Brandon Bell

Article Thesis

Occidental Petroleum (NYSE:OXY) has been a strong performer so far this year, like basically all other oil and gas companies. Recently, the stock experienced a lot of hype thanks to the fact that Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) has been buying shares of the company and increased its stake to a little less than 20%. That alone does not make OXY a buy, though, and Warren Buffett’s reasoning may be different compared to what we normal investors are thinking when making investment decisions. In this report, I’ll highlight why I see OXY as not ideal and show a couple of cheaper alternatives for energy exposure.

OXY: Strong Share Price Gains, But Not The Best Oil Pick

Year-to-date, Occidental Petroleum has delivered gains of 90% on the back of surging energy prices that have vastly improved Occidental Petroleum’s earnings outlook. The same holds true for other energy names, of course, which is why many of those rallied as well.

Occidental Petroleum will be pretty profitable this year, but it has a couple of characteristics that nevertheless make it a sub-ideal pick at current prices. First, the ill-timed and overpriced acquisition of Anadarko showed that management wasn’t focused on creating the most value for shareholders in the past. Instead, a tendency of empire-building at any price has hurt shareholders quite a lot. In fact, OXY currently trades around one-third below levels seen in 2018, which is a pretty bad performance when we consider the very supportive oil price environment we have today. Management alignment matters and OXY has not been strong in that regard at all.

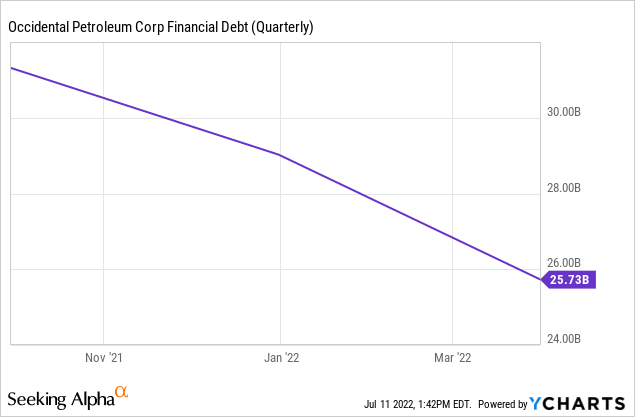

Second, Occidental has a sub-par balance sheet compared to many of its peers. The company is still heavily indebted, as financial debt stands at $26 billion right now:

That amount has declined in recent quarters but is still at a rather high level of around 1.7x trailing EBITDA. Many other energy names have stronger balance sheets, with low debt levels or even no debt at all in some cases. On top of that, Occidental Petroleum also has $10 billion in high-yielding preferred stock outstanding. Berkshire owns those preferred shares that some might consider toxic thanks to their high yield of 8%.

Occidental Petroleum’s high debt load and the $800 million worth of dividends its preferred shares consume also explain why Occidental Petroleum does not offer large shareholder returns right now — the company’s cash flow is needed to bring down debt levels and to pay preferred stock dividends. Contrast this with many other energy names that offer dividend yields that are generally way above the market average. In some cases, such as with Pioneer Natural Resources (PXD), the dividend yield is higher than 10% when we consider base dividends and variable dividends. Other energy companies are committed to buy back shares at a hefty pace, such as Marathon Oil (MRO) which could buy back more than 15% of its shares this year. Occidental Petroleum offers a dividend yield of just 0.5% and its share count has actually risen over the last year, meaning it’s a pretty weak pick from a shareholder return perspective for now.

