ipopba

Tetra Tech, Inc. (NASDAQ:TTEK), a consulting and engineering services firm, has enjoyed a long steady climb from about $23.00 per share in January 2016 to its recent 52-week high of $192.91 close to a year ago. Although it has had some temporary bumps on the road, it has maintained its upward trajectory until the latter part of 2021, where it started to fall, eventually ending up as low as $118.55 on June 13, 2022.

From January 2022 it has been volatile and trading choppy, trading from approximately $122.00 per share to about $168.00 per share, with no clear direction during that time.

Even after its record fiscal fourth quarter and full-year beat, the company, while getting a nice upward move in response to its earnings report, it is still trading well below where it was trading a year ago at this time, as well as lower than it was trading in April 2022.

When taking into consideration the numbers it posted in the last quarter, its backlog, and potential in fiscal and calendar 2023, it appears the market has already priced in its future performance and wants to see more before bidding its price up beyond where it’s been trading over the last year.

In this article we’ll look at how the company has performed in its fourth fiscal 2022 quarter, what it did for full-year fiscal 2022, and how the future looks for it in 2023.

Latest numbers

Adjusted net revenue in the fourth fiscal quarter of TTEK was a record $736 million, up 3.81 percent year-over-year, beating by $23.25 million, with overall revenue coming in at $903 million.

Total revenue for the year was $3.50 billion, with net revenue for the year at $2.84 billion, both also record numbers for TTEK.

Adjusted operating income in the reporting period was a record $94 million, up 29 percent from the same quarter of 2021, representing a 170-basis point increase in EBITDA margin to 13.8 percent. Operating income for the year was $334 million, a gain of 24 percent.

Earnings per share in the fourth fiscal quarter were $1.26, up 30 percent year-over-year. Full-year earnings per share were $4.86, an increase of 21 percent from the same quarter of 2021.

EPS guidance for the first fiscal quarter of 2023 is for it to be in a range of $1.15 to $1.20, not including acquisitions that haven’t closed yet. For full-year fiscal 2023, management guides for EPS to be in a range of $4.70 to $4.90. It’s interesting to note that it would need to come in at the high end of that range to match full-year EPS for 2022. Also, of interest is guidance for EPS in the first fiscal quarter of 2023 is lower than it was in the fourth quarter of fiscal 2022.

Cash flow from operations jumped 10 percent to $336 million.

At the end of the quarter TTEK held long-term debt of $246 million and net debt of $74 million, with a leverage of 0.2 times. The company’s total cash position is approximately $185 million.

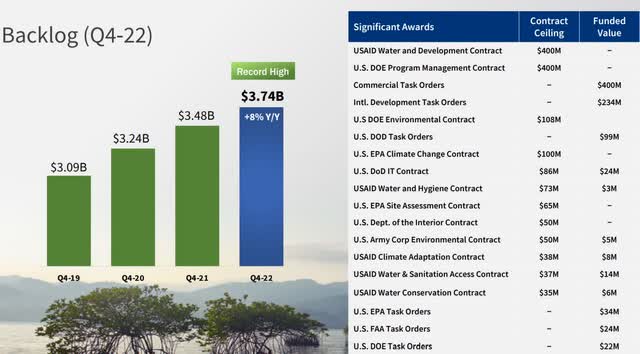

Including new orders valued at $1.3 billion, the backlog of the company has soared to a record $3.74 billion.

Company Presentation

From the report, it looks like there is going to be some downward pressure on EPS next quarter and for 2023. After the blowout numbers in the reporting period, that could be a headwind going forward.

Company Presentation

Performance by segment

Government Services Group

In the fourth fiscal quarter its Government Services Group [GSG] generated revenue of $336 million, up 8 percent year-over-year. Margin in the segment was 15.1 percent, an increase of 130 basis points from last year in the same quarter.

The primary driver in the segment was its “high-end data analytics and design services for our federal water and environmental programs.” That was complemented its digital water work in the U.S.

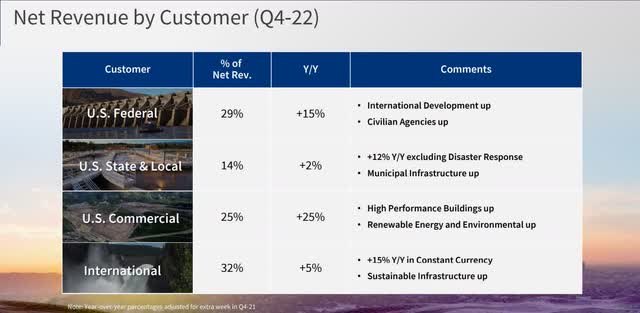

At the U.S. Federal level, the company increased revenue to the point of being 29 percent of total revenue in the quarter, up from 15 percent of total revenue in Q4 of 2021. Most of the growth for its federal business came from “an increase in priority water, environmental and international development programs for our key government clients.”

