Craig Barritt/Getty Images Entertainment

Note:

I have covered Amyris, Inc. (NASDAQ:AMRS) previously, so investors should view this as an update to my earlier articles on the company.

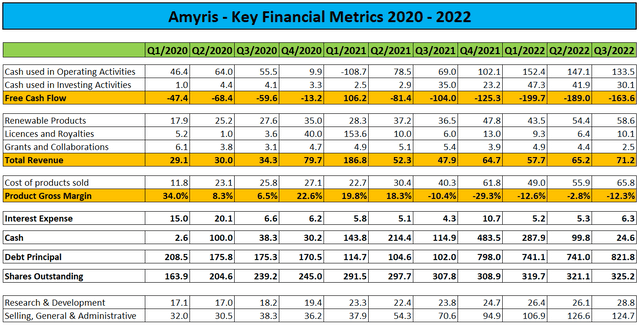

After the close of Tuesday’s session, specialty renewable products developer Amyris reported another set of disappointing quarterly results. As usual, the company missed consensus expectations by a mile while cash burn remained at elevated levels. In addition, gross margins continued to be hurt by higher freight and logistics expenses.

Company Press Releases and SEC-Filings

Revenues in the core consumer business surged 98% year-over-year, but this was again materially below the company’s full-year projection of “well over 150%” growth.

With no credible path to achieve full-year projections, Amyris management reduced 2022 top-line expectations by a whopping 20% while also cutting back on its medium-term growth targets.

According to the company’s quarterly report on Form 10-Q, free cash flow for the quarter was negative $163.6 million, much higher than expected by fellow contributor In The Ruff Research. Once again, Amyris had to fall back on key shareholder John Doerr’s investment vehicle Foris Ventures to avoid running out of funds in Q3:

In September 2022, the Company issued an $80.0 million secured term loan facility to Foris (Foris Senior Note). The Foris Senior Note accrues interest at 7.0% per annum, which is capitalized as additional principal on a monthly basis. Principal and capitalized accrued interest is payable in tranches in April 2023, January 2024, and June 2024. As part of the arrangement, the Company issued 2,046,036 of common stock warrants at an exercise price of $3.91 to Foris with a term of three years.

Despite the new emergency funding, Amyris finished the quarter with unrestricted cash and cash equivalents below $20 million. Even when considering the $75 million in secured debt provided by key stakeholder DSM at less-than-stellar terms last month, the company will be required to raise additional capital before year-end.

According to management, Amyris remains on track to close on a proposed up to $500 million molecule marketing rights sale next month, with anticipated upfront cash consideration of $350 million.

As admitted to by CEO John Melo in the Q&A session of Tuesday’s conference call, a weakening macro environment and rising capital costs are forcing the company to cut back on spending and put an increased focus on near-term profitability:

We are transitioning to more prudent spending and adding a significant focus on making our company profitable. (…)

We are focused on slowing the rate of investment in new brands, while continuing to support our leading brands to meet the strong demand they are experiencing.

(…)

Our goal is to deliver 10% operating income on an estimated $200 million of revenue in the fourth quarter of 2023. We expect this to be our first solid quarter of operating profitability for our core business based on maintaining our current growth rate and delivering on our Fit to Win initiatives.

We expect over 10% operating income for full year 2024 and expanding that to over 20% operating income by 2025 with a goal of more than $1 billion in revenue during 2025.

Please note that on the Q2 conference call, CEO John Melo claimed Amyris being on a “clear path to a $1 billion revenue business that delivers 20% or better operating margin by the end of 2023.”

Quite frankly, given the potentially toxic combination of substantially reduced marketing spend and weakening consumer demand, it’s difficult to envision the company growing core revenue at the projected 100% clip next year.

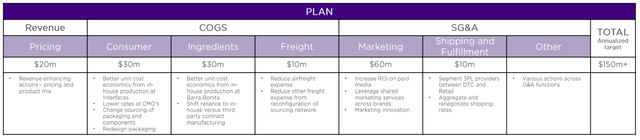

Moreover, targeted annualized savings of $150 million from the company’s recently launched “Fit to Win” initiative appear aggressive, particularly when considering management’s constant pattern of over-promise and under-deliver on virtually every aspect of the business in recent years:

Consequently, I would expect the company to miss out on both its revenue and cost savings targets, thus resulting in ongoing losses and the requirement to raise additional capital next year.

Bottom Line

More of the same at Amyris, with the company delivering another set of disappointing quarterly results and reducing near- and medium-term growth expectations substantially.

Ongoing, elevated cash burn will require the company to close on the proposed strategic transaction before year-end, as otherwise, Amyris would run out of funds next month.

In addition, given management’s constant pattern of over-promise and under-deliver, investors would be well-served to scrutinize the company’s aggressive cost savings and profitability targets.

At least, in my opinion, Amyris is likely to miss out on both its revenue and profitability targets, thus resulting in ongoing losses and the requirement to raise additional capital next year.

With the company’s projected growth reduced well below previous expectations, analysts will be required to adjust their models. Consequently, I would expect a host of price target reductions over the next couple of weeks.

Investors should continue to avoid the shares, until Amyris finally starts delivering on management’s promises.

Be the first to comment