Inside Creative House/iStock via Getty Images

Co-produced with Treading Softly

I love pairing things together. I think many of us do!

Sweet and Sour. Sweet and Spicy. Sweet and Savory.

Apparently, I really like sweet things.

When it comes to my portfolio, I like to pair things together as well. It makes it easier to track them when they’re paired.

By pairing a fixed-income pick with a common equity, one can provide a means to enjoy income from two sources that will trade in related or similar ways.

Today, we’re going to look at a common equity that focuses on commercial real estate and a preferred security that focuses more on residential lending. We are pairing exposure to dividends from commercial real estate loans with dividends from residential real estate loans. Dividends from common equity that could be raised, and dividends from preferred equity that are fixed.

In case you haven’t noticed, I like dividends every bit as much as I like sweet things!

As an added bonus, our common equity pick is trading at a discount to book value, so as its earnings rise, so should its share value. At the same time, our preferred share pick is trading at a discount to par – ensuring that both picks have the potential for future price upside.

Great long-term income, and expected capital gains from both? Sign me up.

Let’s dive in.

Pick #1: ACRE – Yield 11%

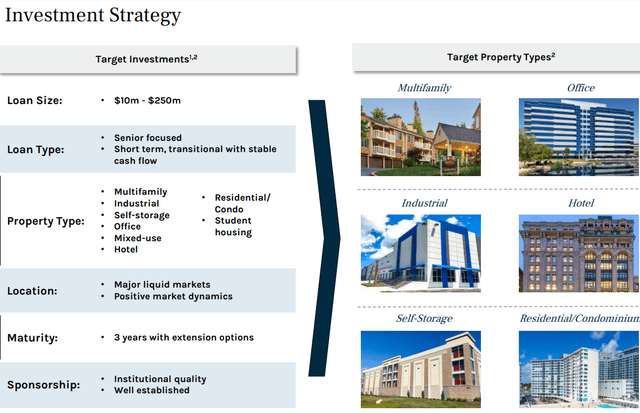

Ares Commercial Real Estate Corporation (ACRE) is a commercial mortgage REIT. This means that ACRE generates its income by lending mortgages that are secured by commercial real estate.

The mortgages that ACRE provides are usually short-term, about 3 years. They will lend on a wide variety of commercial properties, with most deals sourced by their manager Ares (ARES) – the same manager of one of our favorite BDCs, Ares Capital (ARCC).

Ares Commercial Real Estate Corporation

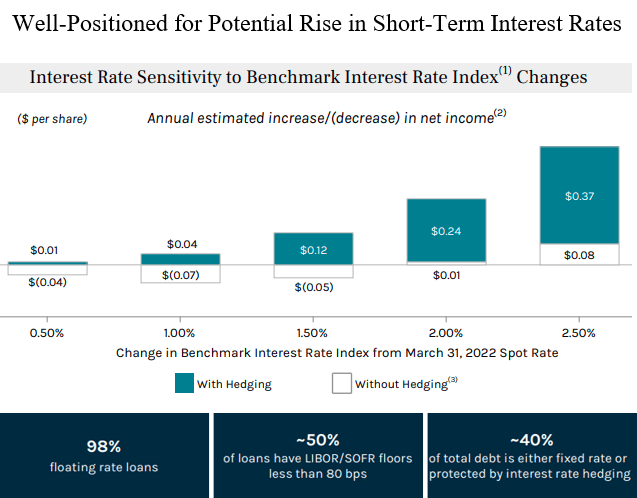

Virtually all of the loans are senior (99%) and are floating rate (98%). This means that ACRE is well-positioned to benefit from rising interest rates. (Source: Ares Commercial Real Estate Corporation)

Ares Commercial Real Estate Corporation

If the Federal Reserve actually hikes to 3%+, as they threatened to at the last meeting, ACRE’s net income will go up over $0.37/year from interest payments alone.

