Alistair Berg

Buying shares of companies that are undergoing significant changes can be both incredibly rewarding and incredibly risky. This is because a tremendous amount of uncertainty can cloud the fundamental picture of the firms in question. That makes it difficult for the market to process whether the company in question offers nice upside or not. And at this point in time, there are few companies that are undergoing as big of a change as Take-Two Interactive Software (NASDAQ:TTWO) currently is. On August 8th, after the market closes, the company is due to report financial performance covering the first quarter of its 2023 fiscal year. Although this on its own is nothing special, it is also true that, on May 23rd, the business completed its merger with Zynga, essentially absorbing the firm in a cash and stock transaction. So what investors have to look forward to is a new quarter for the combined firm. But this is made even more complicated by the fact that Zynga will have only been part of the picture for less than half of a quarter. Add on top of this the fact that Take-Two Interactive Software is already restructuring its operations and likely finding ways to cut costs, and there truly is no way to know what to expect when the company does report.

Take-Two Interactive – Keep it simple

As you can tell already, the data reported by Take-Two Interactive Software for the first quarter of its 2021 fiscal year will be more or less impossible to predict ahead of time. Instead of trying to get these numbers right, a better option would be for investors to focus on what information we do have and to rely marginally on what analysts are currently anticipating. Consider, for instance, what the management team at Take-Two Interactive Software recently said regarding guidance for its 2023 fiscal year. At present, excluding the impact that Zynga should have, the firm is forecasting revenue of between $3.67 billion and $3.77 billion. That represents an increase, at the midpoint, of 6.1% over the $3.50 billion the company reported for its 2022 fiscal year. This will come on the back of bookings for the company climbing to between $3.75 billion and $3.85 billion, up from the $3.4 billion the company reported for the end of its 2022 fiscal year.

Profitability, meanwhile, is likely to be all over the map. Earnings per share of between $1.90 and $2.15 implies income of between $223 million and $252 million. This is actually down from the $418 million reported in 2020. At the same time, however, operating cash flow is expected to rise, climbing from $258 million in 2022 to $390 million in 2023. When it comes to the first quarter alone, management has also provided some thoughts. They currently anticipate revenue of between $810 million and $860 million, with net income of between $94 million and $105 million. To put this in perspective, in the first quarter of 2022, sales came in at $813.7 million, while net income was robust at $152.3 million. Analysts have provided some insight on this front. They think that overall revenue for the quarter will come in at $1.09 billion. However, once again, analysts are factoring in the impact from Zynga, while Take-Two Interactive Software is not factoring that in at this time. From an earnings perspective, analysts do seem to think that the company’s own guidance makes sense more or less.

At first glance, these numbers may not seem all that valuable since they do exclude the impact that Zynga should have. But to me, they are valuable in the sense that they demonstrate that Take-Two Interactive Software continues to grow on its own even though its profitability metrics are going to be volatile from year to year. As for the combined company, I think a better approach is to look at the completed financial performance for the most recent fiscal year for both entities. Doing so, and combining these numbers together, we can start to see whether or not it still makes sense to buy into Take-Two Interactive Software following its acquisition of Zynga.

In a prior article, I detailed the positives and negatives to this merger. And in that article, I ultimately rated Take-Two Interactive Software a ‘buy’ because I felt as though the company was trading at affordable levels compared to the implied buyout price of Activision Blizzard (ATVI) by Microsoft (MSFT). Though I did say that, because of the discount that Zynga was trading for relative to its implied by our price, it would make more sense for investors to buy stock in it than in Take-Two Interactive Software directly. Since then, shares of Take-Two Interactive Software have risen by 17.7% compared to the 3% increase we have seen from the S&P 500.

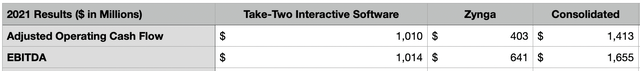

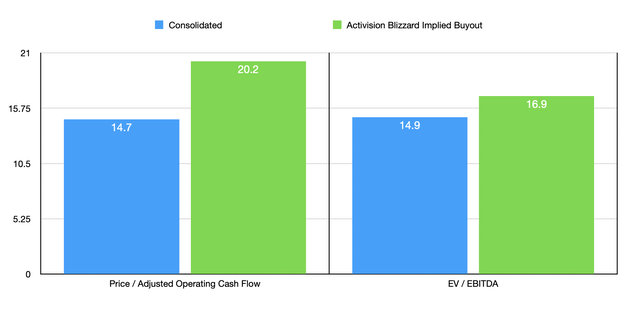

Even after factoring in this increase, the deal to me looks pretty positive. Assuming the 2021 fiscal year is representative of how each business will fare now that they are combined together, shares look quite affordable. All combined and without factoring in the prospect of synergies and continued growth, the adjusted operating cash flow of the two firms should be $1.41 billion. This cash flow figure ignores changes in working capital from year to year. Meanwhile, the EBITDA of the combined entity should be around $1.66 billion. Given the $12.7 billion enterprise value of the transaction, combined with the current enterprise value for Take-Two Interactive Software, the combined firm should be trading at an EV to EBITDA multiple of 14.9. That compares to the 16.9 multiple that Activision Blizzard agreed to be sold off for. Meanwhile, the price to adjusted operating cash flow multiple stands at 14.7. That compares to the 20.2 reading that we get for Activision Blizzard. So at the least, Take-Two Interactive Software is trading cheaper now than its largest rival.

Takeaway

Based on the data provided, it seems to me as though things are looking pretty good for shareholders in Take-Two Interactive Software. To be clear, I fully expect a lot of interesting developments when the company does report financial performance. And I also expect the next few quarters to be particularly enlightening since a lot of activity will be going on behind the scenes. But given where shares are priced, I do still feel comfortable rating Take-Two Interactive Software a ‘buy’, with the idea being that continued growth should help to push the stock even higher than where it is today.

Be the first to comment