takasuu/iStock via Getty Images

DigitalBridge Group Inc (NYSE:DBRG) is a highly impressive stock with an even more impressive growth trend, which I believe any market participant should consider as a buy. Since the dynamic shifts brought about by the outbreak of the Covid-19 pandemic, resulted in surging demand for services relating to the digital ecosystem. Investors looking to ride this long-term growth wave into the post-Covid transition would be wise to buy this stock, which has been soaring ever since its rebound. Buying DBRG would deliver substantial growth to investor portfolios, given its strong financials and its competitive position in value against comparable stocks.

Company Overview

DigitalBridge Group Inc is a global digital infrastructure company that is structured as a REIT and manages a total investment portfolio worth a total of $45 billion, as of 31 December 2021. The investment management company is one of the only data firms that have a portfolio within each of the following key verticals:

- Cell Towers

- Fiber Networks

- Data Centers

- Edge Infrastructure

- Small Cells

DigitalBridge aims toward value maximization for both its shareholders and limited partners, by identifying opportunities across the highly dynamic and rapidly shifting global digital ecosystem. The company leverages its position in the market through its strategically planned acquisitions to access opportunities within this domain.

Price Movements and Correlation to DBRG Performance

Since its trade initiation in late June 2014, DBRG had been off to a steady start. Just four months following its initial public offering, DigitalBridge successfully raised additional equity to finance its US tower platform, the Vertical Bridge. The move had driven up its total equity raised to $1 billion by November 2014. The financing significantly enabled the company to tap into the leading tower markets of the USA, Mexico, and China more effectively. Thereafter, by March 2015, DBRG’s price saw its all-time high of $24.48 in a mere nine-month period since IPO.

The impressive gains on DBRG up to April 2015, however, were short-lived. The stock’s Relative Strength Index based on a 14-day period consistently floated higher than the 70% mark, indicating an overpricing based on movement and momentum. As a result, DBRG took a sharp 60% fall in the 12 months following March 2015.

The company had gone on to maintain its bearish trajectory through to early 2020, with the stock hitting its all-time low of $1.42 per share in March 2020. This sentiment was in large part due to steadily declining revenue figures. The covid-19 pandemic brought a turnaround to tech and IT stocks, which triggered a bounce-back for DBRG. As demand for digital services and tech infrastructure enhanced, so too did the opportunity for sales and profitability for DigitalBridge. As a result, total revenue in 2020 rose to $420 million, as opposed to the previous year’s $60 million.

As of 13th April 2022, DBRG is priced at $6.93 per share, after a steadily rising bullish trend of over two years. The rebound from March 2020 sustained ever since, with DBRG gaining 400% ever since. This movement indicates an impressive growth spurt for DBRG, which is turning the heads of market participants toward the stock.

There is a clear sense of a shift in perception towards the stock, as is evident by taking a holistic look at the historical DBRG price trends. With DBRG holding promise and optimism, I believe the stock performed exceptionally well initially, until being heavily overpriced by 2015. Thereafter, following consistent losses, the price plummeted until 2019, after which its impressive financial improvement, and the promise of sustainability, once again attracted bulls toward the stock that is set to deliver high growth well into the long-term. I believe it is evident that DBRG, following its brief dip in price is all set to achieve unprecedented growth.

Financial Performance Indicating Growth

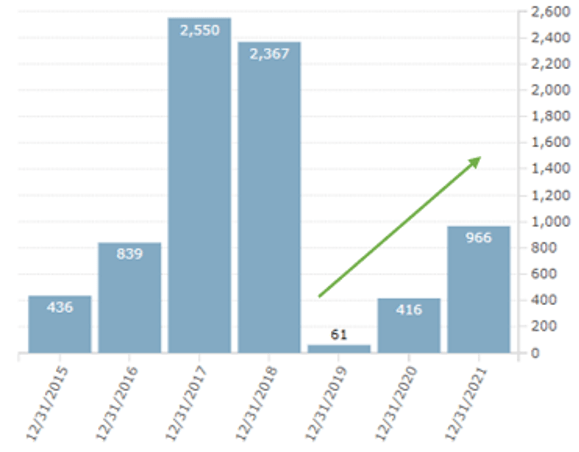

This indication of DBRG making a comeback following its fall is one that is reinforced by taking a broader look at the company’s fundamentals over the years. The revenue chart below shows the company capitalizing on the opportunities for the digital sphere arising after the Covid-19 outbreak. In relative terms, the company delivered a whopping annual sales growth of 582% in 2020, and 132% in 2021.

