SimonSkafar

Dear readers/Followers,

Looking at Fortis (NYSE:FTS) becomes a play on overvaluation – at least it has been for the past few months or so. This is a very qualitative company, but one with issues in so far as the asked price for the respective cash flows go. I wouldn’t “BUY” the company at the prices we’ve seen previously, but I might be interested as we drop down more and more. My previous PT for the company going by my last article was $48/share.

Let’s see if this latest update warrants any change or shift.

Updating on Fortis

Fortis needs no further introduction on my part. It’s an absolutely solid near-dividend king with 49 consecutive years of dividend increases, boasting a $31B mid-year rate base and having delivered 20+ years of superior growth returns. In this, the company does not materially differ from many solid utilities, perhaps except for the fact that, unlike many European peers, it doesn’t share the same exposure to the current macro.

This is of course a positive.

The second positive that needs to be mentioned is how absolutely, ridiculously stable this company actually is. It’s stable enough that analysts, for the past 10 years, have never missed forecast by more than 3-5% in either direction, making it flawless with a 10% margin of error here.

However, this sort of quality tends to come at a price – and that’s also why we have such a usual premium for the business. With 10 solid regulated businesses under its wing and 3.4M combined customers, at a 99% regulated ratio with a $26B market cap, this business is as solid as it gets.

It won’t make you rich – at least not in the short term. But at the right price, it can definitely make you “safe”.

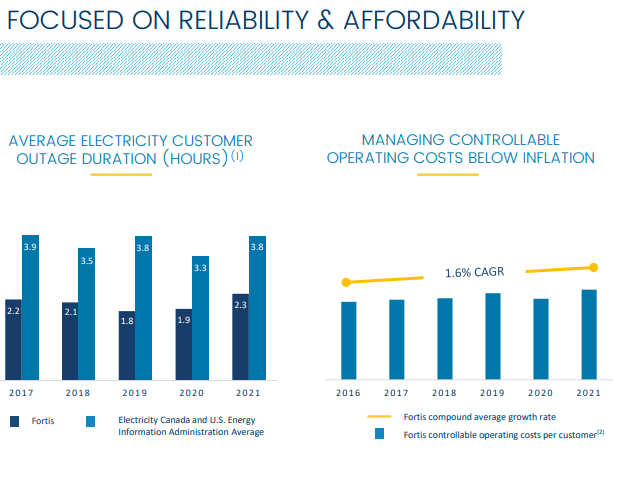

Recent results and trends put this into focus. The company’s focus is razor-sharp upon things like cost control, and keeping this below rates of inflation, as well as keeping the company’s grid reliability at top metrics. The company has consequently outperformed here.

FTS IR (FTS IR)

And, of course, as any conservative utility should, it shines over the long term. The 10-year average CAGR is around 11.3%, compared to 8.8% from the S&P and around 100 bps less from the closest peers. The company never lags peers, but only lags the market in the short, 3-year term.

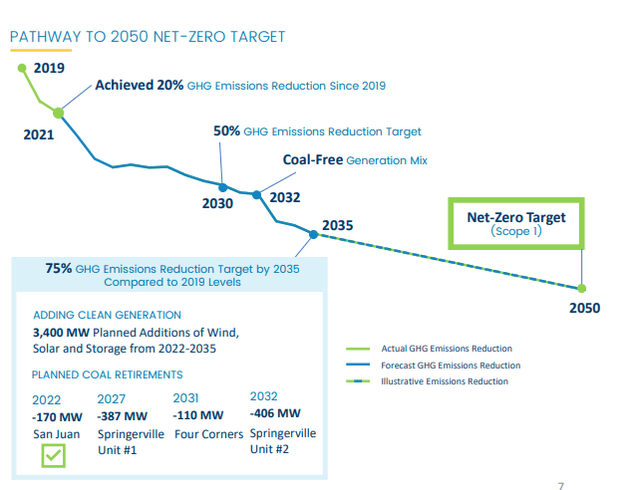

The other current company focus is net-zero – and Fortis has set a target of 2050, with a 2032 complete independence from coal – and this is with the updated geopolitical backdrop.

