Joe Raedle

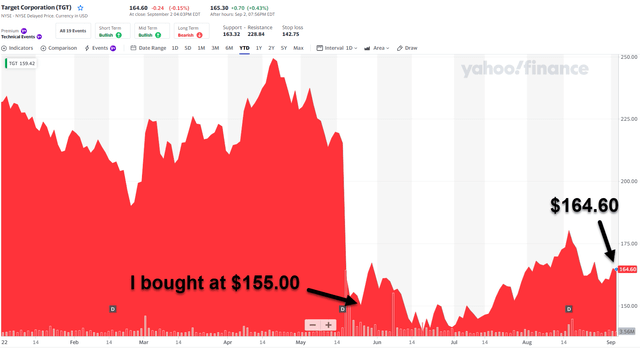

You may recall an article I wrote on Target Corp. (NYSE:TGT) a few months ago titled, Target: A Dividend King On Sale. In that article I explained

If you’re looking for impeccable safety, quality, growth potential, and value, Target is one of the best aristocrat bear market bargains you can buy.

If you’re looking to sleep well at night, knowing your dividends are safe and growing in all economic conditions, Target is a great choice.

If you’re looking to potentially earn Buffett-like 19% to 20% annual returns over the next three to five years? Then Target is a dividend king to consider.

I’ve always wanted to own shares in TGT, similar to my dream of owning shares in McDonald’s (MCD), another impressive “wide moat” stock that also happens to own a healthy amount of real estate. In a recent Seeking Alpha article Ryan Thomson explains,

A majority of franchise restaurants are under a “conventional” franchise, whereby McDonald’s owns or leases the land and building from which the franchise operates.

The rent payment received from franchisees actually represents the most significant element of the revenue received by McDonald’s from its franchises, accounting for over 60% of revenue from franchises in 2021 – or more than one third of the total revenue of the McDonald’s company.

The benefit of this model is that it gives McDonald’s some of the characteristics of a real estate business, providing visible and stable income streams over long time frames – typically 20 years under a typical franchise agreement. Minimum rental payments for the period 2022-2026 are around $3 billion p.a., equivalent to 13% of revenue (based on FY21 levels).

You may recall a Forbes article that I published on McDonald’s around seven years ago, just after activist investor, Glenview Capital Management, was pestering McDonald’s to spin off its real estate into a REIT.

Because McDonald’s real estate empire has such a low basis there is likely to be a nice spread (difference between franchisee rent and rent paid to the REIT) but most of the rental proceeds must be paid out to the REIT in order to be competitive in its dividend payouts…

I went on to explain,

By spinning off the franchise-leased assets McDonald’s would be not only walking away from an incredible cash cow, but also bifurcating the control factor that the global hamburger empire was built on.

Even if a proposed McDonald’s REIT formed, the franchise leases would be considerably above market and it would be challenging for McDonald’s to conduct arm’s length transactions with franchisees. Many of the relationships go back many decades and the complications would be extraordinary.

These days it would be difficult for McDonald’s, or any C-Corp, to spin its real estate into a REIT, simply because Congress closed that loophole back in 2018 that forced the hand for companies that wanted to spin-off their real estate into a REIT to be taxed – the distribution of either the real estate or operating assets are no longer tax-free.

So now C-Corps that want to consider a REIT structure are no longer tax-advantaged. However, this does not apply for REIT-to-REIT spins that created vehicles like Orion Office REIT (ONL) and Urban Edge Properties (UE).

Now, back to Target…

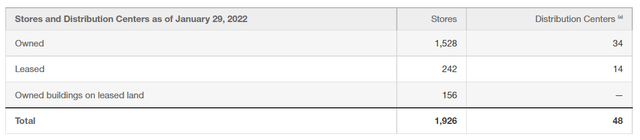

I’ll admit, one of the primary reasons that I bought TGT in the first place is because of its vast real estate empire. Just take a look at the filing below:

As you can see, TGT owns 1,528 stores (only 242 leases) in fee-simple and another 156 stores on leased land. The average TGT store is 126,000 square feet.

In addition, TGT owns 34 of its 48 distribution centers, and the average distribution center has 1.2 million square feet.

- Owned Real Estate: 193 million square feet

- Owned Real Estate (on leased land): 19.7 million square feet

- Owned DC’s: 40.8 million square feet

- Combined: 253.5 million square feet

That, my friends, is a lot of real estate, compared with these REITs:

- Prologis Inc. (PLD) owns 1 billion square feet

- Simon Property (SPG) owns 175 million square feet in the US

- Ventas (VTR) owns 18 million square feet

In other words, TGT’s real estate portfolio is 25% the size of PLD and more than SPG and VTR combined.

I could see now why the C-Corp REIT spin loophole was closed, and if you think Medical Properties (MPW) has a lot of concentration with Steward, a Target REIT would have been fun to watch (and write about).