DBRG Revenue (Finviz)

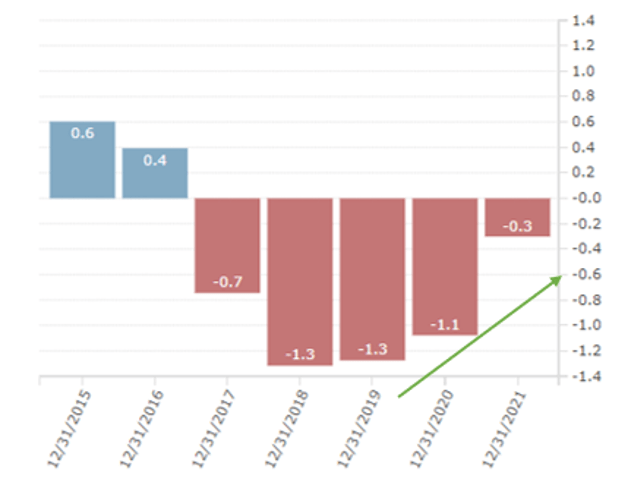

Understandably, this improvement across annual revenues had translated into value for the shareholders of DigitalBridge. DBRG went from delivering a loss of $1.32 per share in 2018 to a loss of $0.30 per share in 2021. This reduction of loss per share by 77% is a highly positive indicator of where the DBRG is headed towards. I believe, DBRG will continue riding on this growth path, capitalizing on opportunities from the post-Covid transition to digitization, and deliver a positive EPS figure by the end of 2022.

Finviz

The stock’s financial trends over the years are clear indicators of the growth it is achieving, following its previously poor performance spell leading up to 2018. DBRG is a stock that is soaring upwards in recovery mode, whilst showing increasing profitability on an annual basis. This indicates that buying the stock in its current form would be a smart investment decision, with investors capitalizing on this rapid turnaround, that continues to push on.

Strategic Acquisitions

Throughout the DGRG price rebound and financial performance improvement, a key catalyst had been the company’s strategic acquisitions that were undertaken. This indicates that the company’s success was not solely a result of the external opportunities provided by changing dynamics as a result of the Covid-19 pandemic. Although the company had been well-positioned to capitalize on these opportunities, this was in large part due to its strategic initiatives.

In August 2021, the company acquired Landmark Infrastructure Partners to continue its growth spurt and enhance its capability to meet the growing demand for digital services. Landmark Infrastructure owns several data center facilities throughout the USA. Similarly, its portfolio of assets also consists of wind turbines, billboards, rooftop wireless sites as well as standard cell towers.

The deal had indeed proven fruitful for DigitalBridge, after its newly acquired subsidiary, Landmark continued to undertake strategic investments and asset acquisitions to drive forward further growth. By October 2021, Landmark had successfully closed a deal to purchase 1.2 million square feet of mission-critical data center space within the historic Quantum Park in northern Virginia. The state-of-the-art infrastructure is housed in the state’s Data Center Alley, giving the company a considerable competitive edge, and enhancing the DBRG REIT portfolio substantially, in terms of growth potential.

Similarly, DigitalBridge had gone on to acquire a controlling stake in Vertical Bridge, which is the largest American private owner and operator of wireless communication infrastructure, on 13 October 2021. The acquired entity holds under its belt over 8,000 cell towers throughout America, as well as over 308,000 master-leased sites. The move is a clear indication of DigitalBridge setting its sights high on long-term growth, with a particular focus on the US markets.

In line with its strategic vision, DBRG had similarly acquired rights to Singapore assets and Hong Kong operations from Superloop on the 18th of October 2021. Expansion whilst ensuring market diversification positions the stock optimally to undertake future growth and meet the demand for telecommunication and digital services throughout these markets. As of April 2022, the total number of portfolio and affiliated companies operating under the DigitalBridge Digital Equity wing is 23.

The latest breakthrough, by the writing of this article, came on 18th April 2022, when DBRG announced its strategic partnership with its management unit, DigitalBridge IM, in which the company had acquired a 31.5% stake. Shortly after, DBRG saw an immediate surge of 3.6% within the pre-market hours. The reason behind this drive-up had been an announcement by the management accompanying this investment. DigitalBridge had stated the move will result in a $38 million climb in total earnings. DigitalBridge IM is stated to have a 20% projected organic growth rate by management personnel involved in the strategic partnership.

DBRG’s rise to the top is not a growth surge without substance but is anchored on its strategically sound initiatives targeting growth and market capture. Similarly, it has the financial results that indicate these moves are translating to value addition for the company, in the form of a rapidly improving earnings graph. These factors add to the list of reasons why DBRG must be immediately bought, given the potential it holds.

Assessment on Valuation

To arrive at a robust valuation assessment for DBRG, an appropriate model to adopt would be to assess the company based on valuation-specific metrics.

