Korrawin/iStock via Getty Images

What is Amortization?

Amortization is an accounting technique used to distribute asset value or loan principal over time.

(read about company assets and asset classifications here)

For companies, amortization is an accounting method used to “expense” or spread out the cost or value of an intangible asset, such as intellectual property or goodwill. The related tool for tangible assets, such as buildings or equipment, is depreciation.

There are different techniques for calculating amortization and depreciation and there is guidance for the industry in section FAS 142 of generally accepted accounting principles (GAAP).

For personal finance, an example of amortization is the determination of fixed mortgage payments that are designed to completely pay off a mortgage loan in say 15 or 30 years.

What is an Amortization Expense?

An amortization expense is an item that appears on a company’s financial statements as a result of amortizing an asset. Amortization of an intangible asset is shown as an expense (i.e., a “write-off”) on a company’s income statement. This expense reduces the residual value of the asset carried on the company’s balance sheet over time, and is expensed on a company’s income statement.

Amortization Versus Depreciation

When applied to assets, amortization and depreciation are similar concepts in that both are used to expense an asset over time. The main difference is that depreciation applies to tangible assets while amortization applies to intangible assets. Tangible assets include buildings, equipment, or other physical assets that are subject to wear and tear or obsolescence over time. Intangible assets are non-physical assets such as trademarks and copyrights.

There are also differences in the way the two are shown on financial statements and how they are calculated. Amortization is indicated by directly crediting (reducing) the specific asset account. Depreciation, on the other hand, is indicated by crediting a separate account called ‘accumulated depreciation’.

Lastly, the calculation of each can be different. Intangible assets are often amortized over their useful life using the straight-line method, while fixed assets often use a much more broad set of calculation methods, such as declining balance, double-declining balance, sum-of-the-years’ digits, or the units of production method.

What is Goodwill?

Goodwill is a unique corporate asset. It is an intangible asset that is only created when a business is acquired. The purchase cost of a company beyond that which is associated with identifiable assets is collectively considered to be goodwill. Goodwill can include the collective value of a company’s brand, customer relationships, artistic or intellectual assets, and proprietary technology or patents.

When a company is acquired, the suitor pays a specified value that will typically be more than the net asset value of the target company to entice the shareholders to sell. If the net assets of the target company add up to say $80 million and the suitor acquires it for $100 million, then the additional $20 million paid for it is deemed to represent “purchase consideration” or goodwill and is then classified as an intangible asset on the suitor’s balance sheet.

The importance of goodwill from an amortization perspective is that under current U.S. GAAP and IFRS accounting rules, goodwill is considered to have an indefinite useful life and therefore cannot be amortized in public companies. There is, however, an exception to this rule available to private companies, which may elect to amortize goodwill over a period of ten years or less under an accounting alternative from the Private Company Council of the FASB.

What is an Amortization Schedule?

An amortization schedule depicts how much of an asset’s value (or a loan’s principal) is amortized over time, showing the amount of amortization amount for each relevant time period.

Loans can be amortized using different methodologies. A loan with constant amortization would simply take the total principal amount and divide it equally over each intended payment period. But the interest payment would vary every month as the remaining balance declines, making payments different every month and quite high in the beginning.

For mortgages, homeowners overwhelmingly prefer a fixed mortgage payment each month to meld with their income. So, for a standard mortgage, banks use a constant payment method instead, which results in a fixed loan payment in which the portions of interest and amortized principal vary with each payment.

An amortization schedule for most mortgages would thus take the form of a table that shows the amount of the principal that amortizes each month for the total duration of the loan. Using the amortization schedule, an individual can see how much total principal has been paid (or remains) at any point in the life of the loan. (There are also ways that a calculator or a computer spreadsheet can be used to calculate the amortization amount for any given month.)

How to Calculate Amortization

Calculating the amortization amount of any loan or asset (i.e., the amount of principal paid in any given time period) depends on the amortization method being used.

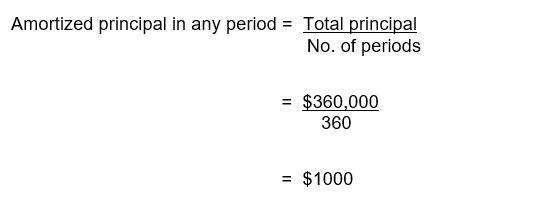

Using ‘constant amortization’, one would simply divide the total principal by the number of time periods desired. For example, a mortgage loan for $360,000 to be paid back monthly over 30 years would require a principal payment of $1,000 each month (30 x 12 x $1,000 = $360,000) to fully amortize. Interest payments would be added to that. The amortization formula would be as follows:

Constant Amortization formula (Author)

To determine the cumulative amortization at any point in the life of the loan (i.e., how much principal has been paid up to that point), one would simply multiply the number above by the number of months the loan has been in place. After 15 months, $15,000 of principal will have been paid and $345,000 of principal will therefore remain.

