SL_Photography

Introduction

In my own trading of preferred stocks and baby bonds, I am constantly swapping between similar securities to increase my yield without adding risk, or to lower risk such as swapping a preferred stock for a bond that has a better yield than the preferred stock. I have coined the term “swapportunities” for when profitable opportunities or mispricings appear due to market volatility and illiquidity.

At our Seeking Alpha “Conservative Income Portfolio” service, I am always looking to identify swap opportunities for our members. These kind of swaps generate outsized total returns which lead to serious outperformance of the fixed-income benchmarks. Below, I describe one swapportunity that currently exists in the market. Or you can simply purchase the undervalued preferred stock on which the article focuses if it interests you.

This article was written on November 6th with prices as of that date. Conservative Income Portfolio members got a first look at it.

Investor Presentation

Fortress Transportation & Infrastructure recently spun off its infrastructure business and is now purely in the aviation business, primarily leasing airplanes and airplane engines. It is this segment of FTAI where the profits were being generated.

Swapportunity Among Fortress Infrastructure Preferred Stocks: Or Just Buy Ticker FTAIN

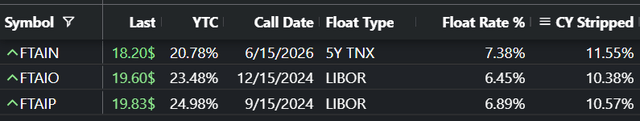

Fortress Transportation and Infrastructure Investors LLC (NASDAQ:FTAI) has 3 preferred stocks outstanding with the tickers FTAIN (NASDAQ:FTAIN), FTAIP (FTAIP) and FTAIO (FTAIO). FTAIN is a reset-rate preferred pegged to the 5 year treasury note, while FTAIO and FTAIP are fixed-to-floaters pegged to LIBOR (or whatever replaces its). Here is a comparison of the 3 preferred stocks.

Author

Prices are as of November 6th – Subscribers Got First View

The reasons for the swap are apparent in the above chart.

- FTAIN has a much better current yield – 11.55% versus 10.38% and 10.57%.

- The floating rate (or reset rate) for FTAIN is also much better than FTAIP or FTAIO at 7.38% plus the 5 year note yield versus 6.89% + LIBOR and 6.45% + LIBOR. The 5 year note is historically higher than LIBOR (or what will be its replacement).

- FTAIN trades at a deeper discount to par giving it more price upside potential

- FTAIN is the most likely of the 3 preferreds to be called at $25.00.

FTAIN – High Yield, High Reset Yield and Excellent Protection Against Higher Interest Rates

FTAIN is also interesting in its own right regardless of whether you own FTAIP or FTAIO for a swap. Not only does FTAIN have a very generous 11.55% current yield with a large capital gains potential, but its reset-rate is extremely generous. In fact, it is so generous that FTAIN is likely to move up in price as times goes by and it gets nearer to its call date. It could even be called providing an annual 20% yield-to-call between now and 6/15/2026.

Although I have no idea what the 5 year treasury note will yield in mid 2026, the 7.38% fixed portion of the reset-rate guarantees a nice yield if it is not called and the dividend gets reset. Using the current 5 year note yield of 4.12%, the dividend would reset much higher to $2.87 per share in 2026. At today’s price, that would put the current yield of FTAIN at 15.9%. So I don’t know whether to hope for a call or hope that they leave FTAIN outstanding in 2026.

This high reset-rate provides excellent protection against higher rates. The very high reset-rate will move even higher in lock step with the 5 year treasury note.

Safety

FTAI does not have a pristine balance sheet, but I believe the risks are minimal and the risk/reward is well worth it.

- FTAI has about $2 billion in debt and an approximate enterprise value of $4 billion. So, 50% leverage, which is actually very reasonable for a leasing company. Leasing companies have to carry a lot of inventory, so you rarely find one with really low leverage.

- The company has paid a common stock dividend every quarter since becoming public in 2015 as well as having paid a consistent dividend for many years before becoming public.

- Analysts estimate that FTAI will earn $2.48 in 2023 which easily covers its common dividend and very easily covers its preferred dividend – estimated earnings of $240 million versus preferred dividends of only $27 million

- FTAI has already completely written down assets likely lost as a result of the Ukraine war and sanctions. They have a $290 million insurance claim in and expect to receive a large amount of this claim. Exactly how much is not clear yet.

- The travel industry continues to be strong.

