NeilLockhart

Just over eight months ago, I wrote on Franco-Nevada (NYSE:FNV), noting that while the company had a record year and a solid organic growth profile, there wasn’t any way to justify chasing the stock above $155.00 in mid-March. This is because the stock was trading at over 2.5x P/NAV, leaving little room for upside, and it had limited margin of safety, especially if we see a pullback in precious metals. Since then, Franco-Nevada has outperformed the Gold Miners (GDX) Index by 2000 basis points but has slid 13% from its highs, with its energy business unable to completely offset the softness in precious metals prices (gold, silver, platinum, and palladium). Let’s take a look at its recent results below:

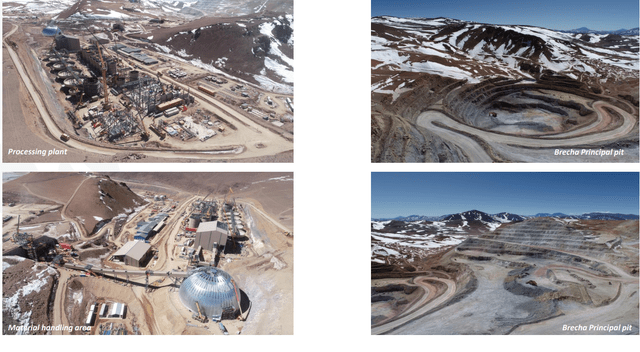

Salares Norte Construction (Franco-Nevada 2% NSR) (Gold Fields Presentation)

Q3 Results

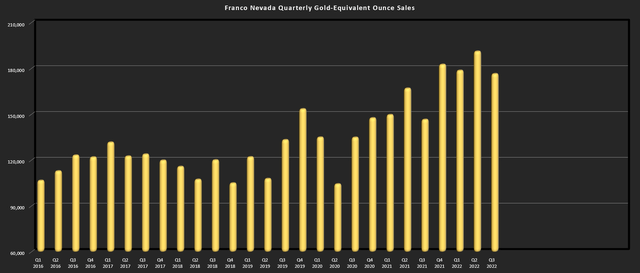

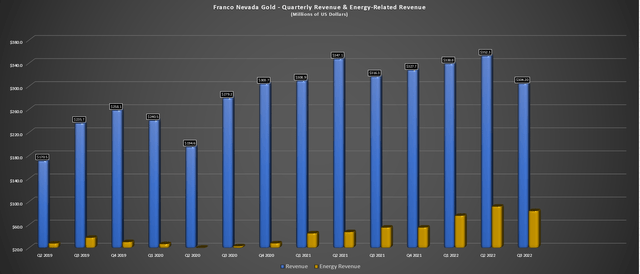

Franco-Nevada released its Q3 results this month, reporting quarterly sales of ~176,400 gold-equivalent ounces [GEOs], translating to revenue of $304.2 million. This translated to a 1% decline in GEO sales from the year-ago period and a 6% decline in precious metals GEOs, which fell to ~120,500 GEOs in Q3 2022 vs. ~127,700 in Q3 2021. Given the lower GEO sales combined with a sharp decline in the prices of gold and silver, Franco-Nevada saw a 4% hit to revenue despite a phenomenal year for its energy portfolio. In fact, energy-related revenue came in at $83.8 million, a 52% increase year-over-year ($83.8 million vs. $55.1 million).

Franco-Nevada – Quarterly GEO Sales (Company Filings, Author’s Chart)

Digging into its precious metals portfolio, Franco-Nevada saw lower GEOs from Guadalupe-Palmarejo (less production from royalty ground), Antamina (lower gold/silver ratio and lower silver production), and Stillwater. Franco-Nevada’s Stillwater royalty contribution saw a significant drop on a year-over-year basis (~3,200 GEOs vs. ~8,000 GEOs), impacted by a less favorable PGM/gold ratio and the temporary suspension of operations following the flooding in June. In addition, the company announced a strategic revision of its PGM operations in the United States due to a changing macro environment, changing palladium market conditions, and ongoing operational constraints.

