Tonpor Kasa/iStock via Getty Images

Butterfly Network, Inc. (NYSE:BFLY) has a corporate mission to bring affordable and accessible ultrasound images to the market. However, the company has had difficulty in scaling revenues. I would recommend investors stay on the sidelines on BFLY until the company can demonstrate better sales traction, as the current cash burn rate is unsustainable.

Introduction To Butterfly Network

Butterfly Network is a digital health company with a mission to make high quality ultrasound imaging more affordable, accessible, and connected (Figure 1). The company has a proprietary ‘Ultrasound-on-Chip’ technology that the company claims can perform ‘whole-body imaging’ using a single handheld probe.

Figure 1 – Butterfly Network’s Mission (Butterfly Network investor presentation)

Historically, the $8 billion global ultrasound market is dominated by cart-based devices manufactured by large conglomerates like GE Healthcare, Canon, and Philips. Traditional cart-based equipment typically cost $45,000 to $60,000 and needs specially trained technicians to operate. More recently, the ultra-sound market has seen the introduction of Point-of-Care Ultrasound (“POCUS”) devices, at a lower price point of $20,000 for the machine and $5,000 to $7,000 per probe. However, these POCUS devices are based on the same 60 year-old piezoelectric crystal technology.

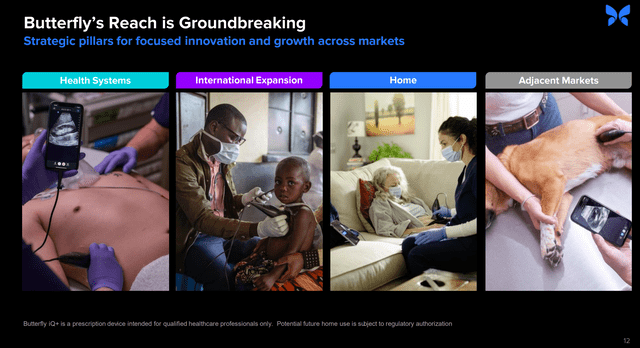

Butterfly aims to disrupt this market with their proprietary ‘Ultrasound-on-Chip’ technology that allows the company to offer a handheld ultrasound at a much lower $2,000 price point. With a lower price point, Butterfly hopes to make ultrasound imaging a standard of care for front-line health systems, as well as offering ultrasound imaging in poor countries that cannot afford traditional cart-based ultrasound machines, and potentially home scanning and adjacent markets.

Figure 2 – Butterfly’s target markets (Butterfly Network investor presentation)

Butterfly Flew In 2021

Butterfly Network came to the public markets through a combination of hedge fund manager Larry Robbins’ $1.5 billion Longview Acquisition SPAC and the Butterfly Network. Butterfly Network had some very prominent early investors such as Baillie Gifford, the Bill and Melinda Gates Foundation, and Fosun Industrial.

As a result of the business combination, Butterfly Network received approximately $589 million prior to transaction fees, including approximately $414 million of cash held in Longview’s trust account and $175 million from private placement (PIPE) investors. In addition, Butterfly’s management and existing equity holders have rolled 100% of their equity into the combined company.

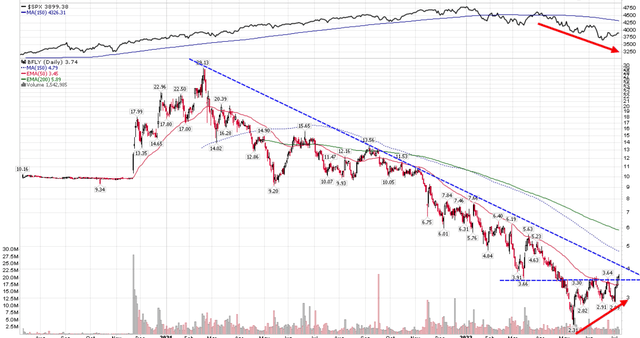

Caught up in the SPAC craze and cheerleaded by famous investor Cathie Wood, Butterfly Network’s stock price rallied to $29 immediately after the de-SPAC (Figure 3). However, that proved to be the peak for the stock, as it subsequently lost over 90% of its value, trading as low as $2.13 earlier this year in March.

Figure 3 – Butterfly price down 90% from peak. (Author created with price chart from stockcharts.com)

More recently, the stock has started to form a potential bottoming pattern. Is it now time to take a closer look?