For a constant payment loan, the amortization is generally laid out in a table such as the one below. The process of filling it in is as follows:

- Input the beginning loan balance for month 1 (Column A)

- Input the full-amortization payment (calculated separately from the loan amount, interest rate, and loan term) (B)

- Input the monthly interest due on the current loan balance (C = A * .05/12)

- Determine the amortization (Column D = B – C)

- Calculate the ending loan balance for the period (Column E = A – D)

- Bring the ending balance to the next month as the new beginning balance (A = prior month’s E)

- Repeat for the entire term of the loan

Assumptions:

Principal borrowed = $360,000

Interest rate = 5% annually

Monthly fixed payment to fully amortize = $1932.56

|

Month |

Beginning loan balanceA |

Monthly paymentB |

InterestC |

AmortizationD |

Ending loan balanceE |

|

1 |

$360,000 |

$1932.56 |

$1,500 |

$432.56 |

$359,567 |

|

2 |

359,567 |

1932.56 |

$1,498 |

434.36 |

359,133 |

|

3 |

359,133 |

1932.56 |

$1,496 |

436.17 |

358,697 |

|

4 |

358,697 |

1932.56 |

$1,495 |

437.99 |

358,259 |

|

5 |

358,259 |

1932.56 |

$1,493 |

439.81 |

357,819 |

|

6 |

357,819 |

1932.56 |

$1,491 |

441.65 |

357,377 |

|

… |

… |

… |

… |

… |

… |

|

360 |

1924 |

1932.56 |

8.01 |

1924.55 |

0 |

What is Negative Amortization?

Loan amortization is generally designed to reduce the loan balance each period until it reaches zero and the balance is totally paid off. For each payment period, the amortization amount is paid and the remaining balance on the loan is reduced. In this manner, positive amortization in a loan reduces the principal balance each period.

If the principal balance is not sufficiently reduced each month, it will not reach zero by the end of the loan term. This scenario results in “partial amortization”.

If the principal balance is not reduced at all each month, then it will be the same at the end of the loan term as when it started. This scenario occurs with an “interest-only” loan. A borrower pays the interest on the outstanding balance each month and is then required to pay the principal back in a lump sum payment at the end of the loan. (Such payments are called “balloon payments”.)

If the principal balance increases, that causes a ‘negative amortization’. This would not be the way a bank would offer a loan to a borrower and occurs instead when a borrower fails to make a payment. If no payment is made on a fixed payment mortgage, no scheduled amortization occurs and no interest is paid. In this instance, the lender would generally add the accrued interest to the loan balance.

So, instead of the outstanding principal balance decreasing, it is increased by the unpaid interest instead. This results in negative amortization. Lenders do not want negative amortization and will likely consider the borrower in default if it persists.

Is Amortization Included in Cash Flow?

No. For companies, depreciation and amortization are noncash accounting items. Also, they can be calculated differently by different companies, thereby obscuring comparisons between one company’s fundamentals and another’s.

On a company’s income statement, depreciation and amortization will list as expenses. However, the corresponding amounts are usually added back in net income in calculating a company’s Cash Flow from Operations (CFO).

Example of Amortization

For a loan, amortization can be full, partial, zero (interest only), or negative. The table below uses the mortgage example from above to illustrate the different types and show what the loan balance would be under each scenario.

Loan principal = $360,000

Term = 30 years

Interest rate = 5% (fixed)

Payments = monthly

|

Type of Amortization |

Monthly Payment |

Loan balance in 30 years |

|

Full |

$1932.56 |

0 |

|

Zero (Interest only) |

$1500 |

$360,000 |

|

Partial |

Between $1500 and $1932.56 |

Between 0 and $360,000 |

|

Negative |

Payment < $1500 |

> $360,000 |

Bottom Line

Amortization is a mechanism that can apply to both companies and personal finance. For companies, amortization is an expense charged against intangible assets, similar to how depreciation is an expense charged against tangible assets. Both depreciation and amortization are non-cash charges to a company’s income statement.

Be the first to comment