Antonio Bordunovi/iStock Editorial via Getty Images

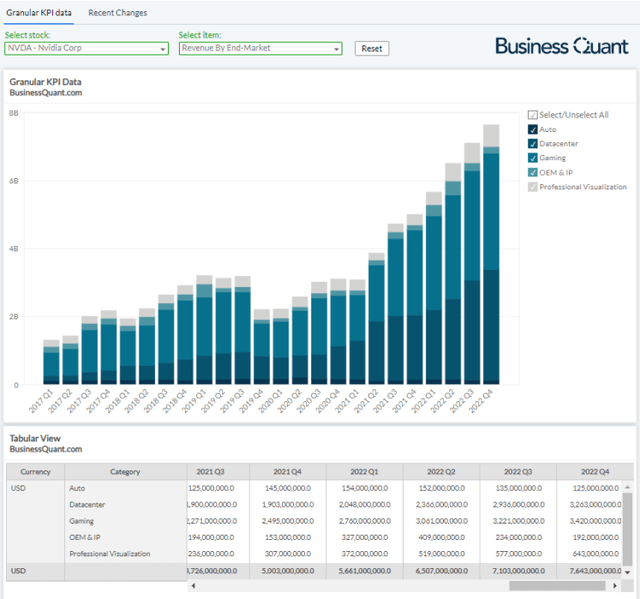

NVIDIA (NASDAQ:NVDA) has had a golden run in the last 2 years. Its revenue is up 146% and its shares have surged 260%. But the chipmaker‘s rapid growth trajectory might be about to take a breather. Latest data reveals that some of Nvidia‘s important channel partners struggled to maintain their sales in the month of March. This indicates towards a moderation in the chipmaker‘s growth momentum in Q2 and probably also in Q3. Let‘s take a closer look.

The Sales Data

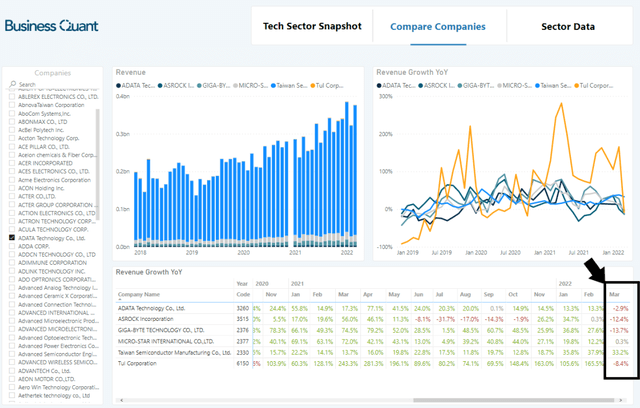

See, Nvidia is not a vertically integrated company. Sure, it has a wide product portfolio, but it relies on key partners (like Taiwan Semiconductor (TSM)) to fabricate and package its chips. Some of its other partners (like Gigabyte, MSI, ASRock) manufacture Nvidia‘s GPUs and/or other related peripherals (like motherboards) and sell them through their respective global distribution networks. So, we can monitor the monthly sales data for these channel partners to get a sense of how Nvidia‘s ongoing quarter might be progressing.

We, at Business Quant, have developed a tool which tracks the monthly sales data for over 1200 Taiwanese companies. It reveals that Gigabyte, Micro-Star International and ASRock’s sales declined significantly in the month of March. These firms design, package and distribute Nvidia-branded GPUs and/or accompanying motherboards, amongst a host of other computing peripherals, so they‘re not necessarily pure-plays. However, the fact that their sales declined after growing continuously for several months straight, does indicate that things didn‘t sail smoothly for them in recent weeks.

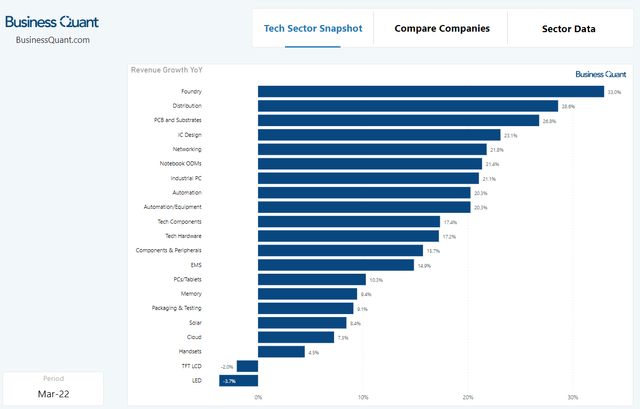

One might argue that maybe all the firms associated with the manufacturing and marketing of semiconductor chips, directly or indirectly, would be adversely impacted due to the ongoing chip shortages. But fact of the matter is that this sales decline isn‘t prevalent in many industries. For instance, revenue for Foundry and IC Design companies, on average, grew by a massive 33% and 23% respectively, year on year during March 2022.