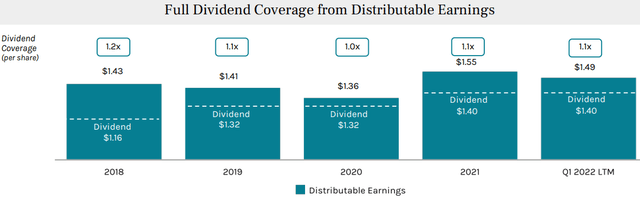

ACRE is already easily covering its $0.35 dividend, which is composed of a $0.33 “regular” dividend and a $0.02 “supplemental” dividend.

Ares Commercial Real Estate Corporation

As interest rates drive cash flow higher, it is very likely that ACRE will hike the dividend again. If the Fed decides to slow down and stop raising rates, ACRE is paying a very generous yield with its current earnings.

High-yield if the Fed stops hiking, even higher if the Fed does stay on this path. ACRE is a great option to protect your portfolio from an overzealous Fed.

Pick #2: SACH-A, Yield 8%

Sachem Capital (SACH) is a niche hard-money lender based in Connecticut. Their original focus was on residential fix-and-flip type loans to smaller players in their local area. However, as SACH has grown, so too has its focus and range of lending.

SACH continues to see recurring clients who use SACH for rapid lending and short-term loans, which allows SACH to reap the rewards of interest on their loans and fees charged for underwriting them. SACH’s average loan size in their portfolio has grown, while foreclosure rates remain very low. This is extremely positive.

While it might seem foolhardy to buy into a hard-money lender at the tipping point of the real estate market, we see this as an excellent time to buy into their fixed income offerings. Why? SACH has been extremely conservative when the market goes off the rails. During COVID-19, SACH effectively managed its operations and the company as a whole was never in financial calamity. A large benefit is how they’re built out their leverage, using frequent issuing of fixed-rate baby bonds and issuing common equity when it trades at a premium to book value. This has allowed them to lock in rates before interest rates started to climb, all while having those rates provide a great margin between their portfolio yields.

In our recent conversations with management, shared with High Dividend Opportunities members, we gained more insight into how SACH plans to survive the value drops they expect to see across the real estate sector. SACH is currently covering their common dividend on a cash flow basis – unlike many of their peers – meaning their fixed income offerings are also strongly covered.

We like Sachem Capital Corp. 7.75% Series A Cumulative Preferred Stock (SACH.PA) which currently trades below its PAR value and cannot be called until 6/2026. With rates rising, it is unlikely SACH will call this preferred in 4 years unless rates heavily fall before then. Meanwhile, the coverage on SACH-A remains very strong. SACH-A pays its next dividend at the end of September, giving you plenty of time find the perfect time to jump in and receive it.

We expect SACH’s common shares to perform strongly, as SACH’s earnings continue to cover their dividends going forward and open the door to potential dividend increases. First and foremost, as income investors, we want to lock in easily predictable income for the future. So, we’d recommend a position in their fixed income offerings as a great starting spot.

Shutterstock

Conclusion

With ACRE and SACH-A, we can benefit from two different discounts – discount to book value, and discount to PAR – while simultaneously locking in excellent income. SACH-A is unable to be called until 2026, while ACRE has room to grow with rising rates!

By pairing these two securities together, we can enjoy reduced volatility while locking in two discounts at the same time, all while making it easier to manage one’s portfolio.

I like to make my life as simple as possible, while also ensuring my income keeps pouring in day after day and month after month. This way I maintain as much flexibility and freedom as possible. Every cash dividend received allows me to have options and opportunities to pick from. I can reinvest. I can splurge. I can hoard. I can sit back and do nothing as more are due in soon.

This is the beauty of laying down a solid foundation of income-paying picks in your portfolio. Every day can be a great day when you get more dividends coming in, or it gives you something to look forward to soon!

Here are two more ideas for your watchlist, I look forward to seeing you join us investing in them soon!

Be the first to comment