Aside from ESG and cost control, the company’s plan focuses on a low-risk rate base growth with 6.2% CAGR until 2027 fiscal. This 5-year plan will cost the company around $22.3B worth of CapEx and is around $2B increase from the previous plan, which went to 2026E. This equates to an annual capital spending of around $4.4B, of which 83% is smaller projects. In accordance with the company’s capitalization and debt, this is highly executable. The plan focuses, above all, on three of the company’s largest utilities.

In terms of funding, the company won’t need to tap equity at all to fund its plan – instead managing to fund it to 57% from operational cash flow, 33% from net debt, and a 10% DRIP financing. IG-rating will be maintained during the expansion as well.

In short, the plan is about connecting more renewables, building more renewable, sourcing alternatives to reduce Co2, replacing legacy assets, harden and preparing the grid for electrification.

The company forecasts that all of these strategies and approaches will enable Fortis to grow the annual dividend by 4-6% going forward until 2027, turning the company into a dividend king and beyond.

As always when looking at regulated players, the regulators and relevant regulations/base rates should be looked at and understood. I believe it to be a fair assessment overall that based on the current socioeconomic environment and flows, companies have a much harder time getting their demands heeded by regulators. We saw it for Pinnacle West Capital (PNW), and we’ve seen it in Europe as well.

Fortis is seeing some of these flows as well. Regulators are denying capital structure complaints, and eliminating certain adders, and I believe it should be understood that increases going forward may be less than stakeholders and investors hope for and expect. Regulators need to protect their customers from “too high” increases, and the easiest way for them to do so is to pressure companies to give up portions of their margins – at least some of them.

However, this does not make Fortis a bad or uninteresting investment in the least – it does mean though that we may want to expect slightly less from the company going forward than we’ve traditionally expected. This is also part of the reason why the company is trading southward, rather than north.

With hundreds of billions slated for investment in energy and climate, Fortis may be one of the primary beneficiaries of the climate portion of the inflation reduction act – or at least a company that will certainly enjoy advantages from it.

News in the earnings calls, including the most recent ones, centered mostly on the lake Erie cancellation – which makes sense. I believe, however, that the company’s choice here was very prudent. The expected RoR and the current circumstances were no longer in line with expectations – and Fortis showed the quality that a company in their situation needs to show when the math no longer “works out”.

All in all, Fortis remains safe. Fortis remains sound. Fortis remains profitable – but we do need to consider the valuation.

Fortis Valuation

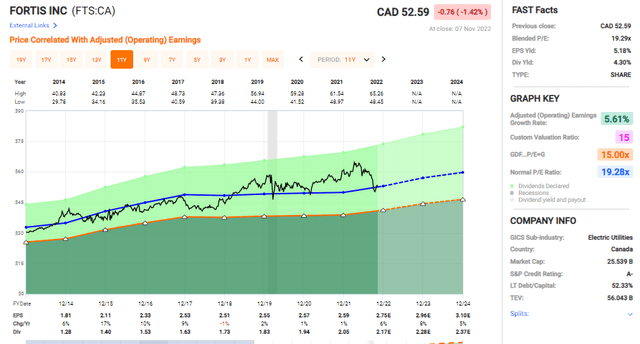

Fortis remains at a massive premium compared to where other companies trade. While the picture is that the company has dropped in the last few months, the fact is that on a broader picture, the valuation isn’t as enticing as we might be looking for after all.

FTS Valuation (F.A.S.T graphs)

Despite dropping 10%+ or so since my last piece, the company still cannot in good conscience be said to be “cheap”. Current trends see FTS trading close to 19.3x P/E, and this is still a bit much for a utility, no matter how good the company is. However, at the same time, it would be completely wrong for me to ignore Fortis at a valuation that’s essentially the low point we’ve seen since COVID-19. Yes, the business was cheaper in 2017-2018, but there were reasons for this. And like it or not, the premium is actually fairly well established at this point.