Target’s Business Model

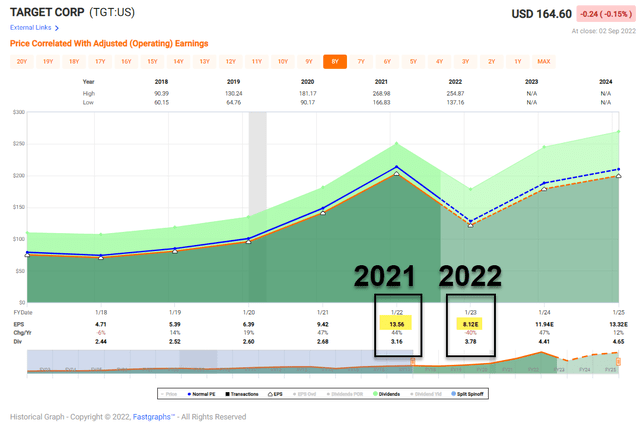

Clearly Mr. Market is not impressed with TGT’s operations, the company has had supply chain issues, that has racked up inventory costs, leading for cost cutting across many categories.

The company has cut its guidance (twice) and the latest earnings were painful to watch, as inventory on the balance sheet was about $6 billion higher than it had reported three years ago, and about $3 billion (or approximately half of that total growth) was the result of higher unit costs across our assortment.

In the most recent quarter TGT generated earnings of $.39 per share, down 89% from last year’s earnings of $3.65 per share.

Remember that retailers such as Walmart (WMT) and TGT use a fiscal year that ends on January 31 rather than December 31 because December is their busiest month due to the holiday season, and they prefer to wait until the holiday season ends to close out their year-end books.

Thus, analysts are estimating TGT to generate around $8.13 in EPS in 2022, which is just around $1.75 per share higher than 2019.

Meanwhile, TGT continues to throw off some mouth-watering dividend increases, the latest was $417 million in dividends paid to shareholders in Q2, up from $336 million a year ago, driven by a 32% increase in the per share dividend.

You know what I’m thinking, “the safest dividend is the one that’s just been raised”.

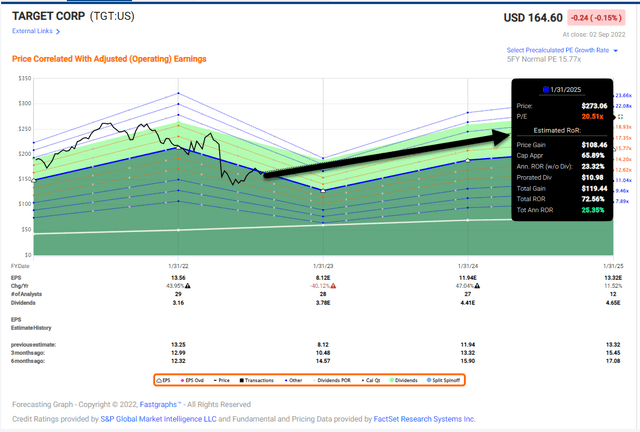

Now, what’s even more telling is the analyst EPS estimates for 2023 of $11.94 per share, and if this happens, TGT will have its second most profitable year in its entire history.

What’s not to like about that?

Now, Some Icing on the Cake

When you check under the hood, you can see some really impressive assets, and of course I’m referring to the brick-and-mortar.

Remember TGT is A-rated and although it doesn’t need the capital, it could easily transact on 10% to 25% of its owned stores via a direct sale-leaseback with a firm like Realty Income (O).

Just for giggles, let’s assume TGT took 10% of its owned stores, or 150 stores (averaging 126,000 sq. ft.) and sold them to Realty Income. My back of the napkin:

- 1 store (126,000 sq. ft.) rented at $5.00 NNN and applying a 5.5% cap rate = $11.5 million

- 150 stores x $11.5 mm = $1.725 billion

By the way, Realty Income has very capable of transacting on a $1.725 Billion sale-leaseback, given its size today ($58 Billion Enterprise Value) and recent deal with Wynn Resort (Encore Resort and Casino) for $1.7 billion at a 5.9% cash cap rate.

Now, there’s tax leakage to consider, but a sale-leaseback with TGT would put around $1.2 Billion back to work for the big box retailer, and given the depressed share price today, buying back stock would be one of the best ways to reinvest into the company.

So, what would happen of TGT bought back $1 Billion of stock?

How’s 25% annual returns look?

Shares are now trading at 15.8x with a dividend yield of 2.6%.

While my checkbook is not large enough to become an activist (currently), I think the sale-leaseback conversation is merited given the discount reflected and compared with WMT’s multiple today (trading at 22x).

My ‘suggestivist’ approach is oftentimes noticed, especially when my calls regarding Iron Mountain (IRM) – regarding the sale/leaseback – Franchise Group (FRG) – regarding Badcock – and Gaming and Leisure (GLPI) – regarding Bally’s – have resulted in material profits due to real estate.

Look folks, Target is sitting on a gold mine of real estate and Mr. Market has no clue what the discount chain could do with it.

Show me another A-rated Dividend King that has this lever on the balance sheet?

Remember, when you buy shares in Target, you are also getting 1,528 of these…

And 34 of these:

Who cares about the Target REIT, I’ll just buy Target the C-Corp., recognizing that I’m getting a cheap retail stock and billions of dollars in high quality real estate.

Ray Kroc was in deep debt and put his home up for mortgage as the number of McDonald’s kept growing by the day. That’s when a smart lawyer told him,

Mr. Kroc you don’t quite understand the real business you are in. You are not in the business of selling burgers.

“Then what is it?” he asked the lawyer. The lawyer said,

You are in the business of real estate Mr. Kroc.

The rest is history!

Be the first to comment