Great Promise But Poor Financial Results

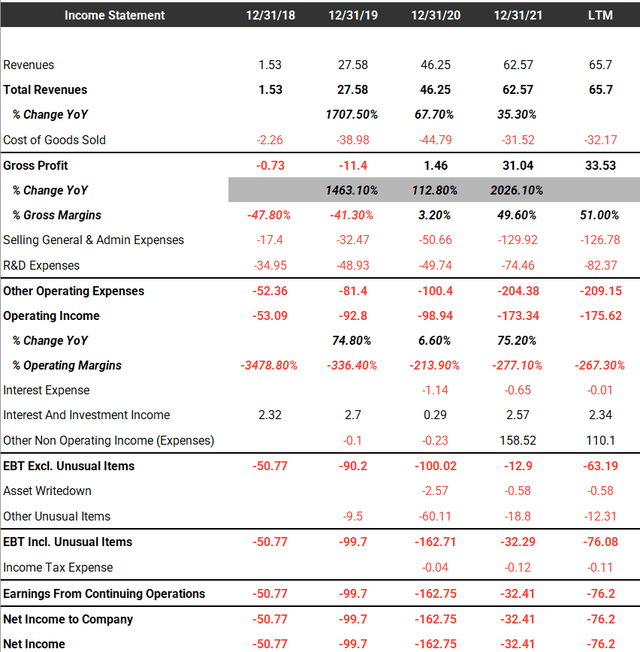

Although Butterfly Network’s mission to make ultrasound affordable and accessible is very noble and commendable, that has not translated into tangible financial results. Figure 4 is a financial summary for Butterfly Network.

Figure 4 – Summary financials. (tikr.com)

Unlike Nano-X Imaging (NNOX) that I wrote an article on recently, Butterfly Network does have a commercial product and the company do have revenues. The problem is that revenues are scaling far too slowly to justify the company’s valuation.

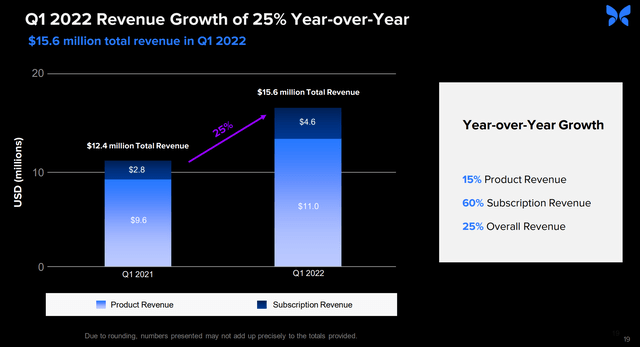

For example, when the company de-SPAC’ed, Butterfly delivered promising 68% YoY revenue growth from 2019 to 2020. What investors did not plan on was a deceleration in revenue growth to 35% YoY for 2021. And the deceleration continued, with the recently released Q1/2022 quarter showing only 25% YoY revenue growth (Figure 5).

Figure 5 – Slowing YoY growth (Butterfly Network investor presentation)

Meanwhile, the company continued to build out its sales infrastructure. SG&A increased 56% YoY in 2020, and accelerated to 156% YoY in 2021. This culminated into large operating losses for 2020 and 2021 of $99 million and $173 million respectively. At the current $54 million a quarter cash burn rate (cash flow from operations -$54 million in Q1/22), Butterfly Network’s cash reserves of $360 million will only last another 6 to 7 quarters. Unless revenues experience a step change in growth, the company will either have to return to the public markets for additional capital or declare bankruptcy.

Why Has Scaling Been So Difficult?

One challenge is that although the low-cost ultrasound in front-line care is good in theory, it is difficult in practice. Imagine being a frontline doctor or nurse. They have trained for years, even decades, in diagnosing injuries and diseases using standard best practices. Adding low cost ultrasound could be a novelty, but they will not immediately abandon their tried and true practices, not least because the cost of an error could be a matter of life and death for patients!

Furthermore, operating ultrasound machines and interpreting ultrasound images takes skill and experience. Sonographers typically train for 3-4 years in specialized programs to gain this skill. It is simply wishful thinking that frontline workers can pick up a novel ultrasound scanner and be able to correctly and accurately use it within a short period of time.

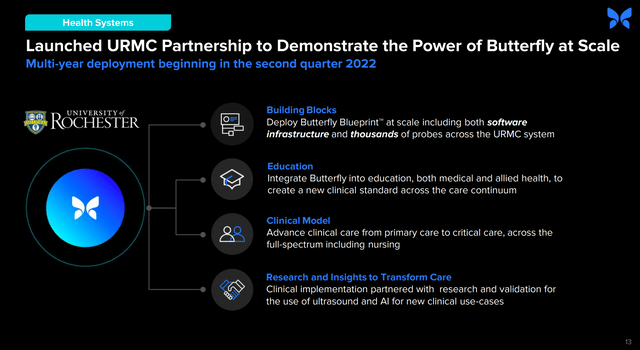

Butterfly Network recently launched a large-scale partnership with the University of Rochester Medical Center to deploy Butterfly devices at scale (Figure 6). Due to their conservative nature, I believe most other medical centers and hospital systems will adopt a wait-and-see approach before deploying POCUS devices their own systems, which could be years down the road.