Fortis is a 4.3%-yielding utility with superb A-quality in a market where utilities don’t seldom yield twice as much, but at a somewhat different risk “cost” or risk/reward-relationship

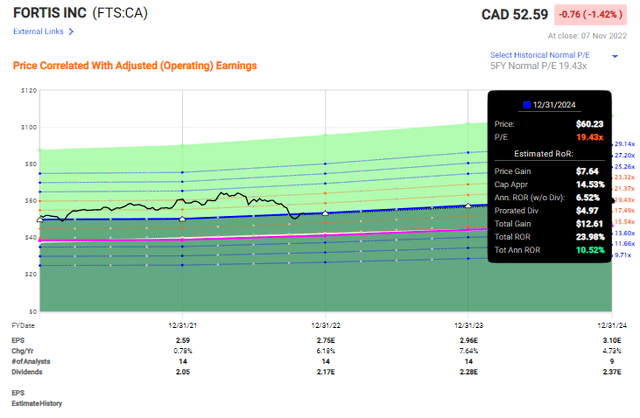

If you want to “BUY” Fortis here, you need to accept the company’s 19-20x P/E premium, despite the company only growing around mid-single digits over the coming few years. If you’re willing to set a 5-6% growing company at a 19-20x P/E premium, then your RoR could be close to 10.5% annually, or 24% until 2024E.

Fortis Upside (F.A.S.T graphs)

Is it bad? No.

Is it great? No, not really.

Is it market-beating? Yes, potentially.

So while not the best opportunity to “park” cash, I believe Fortis at this price is starting to look as an opportunity that could generate alpha at a substantial amount of relative safety. Consider for a moment what has happened with many of the Russian/Ukraine-impacted utilities, and you can see how some of these businesses can really “shake”, but as you can see from the history, that does not mean it has always-low volatility.

While any time this company was bought at 21-22X P/E or above during the last 20 years, your long-term returns over time would have been less than 5-6% including dividends – the fact remains that once you start buying at below 20x P/E, historical records change to show potential RoR of closer to 8-9%, or even double digits depending on where you look at.

Specifically, I revised my previous target for Fortis, by accepting a higher-end P/E multiple of around 19x. If you bought the company at 15-19X P/E, that minimum RoR goes up to between 7.5-15% annually, including dividends. So I’m willing now to extend my “BUY” range up to 19x P/E for the company, which is closer to the company’s 5-year average here.

So a 19.3x P/E? That’s hovering very close to what I would consider acceptable here. You only need to adjust forecasts slightly, or have the company beat estimates a little to make that 19.3x into a 19x. What I mean is that it’s within the margin of error, and that Fortis can indeed be bought here – if you’re willing to accept only a bare-one 10% or high 9% conservative annual RoR.

S&P Global analysts still have a hard time accepting my stance of “overvaluation” for Fortis. While the average is finally down below $60/share, 17 analysts give the company an average of $55.5 per share, which is still more than I would be willing to accept, considering Fortis around 5% undervalued here. Despite that though, out of 17 analysts, only 2 consider the company a “BUY”, revealing how unconvinced some of these analysts are by their own targets and the current market.

Forecasts? Single-digit EPS growth could grow faster as some of the company’s green/ESG ambitions become realized. But even in this scenario, we’re not talking massive double-digit growth.

So – growth is poor, momentum really isn’t there at this valuation, and the company recently cut a large project. On the basis of this, we’ve seen some valuation decline.

I said that I want to “BUY” Fortis, and at this valuation, it becomes conceivable that we might see a double-digit upside here. Let me revise my thesis slightly.

Thesis

My thesis for Fortis is:

- An absolutely solid, A-grade utility with safety that can’t be beaten by really any business on the NA market in the same sector. A definite “BUY” at the right valuation, with an excellent potential yield.

- However, 22X P/E is the historical high. The P/E to “BUY” FTS is no higher than 18-19X and preferably lower than 17X P/E. That’s when you stand to gain those double-digit RoR that we so want to have.

- FTS is still a “HOLD” here, but one that’s moving very, very close to a fair-value “BUY”. I would set that price at around $51/share, bumping my target slightly to account for some of the updated numbers for the company going forward, and accounting for an increased overall macro risk premium. I would always consult with a finance professional before making investment decisions such as this.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized)

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment