bmcent1

Investment Thesis

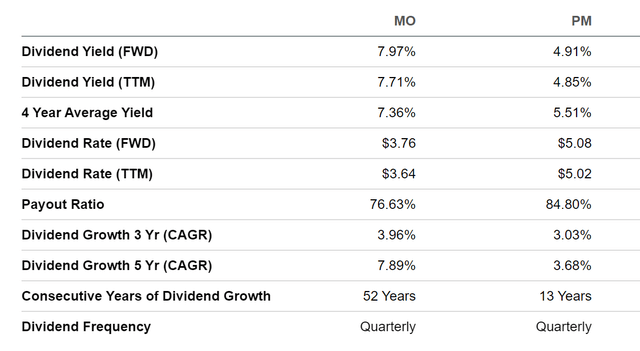

Dividend income stocks provide an excellent opportunity for investors to generate an additional income when investing on a long-term basis. In today’s comparative analysis, I will analyze which of the tobacco product manufacturers Altria (NYSE:MO) and Philip Morris (NYSE:PM) I consider to be the more attractive choice to provide you with additional income in the form of dividends. Both companies receive my buy rating. However, if I were to only choose one out of the two companies, I would select Altria: among other factors, my decision is based on its higher Dividend Yield (7.97% as compared to Philip Morris’ 4.91%) and lower Dividend Payout Ratio (76.63% and 84.80%). In addition to that, Altria shows a higher Dividend Growth Rate [CAGR] over the last 5 years (7.89% in comparison to 3.68% for Philip Morris). All of these numbers lead me to the conclusion that Altria is the slightly more attractive prospect for dividend income investors that, at the same time, are seeking dividend growth in order to successfully build a long-term investment portfolio.

The Competitive Advantages of Altria and Philip Morris

With a market capitalization of $160.41B and $84.57B respectively, Philip Morris and Altria are among the world’s largest tobacco product manufacturers.

Both companies dispose of a wide economic moat: this is based in particular on the fact that tobacco product manufacturers have strong advertising limitations when it comes to promoting their products. However, the brand image that these companies have built over the past decades is still anchored in people’s minds (Marlboro’s brand value for example, is estimated to be $36,278M and is listed as the 42nd most valuable brand in the world).

However, for new entrants it would be very hard to succeed in building up their own brand image due to these advertising limitations. Therefore, this wide economic moat makes tobacco manufacturers attractive from an investor’s point of view.

Tobacco manufacturers are countering the fact that smoking is tending to decline with annual price increases for their products (the smoking population of U.S. adults has decreased from 21% in 2005 to 13%). According to a study that was published this year in JAMA, the annual number of cigarette packs that were sold, decreased from 12.5B in 2015 to 9.1B in 2021 (implying a decrease of 27.2%). However, prices were raised by 29.5% over the same time period (from $5.57 per pack in 2015 to $7.22 in 2021). This price increase enables tobacco product manufacturers to raise their revenue and profits despite a decreasing demand for their products.

The fact that both Altria and Philip Morris dispose of strong competitive advantages and a wide economic moat is supported by Altria’s high EBIT Margin of 59.01% while Philip Morris’ is 39.43%.

The Valuation of Altria and Philip Morris

Discounted Cash Flow [DCF]-Model

I have used the DCF Model to determine the intrinsic value of both Altria and Philip Morris. The method calculates a fair value of $51.75 for Altria and $112.41 for Philip Morris. For Altria, I have assumed a Revenue and EBIT Growth Rate of 1.5% for the following 5 years and a Perpetual Growth Rate of 1.5% afterwards. For Philip Morris, I assumed a Revenue and EBIT Growth Rate of 2.5% for the next 5 years and a Perpetual Growth Rate of 2.5% afterwards.

At the current stock prices, this gives Altria an upside of 10.1% and 9.1% for Philip Morris.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

Altria |

Philip Morris |

|

|

Company Ticker |

MO |

PM |

|

Revenue Growth Rate for the next 5 years |

1.5% |

2.5% |

|

EBIT Growth Rate for the next 5 years |

1.5% |

2.5% |

|

Tax Rate |

35.3% |

21.8% |

|

Discount Rate [WACC] |

7.75% |

8.00% |

|

Perpetual Growth Rate |

1.5% |

2.5% |

|

EV/EBITDA Multiple |

7.9x |

13.1x |

|

Current Price/Share |

$47.00 |

$103.00 |

|

Shares Outstanding |

1,792 |

1,550 |

|

Debt |

$26,291 |

$27,305 |

|

Cash |

$2,483 |

$5,560 |

|

Capex |

$214 |

$1,019 |

Source: The Author

Based on the above, I have calculated the following results:

Market Value vs. Intrinsic Value

|

MO |

PM |

|

|

Market Value |

$47.00 |

$103.00 |

|

Upside |

10.1% |

9.1% |

|

Intrinsic Value |

$51.75 |

$112.41 |

Source: The Author

Internal Rate of Return for Altria

Below you can find the Internal Rate of Return as according to my DCF Model (when assuming different purchase prices for the Altria stock).

At Altria’s current stock price of $47, my DCF Model indicates an Internal Rate of Return of approximately 10% (when assuming a Revenue and EBIT Growth Rate of 1.5% for the coming 5 years and a Perpetual Growth Rate of 1.5% afterwards). (In bold you can see the Internal Rate of Return for Altria’s current stock price of $47.)

|

Purchase Price of the Altria Stock |

Internal Rate of Return as according to my DCF Model |

|

$37.50 |

15% |

|

$40.00 |

14% |

|

$42.50 |

12% |

|

$45.00 |

11% |

|

$47.00 |

10% |

|

$50.00 |

9% |

|

$52.50 |

7% |

|

$55.00 |

6% |

|

$57.50 |

5% |

Source: The Author

Please be aware of the fact that the Internal Rates of Return above are a result of the calculations of my DCF Model and changing its assumptions could result in different outcomes.

Internal Rate of Return for Philip Morris

At Philip Morris’ current stock price of $103, my DCF Model indicates an Internal Rate of Return of approximately 10% for the company when assuming a Revenue and EBIT Growth Rate of 2.5% and a Perpetual Growth Rate of 2.5% afterwards. (In bold you can see the Internal Rate of Return for Philip Morris’ current stock price of $103.)

|

Purchase Price of the Ford Stock |

Internal Rate of Return as according to my DCF Model |

|

$85.00 |

15% |

|

$90.00 |

14% |

|

$95.00 |

12% |

|

$100.00 |

11% |

|

$103.00 |

10% |

|

$105.00 |

10% |

|

$110.00 |

9% |

|

$115.00 |

7% |

|

$120.00 |

6% |

Source: The Author

Fundamentals: Altria in comparison to Philip Morris

At this moment of writing, Philip Morris has a significantly higher market capitalization ($160.41B) than Altria ($84.57B).

Altria’s P/E GAAP [FWD] Ratio of 15.01 is lower than the one of Philip Morris (18.69), indicating that Altria is more attractive than its competitor when it comes to Valuation.

Even though Philip Morris shows a higher Revenue Growth Rate [CAGR] over the last 5 Years (2.95% as compared to the 1.18% of Altria), Altria has shown a slightly higher EBIT Growth Rate [CAGR] over the past 3 Years (4.98% compared to Philip Morris’ of 4.68%).

When looking at the companies’ Dividend Yield, Altria seems to be slightly more attractive: at the time of writing, Altria has a Dividend Yield [FWD] of 7.97% while Philip Morris’ is only 4.91%. In addition to that, Altria’s Payout Ratio of 76.64% is slightly lower than the one of Philip Morris (84.80%), indicating that Altria has more scope for dividend enhancements. Furthermore, Altria shows a higher Dividend Growth Rate [CAGR] over the past 3 Years (3.96% compared to 3.03%) and a higher Dividend Growth Rate [CAGR] over the last 5 Years (7.89% in comparison to 3.68%).

In addition to the above, Altria has shown 52 Consecutive Years of Dividend Growth while Philip Morris has shown the same over 13 years.

All of these factors support my theory that Altria is the more appealing choice for dividend income investors and strengthens my opinion to select the company over Philip Morris. Below you can find some additional data on both companies’ Dividend.

In addition to the above, you can also find an overview of the Fundamental Data for both companies.

|

Altria |

Philip Morris |

||

|

General Information |

Ticker |

MO |

PM |

|

Sector |

Consumer Staples |

Consumer Staples |

|

|

Industry |

Tobacco |

Tobacco |

|

|

Market Cap |

$84.57B |

$160.41B |

|

|

Profitability |

EBIT Margin |

59.01% |

39.43% |

|

ROE |

NM |

NM |

|

|

Valuation |

P/E GAAP [FWD] |

15.01 |

18.69 |

|

Growth |

Revenue Growth 3 Year [CAGR] |

1.51% |

2.34% |

|

Revenue Growth 5 Year [CAGR] |

1.18% |

2.95% |

|

|

EBIT Growth 3 Year [CAGR] |

4.98% |

4.68% |

|

|

EPS Growth Diluted [FWD] |

4.70% |

3.47% |

|

|

Income Statement |

Revenue |

20.69B |

31.71B |

|

EBITDA |

12.43B |

13.68B |

|

|

Balance Sheet |

Total Debt to Equity Ratio |

NM |

NM |

Source: Seeking Alpha

Projection of the Companies’ Yield on Cost

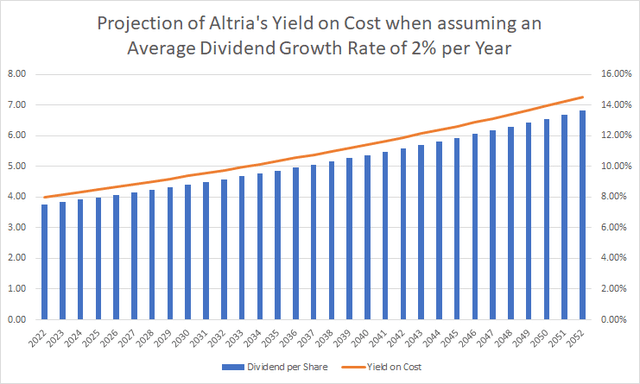

Below is a projection for Altria’s Yield on Cost when assuming an Average Dividend Growth Rate of 2% in the following 30 years. You can see that you could reach a Yield on Cost of 9.75% in 2032, 11.89% in 2042 and 14.49% in 2052 when assuming a Dividend Growth Rate of 2% for the company.

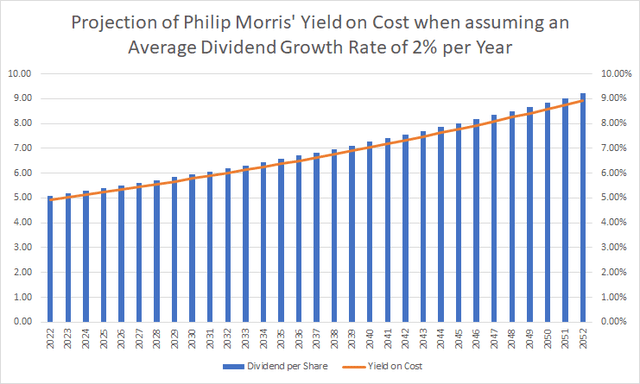

Below you can find the same projection for an investment in Philip Morris when assuming an Average Dividend Growth Rate of 2% for the company over the coming 30 years. You could reach a Yield on Cost of 6.01% in 2032, 7.33% in 2042 and 8.93% in 2052.

These assumptions of the companies’ Dividend Growth Rates are very conservative; but the examples underline that Altria can be considered the more attractive choice for dividend income investors when aiming to invest with a long investment horizon. When assuming the same Dividend Growth Rate of 2% for both companies, you could expect a Yield on Cost of 14.49% for Altria in 2052 and one of 8.93% for Philip Morris in the same year. This example once again strengthens my opinion to select Altria over Philip Morris.

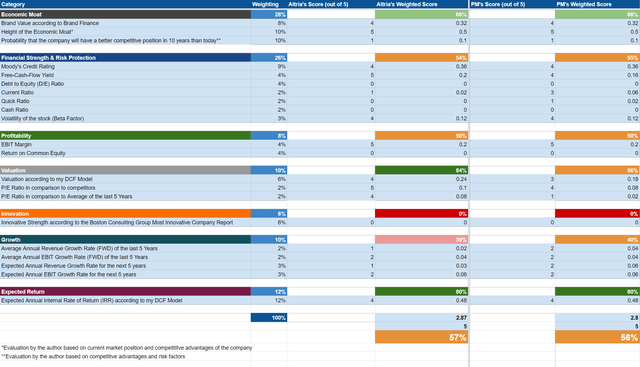

The High-Quality Company [HQC] Scorecard

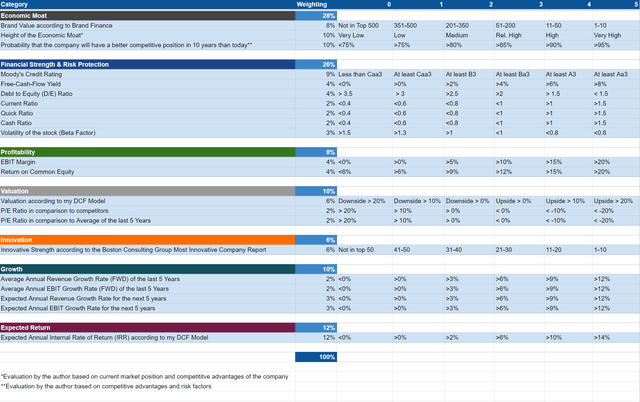

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

Altria and Philip Morris According to the HQC Scorecard

According to the HQC Scorecard, both Altria and Philip Morris are rated as moderately attractive in terms of risk and reward: while Altria receives 57/100 points, Philip Morris gets 56/100.

Both companies show attractive results when it comes to Economic Moat (both receive 66/100 points). In terms of Financial Strength, Altria scores 54/100 points while Philip Morris gets 55/100.

In terms of Valuation, Altria is ahead of Philip Morris: Altria receives 84/100 points, while Philip Morris only gets 56/100 in this category.

However, when it comes to Growth, Philip Morris is slightly ahead: while Altria only receives 30/100 points, Philip Morris scores 40/100.

For Expected Return, both companies receive a very attractive rating (80/100 points).

The fact that Altria is rated slightly ahead of Philip Morris further supports my investment thesis to currently select the company over its competitor.

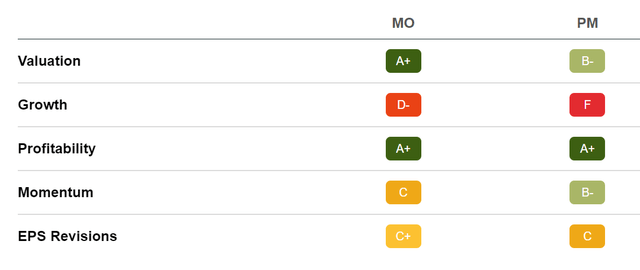

Altria vs. Philip Morris according to the Seeking Alpha Factor Grades

When considering the Seeking Alpha Factor Grades, we see that Altria is slightly more attractive when it comes to Valuation (A+ rating) in comparison to Philip Morris (B- rating). In terms of Growth, Altria is also rated higher: the company is rated with a D- while Philip Morris gets an F. For Profitability, both companies receive a very attractive A+ rating. The Seeking Alpha Factor Grades reinforce my theory to rate Altria over Philip Morris at this moment in time.

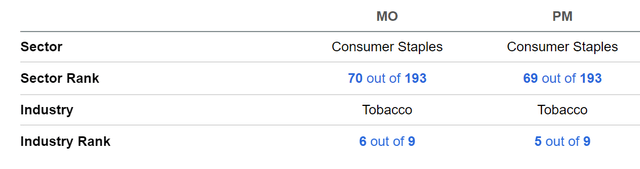

Altria and Philip Morris according to the Seeking Alpha Quant Ranking

Considering the Seeking Alpha Quant Ranking, both companies show similar results: Altria is ranked 70th within the Consumer Staples Sector while Philip Morris is ranked 69th (both out of 193). Within the Tobacco Industry, Altria is ranked 6th while Philip Morris is 5th out of 9.

