Guido Mieth

Investment Summary

We’ve revised our rating from a buy to hold on shares of STERIS plc (NYSE:STE) after the market punished the stock on news of the Sotera Health lawsuit. Despite an overall positive fiscal Q3, the market has brushed over its latest growth estimates and re-rated STE heavily to the downside since September. Price visibility in the mid-term is now weaker. Alas, the market has some work to do before it comes to consensus on the STE share price in our estimation.

Our last publications on STE [newest to oldest]:

Net-net, revise to hold until market data shows more buying support for STE.

Q3 marked by revenue growth, Cantel synergies

STE produced another mixed quarter, with revenue flat YoY and non-GAAP EPS ahead of consensus by $0.01. It recorded $1.2Bn in quarterly revenue and clipped core EBITDA of $325mm. It’s now held a >$300m run-rate in core EBITDA for the last 4 consecutive quarters. Meanwhile, the revenue split was 44%/56% to service and product revenue respectively, similar to last year.

We note the c.$500mm backlog in STE’s healthcare division as confirmation of a strong cycle in the hospital capital budgeting landscape. The order breakdown of 60%/40% replacements/large projects is further evidence in our opinion. Looking ahead, this is constructive for STE.

The Cantel Medical integration continues to track well in Q3 with $15mm in realized cost synergies for the quarter, $35mm for the entire H1. Management project ~$50mm in total synergies for FY23, and remains confident on this trajectory. It also expects some revenue pull-through in the coming quarters from ~$60mm in capital shipment delays due in Q3 to finally settle.

Our key operating takeouts from the quarter include:

(1). The main mid-term growth driver is capital shipments from the healthcare segment in our estimation. Management also expect this to be the key lever lifting organic revenue growth to ~10% for FY23/24′. Hence, STE is prioritized on ensuring its onramp for capital shipments is as flat as possible.

(2). Gross margin compressed by ~140bps YoY as productivity, material costs proved to be headwinds for margin growth. Despite this, it retained 50bps upside in cash EBIT margin as a result of its Cantel Medical synergies. We were searching for this kind of data from language in our previous analyses [listed earlier].

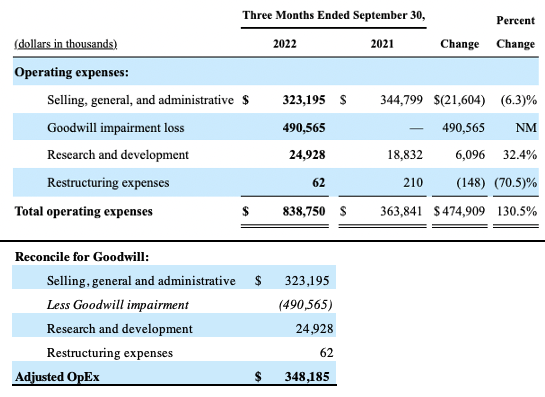

(3). STE recognized a net loss of $333mm for the quarter, down from net profit of $69.6mm a year ago. However, this is on a GAAP basis, and must be reconciled. The discrepancy from year-to-year stems from a $490.6mm non-cash expense related to impairment of goodwill in its dental segment. It recorded the impairment after revising its future cash flow estimates and marked the fair value of the dental segment below its carrying value. Hence, the resulting goodwill impairment. Removing this non-cash charge reconciles Q3 OpEx to $348.2mm from $838.75mm. After all adjustments, STE reported non-GAAP net income of $199mm or $1.99 per share. The reconciliation of OpEx is shown in Exhibit 1.

Exhibit 1. Reconciliation of GAAP OpEx to remove non-cash goodwill impairment charge

Data: HB Insights, STE 10-Q Q3 FY22

Key segment Highlights:

The healthcare division grew 700bps YoY [constant currency], and management note shipments stepped up throughout the quarter.

Based on backlog, it sees capital shipments remaining strong over the coming 6 months.

Applied sterilization technologies (“AST”) stood out with 13% YoY growth in turnover to $232mm and $110mm in segment EBITDA, underscored by strong demand in its biopharma and medical device markets.

