posteriori

It’s hard to find a Dividend King that pays a decent yield. For example, Target Corporation (TGT), which has raised its dividend consecutively for 54 years still yields just 2.7%, despite having fallen by 36% over the past 12 months.

This brings me to National Fuel Gas (NYSE:NFG), which is also a Dividend King, having raised its dividend for 52 consecutive years, and currently yields near 3%. NFG currently is also well off its 52-week high of $76, and in this article, I highlight why the stock is currently a sound buy for an all-weather portfolio.

Why NFG?

National Fuel Gas is a diversified energy company, with natural gas assets in the highly productive Marcellus and Utica shale formations in Appalachia, and oil producing assets on the West Coast. What sets NFG apart is the vertically integrated nature of its operations, with upstream, midstream, and downstream utility, serving 747K customers in Western New York, Northwestern Pennsylvania.

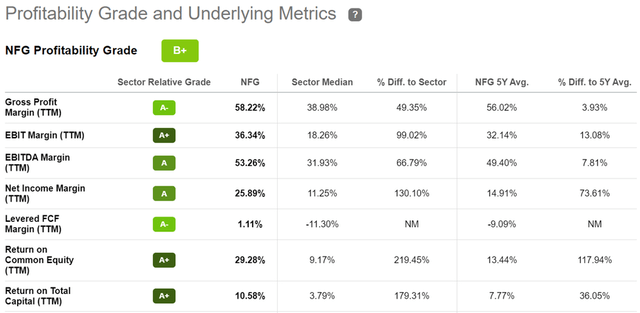

What sets NFG from a traditional utility is its integrated structure that gives it the ability to adjust to changing commodity price environments. This structure also opens up avenues and flexibility for management to invest where they expect to achieve best returns on investment. Examples of the integrated structure include co-developments in the shale gas producing regions of Marcellus and Utica spanning across 1.2 million acres, with just in time gathering facilities for enhanced capital efficiency. As shown below, NFG scores a B+ rating for profitability, with strong EBITDA and Net Income margins of 52% and 26%, respectively.

NFG Profitability (Seeking Alpha)

These features help to shield NFG from commodity price volatility while also helping to capture profits from the energy value chain. NFG is seeing robust growth, with adjusted EBITDA growing by 23% YoY to $1.2 billion in its fiscal fourth quarter (ended Sep. 30th). This was driven by across growth in every segment, including Exploration & Production, Gathering, and Pipeline & Storage revenues growing in the 8% to 11% range YoY.

These strong results led management to increase the dividend by a respectable 4.4% to an annual rate of $1.90, resulting in a 2.9% yield at the current price. The dividend remains very well covered at a low 32% payout ratio. This also marks NFG’s 52nd consecutive year of raising its dividend, and its very impressive 120th year of paying an uninterrupted dividend.

Looking forward, NFG should continue to see strong bottom line growth next year, as management provided an update on earnings guidance and natural gas price hedging during the recent conference call:

Switching to the outlook for our fiscal 2023, the recent drop in the natural gas forward curve has led us to revise guidance to a new range of $6.40 per share to $6.90 per share. At the midpoint, this is an $0.85 per share reduction, almost all of which is driven by our revised natural gas price assumptions. Despite the reduction, our $6.65 midpoint represents a 13% increase in expected earnings year-over-year.

Our longstanding hedging program mitigated a large portion of the drop in expected pricing. Our fiscal 2023 reduction is roughly two-thirds hedged, which is right in line with our stated policy. As a reminder, our debt policy gives us a lot of latitude allowing us to hedge between 40% and 80% of our production in the current fiscal year.

Over the past few years, we have trended closer to the high end of that range and this was the result of the natural gas pricing outlook that was in place at the time we did the hedges, as well as the desire to have greater certainty around cash flows to help support our investment grade credit rating.

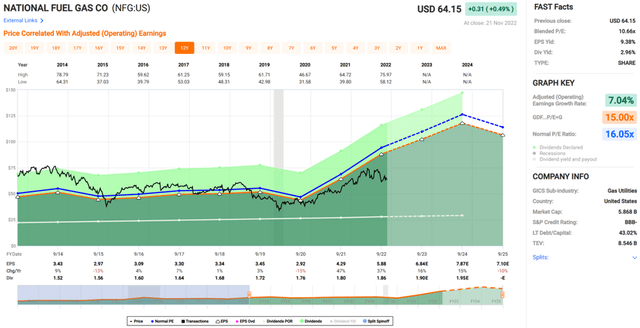

Meanwhile, NFG sports a BBB- investment grade rated balance sheet with a safe long-term debt to capital ratio of 43%. It also appears to be rather cheap at the current price of $65.54 with a forward PE of 9.6. Sitting well below its normal PE of 16.1 over the past decade. Moreover, analysts expect to see 17% and 7% EPS growth in fiscal years 2023 and 2024, respectively, and have a consensus Buy rating with an average price target of $77, equating a potential 20% total return including the dividend.

Investor Takeaway

National Fuel Gas has a robust integrated structure that allows it to protect itself from commodity price volatility while capturing profits from the energy value chain. It also sports a strong dividend with 120 years of uninterrupted payments and 52 consecutive years of dividend increases. Furthermore, NFG’s balance sheet is investment grade rated and appears to be undervalued at the current price for potentially strong total returns.

Be the first to comment