The result of these extreme weather events and skill shortages is that PGM production is expected to be 150,000 ounces lower vs. its previous outlook by 2027 (700,000 PGM ounces vs. 850,000 ounces). This is a negative development for Franco-Nevada, given that this is a significant contributor, with $57.8 million in revenue from the asset in FY2021. Meanwhile, Franco-Nevada also saw lower production from Cobre Panama in Q3, contributing ~26,400 GEOs, down from ~29,900 GEOs in the year-ago period. That said, this was strictly related to the timing of deliveries (7,000+ GEOs missed), which would have otherwise resulted in an increased contribution on a year-over-year basis. In fact, First Quantum (OTCPK:FQVLF) had a record quarter of production at Cobre Panama, with 92,000 tonnes of copper produced.

Finally, Franco-Nevada also saw lower GEOs from Antamina (~9,100 vs. ~13,800) due to lower silver production and a lower gold/silver ratio vs. the year-ago period, and its Vale royalty contributed significantly less, partially due to lower iron ore prices. Fortunately, despite these sharp declines in contribution across the portfolio from these assets, Cobre Panama will boost Q4 production with higher deliveries and the company remains on track to meet its FY2022 of 680,000 to 740,000 GEOs, with ~546,100 GEOs produced year-to-date, tracking slightly ahead of last year’s levels. In fact, we should see Franco-Nevada come in near the upper end of guidance above 720,000 GEOs for the year.

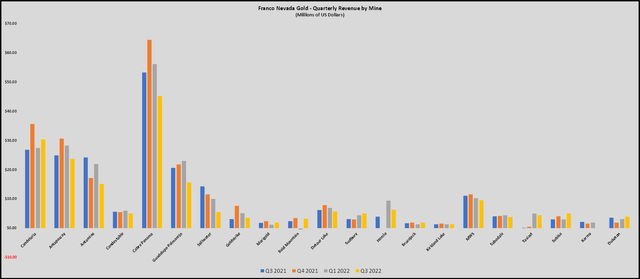

Franco-Nevada – Quarterly Revenue by Mine (Company Filings, Author’s Chart)

From a positive standpoint, Franco-Nevada saw much higher production from Candelaria related to improved head grades and a significant recovery in GEOs from its Tasiast royalty with easy year-over-year comps due to last year’s mill fire. Elsewhere, the company saw higher revenue from Hemlo, Subika, and Goldstrike. However, the major improvement was in its energy portfolio, as noted earlier, with energy revenue soaring to $83.3 million, with significant increases in revenue at Marcellus (higher NGL and natural gas prices), Haynesville (higher natural gas prices), and SCOOP/STACK was a major contributor (revenue of $16.2 million vs. $8.4 million). This benefit from higher energy prices (WTI price: $91.56/barrel vs. $7.52/barrel & Henry Hub: $7.91/mcf vs. $4.32/mcf) mostly offset softness elsewhere in the portfolio.

Franco-Nevada – Quarterly Revenue & Energy-Related Revenue (Company Filings, Author’s Chart)

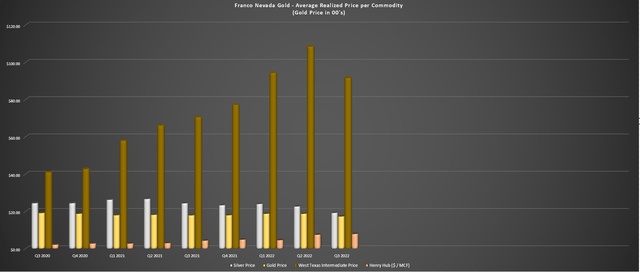

Looking at average realized prices in the quarter, we can see that silver prices were down sharply year-over-year ($19.22 vs. $24.36/oz), and gold prices also fell by over 3% to $1,728/oz vs. $1,789/oz. Meanwhile, platinum and palladium prices fell by 13.5% and 15.7%, respectively. Lastly, iron ore prices fell 45% in the period ($105/tonne vs. $191/tonne). This was offset by high double-digit increases in energy prices, but wasn’t quite enough to overcome the lower sales prices in the larger portion of Franco-Nevada’s business. That said, when it comes to things that Franco-Nevada can control, the company continues to build on its portfolio nicely with a few new royalty/streaming acquisitions this year. Let’s take a closer look:

Franco-Nevada – Average Realized Price Per Commodity (Company Filings, Author’s Chart)

Recent Developments

The most significant acquisition this year was the ~$350 million financing package announced with G Mining Ventures (OTC:GMINF) on its Tocantinzinho [TZ] Project in Brazil ($250 million gold stream, $75 million term loan, $27 million private placement). Investors might recall that this project as it used to be in Eldorado Gold’s (EGO) portfolio before its divestment, and this is expected to be a very high margin asset with a respectable production profile of ~175,000 ounces of gold per annum at all-in-sustaining costs below $700/oz. Under the terms of the gold stream, Franco-Nevada will receive 12.5% of gold production until 300,000 ounces have been delivered for a price of 20% of the spot gold price for each ounce delivered (7.5% of gold produced thereafter).

Early production will be higher with ~196,000 ounces per annum for the first five years, translating to ~24,500 ounces per year attributable to Franco-Nevada.

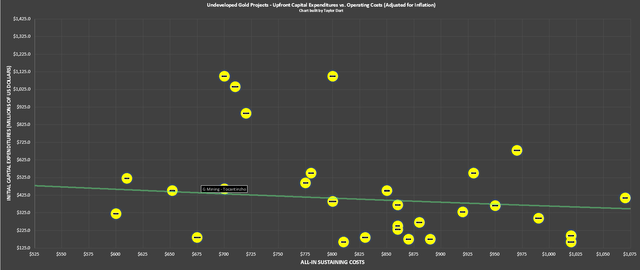

Tocantinzinho Project Economics vs. Undeveloped Gold Projects (Adjusted for Inflation) (Company Filings, Author’s Chart & Estimates)

Looking at the chart above which compares undeveloped gold projects, it is quite clear that TZ is a phenomenal asset, evidenced by industry-leading projected all-in-sustaining costs and relatively modest upfront capex. However, it’s the team that will construct/operate this asset that really makes TZ stand out. G Mining Ventures is led by Louis-Pierre Gignac, who has more than 20 years experience in the industry, including project development studies, financial modeling, and economic evaluation, with the Board of Directors made up of Jason Neal (previously Kirkland Lake Gold/TMac), and Louis Gignac Senior (Non-Executive Chairman/Founder).

Past Projects – G Mining Services (Company Presentation)

For those unfamiliar, Louis Gignac Senior founded G Mining Services in 2006 and they have an excellent track record of delivering major projects on budget (or under) and on schedule/ahead of schedule. Some major projects include Meriant Stage 1 & 2 in Suriname, Fruta De Norte in Ecuador, and Essakane in Burkina Faso. Other projects include Process Plant Automation at Meliadine, and mine engineering/technical studies at several other major assets (Malartic, Greenstone, Sabajo). To summarize, I see this as a phenomenal deal by Franco-Nevada given that it’s getting a royalty on a very solid asset with a team that’s very capable of delivering it on schedule and operating it to its full potential given the track record of the G Mining Services led team at G Mining Ventures.

Detour Lake Mine (Franco-Nevada 2% NSR) (Agnico Eagle Presentation)