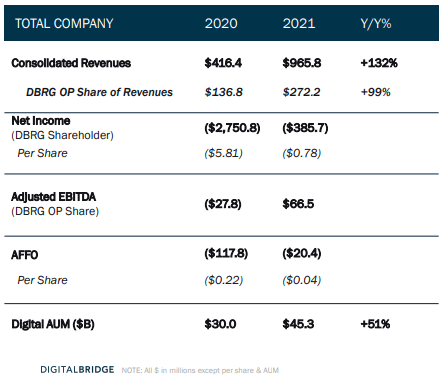

DigitalBridge

Taking a look at DBRG’s adjusted funds from operations per share, there is a clear improvement across the year, from a negative flow of $117.8 million in 2020 to a negative $20.4 million in the year 2021. This indicates the value-generating capacity DBRG holds, given its portfolio of assets within the digital infrastructure. Given the AFFO factors in capital expenditures and costs to maintain underlying asset qualities, the reduction of 83% in negative AFFO could be linked to a value enhancement for the REIT across the same period.

Given the nature of DigitalBridge, and REIT stocks in general, PE ratios may not be entirely appropriate for valuation, given the impact of depreciation that is factored in. The wide pool of DBRG assets is primarily those that appreciate over time, and hence adding back the impact of depreciation and amortization would result in a metric with far greater utility. On this basis, although the PE ratio for the company may appear unfavorable to other industry stocks, it may not be entirely relevant for DigitalBridge.

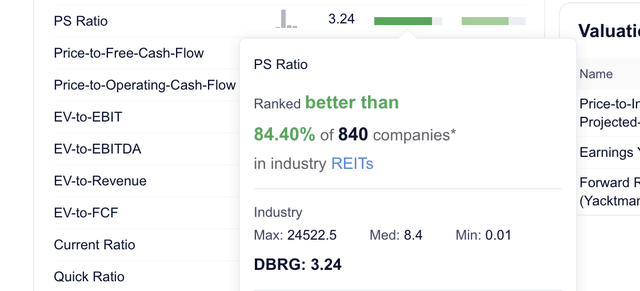

The stock has a PS ratio of 3.24, which outperforms 84.4% of 840 industry players. The PS ratio indicates how much the market is presently valuing $1 of revenue earned by the company in question. For DBRG, the 3.24 figure is significantly lower than industrial players, which hints at the stock being undervalued. The same amount invested in other stocks would yield a lower return, making DBRG more valuable, as well as a more efficient investment, reflecting a superior buying opportunity for the market.

DBRG price to sales (Guru Focus)

Risks

Despite surging DBRG performance and its robust portfolio of companies, investors must consider a few specific areas of caution that may be critical in investment calculations. Earnings and profitability-related metrics have been omitted, on account of DBRG being a stock that is seeing a recent performance-based surge, which may not be optimally reflected in such backward-looking metrics. These can be best reflected in a comparative analysis against similar-sized specialized REIT firms.

|

Ticker |

Company |

Market Cap in Billions |

Insider Ownership |

Institutional Ownership |

Float Short |

Total Debt/Equity |

Price |

Volume |

Target Price |

|

DBRG |

DigitalBridge Group, Inc. |

3.87 |

0.70% |

81.20% |

4.08% |

3.87 |

7.01 |

114,875 |

9.93 |

|

HASI |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. |

3.78 |

0.80% |

89.90% |

8.16% |

1.61 |

44.27 |

54,289 |

58.89 |

|

OUT |

Outfront Media Inc. |

3.98 |

0.80% |

– |

3.15% |

2.64 |

26.87 |

73,177 |

32.67 |

|

PCH |

PotlatchDeltic Corporation |

3.58 |

0.70% |

84.00% |

1.59% |

0.5 |

52.6 |

13,067 |

64.67 |

|

RYN |

Rayonier Inc. |

6.24 |

0.40% |

91.50% |

0.77 |

43.91 |

106,440 |

38.5 |

|

|

UNIT |

Uniti Group Inc. |

3.21 |

0.70% |

86.30% |

5.01% |

13.57 |

86,635 |

13.65 |

Source: Finviz.com as at 4/13/2022

As is apparent, DBRG stands with the highest total debt to equity ratio, which exposes the company’s shareholders to a high degree of credit risk. As a result, the company is financing its growth and operations by debt as opposed to shareholders’ equity or retained earnings, in comparison to competing firms. This higher reliance places the stock in a comparatively riskier position. This is likely why DBRG holds a relatively lower level of institutional ownership, in comparison to competing firms.

As DigitalBridge continues to enhance its financial performance, and will eventually deliver positive net earnings, this reliance on external debt is likely to see a reduction.

Conclusion

Investors would be wise to include DBRG in their portfolios given its track record of impressive wins. The stock stands strong, having made a remarkable comeback after reversing its downward slide, bringing substantial gain to its investors in the process. This impressive growth trajectory is in large part due to the opportunities presented as a result of the dynamic shifts brought about by the outbreak of the Covid-19 pandemic in early 2020. With its strategic acquisitions in the digital ecosystem, DBRG stood well prepared to capitalize on the surge in demand and is clearly on its way to achieving long-term growth, as a result. This is a stock that I feel is a clear winner, given its fundamentals that make it a clear buy. The market cannot ignore the DBRG growth potential that is clearly apparent in its fundamentals.

Be the first to comment