Figure 6 – Launching large scale deployment at URMC (Butterfly Network investor presentation)

Valuation

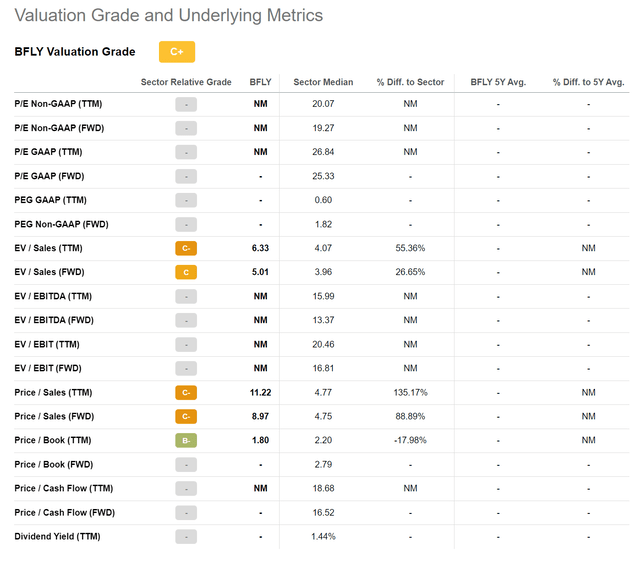

In terms of valuation, using Seeking Alpha’s valuation tool (Figure 7), we can see that Butterfly Network still trades at a significant P/S premium to the healthcare sector, at 9x Fwd P/S compared to 4.8x.

Figure 7 – Valuation still elevated (Seeking Alpha)

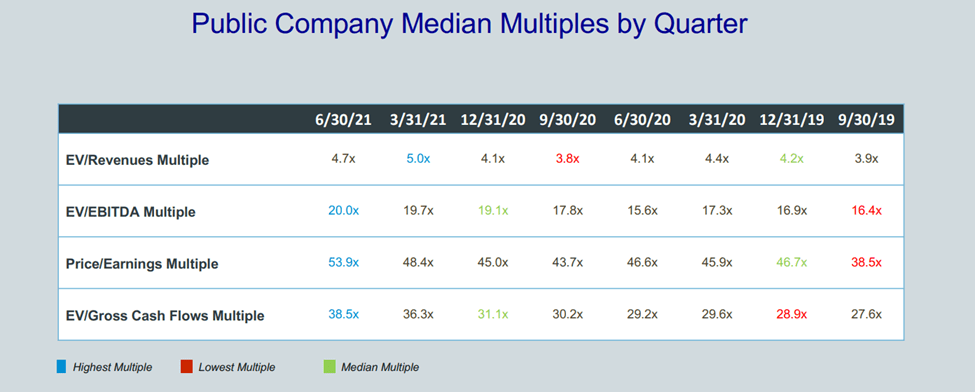

Also, from a recent article I wrote on Pulmonx (LUNG), I showed a valuation comparable of medical devices companies done by Cogent Valuations. I have reproduced the table below in Figure 8. While the data is a dated, we can see that medical devices EV/Rev multiples peaked in Q2/2021 at 5.0x. Since Butterfly Network’s current EV/Rev multiple of 5.0x is the same as the industry’s peak multiple, I think Butterfly Network’s shares are still too richly valued.

Figure 8 – Medical devices EV/Revenues multiple (Cogent Valuations)

Risks To Butterfly Network

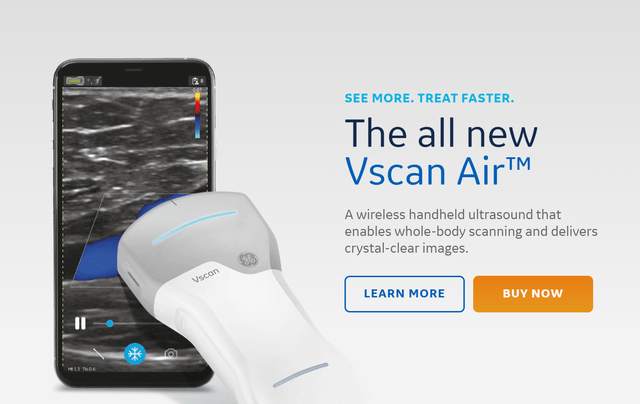

The biggest risk to Butterfly Network is that their handheld ultrasound scanner is not unique. In fact, as mentioned in the company’s 10K, POCUS ultrasound devices have been slowly gaining traction. These devices are often made by incumbent ultrasound manufacturers like GE Health (Figure 9). It is naive to believe the incumbents will voluntarily cede the market to Butterfly Network. Already, competing device price points are coming down, with GE’s VScan Air being marketed at 4,250 Euros, comparable to Butterfly Network.

Figure 9 – Handheld ultrasound device from GE Health (vscan.rocks)

Conclusion

In conclusion, I think Butterfly Network has a very commendable corporate mission of delivering affordable and accessible ultrasound images. However, that does not necessarily translate into a good business, as shown by Butterfly Network’s difficulty in scaling revenues. I would recommend investors stay on the sidelines on BFLY until the company can get sales traction, because the significant cash burn means the Butterfly Network only has 6 to 7 quarters of runway.

Be the first to comment