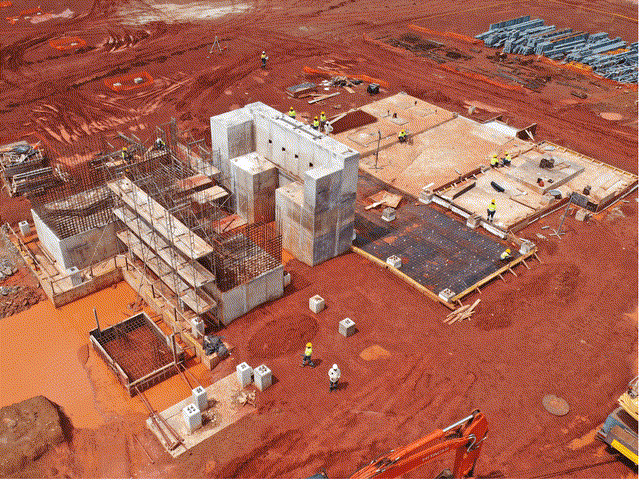

In addition to the major TZ gold stream, Kinross (KGC) continues to work to bring Tasiast up to its 24K TPD goal by mid-2023, and Salares Norte is now ~85% complete, a massive Chilean mine where Franco-Nevada has a 1.0% or 2.0% royalty depending if a buyback is exercised (1.0%). Elsewhere, Island Phase 3 continues to progress for Alamos Gold (AGI) which will increase production by ~120% by 2026, Greenstone is nearly 60% complete (first production H1 2024) and Valentine Lake is on track for a 2025 gold pour, even if Marathon (OTCQX:MGDPF) managed to torpedo investor confidence in the process with a massive capital raise at multi-year lows. Finally, if Detour Lake does achieve its 1.0 million-ounce per annum potential later this decade, this would be another solid boost to attributable production for Franco-Nevada at what will be Canada’s largest gold mine.

When it comes to smaller assets, Franco-Nevada added a 2% NSR on the Magino Project in Ontario which is nearly 80% complete, and also added a 2% NSR on the Spences Bridge Gold Belt claims where Westhaven is (OTCPK:WTHVF) is exploring and has delineated a ~1.12 million ounce resource that looks like it could grow to north of 2.0+ million ounces at a project (Shovelnose) that lies just off the Coquihalla Highway. However, the total land package where Franco-Nevada has secured a royalty is over 30,000 hectares, making this a very solid deal given the price paid ($6.0 million). Lastly, Seguela is on track for first gold pour by summer of next year where Franco-Nevada holds a 1.2% royalty on the high-grade open-pit assets in Cote d’Ivoire.

Seguela Process Plant Construction (Fortuna Silver Presentation)

To summarize, Franco-Nevada has a very impressive organic growth profile on assets that are already bought and paid for, and many of these assets are already world-class operations that will get even better if future expansions come to fruition (Malartic, Detour, Brucejack) or projects are fully permitted and a future construction decision is made (Eskay Creek, Stibnite, Granite Creek Open-Pit, Fenelon, Rosemont/Copper World). In fact, I would argue that it’s hard to find a world-class project mine that Franco-Nevada doesn’t have its tentacles in, making it one of the most unique names in the sector given that it has an eye for spotting great projects/mines early and getting exposure to them through royalties/streams. So, for an investor that wants a buy-and-forget stock in the sector, it’s hard to find a better candidate than FNV.

So, is the stock a Buy?

While Franco-Nevada stands head and shoulders above its peer group and this certainly justifies part of its premium valuation, I see two issues currently. The first is that the company is coming up against very difficult comps in H1-2022 and will lap an average WTI price of ~$101.30/barrel, an average gold price of $1,870/oz, and an average silver price of $23.30 as well as much higher palladium prices. While this isn’t much different than the rest of the sector which is coming up against higher gold/silver prices on a year-over-year basis, Franco-Nevada was able to skirt any material margin compression and revenue hit partially due to the strength in oil prices and this will not be the case in H1 2022 unless oil rebounds sharply.

Average Light Crude Oil Price (StockCharts.com)

Looking at the chart above, we can see that oil is rolling over, its quarterly moving average is now at its lowest levels since mid-March and this moving average will continue to decline as higher readings are rolled off from the brief spikes to the ~$95.00/barrel level in Q3. This is not ideal for Franco-Nevada given that this is an unusual headwind with it having a sizeable portion of revenue from oil this year vs. peers that do not. So, while Franco-Nevada will benefit from higher GEO production in H2-2022 as some new assets come online (Magino, Seguela, Salares Norte), this benefit won’t be in place in H1 2022 in a period where Franco-Nevada will be lapping tough comps. Given this less robust outlook and what I believe to be a stock that is close to fully-valued relative to peers, I would not be surprised to see FNV outperform after a year of outperformance.

