traveler1116/iStock Unreleased via Getty Images

The Macroeconomic Situation Is Leading To More Bearish Sentiment For Gold And Gold-Backed Assets

Inflation will remain high as long as employment levels are healthy, wages continue to rise and consumption doesn’t welcome the recession signal from the hawkish US Federal Reserve.

The US Federal Reserve will continue to hike interest rates to fight stubborn inflation and its rapid rise. Therefore, it is likely that a gold bear market amid higher interest rates will weigh on the valuation of gold-backed assets for the foreseeable future.

Caledonia Mining Corporation Plc (NYSE:CMCL) is also expected to suffer from the above backdrop as lower gold prices are not positive for the prospects of its mineral projects apart from the direct impact on the company’s shares.

The following explains why investors should consider reducing their holdings in Caledonia Mining Corporation, contrary to Wall Street recommendations.

Caledonia Mining Corporation Plc

Based in Saint Helier, Jersey, Caledonia Mining Corporation Plc, operates a 64% interest in a gold mine called Blanket Mine, located in the Matabeleland South Province of Zimbabwe.

Caledonia Mining also has the expertise and equipment for the exploration and development of mineral properties containing precious metals.

The mineral portfolio includes a purchase agreement whereby Caledonia Mining will acquire 100% ownership of a brownfield gold exploration project called the Maligreen Project, located in the Gweru mining district of the Midlands province of Zimbabwe.

Operating And Financial Results For The Second Quarter Of 2022

Caledonia Mining said that the second quarter of 2022 was a record quarter in terms of gold production, with the Blanket Mine yielding over 20,000 ounces of the precious metal.

Gold production increased approximately 20% year-on-year from 16,710 ounces which were produced in the second quarter of 2021.

As Caledonia ramped up production, the price of the precious metal performed well, in line with gold bulls’ expectations. Gold futures averaged $1,873.76 in the second quarter of 2022, up 3.1% from the same quarter in 2021.

The company managed to keep costs under control, but only partially. Costs borne at the mine site, and therefore more directly related to mining and exploration activities, were $692, approximately 3.2% lower than last year.

However, the positive effect was not enough to halt the increase in All-in Sustaining Costs [AISC], which stood at $925 an ounce, or an increase of about 2.7% year-over-year, due to a remarkably higher charge of $2.91 million in administrative expenses. The administrative expenses increased over 65% year over year.

Thanks to the combined effect of these three factors, namely production, price and costs, the company was able to realize an increase in sales and operating cash flow, while profit did not always show the same sign in the transition from Q2 2021 to Q2 2022.

So, net revenues increased 23.4% year over year to $35.14 million and operating cash flow increased 31.5% to $16.7 million.

Regarding the earnings data, the company has provided three different lines of it.

Basic earnings per share [EPS] increased 4.2 times to $0.88, and earnings before interest, taxes, depreciation and amortization [EBITDA] increased 24% to $17.8 million.

While adjusted EPS fell 10.2% to around $0.56.

Caledonia Mining Corporation Plc’s Mineral Projects In Zimbabwe

For Caledonia Mining, Zimbabwe does not only mean the exploitation of the Blanket Mine. Management believes that Zimbabwe has much more to offer than the operation of the Blanket Mine.

Zimbabwe ranks very highly in the world in terms of existing mineral resources and the Board of Caledonia Mining will base most of its growth strategy on the potential of this country in the southern region of Africa to become a multi-asset gold producer.

In 2021, the country has mined about 27 tons of gold thanks to the exploitation of deposits in Bulawayo, Gweru, Gwanda, Chegutu, Harare [the capital], Mvuma and Masvingo.

More than 60% of the country’s total output is produced by small-scale producers, leaving plenty of room for multinationals should they wish to get involved in Zimbabwe’s mining industry.

The Risk Of Investing In Zimbabwe

However, as with any industry, allocating capital to mining activities in Zimbabwe should involve significant investment risk. The country is often the scene of social protests, most of which lead to real and very violent clashes. These rebellions almost always result from people’s dissatisfaction with the way the government is running the country amid a severe economic crisis that has plagued Zimbabwe for years. Many people cannot afford their basic needs because prices have increased dramatically due to this critical situation.

Caledonia Mining faces increased investment risk in Zimbabwe as it advances its two major mining projects. This is the ramp-up of Blanket mine production and the next acquisition of the Bilboes Gold Project.

The Ramp-Up Of Blanket Mine Production

In the near term, the company is targeting to increase Blanket’s gold production to 80,000 ounces per year, perhaps as early as this year.

The chance of success is not small, as almost half of the target has already been achieved in the first six months of operation of the mine in 2022.

The increase in production should lead to a reduction in operating costs, as long as the supply of raw materials, fossil fuels and electricity is not too expensive.

However, a stronger US dollar due to the increase in the cost of money will not make the task easier, as it will lead to higher costs at the mining site.

To have a more flexible budget for exploration activities at the Blanket Mine, the company is 100% focused on lower operating costs, knowing that gold is likely to trade lower in the coming period.

Gold Futures – December 22 (GCZ2) was trading at $1,715 at the time of writing, but is expected to fall 6.7% in a year, according to analysts‘ 12-month price target of $1,599.41.

The Bilboes Gold Project

One gold project consists of the development of the Bilboes Gold Project following the completion of the acquisition of the gold mine from Bilboes Gold Limited under the purchase agreement announced last July.