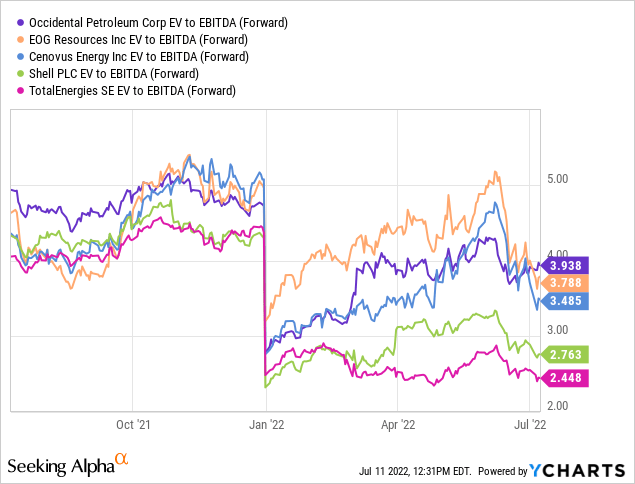

On top of that, Occidental Petroleum is rather pricy compared to how many other energy names are valued:

In absolute terms it is not expensive, of course, at 3.9x EBITDA. But peers with stronger balance sheets, better management alignment, higher shareholder returns, etc. are in some cases trading at even lower valuations, which makes OXY look like a less favorable pick on a comparable basis.

Why Buffett Is Buying?

There are a couple of reasons to believe that OXY is not the best energy name by far, and yet Buffett’s Berkshire is buying. Why is that? There are several potential reasons. First, Buffett likes names where average liquidity is high — with his buying volume, some names are just too illiquid. Second, the preferred shares and their high yield isn’t an argument against OXY from Buffett’s perspective, as he is the one getting those dividends. If Berkshire were to buy Occidental completely, those preferred shares could get canceled. Buffett could then also change out management if he wants to in order to improve management alignment. For Buffett, who might be interested in buying the company outright, the perspective thus is different compared to individual investors that might buy a couple thousand dollars’ worth of shares in the company and that would not be able to influence anything there.

Stocks That Might Be Better Than Occidental Petroleum

1: EOG

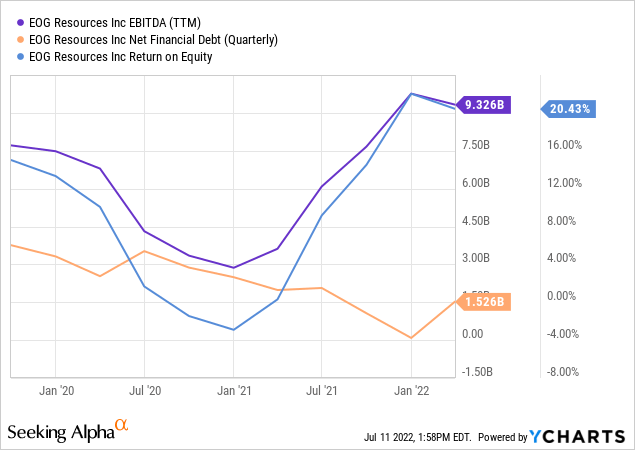

EOG Resources (EOG) is a shale-focused energy company that has a fantastic track record, excellent returns on capital, steady dividend growth, and that has a fortress balance sheet:

EOG’s net financial debt of $1.5 billion is equal to just 2 months’ worth of EBITDA, there are no preferred shares, and EOG has been generating hefty returns on capital. Its return on equity was north of 20% over the last year (April 2021 to March 2022), and should be even better going forward thanks to the hefty rise in oil and gas prices since April 2021.

EOG has an A grade in both Dividend Growth and Dividend Safety according to Seeking Alpha’s Quant scores, and the Dividend Consistency is rated B+. With a dividend yield of 2.2% and a 28% 5-year growth rate, EOG is a compelling dividend growth pick. On an EV/EBITDA basis, it trades at a discount of a couple of percentage points relative to OXY, despite arguably higher quality.