Valuation & Technical Picture

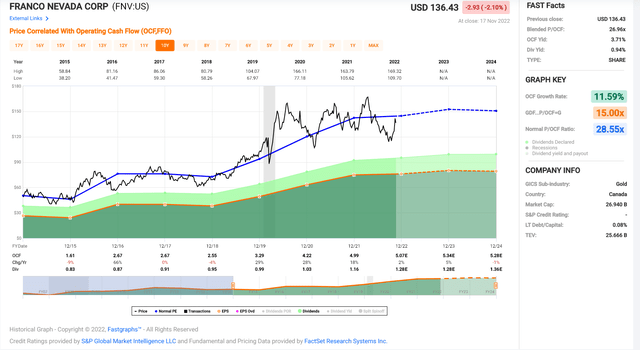

Franco-Nevada has ~193 million fully diluted shares and a share price of $137.00, giving it a market cap of ~$26.45 billion and an enterprise value of $25.4 billion. This is not a cheap valuation for a company set to generate ~$1.07 billion in operating cash flow next year ($5.54), leaving the company trading at a cash flow multiple of ~24.7. While this is below the stock’s historical cash flow multiple based on a 10-year average of 28.6, Franco-Nevada has tougher sledding ahead from a growth standpoint, given that it’s much easier to grow from a base of ~230,000 GEOs (2012) vs. ~730,000 GEOs in FY2022, especially amidst increased competition.

Franco-Nevada – Historical Cash Flow Multiple (FASTGraphs.com)

Based on what I believe to be a more conservative cash flow multiple of 28.0 to reflect the lower growth in the future, balanced by the fact that Franco-Nevada has a sector-best royalty/streaming portfolio and a near-flawless track record, I see a fair value for the stock of $155.10. This translates to a 13% upside from current levels, which doesn’t offer nearly enough margin of safety to justify entering a new position at current levels. In fact, I prefer to buy at a minimum 30% discount to fair value when it comes to large-cap cyclical stocks, and this means that Franco-Nevada would need to dip to $108.60 or lower to enter a low-risk buy zone. This may not transpire, but in my view, it’s best to get the right price for a stock or pass entirely, especially in a sector with elevated volatility.

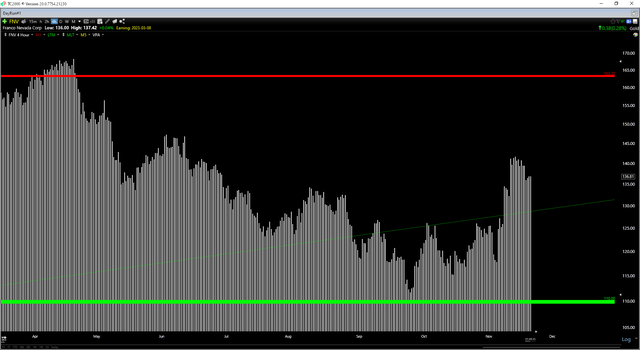

FNV 6-Month Chart (TC2000.com)

Moving to the technical picture, Franco-Nevada is trading near the middle of its expected trading range, with strong support at $110.00 and no strong resistance until $163.20. This translates to a reward/risk ratio of 0.97 to 1.0, which is based on $26.20 in potential upside to resistance and $26.00 in potential downside to support. The balanced reward/risk ratio doesn’t mean that the stock can’t go higher, and it could certainly head back above $155.00 if the gold price heads back above $1,850/oz. That said, I prefer a minimum of 5.0 to 1.0 reward/risk ratio to justify entering new positions. Franco-Nevada would have to decline below $118.50 to enter a low-risk buy zone from a technical standpoint.

Summary

Franco-Nevada had another solid quarter in Q3, and it has an exciting two years ahead as multiple new assets come online. That said, the company is not cheap after years of outperformance, and at the same time, it has difficult comps on deck in H1 2022 as it laps strength in oil prices, which was one benefit that buoyed its results this year despite weakness in precious metals prices. So, with a limited margin of safety vs. several names that have more than 60% upside to fair value due to recent underperformance, I continue to see more attractive bets elsewhere in the sector.

Be the first to comment