This suggests that the sales decline in March was limited to only a few computing devices and peripherals manufacturing firms, perhaps, because the consumer demand has temporarily waned off. This might very well be the case as Intel (INTC), AMD (AMD) and Nvidia are due to release a slew of major product generations later this year, and consumers might just be deferring their purchases until the new SKUs are out. Just to cite some of these upcoming releases for this year:

- AMD is due to release its 5nm-based CPU and GPUs,

- Nvidia is due to release its 5nm-based RTX 40-series GPU,

- Intel is due to release its first generation of Arc-based desktop GPUs.

This brings us to the next question – what does all of this mean for Nvidia‘s shareholders?

The Implications for Investors

See, the aforementioned firms aren‘t pure-plays. Also, these firms manufacture products for competing platforms from AMD and Intel as well. So, their monthly sales numbers provide us with leading insights about the state of consumer computing industry in general, rather than it being specifically limited to Nvidia.

It‘s also important to understand that if AMD, Nvidia and Intel‘s SKUs were still selling like hotcakes, then these partner firms would be flush with orders and they‘d be reporting continued sales growth. But there has clearly been a sales slump of late. So, I believe the demand for consumer computing devices has waned off in recent weeks. This will eventually reflect in AMD, Nvidia and Intel‘s earnings results in subsequent quarters, if not outrightly in Q1.

Therefore, I contend that Nvidia‘s investors should brace for subdued growth rates from their company in Q2 at the very least. Only time will tell if this is a transitory weakness or a longer-lasting trend, so investors may want to closely monitor the monthly sales figures for April, May and June as well. This would provide a head start to investors, before Nvidia reports its Q2 results sometime in July.

This very industry dynamic seems to have also prompted two research firms, Truist and Baird, to downgrade Nvidia in the last two weeks. They didn‘t provide any specifics and they also did not reveal their sources, but just said that they “found hard evidence of order cuts” which could weigh down on Nvidia‘s sales growth in Q2 and beyond.

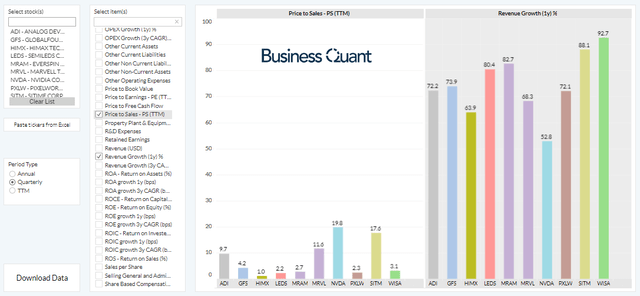

What further exacerbates the problem is the fact that Nvidia‘s shares trade at a significant premium compared to many of the other rapidly growing semiconductor stocks. This suggests that the stock packs in more downside potential, than upside potential, at its current levels. This should encourage investors to rethink their thesis in the name and ask themselves – why invest in Nvidia when there are other rapidly growing companies out there, that trade at lower valuation multiples.

Final Thoughts

There‘s no denying that Nvidia is a technology leader in its space. Its management has, time and again, found pockets of growth within the consumer and enterprise computing space, which has continually catapulted the company‘s revenue over the past decade. This fundamental philosophy of industry-leading innovation still remains at the heart of Nvidia and is likely to drive its sales to new highs in the years to come.

At the same time, the company seems to be surrounded by some near-term challenges which could subdue its stock price in the coming weeks and months. So, I believe that investors with a short-term time horizon may want to avoid investing in the name altogether as it‘s likely to remain distressed or range-bound. On the other hand, investors with a multi-year time horizon, who can ride out the near-term volatility due to this transitory weakness in channel sales and believe in the company’s growth prospects, may want to accumulate its shares on potential price corrections. Good Luck!

Be the first to comment