New programs won in the quarter at the federal level include work from the Army Corps of Engineers, the Department of Energy, U.S. Environmental Protection Agency, and USAID, among others.

Legislative actions that are expected to be tailwinds going forward are, the $1.2 trillion Infrastructure Investment and Jobs Act, which will provide a lot of funding in the near term for infrastructure projects, and another $550 billion in funding for the next 10 years of so.

Another important piece of legislation was the $280 billion CHIPS Act, of which $53 billion is set aside for developing and/or expanding of semiconductor facilities in the U.S. This plays into one of TTEK’s strengths of providing specialized design services to the chip manufacturers based in the U.S.

Last is the passing of the Inflation Reduction Act, which includes $369 million for investment in energy security and environmental concerns over the next decade.

TTEK should get a significant amount of business from the additional revenue targeted at projects the company has the expertise and capacity to work on.

CEO Dan Batrack said at this time TTEK’s contract capacity with the U.S. government is about $25 billion.

That said, with the slow pace of these types of government plans, expectations are these aren’t going have a material impact on the performance of TTEK until the latter part of 2023. Consequently, they’re not included in company guidance. In regard to its performance at the state and local level, revenues grew 12 percent year-over-year, not including revenue from its disaster response work from fiscal 2021.

Revenue from state and local is projected to continue to grow in double-digits. Non-episodic revenues are guided to grow from 10 percent to 15 percent for the year.

U.S. state and local accounts for 14 percent of net revenue and was up 2 percent year-over-year.

Company Presentation

Commercial/International Group

The Commercial/International Group [CIG] was up 15 percent from Q4 of 2021, with a margin of 13.6 percent, up 80 basis points from the same quarter last year.

U.S. commercial accounts for 25 percent of net revenue delivered by TTEK. U.S. commercial is expected to account for approximately 20 percent of the company’s overall business and is guided to grow at a rate of 5 percent to 10 percent.

In the reporting period, the company won more than $400 million in commercial orders related to environmental restoration, renewable energy, and sustainable infrastructure services. TTEK’s international commercial business is split evenly between public and commercial, and based upon international public and commercial net revenue being 32 percent of TTEK’s total net revenue, it should represent about 16 percent of net revenue coming from international commercial.

International as a whole is projected to grow at a rate of 5 percent to 10 percent as well.

Company Presentation

RPS Group acquisition

Almost two months ago TTEK announced it had made an offer for UK-based RPS group. While the deal has yet to be closed, it’s worth looking at what it will add to Tetra Tech once it is. The company has worked with RPS for a number of years, and knows it very well.

The RPS group is similar to TTEK in that it offers high-end global consultancy. It competes primarily in Australia, Europe, the UK, and the United States. While there is some overlap geographically, it’s not much.

Among the benefits of the acquisition are its complementary clients and environmental services, expertise in the sector, a strong water practice in the UK, expanded client base in new geographies, offshore wind, and “new software solutions for chemical spill and fate and transport modeling and real-time oceanographic analysis systems. “It has about 5,000 employees and annual revenue of about $700 million.

Over time it should prove to be a great addition to TTEK.

Company Presentation

Conclusion

There’s a lot to like about TTEK. Yet, after a record-breaking quarter in a number of its results, I think the reason it hasn’t taken off is primarily because much of its current and future performance has already been priced in, also, after that type of performance, it’s going to be difficult to repeat in at the same level in the quarters ahead.

Even so, the strong backlog of the company, and expectations it should continue to grow at a decent pace points to TTEK having the potential to grow incrementally in the near term.

Further out, once the RPS deal is closed and it starts counting in the company’s performance and results, at that time it’s likely that it will break out of its current ceiling and possibly start trading at higher lows and higher highs. Combined with the increased funding for projects in its wheelhouse from the U.S. federal government, it could be the catalysts the company needs to sustainably increase its share price.

In the near term I think it may have reached a ceiling, with the caveat it’s likely to trade slightly above it at times in the short term, and trade in a similar manner on the downside.

Be the first to comment