2: Cenovus Energy

Cenovus Energy (CVE) is a Canadian integrated oil company with large production assets, primarily in oil sands, but also downstream assets that allow it to benefit from high crack spreads. The company’s oil sands assets have low decline rates, very low variable costs, and very long reserve lives. There is little need to invest into new production assets in order to keep production at the current level for many years, which is why Cenovus generates hefty free cash flows. Cenovus has paid down a lot of debt in recent quarters and has now amped up its buybacks. By the end of the third quarter, Cenovus should have met its net debt goal of CAD$4 billion. At that point, Cenovus plans to return 100% of all free cash flows to its owners, as further deleveraging does not really generate a lot of shareholder value. With the company forecasted to generate free cash flows of 20%+ of its market capitalization over the next year, shareholders can expect hefty payouts. A lot of that will come via buybacks, which will be highly accretive at current prices. But variable dividend payments or special dividends are possible as well. Cenovus trades at a ~20% discount compared to OXY, despite arguably better assets, a way stronger balance sheet, and massive shareholder payout potential.

3 & 4: Shell and TotalEnergies

Shell (SHEL) and TotalEnergies (TTE) are two European supermajors. They are very diversified across the energy value chain, which includes oil and natural gas production, refining, marketing, but also areas such as LNG and energy trading. On top of that, they have some renewable energy assets, although those are not a major profit source yet.

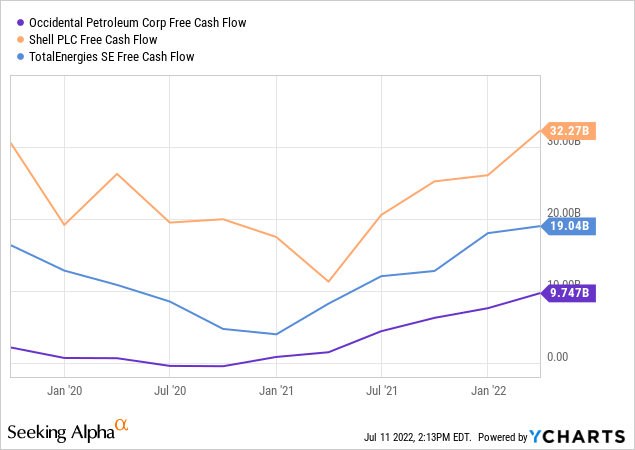

Their very diversified business, across products and geographies, make Shell and TotalEnergies less vulnerable to commodity price declines. Even if oil prices were to crash, Shell and TotalEnergies would likely remain profitable thanks to exposure to other energy themes, such as high gas prices in Europe. This is why the diversified integrated supermajors oftentimes trade at premiums compared to less diversified, more commodity-price-dependent E&Ps. This resilience is also visible in the following chart:

While OXY and many other energy names saw their free cash flows drop to zero or into negative territory during the pandemic, Shell and TotalEnergies continued to generate billions of dollars in free cash even during the worst times. For risk-averse investors, this resilience is a major positive that should be considered when choosing among potential energy investments.

Both Shell and TotalEnergies offer nice dividend yields of 5.9% and 4.1%, respectively. That does not eat up all of their free cash flows, however. Based on their Q1 free cash flow, both companies offer free cash flow yields of more than 10%. In Shell’s case, the Q1 annualized free cash flow yield even is above 20%. With both companies’ cash flows likely improving further during Q2 and Q3, thanks to higher energy prices and higher crack spreads, free cash flow yields could be enormous. There is no need to deleverage a lot, as both companies employ less leverage than Occidental Petroleum. This should allow them to buy back shares aggressively this year, thereby both offering price support to share prices in case of a recession while also boosting shareholder value by buying back shares at low valuations.

Both companies trade at a 30%+ discount compared to Occidental Petroleum based on their EV/EBITDA ratios, despite higher shareholder returns, better recession resilience, and stronger balance sheets.

Takeaway

Occidental Petroleum has been a strong performer this year, and it may very well be a solid investment going forward. But other energy names look even more promising, thanks to better balance sheets, higher shareholder returns, and so on. When those companies are also trading at a discount compared to OXY, I do believe that opting for these companies instead of Occidental Petroleum is a good idea.

Be the first to comment