Another standout was the 12% decrease in capital equipment revenue from the segment and another 700bps YoY decline in consumables.

It booked $48.6mm in core EBITDA versus $57.5mm the year prior.

Finally, dental revenue was the laggard with a 500bps YoY decline driven by reduced volumes and supply chain headwinds.

Growth outlook maintained despite challenging macro landscape

Management retained its FY22 revenue outlook for 10% growth at the top in constant currency terms but revised down to 8% for its printed number.

It forecasts FX headwinds of $150mm to revenue and ~$0.15 dilution to EPS for the full year.

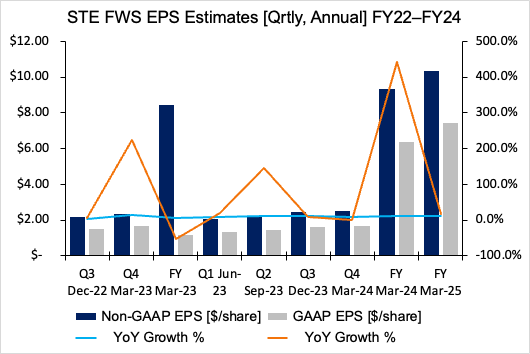

We’ve found it’s important to look at the non-GAAP EPS number for EPS, and management expect $8.40-$8.60 at the bottom-line this year after adjustments.

We forecast $8.40 in EPS for the company this year and see this stretching up to $9.32 by FY24, a 10.6% gain.

Our adjusted EPS forecasts with corresponding growth percentages are observed in Exhibit 2.

Exhibit 2. Forward EPS estimates, adjusted from GAAP to non-GAAP forecasts

Note: STE defines adjusted/non-GAAP net income as excluding the amortization of intangible assets acquired in business combinations, acquisition and divestiture related transaction costs, integration costs related to acquisitions, tax restructuring costs, and certain other unusual or non-recurring items. The same reconciliation is performed for our forward estimates. (Data: HB Insights Estimates)

The technical picture

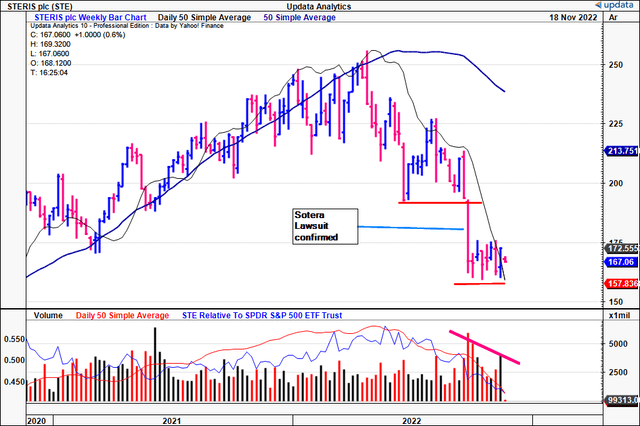

Chart studies also suggest the stock is facing pressure to claw back gains. It plunged to 2-year lows following the Sotera Health lawsuit, where Sotera was ordered to pay $363mm to a plaintiff [more details here] in late September.

Just prior to this, it had formed a solid base and was testing the 50DMA after facing resistance at this level for 7 weeks.

After the market was done, it had vaporized a large chunk of STE’s market cap.

The stock has been backing and filling for 7 weeks basing-up in September and it’s now testing the 50DMA again.

However, as seen, the volume trend is contracting heavily. The sideways action with declining volume is evidence of heavy resistance in our opinion.

Point is, there’s not the market data to imply investors are forming buying support for the stock.

We are happy to see a change to this setup but for now this confirms our neutral view.

Exhibit 3. STE 2-year weekly price evolution [log scale shown]. Note large re-rating after Sotera Health lawsuit in September.

In short

Despite an overall positive quarter, we are searching for larger earnings growth percentages than what’s on the table for STE. The stock has some work to do before the market is able to arrive at a consensus on its share price. We had strong conviction on STE prior to the Sotera Health lawsuit, however, there’s chance the market will continue its punishment of the company until more clarity is achieved on the matter. Net-net, rate hold.

Be the first to comment