hapabapa

Investment Thesis

Fortinet (NASDAQ:FTNT), the network security company, has seen its stock slide more than 20% since its Q2 report came out with guidance that didn’t quite meet expectations.

The problem here is that its Service guidance got pulled back slightly on the back of lost business in Russia.

Simply put, this is the same issue that’s hitting the sector overall, the realization that cybersecurity may be somewhat more susceptible to macro factors than we all previously believed.

Nevertheless, at 7x next year’s sales, I’m inclined to believe that a lot of negativity is now being priced in.

Particularly when we note FTNT’s very high GAAP profit margins.

Thus, all considered, I assert this stock with a tepid buy rating.

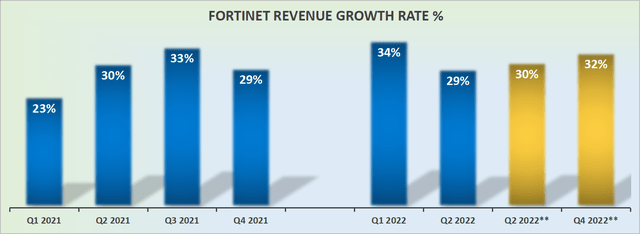

Fortinet’s Revenue Growth Rates Are Still Attractive

FTNT revenue growth rates

During FTNT’s earnings call management said,

In Q2, we noted certain larger transactions with increased or elongated negotiating cycles. Also, linearity pushed to later in the quarter, and later in the last month of the quarter, mainly due to supply constraints and the deliveries.

In the quote above we see succinctly the description of the same theme that’s hitting several cybersecurity names.

The problem for bulls is that these stocks had been bid up on the expectations that cybersecurity was a non-discretionary budget line for enterprises.

However, FTNT’s comments go to the heart of the bear case. Namely that cybersecurity demand may be a touch more cyclical than we were led to believe.

Furthermore, another problem for FTNT is that investors are willing to reward its Service business with a higher multiple than its product business.

And since FTNT needed to slightly downwards revise its service revenues for the full year 2022 from $2.7 billion to a nudge below this figure, this was bad news at a bad time, and the stock sold off on the back of this updated guidance.

Consequently, as we’re getting close to ending 2022, FTNT has been one of the worst-performing stocks in cybersecurity.

Why Fortinet? Why Now?

FTNT’s solutions are focused on automated network security solutions. It’s a network security company that has a significant proportion of its business exposed to product sales. These are typically one-off sales.

That being said, as of Q2 2022 more than 60% of its business is derived from its Service business.

And that’s the area that investors really want to see thrive. Investors believe that its Service business is where the company’s future is at. FTNT’s Service business is a sticky subscription business.

And even though FTNT’s Service business doesn’t have the profit margins today that its product business has, investors believe that in the future, that’s where the company’s growth will come from.

This leads me to discuss FTNT’s profit margins.

Alluring GAAP Margins

Unquestionably the most compelling reason to get behind this company is that it has very high GAAP profit margins.

- Q2 2021: 18%

- Q3 2021: 19%

- Q4 2021: 22%

- Q1 2022: 16%

- Q2 2022: 19%

While we don’t have visibility into its guided GAAP operating margins for Q3, looking back historically, the difference between FTNT’s GAAP and non-GAAP operating margins has often been around 6% to 7%.

Hence, when FTNT guides for Q3 2022 to report approximately 23% of non-GAAP operating margin, we can infer that its GAAP operating margins will probably be approximately 15% to 16% on a GAAP basis.

This is approximately 300 basis points lower profit margins than the same period a year ago, and this is yet another factor that is clearly weighing on the stock.

On the other hand, let’s consider some of FTNT’s peers. Okta (OKTA), the identity management platform, just reported negative 46% GAAP operating margins.

While CrowdStrike (CRWD), arguably the leading cybersecurity company, recently reported a negative 9% GAAP operating margin.

Hence, even if FTNT’s GAAP margins have recently moved in the wrong direction, they are still substantially higher than those of its peers.

FTNT Stock Valuation – Priced at 7x Next Year’s Sales

If we assume that FTNT is able to grow its revenues next year by approximately 25% y/y, that would see the company printing $5.5 billion of revenues in 2023.

Accordingly, I believe that paying 7x next year’s sales is a fair multiple. Particularly given that this business is already meaningfully GAAP profitable.

Meanwhile, FTNT continues to repurchase shares. During H1 2022 FTNT bought back $1.5 billion worth of stock at approximately $58 per share. And now, as of Q2 2022, FTNT still had a further $1 billion authorized to repurchase.

This equates to approximately 2.6% of its market cap. While these repurchases are not an investment thesis mover, they are still a ”nice to have”.

The Bottom Line

Two aspects weighed down FTNT’s recent results.

Firstly, the commentary around a slightly longer sales cycle, which translated into its full-year Service guidance being pulled down ever-so-slightly.

Secondly, FTNT’s guided Q3 profit margins showing some compression when compared with the same period a year ago.

However, since the stock is already down 20% in the past month, and is a laggard compared to its peers, I believe that at 7x next year’s sales, a lot of negativity could already be priced in. Hence, I’m asserting a tepid buy rating on this stock.

Be the first to comment