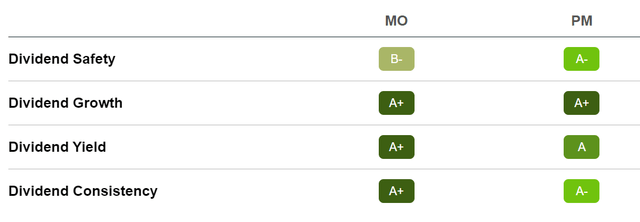

Altria and Philip Morris according to the Seeking Alpha Dividend Grades

The theory that Altria is the more attractive choice for dividend income and dividend growth investors is underlined by the rating of the Seeking Alpha Dividend Grades: Altria receives an A+ rating in terms of Dividend Yield (while Philip Morris gets an A) and an A+ rating for Dividend Consistency (Philip Morris receives an A- rating). For Dividend Growth, both companies score an A+.

Risks

Several factors underline my theory that an investment in Altria comes along with slightly less risk compared to Philip Morris.

At this moment in time, Altria offers a dividend yield of 7.97%. If we were to assume that the company would increase the dividend yield by 2% per year, investors would get back 107.30% of their initial investment in the form of dividends after 11 years (without taking withholding tax into account). In the case of Philip Morris, at the current dividend yield of 4.91%, it would take until 2039 for an investor to get their invested capital back in the form of dividends (with the same assumption of an average dividend growth of 2% per year).

The fact that Altria has a lower Payout Ratio (76.63% compared to 84.80% of Philip Morris) is an additional indicator that the risk of an investment in the company is lower than with Philip Morris: the higher the Payout Ratio of a company, the more likely that it will be forced to cut its dividend in the future. This can be the case if the dividend per share can no longer be covered by the company’s earnings per share. As a result, a dividend cut would increase the risk of the share price dropping significantly.

Altria’s Free Cash Flow of 9.65% is higher than that of Philip Morris (6.70%), which can be interpreted as an additional indicator that the risk of investing in the company is lower.

Furthermore, Altria’s EBIT Margin of 59.01% serves as an additional indicator to support this theory (Philip Morris has an EBIT Margin of 39.43%). A higher EBIT Margin shows that a company is better prepared for a possible recession.

Altria’s lower P/E [FWD] Ratio of 15.01 can also be interpreted as an indicator demonstrating that an investment in the company comes with less risks attached. This is based on the fact that in Philip Morris’ stock price, higher growth expectations are priced in (the company shows a P/E [FWD] Ratio of 18.69).

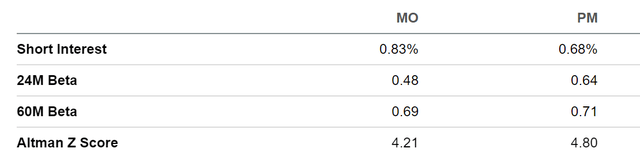

An additional number that shows us that an investment in Altria is slightly less risky is its 24M Beta of 0.48 (Philip Morris’ is 0.64) and the company’s 60M Beta of 0.69 (while Philip Morris’ is 0.71). The companies’ low Beta numbers demonstrate that its stocks are less volatile than the broad stock market.

The Bottom Line

In my opinion, companies that pay its shareholders a relatively high Dividend Yield and at the same time, offer the perspective of raising its dividend in the foreseeable future, offer investors an excellent opportunity to gain an additional income in the form of dividends while having a long investment-horizon. At the same time, these companies provide investors with the chance to reach a high Yield on Cost when investing over the long-term.

Two of the companies that fulfill these characteristics are Altria and Philip Morris: both have strong competitive advantages and dispose of a wide economic moat. However, I consider Altria to currently be the slightly more attractive option. For this reason, I would select Altria out of the two companies.

My decision is mainly based on the fact that Altria offers a slightly higher Dividend Yield (7.97% as compared to 4.91% of Philip Morris) and has a slightly lower Dividend Payout Ratio (76.63% compared to 84.80%), giving the company more room for future dividend enhancements. In addition to that, Altria shows a higher Dividend Growth Rate [CAGR] over the last 5 years (7.89% compared to 3.68%). All of these are indicators that strengthen my belief to select Altria over Philip Morris.

This analysis should not only help you identify which of the two companies currently represents the more attractive choice, but also show you the excellent opportunities provided by companies that already pay an attractive dividend and at the same time, might still be able to increase it over time. By identifying and investing in these types of companies, you can focus on the dividend you will receive over time. Perhaps, focusing on the dividend will even help you sleep better at night, as you’ll care less about the stock price of the company you have invested in.

Author’s Note: Thank you very much for reading and for providing any feedback on this analysis!

Be the first to comment