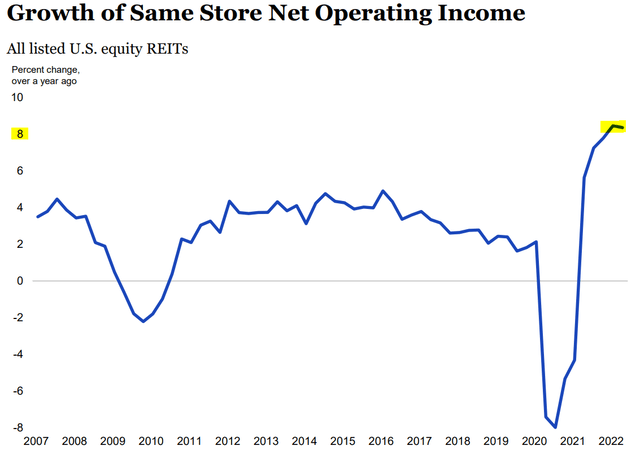

REITs have been unfairly beaten down in 2022, dropping by nearly 30% on average along with the rest of the stock market (SPY). The market reacted this way because it fears rising interest rates, but it appears to have ignored that REIT balance sheets are today the strongest ever, with just 35% LTVs and long debt maturities are nearly 10 years. Therefore, the impact of rate hikes won’t be significant for years to come and yet, the rents of REITs are today growing the fastest in years because they benefit from inflation:

As a result, about 2/3 of REITs actually hiked their full-year guidance in the last quarter. They are generating more cash flow than ever, hiking dividends, and their growth outlook remains strong, and yet, many REITs are now priced at just 50 cents on the dollar.

To give you an example again: BSR REIT owns rapidly growing Texan apartment communities that enjoyed near 10% same property NOI growth in the last quarter, and yet, its shares are today priced at a ~40% discount relative to the value of its assets, net of debt.

This gives them the opportunity to grow their value by buying back shares at depressed levels and REIT investors can expect 50-100% upside potential as the share price eventually recovers closer to fair value. That’s on top of the returns that the REIT will generate through the ownership of its properties. Rental investors cannot compete with that.

Here is one of the communities that they own:

BSR REIT

Bottom line

REITs have historically been more rewarding investments than rental properties and this is expected given that:

- #1: REITs have better access to capital

- #2: The management of REITs is extremely cost-efficient

- #3: REITs enjoy huge economies of scale also on other levels

- #4: REITs can do spread investing to grow faster

- #5: REITs are able to develop their own properties

- #6: REITs can skip brokers and do sale-and-leaseback transactions

- #7: REITs can enter additional real estate-related business

- #8: REITs have access to the best talent

- #9: REITs are highly taxed efficient

- #10: REITs are able to invest in more rewarding property sectors

- Bonus Reason: REITs are today discounted relative to their net asset value.

Some rental investors may claim that they are able to earn far higher returns, but from my experience, they are simply miscalculating their returns by ignoring the value of their own time and work in most cases.

Several independent studies prove that REITs are more rewarding, and they are also safer, and passive. Especially today, I think that they are far better investments given that they are heavily discounted. That’s why most of my real estate investments are today in REITs.

Be the first to comment