To complete the transaction, Caledonia Mining is required to pay an aggregate of $53.3 million through newly issued shares in connection with the transaction [representing 28.5% of Caledonia Mining’s equity on a diluted basis], along with a net smelter royalty of 1% on the revenue of the project.

The company believes it can turn Bilboes into an asset producing 240,000 ounces of gold per year, which is approximately three times the annual production that the Blanket mine is projected to produce. This is an estimate not based on a feasibility study prepared by Bilboes Gold Limited which instead indicates a significantly lower annual production of 168,000 ounces of gold for 10 years of mining activity.

The estimate of 240,000 ounces per year is based on a mining model that Caledonia intends to advance through a proprietary feasibility study showing how the Bilboes Gold Project can profitably mine the precious metal. Huge capital is required to develop open pit mining which has been able to produce less than 300,000 ounces in over 3 decades.

No small feat when you consider the following aspects. The first aspect is the balance sheet. According to Q2 2022 Earnings Report data, Caledonia can use cash up to $11 million, which isn’t much, plus the funds it can set aside from the gold it will sell at Blanket Mine.

But even during one of the best times for gold prices, Blanket Mine couldn’t generate enough cash to fund capital expenditures. For the 12-month period including the second quarter of 2022, gold averaged $1,835 per ounce versus a 10-year average of $1,440 per ounce. While Blanket Mine generated a cash flow of $45 million versus capital expenditures of $46.5 million.

Now that the precious metal is expected to trade lower on tighter US Federal Reserve’s [Fed] monetary policy, as higher interest rates downgrade gold against a stronger USD or rising coupons on fixed-income assets, Caledonia could cut its spending budget at Blanket Mine.

This means that any project to expand production capacity at the Blanket Mine could be delayed, potentially affecting cash flow from operations as well.

Blanket Mine is unable to provide significant funds to support the construction of the second gold mine in Zimbabwe, therefore the company will rely on Bilboes’ ability to self-fund its gold resource expansion needs.

But at least initially it will be necessary to resort to one of the two forms of financing, namely the issuance of equity capital and the raising of debt capital. Neither path will be easy to follow, as neither the price of gold nor the cost of money will be favorable factors.

A less favorable gold price outlook increases downside risk for the value of gold-backed assets, including Caledonia Mining, and makes it more difficult to raise capital through new share offerings.

Additionally, the Fed’s tightening monetary policy will drive up borrowing costs, which could cause Caledonia Mining Corporation to stall on Bilboes while it waits for better capital market conditions.

The Stock Looks Overvalued

As of this writing, shares are trading at $11.43 per unit with a market cap of $190.43 million and a 52-week range of $8.75 to $18.23.

After a 10.53% drop in share price over the past year, the stock is still not cheap but remains overvalued given the above reflections on its prospects analyzed in the context of the current macroeconomic situation and its future development.

The share price could fall further due to the lower gold price, which will impinge on the profitability of the Blanket mine while increasing the risk of delaying the feasibility of the Bilboes project, both located in Zimbabwe.

Additionally, Zimbabwe represents a significant investment risk, which contributes to the thesis that the market valuation is overstated today.

What would change the cards on the table is the bullish price of gold. The precious metal must become more attractive again as an investment compared to the US dollar and the bond. This can only happen if the US Federal Reserve reverses monetary policy execution and interest rates return accommodatively.

To reverse course, the US Federal Reserve needs a signal from the economy. But as long as the gross domestic product is growing rather than contracting and employment levels aren’t recessionary, the Federal Reserve will keep raising interest rates to fight stubborn inflation that’s fast building.

So a bull market for gold has little chance, while a bear market has much better chances. Meanwhile, not only the precious metal, but gold-backed assets, including shares in Caledonia Mining, could continue to fall.

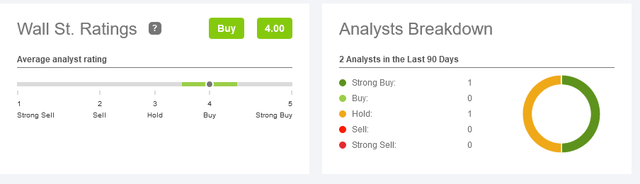

Wall Street Recommendations And Average Price Target

Wall Street analysts recommended 1 Strong Buy and 1 Hold, resulting in a medium rating of Buy.

seekingalpha/symbol/CMCL/ratings/sell-side-ratings

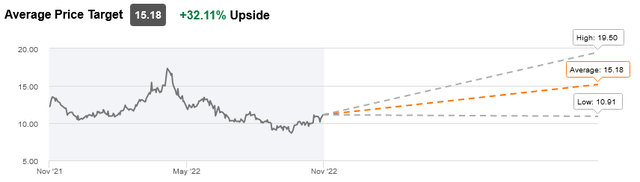

Wall Street analysts recommended an average target price of $15.18, reflecting a 32.11% upside potential.

seekingalpha/symbol/CMCL/ratings/sell-side-ratings

Conclusion – The Stock Looks Overvalued And Its Share Price Has Little Chance Of Improving

The value of Caledonia Mining Corporation’s mineral assets depends on the price of gold, which is likely to decline. A lower gold price will affect the feasibility and development of mining projects in Zimbabwe, a country that also poses significant investment risk.

With these factors putting a lot of downward pressure on shares, the stock could be overvalued at the moment.

Be the first to comment