FTAI Common Stock Has Been Strong While FTAIN Has Lagged

At Conservative Income Portfolio, we like to find laggards likely to move higher in price – those preferred stocks or baby bonds that have lagged the market, lagged their common stock, or have lagged similar preferred stocks or baby bonds. The illiquidity and volatility of this market is giving us many relative mispricing opportunities.

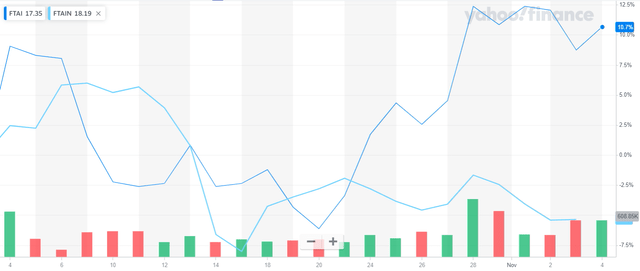

1 Month Price Chart

Yahoo Finance

As can be seen, over the last month the common stock, FTAI, is up over 10% and actually up 17% in the last couple of weeks. So it has been acting very well and one would have expected this to benefit FTAIN. But it has greatly lagged and is actually 5.3% lower in price over the last month. And more importantly, the disconnect between FTAIN and the other 2 FTAI preferreds stocks is also very large as we will now see.

Fair Value of FTAIN Relative to FTAIP and FTAIO

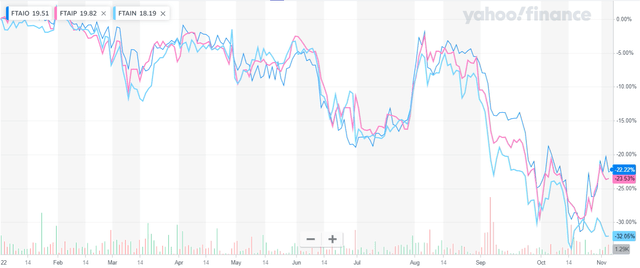

Year-To-Date Price Chart

Yahoo Finance

I have followed the FTAI preferred stocks for a long while and generally FTAIN trades at price that is $0.90 higher than FTAIP and $1.60 higher than FTAIO because of its higher dividend relative to FTAIO and its superior reset-rate relative to both FTAIO and FTAIP. If it traded as usual relative to its sister preferreds, FTAIN should trade between $20.70 and $21.00.

And the above chart shows that FTAIN is now 9% to 10% undervalued relative to its historical pricing versus the other 2 FTAI preferred stocks. And you can see from the chart that a large disconnect has occurred just recently, which is why I believe we have an excellent entry point for buying FTAIN.

Thus, I would say that relative fair value for FTAIN is now around $20.30, or more than $2.00 higher than its current price.

Taxation of FTAI Preferred Stocks

- The information I am about to provide is to the best of my knowledge but I am not a tax expert, or even close, so do your own due diligence.

FTAI was an MLP but will become a corporation on November 11th according to FTAI investor relations. Thus, no more K-1s, and so I presume the next dividend will be without a K-1 since it comes when FTAI will no longer be an MLP.

However, FTAI will be classified as a Passive Foreign Investment Company (PFIC). From what I understand from a CPA who has worked with dividends from PFICs, those who own FTAI securities in a U.S. taxable account may be required to file a rather complicated form under certain circumstances. This will not affect foreign investors nor those who purchase FTAI securities in IRAs or 401Ks. So I recommend that U.S. investors interested in purchasing FTAIN do so in an IRA or 401K. Since the dividends from FTAIN are not qualified, you lose nothing by purchasing shares in an IRA/401K.

Summary

- FTAIN has an 11.6% current yield and has a very large upside price potential given its large discount to par (liquidation value).

- FTAIN is at least $2.00 per share undervalued relative to where it generally trades in relation to FTAI’s other 2 preferred stocks

- FTAIN will achieve a 20% annual return through 2026 if FTAIN if called

- If not called, FTAIN’s dividend will reset. If rates in 2026 are similar to today, the yield on FTAIN will rise from its current 11.6% to 15.9%.

- The very generous reset-rate, that is pegged to the 5 year treasury note, provides excellent protection against higher interest rates in the future

- FTAI very easily covers its preferred dividends out of estimated earnings

It is recommended that U.S. residents purchase FTAIN in an IRA or 401K to avoid the possibility of needing to fill out a complicated tax forms.

Be the first to comment